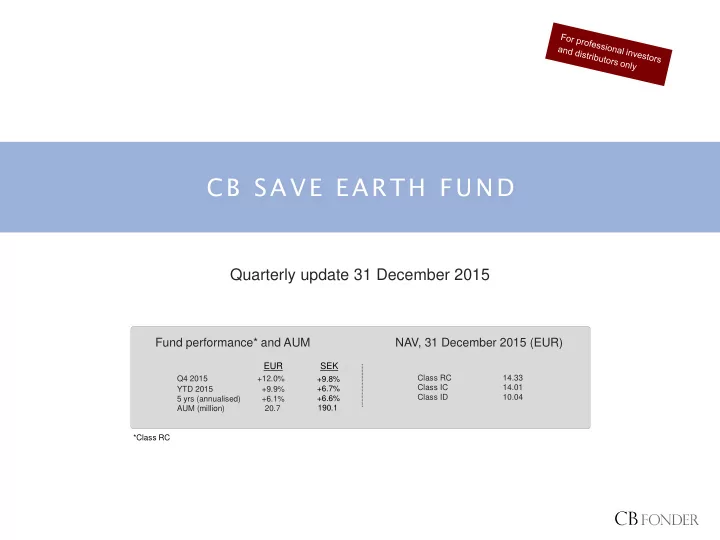

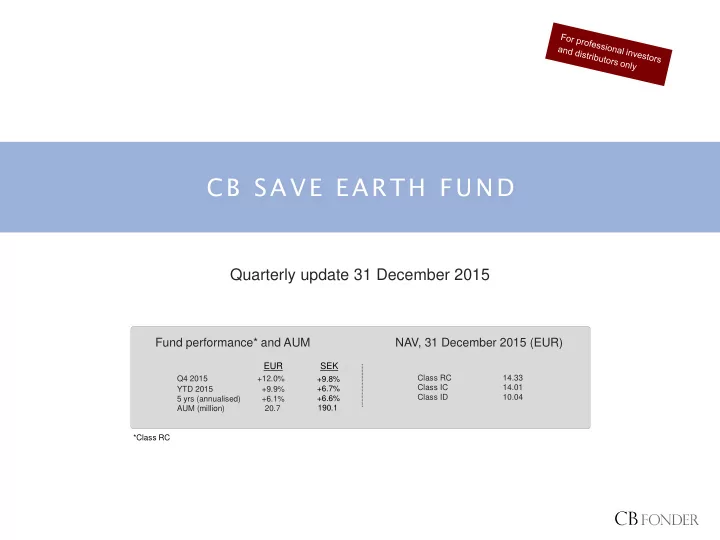

C B S A VE EA R T H F U ND Save Earth Fund CB SAVE EARTH FUND Quarterly update 31 December 2015 Fund performance* and AUM NAV, 31 December 2015 (EUR) EUR SEK Class RC 14.33 Q4 2015 +12.0% +9.8% Class IC 14.01 YTD 2015 +9.9% +6.7% Class ID 10.04 +6.6% 5 yrs (annualised) +6.1% 190.1. AUM (million) 20.70 *Class RC

C B S A V E E A R T H F U N D The strategy and the team Overview - CB Save Earth Fund The Team A global environmental fund, three megatrends: renewable Carl Bernadotte Portfolio Manager & owner energy, cleantech and water >25 years’ experience The strategy was launched in 2008 Born 1955 Concentrated portfolio and a long-term perspective Owns shares in CB Save Earth Fund Benchmark: MSCI World Net Marcus Grimfors Portfolio Manager Objective: Lower standard deviation than benchmark Objective: Outperform benchmark over 12 months 7 years’ experience Born 1981 Owns shares in CB Save Earth Fund Overview - CB Fonder Alexander Jansson Portfolio Manager & CEO Company founded in 1994 7 years’ experience Family owned, acting under the supervision of the Swedish Born 1983 Financial Supervisory Authority Owns shares in CB Save Earth Fund Guidelines: active, ethical and long-term Erik Allenius Somnell Business Development An ethical and sustainable framework is applied in the portfolio 3 years’ experience management Born 1984 The team is based in Stockholm, Sweden; all fund Owns shares in CB Save Earth Fund administration is performed in Luxembourg 2

