Optio ns a nd the Bla c k-Sc ho le s Mo de l R GE JAE BY CHASE

De fining Optio ns A put o ptio n (usua lly just c a lle d a "put") is a fina nc ia l c o ntra c t b e twe e n two pa rtie s, the write r (se lle r) a nd the b uye r o f the o ptio n. T he b uye r a c q uire s a sho rt po sitio n with the rig ht, b ut no t the o b lig a tio n, to se ll the unde rlying instrume nt a t a n a g re e d-upo n pric e (the strike pric e ). I f the b uye r e xe rc ise s his rig ht to se ll the o ptio n, the se lle r is o b lig e d to b uy it a t the strike pric e . I n e xc ha ng e fo r ha ving this o ptio n, the b uye r pa ys the write r a fe e (the o ptio n pre mium). A Ca ll o ptio n g ive s the b uye r o f the o ptio n the rig ht, b ut no t the o b lig a tio n to b uy a n a g re e d q ua ntity o f a pa rtic ula r c o mmo dity o r fina nc ia l instrume nt (the unde rlying instrume nt) fro m the se lle r o f the o ptio n a t a c e rta in time (the e xpira tio n da te ) fo r a c e rta in pric e (the strike pric e ). T he se lle r (o r "write r") is o b lig a te d to se ll the c o mmo dity o r fina nc ia l instrume nt sho uld the b uye r so de c ide . T he b uye r pa ys a fe e (c a lle d a pre mium) fo r this rig ht.

Optio ns a nd I nsura nc e I t is OK to ‘ think’ o f o ptio ns a s insura nc e b ut it is inc o rre c t to c a ll the m insura nc e . A ke y diffe re nc e s is simply tha t fo r insura nc e a n inde mnity must b e tie d to a spe c ific a nd me a sure d lo ss F ina nc ia l o ptio ns ha ve no re q uire me nt me a ning tha t the y ha ve spe c ula tive a nd tra da b le c ha ra c te ristic s

Use s o f Optio ns A money manager whose portfolio has reaped huge gains can safeguard them by buying index put options ( portfolio insurance ). A meat processor can hedge input price from rising by buying a call option on pork belly futures. An American manufacturer buying machines from Germany for which payment is due in three months can remove price risk from dollar/euro exchange rates by buying an option on a euro futures contract. A speculator can make leveraged bets by trading options. A sophisticated investor can alter portfolio’s risk-return tradeoff by trading options. An investor can avoid short selling restrictions on the New York Stock Exchange by taking a “sell” position in the options market.

Histo ry o f Optio ns T he a stro no me r T ha le s (624-547 BC), to o k o ptio ns o n o live o il pre sse s b y pa ying in a dva nc e fo r the rig ht to hire the m. He b a se d his mo ve s o n a stro lo g y a nd whe n ha rve st wa s stro ng so ld his rig hts b y re nting the pre sse s. Mo st fa mo us o ptio ns ma rke ts wa s the g re a t tulip b ub b le c ra ze o f the 1630’ s in Ho lla nd Unre g ula te d o ptio ns sta rte d to tra de o n the L o ndo n e xc ha ng e in the la te 1800s

Ba c kg ro und to Optio ns Pric ing T HE BL ACK -SCHOL E S F ORMUL A

I n the Be g inning …. 1840 Re ve re nd Bro wn a Sc o ttish b o ta nist o b se rve s po lle n in a fluid a nd o utline s the dyna mic mo tio n o f pa rtic le s in mo tio n He nc e … Bro wnia n mo tio n

F o llo we d b y… 1880 T .N. T hie le (Co pe nha g e n) 1900 L . Ba c he lie r (Pa ris) L o o ke d a t ra ndo mne ss in Pa ris sto c k ma rke t b ut wa s ig no re d b e c a use the a pplic a tio n o f pure ma the ma tic s to e c o no mic s wa s fro wne d upo n 1905 A. E inste in (Be rlin) L a id o ut the b a sic fo rm fo r sto c ha stic diffe re ntia l e q ua tio n b ut ma the ma tic s re q uire d fo r g e ne ra l pro o f no t ye t inve nte d 1923 N. Wie ne r (Be rlin) wa s a b le to e sta b lish a pro o f o f E inste in’ s mo de l T his is whe re the te rm Wie ne r Pro c e ss c o me s fro m

I n the me a n time … K o lmo g o ro v in Russia , Ma rko v in Russia a nd L e vy in Pa ris we re a pplying ne w disc o ve rie s in pure ma the ma tic s to the study o f pro b a b ility. T he ma the ma tic ia ns se e k o ut unive rsa l pro o fs tha t ho ld unde r a ll c o nditio ns.

While in T o kyo … K iyo si I to , a 24 ye a r o ld ma the ma tic ia n studie d Ma rko v, K o lmo g o ro v, Wie ne r, a nd L e vy L o o king fo r a n a ppro a c h to unify the ir va rio us the o rie s.

