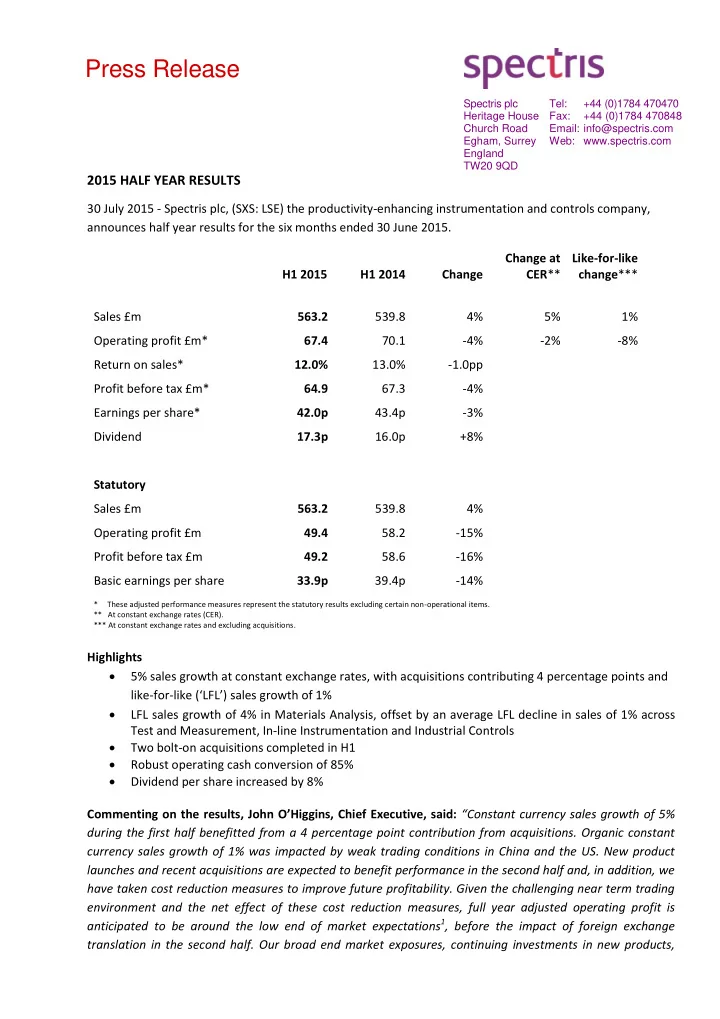

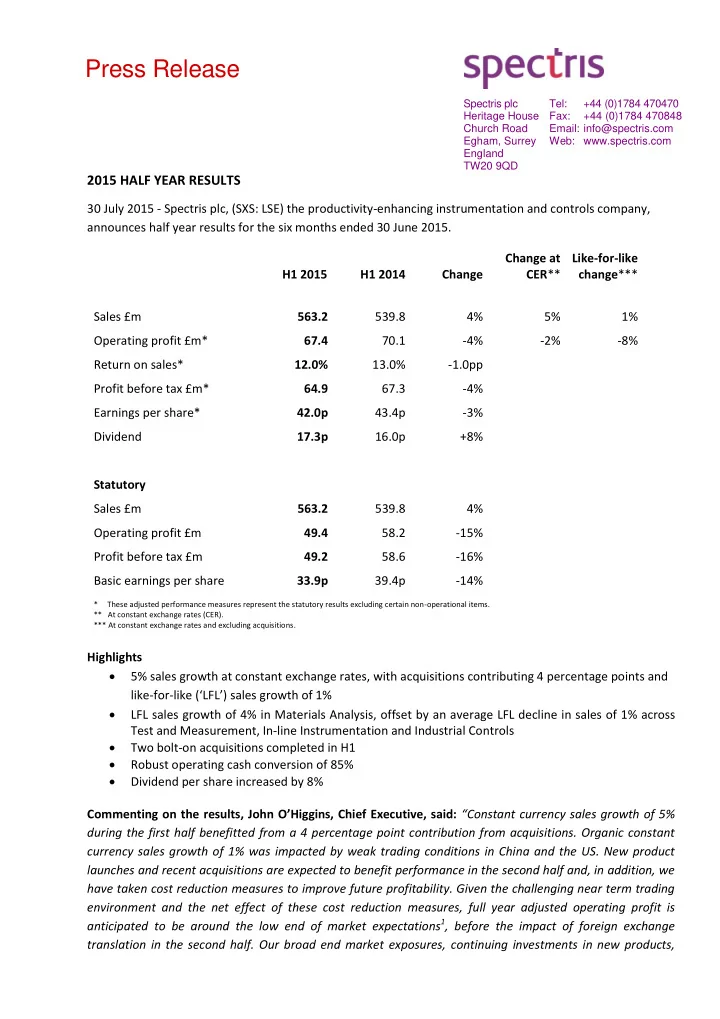

Press Release Spectris plc Tel: +44 (0)1784 470470 Heritage House Fax: +44 (0)1784 470848 Church Road Email: info@spectris.com Egham, Surrey Web: www.spectris.com England TW20 9QD 2015 HALF YEAR RESULTS 30 July 2015 - Spectris plc, (SXS: LSE) the productivity-enhancing instrumentation and controls company, announces half year results for the six months ended 30 June 2015. Change at Like-for-like H1 2015 H1 2014 Change CER ** change *** Sales £m 563.2 539.8 4% 5% 1% Operating profit £m* 67.4 70.1 -4% -2% -8% Return on sales* 12.0% 13.0% -1.0pp Profit before tax £m* 64.9 67.3 -4% Earnings per share* 42.0p 43.4p -3% Dividend 17.3p 16.0p +8% Statutory Sales £m 563.2 539.8 4% Operating profit £m 49.4 58.2 -15% Profit before tax £m 49.2 58.6 -16% Basic earnings per share 33.9p 39.4p -14% * These adjusted performance measures represent the statutory results excluding certain non-operational items. ** At constant exchange rates (CER). *** At constant exchange rates and excluding acquisitions. Highlights 5% sales growth at constant exchange rates, with acquisitions contributing 4 percentage points and like-for- like (‘LFL’) sales growth of 1% LFL sales growth of 4% in Materials Analysis, offset by an average LFL decline in sales of 1% across Test and Measurement, In-line Instrumentation and Industrial Controls Two bolt-on acquisitions completed in H1 Robust operating cash conversion of 85% Dividend per share increased by 8% Commenting on the results, John O’Higgins, Chief Executive, said: “ Constant currency sales growth of 5% during the first half benefitted from a 4 percentage point contribution from acquisitions. Organic constant currency sales growth of 1% was impacted by weak trading conditions in China and the US. New product launches and recent acquisitions are expected to benefit performance in the second half and, in addition, we have taken cost reduction measures to improve future