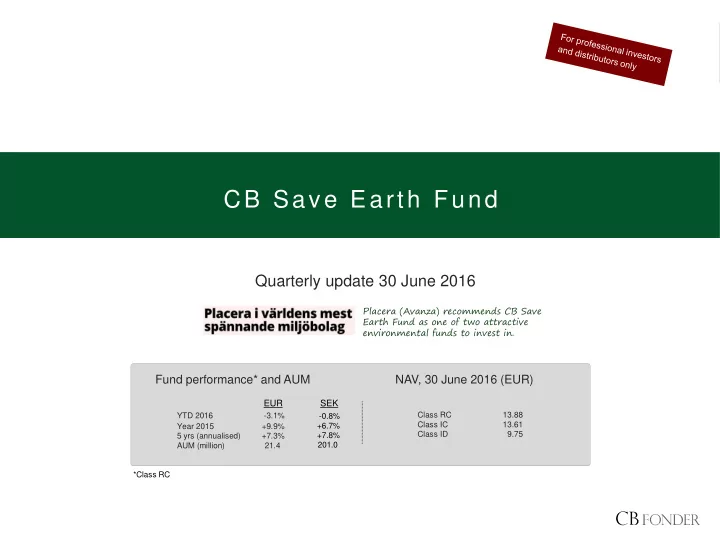

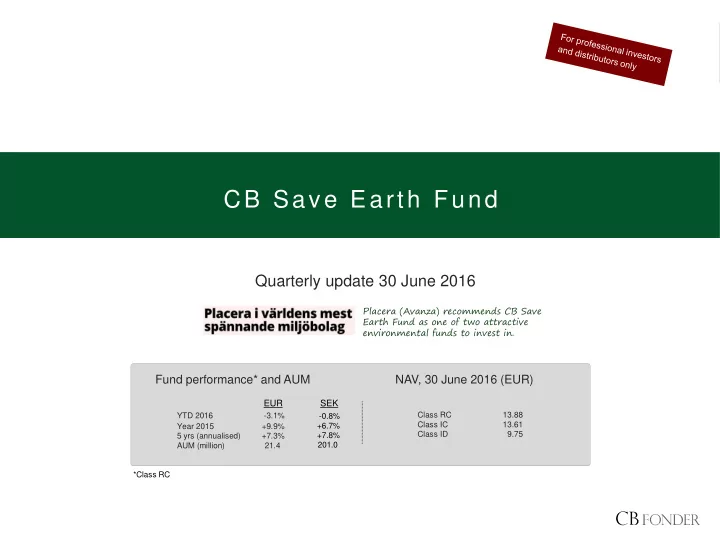

CB Save Earth Fund Quarterly update 30 June 2016 Placera (Avanza) recommends CB Save Earth Fund as one of two attractive environmental funds to invest in. Fund performance* and AUM NAV, 30 June 2016 (EUR) EUR SEK Class RC 13.88 YTD 2016 -3.1% -0.8% Class IC 13.61 Year 2015 +9.9% +6.7% Class ID 9.75 +7.8% 5 yrs (annualised) +7.3% 201.0. AUM (million) 21.40 *Class RC

The strategy and the team C B S A V E E A R T H F U N D Overview - CB Save Earth Fund The team Carl Bernadotte, Portfolio manager & owner A global environmental fund, three megatrends: renewable >30 years’ experience energy, cleantech and water Born 1955 Owns shares in CB Save Earth Fund The strategy was launched in 2008 Concentrated portfolio and a long-term perspective Marcus Grimfors, Portfolio manager Benchmark: MSCI World Net 8 years’ experience Born 1981 Objectives: Owns shares in CB Save Earth Fund Lower standard deviation than benchmark Outperform benchmark over 12 months Alexander Jansson, Portfolio manager & CEO 8 years’ experience Overview - CB Fonder Born 1983 Owns shares in CB Save Earth Fund Company founded in 1994 Viktor Sonebäck, Intern Family owned, acting under the supervision of the Swedish KTH 2012-2017 Financial Supervisory Authority Born 1993 Guidelines: active, ethical and long-term An ethical and sustainable framework is applied in the portfolio Emil Brismar, Intern management KTH 2014-2019 Born 1994 The team is based in Stockholm, Sweden. All fund administration is performed in Luxembourg 2

The strategy: Investment case - three mega trends C B S A V E E A R T H F U N D Three mega trends and a global exposure Cleantech Renewable energy Water Investment areas Investment areas Investment areas Companies in area Companies in area Companies in area Filtration Wind Energy storage • • • Danaher Vestas Wind Tesla Distribution Solar Infrastructure • • • American Waterworks SunPower Legrand Saving/efficiency Hydro Energy efficiency • • • Halma Andritz Kingspan Wastewater Bio Material • • • Geberit Novozymes Mayr-Melnhof Geothermal Recycling & Waste treatment • • Nibe Tomra Systems C B S A V E E A R T H F U N D 3

The sector and the fund in media C B S A V E E A R T H F U N D The Swedish business magazine Veckans Affärer highlights the need for clean water and looks at the sector from an investment perspective. CB Fonder’s CEO and fund manager Alexander Jansson is invited to comment on the story. (N.B. in Swedish). Veckans Affärer, 6 May 2016 Pär Ståhl, fund expert at Placera/Avanza, writes about long term savings for children and occupational pension where CB Save Earth Fund can be found as one of 8 attractive funds in the portfolio for the children, and as one of 9 funds in the occupational pension portfolio. (N.B. in Swedish). Placera.nu, 6 & 17 May 2016 CEO & fund manager Alexander Jansson in an interview with the Swedish business magazine VA Finans about investments in the environmental sector and why solar energy will beat wind energy. (N.B. in Swedish). Veckans Affärer Finans, 8 July 2016 4

