Finding a Stock Winner: Finding a Stock Winner: First Step - PDF document

Finding a Stock Winner: Finding a Stock Winner: First Step Screening First Step Screening John M. Bajkowski President President AAII AAII johnb@aaii.com johnb@aaii.com 1 Discussion Overview Discussion Overview A computerized

Finding a Stock Winner: Finding a Stock Winner: First Step Screening First Step Screening John M. Bajkowski President President AAII AAII johnb@aaii.com johnb@aaii.com 1 Discussion Overview Discussion Overview • A computerized screening program computerized screening program can be used to locate/analyze stocks in an organized, systematic and disciplined fashion • Discuss screening factors that help to highlight winning stocks – Value approach – Growth approach • Stock screening resources – AAII Stock Screens – Top Web Screeners • Take home a feeling for some of the elements that help to build successful portfolios 2

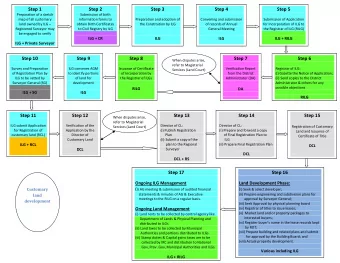

Stock Selection Strategies Stock Selection Strategies 1 st step = Screening Process • Approach should match your investment philosophy • Establishing criteria to narrow a large stock universe to a few that hold promise and warrant further analysis • Screening system identifies stocks that have common, desirable traits • Screening system adds discipline to the stock selection and selling process • Provide framework for buy/ hold/ sell process 2 nd step = Valuation Process • In-depth examination of a company to establish if its stock price reflects a fair value 3 VS. VS. Buy Buy Low, Sell High Low, Sell High Buy Buy High, Sell Higher High, Sell Higher 4

Long-Term Performance by Approach Long-Term Performance by Approach Long-Term Performance 1928 to 2014 Ann'l Return Standard (%) Deviation (%) Large Growth 9.1 20.0 Large Value 11.3 27.4 Small Growth 9.4 32.8 Small Value 14.1 32.3 Long-Term Performance By Approach (%) 1920s* 1930s 1940s 1950s 1960s 1970s 1980s 1990s 2000s 2005-14 Large Growth 8.1 1.5 7.3 17.6 7.9 3.4 15.8 19.9 -1.8 8.5 Large Value 9.0 -5.5 17.2 22.2 10.7 12.2 20.2 13.9 0.3 6.7 Small Growth -13.3 7.4 11.6 17.7 10.7 5.8 10.8 15.0 -1.1 8.2 Small Value -4.8 -0.3 21.0 20.0 15.4 15.0 21.1 14.5 10.6 8.0 *Based on the period 1928-1929 Source: Morningstar & CRSP 5 Long-Term Performance by Size Long-Term Performance by Size % of Total 1926 to 2014 No. of Largest Market Ann'l Standard Serial Firms Stock Cap. Return Deviation Correlation Decile 1 - Largest 9.4 19.1 0.07 185 $591.0 bil 64.3 2 10.7 21.7 0.01 199 $24.3 bil 14.1 3 11.1 23.8 (0.03) 194 $10.1 bil 6.9 4 11 25.8 (0.03) 221 $5.8 bil 4.5 11.7 26.4 (0.03) 215 $3.7 bil 3.0 5 6 11.5 27.3 0.01 265 $2.5 bil 2.5 7 11.6 29.2 0.01 317 $1.7 bil 2.0 8 11.7 33.3 0.00 417 $1.0 bil 1.5 9 11.6 37.4 0.06 395 $548 mil 0.8 10 - Smallest 13.5 42.8 0.14 948 $300 mil 0.6 Large Cap, S&P 500 10.1 20.1 0.02 500 $591 bil 78.3 Mid Cap, 3-5 11.2 24.6 (0.03) 630 $10.1 bil 14.4 Small Cap, 6-8 11.6 28.9 0.01 999 $2.5 bil 5.9 Micro Cap, 9-10 12.3 39.1 0.08 1343 $548 mil 1.3 Treasury Bills 3.5 3.1 0.91 Inflation 2.9 4.1 0.64 Source: Morningstar & CRSP 6

Recent Performance by Size Recent Performance by Size Data as of 4/30/2016 7 7 Recent Performance by Style Recent Performance by Style Data as of 4/30/2016 8 8

See these on AAII.com Stock Strategies Stock Strategies Value Value Benjamin Graham, Walter Schloss Growth Growth William O’Neil Growth at a reasonable price Growth at a reasonable price Davide Dreman, Peter Lynch, John Neff Value with price momentum Value with price momentum Lakonishok, Value on the Move Earning estimate element Earning estimate element Dreman with Est Revisions 9 Strong-Performing Growth & Value Screens Strong-Performing Growth & Value Screens Data as of 4/30/2016 1 0