profitability. Given the challenging near term trading environment and the net effect of these cost reduction measures, full year adjusted operating profit is anticipated to be around the low end of market expectations 1 , before the impact of foreign exchange translation in the second half. Our broad end market exposures, continuing investments in new products,

strong cash flow and robust financial position underpin the Board's view that the company is well positioned to deliver on its growth strategy. ” Notes: 1 Company-compiled range of analyst forecasts for adjusted operating profit: £200.0m - £223.4m. Contacts: Spectris plc John O’Higgins, Chief Executive +44 1784 470 470 Clive Watson, Group Finance Director +44 1784 470 470 Matt Jones, Head of Corporate Affairs +44 1784 470 470 FTI Consulting Richard Mountain / Susanne Yule +44 203 727 1340 A meeting with analysts will be held at 10:30am BST today. This will be available as a live webcast on the company’s website at www.spectris.com and a recording will be posted on the website after the meeting. Copies of this press release are available to the public from the registered office at Heritage House, Church Road, Egham, Surrey TW20 9QD, and on the company’s website at www.spectris.com. About Spectris Spectris plc is a leading supplier of productivity- enhancing instrumentation and controls. The Company’s products and technologies help customers to improve product quality and performance, improve core manufacturing processes, reduce downtime and wastage and reduce time to market. Its global customer base spans a diverse range of end user markets. Spectris operates across four business segments which reflect the applications and industries it serves: Materials Analysis, Test and Measurement, In-line Instrumentation and Industrial Controls. Headquartered in Egham, Surrey, England, the Company employs approximately 8,300 people located in more than 30 countries. For more information, visit www.spectris.com. - 2 -