C B S A V E E A R T H F U N D The strategy: Investment case - three mega trends Three mega trends and a global exposure Cleantech Renewable energy Water Investment areas Investment areas Investment areas Companies in area Companies in area Companies in area Filtration Wind Energy storage • • • Danaher Vestas Wind Tesla Distribution Solar Infrastructure • • • American Waterworks SunPower Legrand Saving/efficiency Hydro Energy efficiency • • • Halma Andritz Kingspan Wastewater Bio Material • • • Geberit Novozymes Mayr-Melnhof Geothermal Recycling & Waste treatment • • Nibe Tomra Systems C B S A V E E A R T H F U N D 3

C B S A V E E A R T H F U N D The sector and the fund in media The climate meeting in Paris, COP21, was widely regarded as a huge success. The Guardian, 14 Dec 2015 The incipient revolution for renewable energy has upended old business models: A Texas utility offers a nighttime special: free electricity. The New York Times, 8 Nov 2015 Despite the falling oil and gas prices, renewables had yet another record-breaking year in 2015. Bloomberg, 14 Jan 2016 The Swedish private savings guru, Claes Hemberg, recommended CB Save Earth Fund as a Christmas gift for the children. As did the Swedish online savings magazine, Placera. (N.B. in Swedish). Placera & Avanza, 11 & 14 Dec 2015 4

C B S A V E E A R T H F U N D Performance: The fund and the index The fund gained +12% in the forth quarter and during the last 12 months the fund has gained +10% . The fund outperformed the benchmark index during the fourth quarter and regained almost all lost ground from the three first quarters. The fund and the benchmark index, 1 year (EUR) The fund and the benchmark index, Q4 2015 (EUR) 120 125 115 120 +12.0% 110 115 +10.4% +8.4% 110 105 +9.9% 105 CB Save Earth Fund RC 100 MSCI World Net CB Save Earth Fund RC 100 MSCI World Net 95 95 Sep-15 Oct-15 Nov-15 Dec-15 Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 4% 2% CB Save Earth Fund RC vs MSCI World Net CB Save Earth Fund RC vs +3.3% 1% 3% MSCI World Net 0% -0.5% 2% -1% 1% -2% -3% 0% -4% -1% -5% -6% -2% Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 Sep-15 Oct-15 Nov-15 Dec-15 Source: MSCI, CB Fonder 5

C B S A V E E A R T H F U N D Performance: The fund and the index The fund and benchmark indices, since fund inception in June 2008 (EUR) 225 200 175 150 125 100 75 50 25 0 Jun-08 Jun-09 Jun-10 Jun-11 Jun-12 Jun-13 Jun-14 Jun-15 Water index (S&P Global Water) MSCI World Net CB Save Earth Fund RC Cleantech index (CTIUS) Renewable energy index (Wilderhill) +100.8% +89.5% +43.3% +32.7% -33.5% • Renewable energy index (including dividends): • Cleantech index (including dividends): WilderHill New Energy Global Innovation Index The Cleantech Index • Water index (including dividends): • World index (including dividends after tax): S&P Global Water Index MSCI World Source: MSCI, S&P, CB Fonder, Reuters, Bloomberg 6 6 Daily data for the period 9 June 2008 – 31 December 2015

