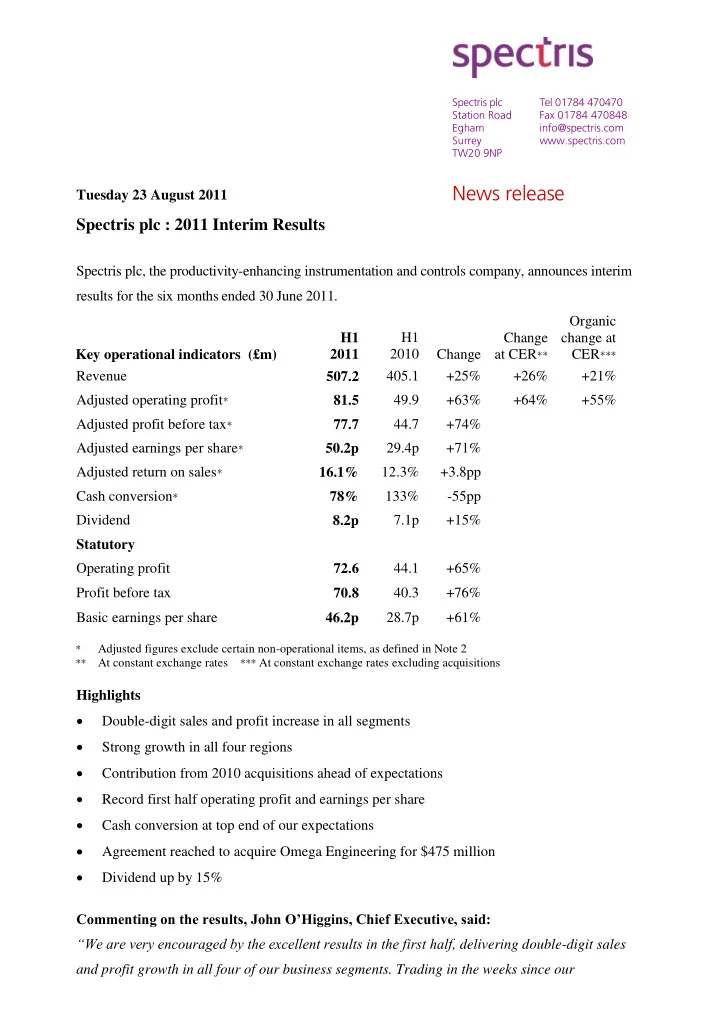

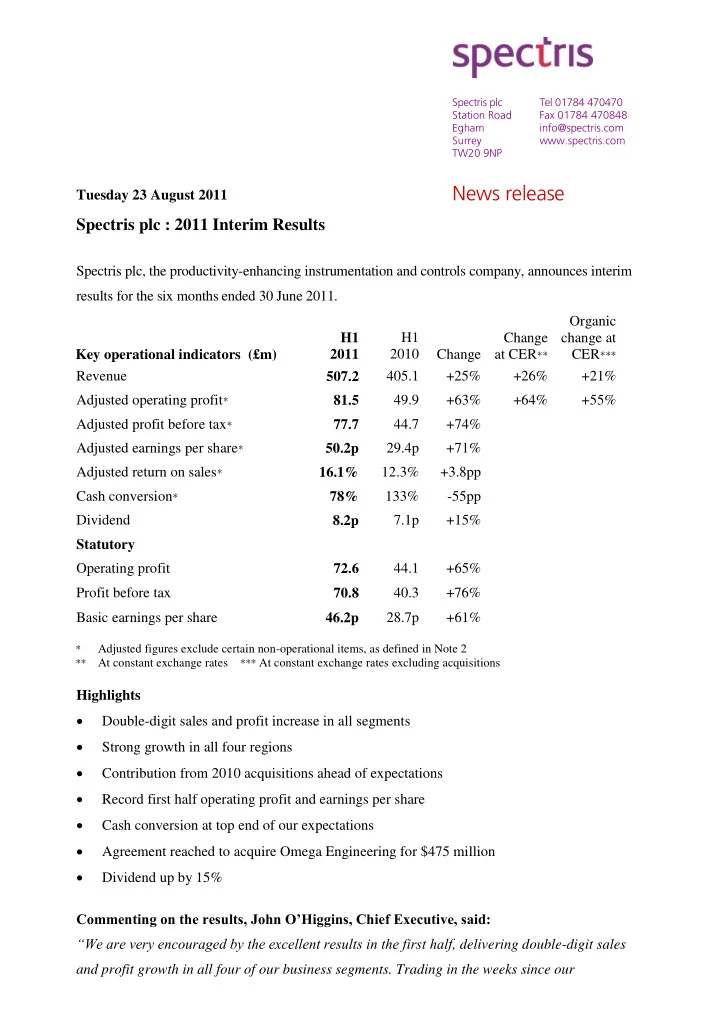

Spectris plc Tel 01784 470470 Station Road Fax 01784 470848 Egham info@spectris.com Surrey www.spectris.com TW20 9NP News release Tuesday 23 August 2011 Spectris plc : 2011 Interim Results Spectris plc, the productivity-enhancing instrumentation and controls company, announces interim results for the six months ended 30 June 2011. Organic H1 H1 Change change at 2010 Change at CER ** CER *** Key operational indicators (£m) 2011 Revenue 405.1 +25% +26% +21% 507.2 Adjusted operating profit * 49.9 +63% +64% +55% 81.5 Adjusted profit before tax * 44.7 +74% 77.7 Adjusted earnings per share * 29.4p +71% 50.2p Adjusted return on sales * 16.1% 12.3% +3.8pp Cash conversion * 78% 133% -55pp Dividend 8.2p 7.1p +15% Statutory Operating profit 44.1 +65% 72.6 Profit before tax 70.8 40.3 +76% Basic earnings per share 28.7p +61% 46.2p * Adjusted figures exclude certain non-operational items, as defined in Note 2 ** At constant exchange rates *** At constant exchange rates excluding acquisitions Highlights Double-digit sales and profit increase in all segments Strong growth in all four regions Contribution from 2010 acquisitions ahead of expectations Record first half operating profit and earnings per share Cash conversion at top end of our expectations Agreement reached to acquire Omega Engineering for $475 million Dividend up by 15% Commenting on the results, John O’Higgins, Chief Executive, said: “We are very encouraged by the excellent results in the first half , delivering double-digit sales and profit growth in all four of our business segments. Trading in the weeks since our

