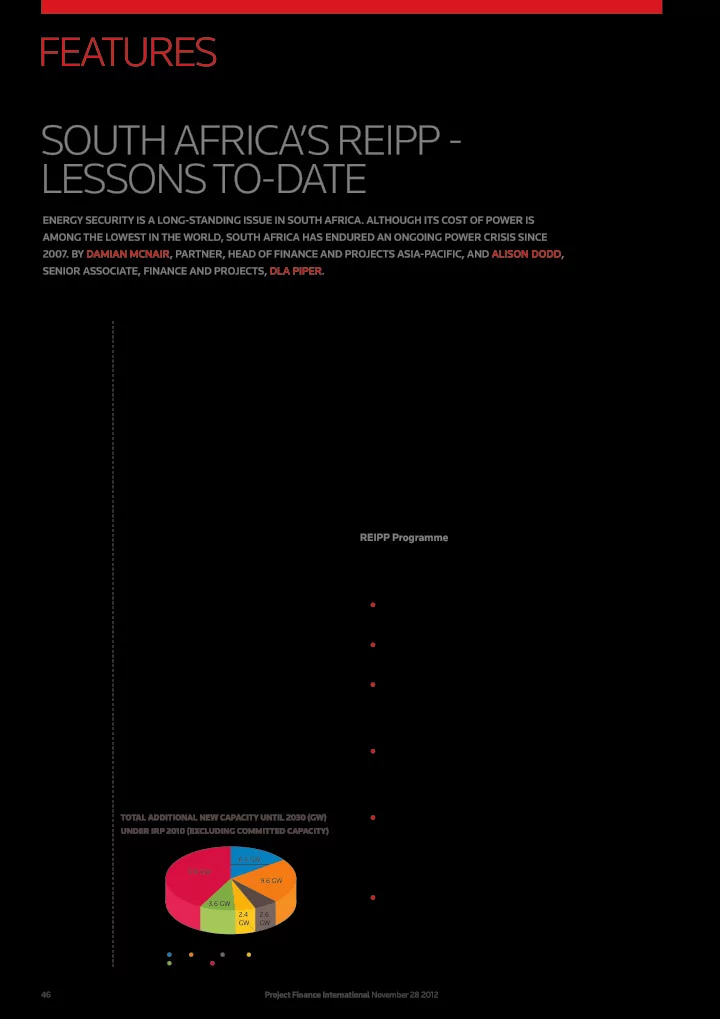

FEATURES SOUTH AFRICA’S REIPP - LESSONS TO-DATE ENERGY SECURITY IS A LONG-STANDING ISSUE IN SOUTH AFRICA. ALTHOUGH ITS COST OF POWER IS AMONG THE LOWEST IN THE WORLD, SOUTH AFRICA HAS ENDURED AN ONGOING POWER CRISIS SINCE 2007. BY DAMIAN MCNAIR, PARTNER, HEAD OF FINANCE AND PROJECTS ASIA-PACIFIC, AND ALISON DODD, SENIOR ASSOCIATE, FINANCE AND PROJECTS, DLA PIPER. At that time, state power supplier Eskom Initially, it was assumed that the additional encountered problems with ageing plants and renewable energy capacity outlined in the IRP meeting electricity demand, necessitating power would be delivered by the Renewable Energy cuts to residents and businesses in the major Feed-In Tariff (REFIT) Programme. Announced in cities. Country-wide rolling blackouts continue, 2009, the REFIT Programme proposed to constraining economic growth, particularly in the provide a guaranteed tariff for electricity supply energy-intensive mining and mineral processing from renewable energy sources that covered the sectors. Combined with South Africa’s rapid cost of generation plus a “reasonable profit”. In industrialisation, these shortages have June 2011, the DoE announced that it would no culminated in an urgent need to increase longer proceed with the REFIT Programme and electricity generation capacity. that it would instead procure the additional In addition to increasing demand, the capacity under a programme now known as the diversification of energy supply is also a key Renewable Energy Independent Power aspect of South Africa’s long-term renewable Producers Procurement Programme (REIPP energy strategy. In its White Paper on Energy Programme). Policy 1998 and reiterated in the supplemental REIPP Programme White Paper on Renewable Energy 2003 (White Paper), the South African Government considered Under the REIPP Programme, bidders submit bids a range of measures regarding the integration of to construct and operate renewable energy renewable energies into the mainstream energy projects and sell power to Eskom. Key features of economy, and said that an increase in renewable the REIPP Programme include: energy capacity would provide improved � A competitive bid process with five rounds opportunities for energy trade and would enhance (phases), with selection on price and non-price energy security by encouraging diversity of both criteria; supply sources and primary energy carriers. � Bidders must meet minimum thresholds in Under the White Paper, South Africa respect of economic development requirements committed itself to a target of a 10,000GW (4%) in order for their bid to be compliant; renewable energy contribution to final energy � In addition to minimum thresholds, there is a consumption by 2013, to be produced mainly strong weighting on criteria relating to job from wind, solar, biomass and small-scale hydro. creation, local content and ownership, social In 2011 the Department of Energy (DoE) development, preferential procurement and published the Integrated Resource Plan (IRP), management control for black South Africans; which contemplated the addition of over 55GW of � Bidders bid the price (tariff) that will be energy generation by 2030 (an increase of more payable by Eskom (as buyer) pursuant to the than 170% on existing levels), 42% of which was to power purchase agreement (PPA), with the price be sourced from renewable energy sources. not to exceed the price cap for each technology for each phase; � Bidders required to submit the detailed heads TOTAL ADDITIONAL NEW CAPACITY UNTIL 2030 (GW) of terms of material contracts, including financing UNDER IRP 2010 (EXCLUDING COMMITTED CAPACITY) agreements and construction and operation 15% 42% contracts (generally an engineer, procure and 6.3 GW construct (EPC) contract and an operating and 17.8 GW 23% 9.6 GW maintenance (O&M) contract); and � Successful (preferred) bidders required to 3.6 GW reach financial close and commercial operation of 2.4 2.6 GW GW the project within specified time-frames. 6% The technologies comprising the REIPP 9% 5% Programme, and their envisaged split, are set out � Coal � Nuclear � Hydro � Gas-CCGT below in Table 1. � Peak-OCGT � Renewables 46 Project Finance International November 28 2012