CHAIRMAN ’S AND CHIEF EXECUTIVE’S STATEMENT Results overview 1 In the first half, reported sales grew by 4% to £563.2 million (H1 2014: £539.8 million). This increase comprised a four percentage point contribution from acquisitions (£22.9 million), an adverse impact of one percentage point from foreign exchange currency movements and, consequently, one percentage point of sales growth on an organic constant currency (like-for- like, ‘LFL’) basis. Regionally, sales to North America declined by 2%, representing a marked change to the strong performance from this region in 2014. Sales to China declined by 4% in the first half and, together with a 5% sales decline in Japan, these geographies partially offset a good performance from India and South East Asia, resulting in overall sales growth in Asia Pacific of 1% in the period. After a strong start to the year, sales growth in Europe moderated as the period progressed, resulting in 4% sales growth in the first half. Growth in Europe was broad-based by industry but was held back by Germany, where sales growth was 1%. There was good sales growth to the pharmaceutical sector during the first half, and within the metals, minerals and mining sector there was growth in both the metals and minerals segments, which more than offset the subdued mining segment. Sales to the academic research sector declined, remaining constrained by fiscal pressures in many of the geographies we serve. Within the energy and utilities sector we saw continued strong growth in the wind energy market and in the downstream petrochemicals industries, particularly in Asia Pacific where there remains a strong focus on emissions control. Together, these more than compensated for weakness in the upstream oil and gas sector. Within transport, sales to the aerospace market grew, despite the effect of economic sanctions on Russia, whilst sales to the automotive market declined slightly as compared to a strong prior-year period. Sales to the pulp and paper market declined due to on-going weakness in the graphic coated paper market, which was only partially compensated for by growth in the pulp, packaging and tissue markets. Sales to the electronics, semiconductor and telecom sector were broadly flat, with growth in the semiconductor segment but lower sales to the consumer electronics segment, due to the absence of major product development activity by customers that benefitted the prior-year period. Operating profit declined by 4% to £67.4 million (H1 2014: £70.1 million) and operating margins declined by 1.0 percentage point to 12.0%. On a LFL basis, operating profit decreased by 8%, as 1% LFL sales growth was insufficient to offset overhead cost inflation and investments in growth initiatives. Given the weak trading conditions, we initiated a number of cost reduction measures, including selective restructuring in certain businesses, in order to improve future profitability. These measures resulted in a net cost of £0.4 million being charged against operating profit in the first half, with an additional net cost of around £3 million expected to be incurred in the second half. The annualised benefits arising from these measures are anticipated to be around £6 million. Net finance costs at £2.5 million were slightly lower than in the same period last year despite a higher average net debt level, due to a reduction in the weighted average interest rate on debt following the re- financing of the revolving credit facility in October 2014. Profit before tax decreased by 4% to £64.9 million. Financial position and dividend Operating cash flow was strong, with 85% of operating profit being converted into cash. Cash outflows in respect of dividends, tax and acquisitions exceeded operating cash flow, resulting in net debt increasing by £23.1 million during the period. At 30 June 2015, net debt stood at £148.7 million, around 0.7 times the 12- month trailing EBITDA of £218.4 million. - 3 -

Recommend

More recommend