last update on 15 July has remained in line with our expectations. We continue to expect that growth rates will revert to more normal levels following the strong recovery in the second half of 2010. The focus we maintained on all aspects of our strategy continues to deliver results and we remain confident that Spectris will make good progress for the full year .” Contacts: Spectris plc John O’Higgins, Chief Executive 01784 470470 Clive Watson, Group Finance Director 01784 470470 FD Richard Mountain 020 7269 7186 The meeting with analysts will be available as a live webcast on the c ompany’s website at www.spectris.com, commencing at 08.30, and a recording will be posted on the website shortly after the meeting. Copies of this notice are available to the public from the registered office at Station Road, Egham, Surrey TW20 9NP, and on the c ompany’s website at www.spectris.com About Spectris Spectris plc is a leading supplier of productivity-enhancing instrumentation and controls. The c ompany’s products and technologies help customers to improve product quality and performance, improve core manufacturing processes, reduce downtime and wastage, and reduce time to market. Its global customer base spans a diverse range of end user markets. Spectris operates across four business segments which reflect the applications and industries it serves: Materials Analysis, Test and Measurement, In-line Instrumentation and Industrial Controls. Headquartered in Egham, Surrey, England, the company employs over 6,400 people, with offices more in than 30 countries. For more information, visit www.spectris.com 2