Value Screen: John Neff • While serving as portfolio manager of the Vanguard Windsor Fund from 1964 until his retirement in 1995, Neff employed a value investing approach using a stringent contrarian's viewpoint • Approach presented in his book "John Neff on Investing" 11 1 1 Screening Process Screening Process 1) 1) Construct and refine primary criteria Construct and refine primary criteria 2) Construct secondary criter 2) Construct secondary criteria to determine if companies ia to determine if companies passed the screen for the right reasons passed the screen for the right reasons 1 2

Prim ary Neff Value Filter: Price-Earnings • Price divided by earnings per share • Ratio embodies the market’s expectations of future company performance – Stocks with high growth prospects trade with high P/ E ratios, while those with low ratios are expected to have low growth or high risk • Seek out stocks with low price-earnings ratios with the belief that the market may be over-discounting the negative news or oblivious to company’s potential 1 3 Price-Earnings Ratio: Drawbacks Price-Earnings Ratio: Drawbacks It’s important to understand the possible drawbacks of the metrics you use. • Low P/E stocks without additional qualifiers may only highlight risky or troubled firms • Quality of earnings: earnings influenced by management assumptions trickling through the account statements • Negative earnings & temporary developments—such as costs of new product rollouts or general cyclical slowdowns—can distort P/E *** *** Be cautious of cyclical and financial firms when it comes to P/E Expectation of peak high earnings, Expectation of increasing expansion improving earnings, earnings figure earnings below $1 or Anticipation of = higher P/E negative earnings decline, trough = high P/E or NA P/E larger earnings = low P/E 1 4

P/ E Ratio: Screening Strategies • Low absolute price-earnings screens • Relative price-earnings screens – Below market P/ E ratios – Below industry norms – Below company historical average • P/ E to growth ratio (PEG ratio) screens – P/ E divided by EPS growth • Future vs. historical earnings growth • Adding dividend yield to growth rate – Look for low ratios – Identify stocks with earnings growth prospects that are not fully recognized by the market as measured through the price-earnings ratio 1 5 • P/ E Ratio = 10, EPS Growth = 5% – PEG = P/ E ÷ Growth = 10 ÷ 5 = 2.0 • P/ E Ratio = 10, EPS Growth = 10% – PEG = P/ E ÷ Growth = 10 ÷ 10 = 1.0 • P/ E Ratio = 10, EPS Growth = 10, Yield = 5% • Div Adj. PEG = P/ E ÷ (Growth + Yield) = 10 ÷ (10 + 5) = 0.67 • For further info see AAII stock screen “A Combination Approach: Value on the Move” w w w .aaii.com / stock-screens/ screendata/ ValueEstGrow th 1 6

Screening Using Stock Investor Pro Screening Using Stock Investor Pro 1 7 The ratio of the price-earnings ratio to the sum of the estimated growth in earnings and dividend yield (div-adjusted PEG ratio) is less than or equal to half the median value for the entire database Current Market PEG Avg: 3.48 Median: 1.80 Stocks: 1,675 219 firms passing from a total of 6,813 companies (data as of 6/6/2016) 1 8

The estimated growth rate in earnings per share is greater than or equal to 7% and less than or equal to 20% • Neff wants companies with strong projected earnings growth, but not too high to avoid high risk stocks 1,321 firms passing independently, 114 cumulatively Note only 2,359 stocks with long-term growth estimates 1 9 The five-year growth rate in sales is greater than or equal to 7% and less than or equal to 20% • Growing sales leads to growing earnings • Strong, but reasonable growth 1,341 firms passing independently, 30 cumulatively 2 0

Free cash flow over the last 12 months and the last fiscal year (Y1) is positive • Free cash flow is cash from operations left over after satisfying capital expenditures and dividend payments • Excess cash generation will hopefully be used to benefit investors: stock repurchase, increase dividends, strategic acquisitions, expansion, etc. 2,216 firms passing independently, 13 cumulatively 2 1 The operating margin over the last 12 months and last fiscal year is greater than or equal to the industry’s median operating margin • Robust margins point to competitive advantage • Comparison should be made against industry norm because margins are very industry specific 2,362 firms passing independently, 12 cumulatively 2 2

Stock Investor Pro - Screening data date: 5/6/2016 2 3 Value Summary Value Summary • Produces consistent, long-term long-term success, but can fall behind other approaches on occasion, particularly in the strongest portion of a bull market or during economic transitions • Value strategy has worked at all market-cap levels—micro cap to large cap 2 4

Growth Screen: CAN SLIM Growth Screen: CAN SLIM William O’Neil William O’Neil developed his growth stock approach through study of company characteristics prior to their big stock price increase With all the options you have as an investor, why settle for stocks with little to no growth in earnings per share? 2 5 C= Current Quarterly Earnings • Strong and improving quarterly EPS performance—at least 18% to 20% • Important to compare a quarter to the same quarter from the previous year • O’Neil looks at earnings from continuing operations 706 firms passing from a total of 6,813 companies (data as of 5/ 6/ 2016) 26 2 6

Recommend

More recommend

Explore More Topics

Stay informed with curated content and fresh updates.