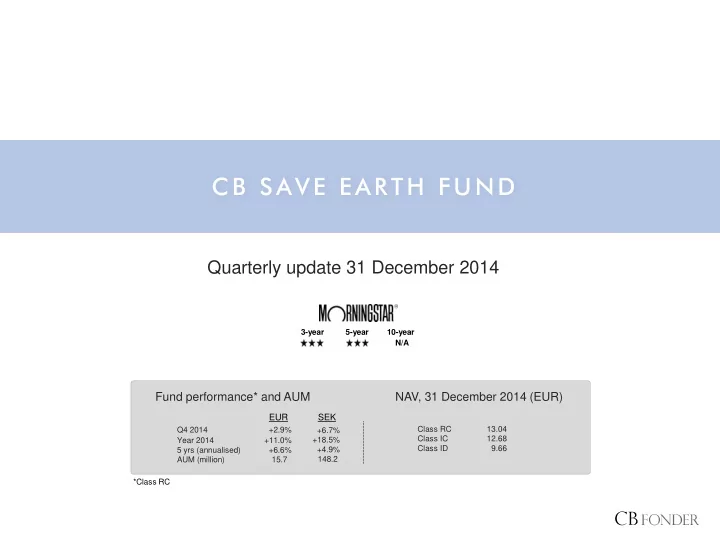

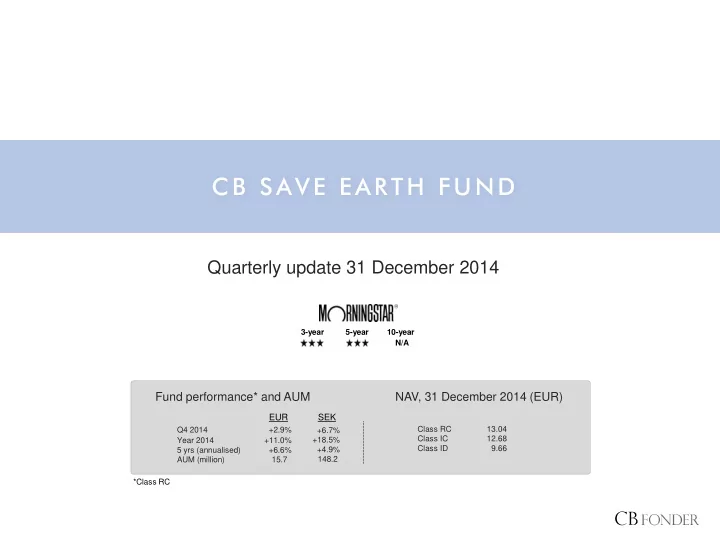

CB SAVE EARTH FUND Quarterly update 31 December 2014 3-year 5-year 10-year N/A Fund performance* and AUM NAV, 31 December 2014 (EUR) EUR SEK Class RC 13.04 Q4 2014 +2.9% +6.7% Class IC 12.68 +18.5% Year 2014 +11.0% Class ID 9.66 5 yrs (annualised) +6.6% +4.9% 148.2. AUM (million) 15.70 *Class RC

C B S AV E E AR T H FU N D The strategy and the team Save Earth Fund The team About CB Save Earth Fund A global environmental fund; three megatrends: renewable Carl Bernadotte Portfolio Manager & owner energy, cleantech and water >25 years’ experience Concentrated portfolio (6-10 funds) Born 1955 Benchmark: MSCI World Net Marcus Grimfors Objective: Lower standard deviation than benchmark Portfolio Manager Objective: Outperform benchmark over 12 months 6 years’ experience Born 1981 About CB Fonder Alexander Jansson Portfolio Manager & CEO Company founded in 1994 6 years’ experience Family owned, acting under the supervision of the Swedish Born 1983 Financial Supervisory Authority Erik Allenius Somnell Guidelines: active, ethical and long-term Business Development An ethical framework is applied in the portfolio management 3 years’ experience The team is based in Stockholm, Sweden; fund Born 1984 administration is performed in Luxembourg 2

Save Earth Fund C B S AV E E AR T H FU N D Cartoon of the quarter: Climate talks A comment from The Economist on what can be expected during the important climate meeting in Paris 2015. The meeting is being held as a follow-up on the failed climate talks in Copenhagen 2009. There are hopes that an agreement (like the one in Kyoto 1997) could be made. The climate agreement in November between China and the US – the world’s two largest polluters – should hardly have worsened the odds for Paris … Source: The Economist 3