Chairman’s Statement Introduction Spectris achieved an excellent performance in the first half of 2011, in terms of both revenue and adjusted operating profit. The focus we maintained on delivery of all aspects of our strategy was instrumental in enabling us to achieve this. Strong customer demand led to revenue for the half year increasing to £507.2 million (H1 2010: £405.1 million) and adjusted operating profit * increasing by 63% to £81.5 million (H1 2010: £49.9 million). On a reported basis, revenue growth was 25%, including a contribution from acquisitions of +5% and the impact from currency of -1%. On a constant currency organic (like-for-like) basis, growth was therefore 21%. The operating margin increased by 3.8 percentage points to 16.1%, largely driven by volume, and this represents a record since the company became Spectris plc in 2001. Profit before tax increased by 74% to £77.7 million (H1 2010: £44.7 million) and earnings per share increased by 71% from 29.4 pence to 50.2 pence. Cash conversion was at the top end of our expectations, with 78% of operating profit converted into operating cash. Planned increases in working capital and capex spend were the primary drivers behind the reduction in the cash conversion rate compared with the prior year. Net debt decreased by £12.5 million to £73.7 million from £86.2 million at the end of December 2010. Net interest costs were £3.8 million. The Board has declared an interim dividend of 8.2 pence (H1 2010: 7.1 pence), an increase of 15%. This is consistent with our policy of making progressive dividend payments based upon affordability and sustainability. The dividend will be paid on 11 November 2011 to shareholders on the register at the close of business on 21 October 2011. On 15 August, we announced that we had reached agreement to acquire the Omega Engineering business for US$475 million (approximately £290 million). Omega provides a broad range of process measurement and control instrumentation to customers in industrial and academic markets and represents a significant strategic growth platform for our Industrial Controls segment. In addition to being earnings-enhancing in the first full financial year of 3

ownership, we see significant opportunities to develop the business, particularly internationally. The transaction is expected to close in Q4 of this year. Outlook We are very encouraged by the excellent results in the first half, with sales and profit growth in all four of our business segments. Trading in the weeks since our last update on 15 July has remained in line with our expectations. We continue to expect that growth rates will revert to more normal levels following the strong recovery in the second half of 2010. The focus we maintained on all aspects of our strategy continues to deliver results and we remain confident that Spectris will make good progress for the full year. John Hughes Chairman *Unless stated otherwise, figures quoted for operating profit, net interest, profit before tax, tax, earnings per share and operating cash flow are adjusted measures – for explanation of adjusted figures and reconciliation to the statutory reported figures see Notes 2 and 7. 4

Chief Executive’s Review Introduction The recovery in our markets which accelerated in the second half of 2010 has continued into 2011, with strong demand in all regions and end markets. The 21% growth in like-for-like sales was balanced across the group, with all four business segments seeing double-digit sales and profit growth. Regionally, North America grew by 26%, Asia Pacific by 21%, Europe by 18% and rest of the world by 27%. The adjusted operating margin, at 16.1%, is 3.8pp higher than in the same period last year and is the highest first half margin in 14 years. Strategy We continued to make good progress on our strategy during the first half. Some of the highlights are illustrated below: Strengthening market positions through innovation We maintained our investment in research and development, with expenditure at £34.5 million in the first half, or 6.8% of sales, and we launched a number of new products, technologies and applications across the group. Notable amongst these was the Epsilon 3 benchtop X-ray fluorescence (XRF) spectrometer. This combines the latest excitation and detection technology with state-of-the-art analysis software to provide best in class analytical performance, challenging that of larger, more powerful spectrometers, and is particularly suitable for mining, cement and petroleum applications. We also launched the Facility Pro Environmental Monitoring System. This system is unique in combining both biological and particle contamination monitoring on a single platform for cleanroom environments in drug manufacture. In June, we launched the next generation of vibration controllers. Featuring the latest technology, these modular products are designed for a wide range of applications including large-scale satellite pre-launch vibration testing and fatigue durability testing, where they can reduce testing times by up to 70%. Increasing regional expansion with a focus on emerging markets Asia Pacific continued to see strong growth, with sales up by 21% on a like-for-like basis. This remains our second-largest regional market, and its share of total group sales is now just 2pp behind Europe. We also saw strong growth in Latin America, particularly Brazil, where sales increased by almost 30% compared with the prior year period. In order to respond to the 5

Recommend

More recommend