C B S A V E E A R T H F U N D Performance: The fund and the index CB Save Earth Fund has returned +4.9% p.a. since inception in 2008; the fund’s return has been higher than for two of the three sectors it invests in (Water index +9.7% p.a.; Cleantech index +3.8% p.a.; Renewable energy index -5.3% p.a.). The risk in the fund is significantly lower than in each of the three sectors in which it invests, and also lower than the risk in MSCI World. The fund’s Sharpe ratio – the risk-adjusted return – is 0.38, which is higher than for two of the three sectors the fund invests in . Risk and return, since fund inception (EUR) Sharpe, since fund inception (EUR) 12% Water index Water index (S&P Global Water) 0.54 10% (S&P Global Water) MSCI World Net 8% MSCI World Net 0.51 6% CB Save Earth Fund Return p.a. 4% Cleantech index (CTIUS) CB Save Earth Fund 0.38 2% 0% Cleantech index 0.16 -2% (CTIUSTR) -4% Renewable energy index (Wilderhill) Renewable energy index -0.22 -6% (Wilderhill) 0% 5% 10% 15% 20% 25% 30% Standard Deviation Source: Bloomberg, Reuters, S&P, CB Fonder 7 Daily data for the period 9 June 2008 – 31 December 2015 (EUR).

C B S A V E E A R T H F U N D Performance: The fund and peers CB Save Earth Fund’s objective is to offer investors a low risk alternative within a segment characterised by high risk . The fund has, since inception in 2008, had a significantly lower risk than peers while delivering a highly competitive return; a combination that results in a high Sharpe ratio. The water sector has been the best performer by far among the three environmental sectors. Nevertheless, the fund has a competitive Sharpe ratio also compared to the water funds. Risk and return, since fund inception (EUR) Sharpe, since fund inception (EUR) 8% Pictet - Water 0.39 6% CB Save Earth Fund 0.38 RobecoSAM Sust. Water Fund 0.36 4% CB Save Earth Fund Parvest Global Env. C C 0.31 2% Return p.a. Schroder Gl. Climate Change 0.28 0% Handelsbanken Hållb. Energi 0.13 Nordea Klimatfond 0.07 -2% SAM Sustainable Climate 0.06 -4% DNB Renewable Energy -0.09 -6% Allianz Global EcoTrends -0.17 0% 5% 10% 15% 20% 25% 30% Standard deviation BlackRock New Energy -0.20 CB Save Earth Fund Handelsbanken Hållb. Energi DNB Renewable Energy BlackRock New Energy Nordea Klimatfond SAM Sustainable Climate Allianz Global EcoTrends Schroder Gl. Climate Change Parvest Global Env. C C RobecoSAM Sust. Water Fund Pictet - Water Source: Bloomberg, CB Fonder 8 Daily data for the period 9 June 2008 – 31 December 2015 (EUR).

C B S A V E E A R T H F U N D The portfolio: Holdings The 10 largest company exposures, as of 31 December 2015 Founded/ Market cap Company Country Sector Share of AUM € bn listed Geberit 1874/1999 Switzerland Water 11 5.0% Vestas Wind 1945/1998 Denmark Renewables 14 3.8% Nibe 1949/1997 Sweden Renewables 3 3.6% Andritz 1852/2001 Austria Renewables 5 3.6% Aalberts 1975/1987 Netherlands Water 3 3.6% Danaher 1969/1979 USA Water 56 3.5% Halma 1894/1972 UK Water 4 3.2% Idex Corp 1988/1989 USA Water 5 2.9% SunPower Corp 1985/2005 USA Renewables 3 2.8% Novozymes 2000/2000 Denmark Cleantech 13 2.7% Total/Average 12 34.6% Exposure to large A mixture of high- companies with a long yielding utilities and and proven track growth companies. record i.e. no mayflies. Source: FactSet, CB Fonder 9 9

C B S A V E E A R T H F U N D The portfolio: Historical allocation, share of AUM Sector allocation, 36 months 100% 80% 7% 13% 60% 45% 35% 40% 20% 0% Renewable energy Cleantech Water Cash* As of 31 December 2015 Renewable energy Cleantech Water Cash* Geographical allocation, 36 months 100% 0% 7% 80% 11% 28% 60% 54% 40% 20% 0% Asia Europe North America RoW Cash* As of 31 December 2015 Asia Europe North America RoW Cash* Source: CB Fonder 10 *Including cash in underlying funds

Recommend

More recommend