Performance: The fund and the index C B S A V E E A R T H F U N D The fund has returned -3% during the last 12 months, which is in line with MSCI World . The last six months the fund has returned -3%, compared to -2% for the benchmark. The fund and the benchmark index, 1 year (EUR) The fund and the benchmark index, 6 months (EUR) 110 105 105 100 -1.6% 100 -2.5% -3.1% 95 95 -2.7% 90 90 85 85 CB Save Earth Fund RC (EUR) CB Save Earth Fund RC (EUR) MSCI World Net (EUR) MSCI World Net (EUR) 80 80 Jun-15 Aug-15 Oct-15 Dec-15 Feb-16 Apr-16 Jun-16 Dec-15 Feb-16 Apr-16 Jun-16 6% 4% 5% 3% 4% 2% 3% 1% 2% 0% 1% 0% -0.2% -1% -1.6% -1% -2% CB Save Earth Fund RC CB Save Earth Fund RC vs MSCI -2% vs MSCI World Net World Net -3% -3% -4% -4% Dec-15 Feb-16 Apr-16 Jun-16 Jun-15 Aug-15 Oct-15 Dec-15 Feb-16 Apr-16 Jun-16 Source: MSCI, CB Fonder 5 Data as of 2016-06-30

Performance: The fund and indices C B S A V E E A R T H F U N D The fund and benchmark indices, since fund inception in June 2008 (EUR) 225 200 175 150 125 100 75 50 25 0 Jun-08 Jun-09 Jun-10 Jun-11 Jun-12 Jun-13 Jun-14 Jun-15 Jun-16 Water index (S&P Global Water) MSCI World Net CB Save Earth Fund RC Cleantech index (CTIUS) Renewable energy index (Wilderhill) +117.0% +86.5% +38.8% +33.4% -39.5% • Renewable energy index (including dividends): • Cleantech index (including dividends): WilderHill New Energy Global Innovation Index The Cleantech Index • Water index (including dividends): • World index (including dividends after tax): S&P Global Water Index MSCI World Source: MSCI, S&P, CB Fonder, Reuters, Bloomberg 6 Daily data for the period 9 June 2008 – 30 June 2016

Performance: The fund and indices C B S A V E E A R T H F U N D CB Save Earth Fund has returned +4.2% p.a. since inception in 2008; the fund’s return has been higher than for two of the three sectors it invests in (Water index +10.1% p.a.; Cleantech index +3.6% p.a.; Renewable energy index -6.1% p.a.). The risk in the fund is significantly lower than in each of the three sectors in which it invests, and also lower than the risk in MSCI World. The fund’s Sharpe ratio – the risk-adjusted return – is 0.33, which is higher than for two of the three sectors the fund invests in . Risk and return, since fund inception (EUR) Sharpe, since fund inception (EUR) 12% Water index 0.57 Water index (S&P Global Water) (S&P Global Water) 10% MSCI World Net 8% MSCI World Net 0.46 6% CB Save Earth Fund 4% Return p.a. CB Save Earth Fund 0.33 Cleantech index (CTIUS) 2% 0% Cleantech index 0.16 -2% (CTIUSTR) -4% Renewable energy index (Wilderhill) Renewable energy index -6% -0.25 (Wilderhill) -8% 0% 5% 10% 15% 20% 25% 30% Standard Deviation Source: MSCI, S&P, CB Fonder, Reuters, Bloomberg 7 Daily data for the period 9 June 2008 – 30 June 2016

Performance: The fund and peers C B S A V E E A R T H F U N D CB Save Earth Fund’s objective is to offer investors a low risk alternative within a segment characterised by high risk . The fund has, since inception in 2008, had a significantly lower risk than peers while delivering a highly competitive return; a combination that results in a high Sharpe ratio. The water sector has by far been the best performer among the three environmental sectors. Nevertheless, the fund has a competitive Sharpe ratio also compared to the water funds. Risk and return, since fund inception (EUR) Sharpe, since fund inception (EUR) 8% Pictet - Water 0.39 RobecoSAM Sust. Water Fund 0.38 6% CB Save Earth Fund 0.33 4% Parvest Global Env. C C 0.30 CB Save Earth Fund 2% Return p.a. Schroder Gl. Climate Change 0.23 0% Handelsbanken Hållb. Energi 0.09 Nordea Klimatfond 0.05 -2% SAM Sustainable Climate 0.03 -4% DNB Renewable Energy -0.15 -6% Allianz Global EcoTrends -0.20 0% 5% 10% 15% 20% 25% 30% Standard deviation BlackRock New Energy -0.21 CB Save Earth Fund Handelsbanken Hållb. Energi DNB Renewable Energy BlackRock New Energy Nordea Klimatfond SAM Sustainable Climate Allianz Global EcoTrends Schroder Gl. Climate Change Parvest Global Env. C C RobecoSAM Sust. Water Fund Pictet - Water Source: Bloomberg, CB Fonder 8 Daily data for the period 9 June 2008 – 30 June 2016 (EUR).

Recommend

More recommend