SOUTH AFRICAN RENEWABLES will be added to allocation available in the later TABLE 1 - TECHNOLOGY SPLIT phases of the REIPP Programme. Given that Proposed Percentage 2,460MW has been allocated during Phases 1 and 2 Technology amount (MW) allocation (%) of the REIPP Programme, this additional amounts Onshore wind 1,850 49.7 means that a total of 4,360MW of capacity remains Concentrated 200 5.3 for allocation during Phases 3 to 5. solar power Solar photovoltaic 1,450 38.9 Contractual structure for projects under the Biomass 12,5 0.3 REIPP Programme Biogas 12,5 0.3 Preferred bidders under the REIPP Programme are Landfill gas 25 0.7 required to enter into the following (non-negotiable) Small hydro 75 2.0 documents in order to reach financial close: (<10MW) � A PPA with Eskom; Small projects IPP Total of 100 2.8 � An implementation agreement (IA) with the Total 3,725 100 DoE; � Transmission agreement or distribution The bid submission date for Phase 1 of the agreement with Eskom (depending on which REIPP Programme was November 4 2011, with network the facility will connect to); and 53 bids received. Of these, approximately 50% � A direct agreements – (all together, the project were for wind projects and 48% were for solar PV documents.) and CSP. The 28 preferred bidders were The DOE has issued a number of clarifications in announced on December 7 2011, with projects the form of briefing notes to the versions of the comprising a total of 1,275MW of installed project documents released with the RFP and the capacity. Phase 1 preferred bidders were initially RFP documentation itself. These clarifications have required to finalise all of their contractual related to a range of issues, including definitions arrangements by May 22 2012, although this date such as “contracted capacity” used in the project was extended and the final date for financial documents. Uncertainty still remains in relation to close was November 16 2012. some issues despite the Briefing Notes, such as the The “not to exceed” price cap for each role of, and contractual arrangements relating to, technology that bidders were required to bid the Independent Engineer in the testing regime against for Phase 1 is set out below in Table 2. established by the Project Documents. Key project finance issues and lessons learned TABLE 2 - PRICE CAPS Under the non-negotiable REIPP Programme Technology Commercial energy rate (R) (MWh) project documents, the project company is Onshore wind 1,150 entitled to relief in respect of a number of Solar PV 2,850 narrowly defined circumstances, including in Solar CSP 2.850 respect of force majeure, compensation events Biomass 1,070 (breaches by Eskom of its PPA obligations), system Biogas 800 events (delays in connecting the facility to the grid Landfill gas 840 and grid unavailability) and unforeseeable conduct Small hydro 1,030 (broadly equivalent to change in law risks). To minimise exposure to risk, lenders require The Phase 1 projects will be delivered at a tariff project companies to ensure that their contracts of R1.14 kW/h for wind, R2.76/kWh for solar PV “pass through” all relevant obligations to and R2.69/kWh for CSP. The competitive bid contractors and to ensure that contractors’ process under the REIPP Programme has resulted entitlements to extensions of time or costs are in reduced tariff prices bid for Phase 2 projects, and “back to back” with and limited to the project this downward trend of tariff pricing is expected to company’s limited entitlements under the project continue in Phase 3 and subsequent phases. documents. Where a pass-through of obligations The Phase 2 bid submission date was March 5 to contractors is not possible, project companies 2012 and 19 preferred bidders were announced on have looked to insurance or other sponsor May 21 2012. Preferred bidders were initially support methods to mitigate risks under the required to reach financial close by December project documents to the satisfaction of lenders. 2012, but the date for financial close for Phase 2 Forms of sponsor support utilised have included has been extended to March 18–28 2013. The bid equity subscription agreements (base and standby submission date for Phase 3 has also been extended equity), completion guarantees of whole or part from October 1 2012 to May 7 2013, with the of the debt until commercial operation of the financial close date for Phase 3 to be confirmed. facility, bank guarantees to support completion On October 29 2012, the DoE announced that it guarantees and cost overrun guarantees. intended to procure an additional 3,200MW of Lenders have also paid particular attention to renewable energy capacity between 2017 and aligning, and minimising any gaps between, the 2020, in addition to the 3,725MW currently being provisions of the project documents and the EPC procured to 2016 under the REIPP Programme. It is and O&M contracts regarding a range of issues generally understood that this additional capacity including site risk, the exclusion of special or Project Finance International November 28 2012 47

Recommend

More recommend