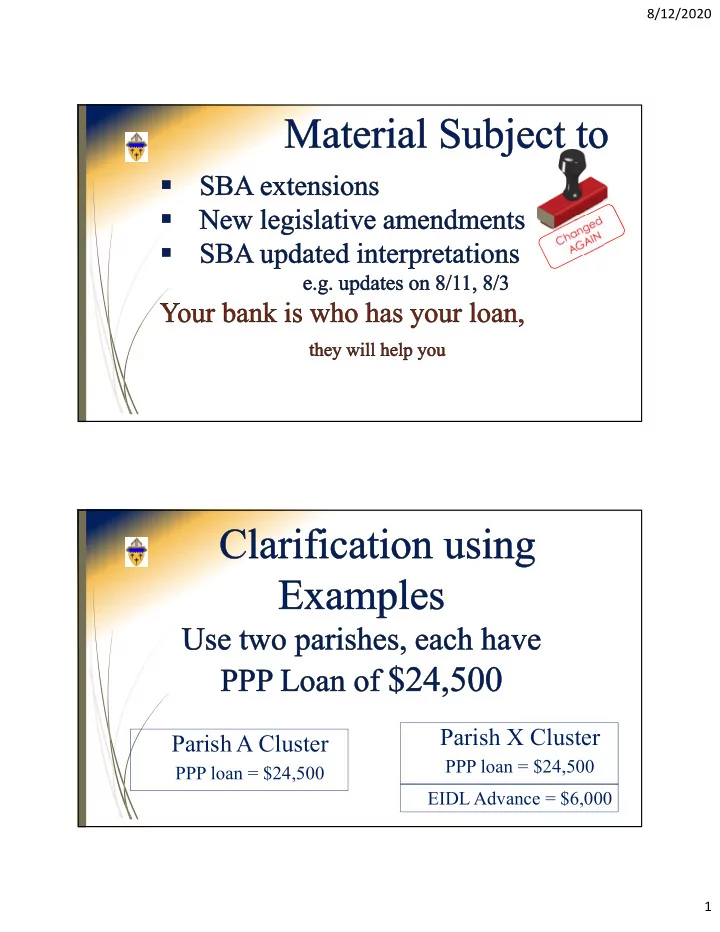

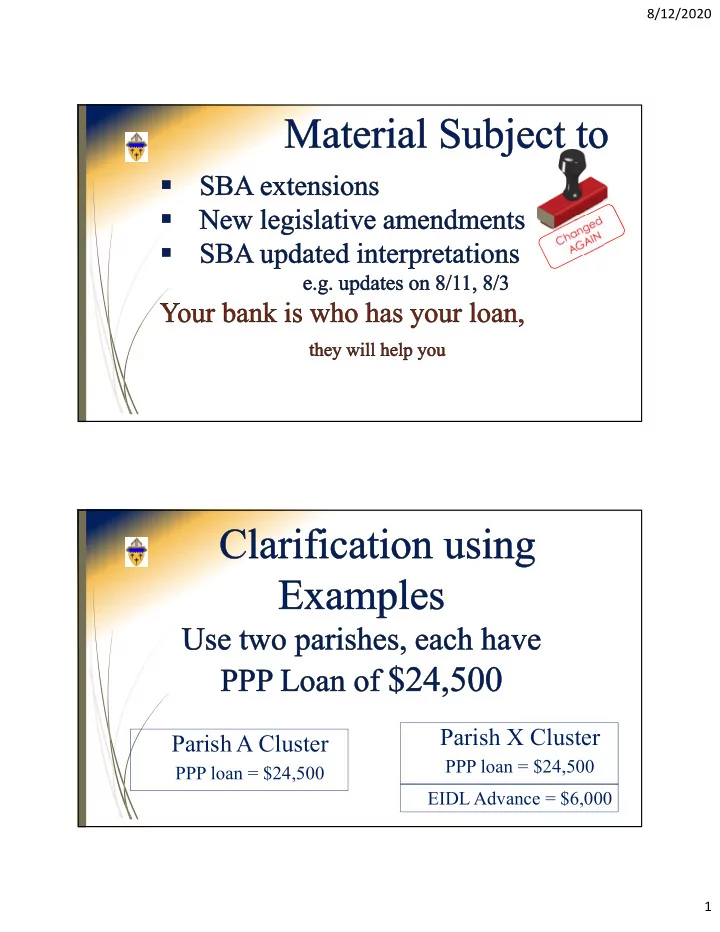

8/12/2020 Parish X Cluster Parish A Cluster PPP loan = $24,500 PPP loan = $24,500 EIDL Advance = $6,000 1

8/12/2020 2

8/12/2020 3

8/12/2020 (This $6,000 amount is a loan to be paid back) (This $6,000 amount is a loan to be paid back) 4

8/12/2020 Covered Period The Covered Period started on the PPP Loan Disbursement Date and is either: 1.The 24-week (168-day) from Disbursement 2.The 8-week (56-day) [not recommended] There is no alternative period option. This is due to the duration of our payroll frequency which is Bi-Monthly ** Know your Distribution Date (Check your bank Stmt) ** A copy of your bank stmt should be part of your records 5

8/12/2020 Oct 1 2 3 4 5 1 2 3 6

8/12/2020 On the Diocesan website In PDF format 1.Two government issued documents U nable to operate during the Covered Period at the same level of business activity . . . due to compliance [with these orders(WI Shelter in place orders)] 2.This 4page EZ INSTRUCTIONS Qualifications for EZ & Instructions PDF 3 On page 4 of the EZ Instructions Section on: Documents that Each Borrower Must Submit with its PPP Loan Forgiveness Application Form 3508EZ In less complicated language, you need your ADP report documenting the a. Amount paid to employees b. Amount paid in payroll taxes c. Amount paid for Healthcare and 401 d. More if you checked Box 2 On ADP form A copy should be part of your records 7

8/12/2020 Wage Report Other ADP Reports Must retain but not required to submit ADP report you can get from the Chancery documenting that you a. Maintaining Staffing Levels (Hours) b. Maintaining Pay Levels (wages) These are to show you did not reduce annual salary or hourly wages by more than 25 percent during the Covered A copy should be part of your records 8

8/12/2020 Other Records to keep 1. Staffing changes (including but not limited to) Job Offers, self isolation requests, maternity or other leave, refusals, written request for reduction 2. Any inability to hire, etc. These are to document your changes A copy should be part of your records Payroll Reports The ADP reports are arranged to only contain approved payroll data and expenses for SBA Loan Forgiveness Be patient, your 24 weeks are not up until approximately end of September or later 1.Know last pay date in your 24-week Covered Period 2.Cindy will generate your ADP reports A. Contact Cindy after last pay date(reports now are only interim) B. Give start date of covered period 3.Retain these reports 9

8/12/2020 Payroll Reports 100% forgiveness is dependent on both 1.average annual salary and average hourly wages are NOT reduced by more than 25% during the Covered Period 2.the average number of full-time equivalent employees (FTEEs) are NOT reduced by more than 25% during the Covered Period There are reports that shows this information. Warning: these reports are not user friendly Payroll Reports We have hired a friendly staff accountant for parish support They start September 1 st , will help with reports Please be patient 1.Lot of detail 2.Additional formulas will help 3.Cindy will generate and copy both you and the staff accountant 4.Retain these reports 10

8/12/2020 Comparison Report for FTEE Webinar on filling out the Standard forgiveness form : Thursday September 3 rd 11:00 When: Diocese Training Videos QuickBooks transactions to cover PPP loan forgiveness Watch the DOS Website 11

8/12/2020 12

Recommend

More recommend