K iyo si I to I n 1941 pub lishe d a mime o in Ja pa ne se de fining the first sto c ha stic inte g ra l fo r a Bro wnia n mo tio n. I n 1951 this wa s pub lishe d in E ng lish And b e c a me kno wn a s I to ’ s L e mma But the L e mma sa w little use a nd ling e re d thro ug h the mid 1960’ s

I to Go e s to Princ e to n Whe n pub lishe d in E ng lish I to ’ s pa pe rs b e c o me no ta b le 1954 to o k le a ve to g o to Princ e to n’ s I nstitute fo r Adva nc e d Studie s whe re he me t up with the yo ung ma the ma tic ia n He nry Mc K e a n. Mc K e a n wa s wo rking with the ma the ma tic ia ns Bo c hne r a nd F e lle r who we re a lso lo o king a t diffusio n pro c e sse s. Mc K e a n tra ve le d to wo rk with I to in T o kyo fo r two ye a rs in 1957/ 58 whe re the y sta rte d tra ining Ja pa ne se ma the ma tic ia ns in diffusio n pro c e sse s I t wa s this g ro up tha t fine tune d the sto c ha stic c a lc ulus a nd c o ine d the te rm ‘ I to ’ s L e mma ’ in the la te 1960’ s

And…. Ro b e rt Me rto n, Sa mue lso n’ s stude nt a t MI T sta rts e xa mining o ptio ns pric ing fro m the ra tio na l po int o f vie w de ve lo ping c e rta in b o unda ry c o nditio ns a nd is the first to a pply I to ’ s le mma in its c urre nt fo rm to fina nc ia l e c o no mic s AND Myro n Sc ho le s a lso a t MI T wa s ta king a no the r lo o k a t the pric ing o f o ptio ns a nd te a ms up with pra c titio ne r F isc he r Bla c k. I t wa s Mc K e a n, Sa mue lso n, Me rto n a nd Sc ho le s a ll a t MI T a t the sa me time tha t c a me to g e the r to so lve the o ptio ns pric ing fo rmula .

Bla c k a nd Sc ho le s Applying I to ’ s L e mma the y c o me up with a sto c ha stic diffe re ntia l e q ua tio n fo r the dyna mic s o f the o ptio ns pric e b a se d o n the Bro wnia n mo tio n o f the unde rlying 2 , , , 1 w p t w p t w p t 2 dw dp dt dp 2 2 p t p 2 , , , 1 w p t w p t w p t 2 dw pdt pdz dt pdt pdz 2 2 p t p 2 , , , 1 w p t w p t w p t 2 2 dw pdt pdz p dt dt 2 2 p p t

Bla c k a nd Sc ho le s T he y e mplo y CAPM a nd risk ne utra l va lua tio ns a rg uing tha t b e c a use the he dg e po sitio n is riskle ss the va lue o f the po rtfo lio must e q ua l the risk fre e ra te , 2 w p t , , 1 1 w p t w p t 2 2 dE p rdt dE p dt , , 2 w p t 2 w p t p t p p , w p t , p w p t 2 , , 1 1 w p t w p t p 2 2 p dt rdt , 2 , 2 w p t w p t p t p p 2 , , , 1 w p t w p t w p t 2 2 , rw p t rp p 2 2 t p p

T he Bla c k Sc ho le s F o rmula fo r a Ca ll & Put Optio n o n no n-divide nd pa ying sto c ks B-S Ca ll: B-S Put: , , rt rt w p t pN d xe N d w p t xe N d pN d 1 2 2 1 1 1 p p 2 2 ln ln r t r t 2 2 x x d d 1 1 t t 1 1 p p 2 2 ln ln r t r t 2 2 x x d d 2 2 t t

B-S Assumptio ns 1: Pric e o f Unde rlying 2: Strike Pric e 3 T ime to Ma turity 4: I nte re st Ra te s 5: Vo la tility 6: Divide nds

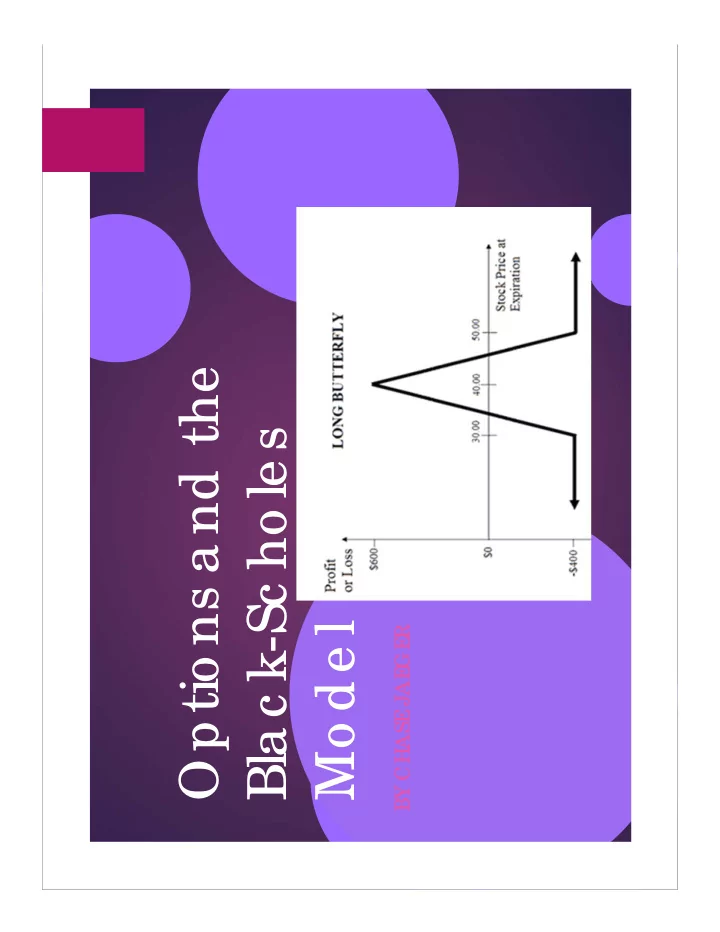

ra ding Stra te g ie s A ORMUL S F E -SCHOL ACK BL HE T T

Va nilla Ca ll/ Put Optio n:

Ca ll/ Put Spre a d

ra de s Vo la tility T Stra ddle : Stra ng le :

Synthe tic L o ng / Sho rt Use d He a vily During F ina nc ia l Crisis

he Gre e ks T

Recommend

More recommend