Save Earth Fund C B S AV E E AR T H FU N D The sector and the fund in media The Swedish business paper Dagens Industri pay attention to climate and environmental funds because of their strong performance over the past year. More on the subject, together with some comments from Alexander Jansson, can be found by clicking on the picture to the right (N.B. in Swedish). Di, 5 December 2014 Financial Times published an award-winning article series on water shortages, which has become a global problem. The series highlights subjects such as the world’s largest infrastructure project in China; the leading technologies for improving the efficiency of water use; and the fact that 95% of California suffer from severe water stress. Read the series by clicking on the picture to the right. FT, Q3-Q4 2014 At the end of November E.ON, Germany’s largest power provider/distributor, announced that the company will be spilt in two: the new E.ON, with renewable energy and distribution as the main focus, and the old E.ON, to which all nuclear and fossil power production will be allocated. A sign of the times and something we believe we will see more of as the share of renewable energy increases at the expense of fossil energy. Read more by clicking on the picture to the right. The Economist, ”E .ON and E. OUT”, 6 December 2014 4

Save Earth Fund C B S AV E E AR T H FU N D Performance: The fund and indices Environmental investments have generally performed well over the past year, which has also been the case for MSCI World, the latter driven by a strengthening US dollar as well as a strong performance for the US stock market. The renewable energy index (Wilderhill New Energy Index), the most volatile sector in the comparison, had a solid start of the year but fell back along with the oil price. Also the Cleantech index was curbed due to the oil price decline, while the water index is fairly uncorrelated with the oil price. Read more about the oil price on page 8. CB Save Earth Fund was +11% for the year. The fund has since inception in June 2008 performed better than two out of the three sectors it invests in. At the same time, the risk for CB Save Earth Fund has been significantly lower than the risk in each of the three sectors, as well as the MSCI World index. Return, sector indices, 1 year (EUR) Risk and return, sector indices, since fund inception (EUR) +19.5% +11.0% Source: MSCI, Reuters, Bloomberg, CB Fonder 5

C B S AV E E AR T H FU N D Performance: The fund and other global strategies Save Earth Fund Our objective is for the fund to offer a green and global exposure and to be a competitive alternative compared to other global funds. Over the last three years CB Save Earth Fund has stood up well, especially when looking at the risk-adjusted return (Sharpe ratio) compared to the global strategies of the most recognized names in the Nordic market. Going forward, we believe that green investments can offer a window of growth and thus a better return than the global stock market. Compare with emerging markets during the 2003-2007 period. Risk and return, 3 years Risk-adjusted return (Sharpe ratio), 3 years Return p.a. Standard Deviation Source: CB Fonder, Lipper, Reuters, Bloomberg 6 Daily data for the period 2011-12-31 – 2014-12-31 (EUR).

Save Earth Fund C B S AV E E AR T H FU N D Performance: The fund and peers CB Save Earth Fund’s objective is to offer investors a low risk alternative within a segment characterised by high risk. The fund has, since inception in 2008, had a significantly lower risk than many competitors while delivering a highly competitive return; a combination that results in a high Sharpe ratio. Risk and return, since inception (EUR) Risk-adjusted return (Sharpe ratio), since inception Return p.a. Standard Deviation Source: CB Fonder, Bloomberg 7 Daily data from Bloomberg for the period 2008-06-30 – 2014-12-31 (EUR).

Save Earth Fund C B S AV E E AR T H FU N D Analysis: Implications of a falling oil price What are the implications of a falling oil price on a green global equity fund? The oil price fell by 46%, in USD, during 2014, which had a big impact on many markets; in particular the ones directly exposed (i.e. energy markets/companies). A falling oil price is first and foremost negative for oil companies, but also companies in renewable energy is exposed due to the decreasing incentives for substitution that comes with a lower oil price. We still believe in a strong long-term case for renewable energy, but we are cautious short term. Our analysis show that the renewable energy sector historically has been hit hardest by a falling oil price, followed by cleantech. The water sector, on the other hand, has consistently performed very well in relative terms. See the below table. The unconstrained allocation mandate (between the sectors cleantech, water and renewable energy) for CB Save Earth Fund allowed us to significantly reduce the exposure towards renewable energy already in October in favor of water and cleantech. The oil price has since then fallen more than 40%. Today, renewable energy represent 1% of invested assets, compared to 72% for water and 20% for the cleantech sector. See the current and historical allocation on page 11. Read the analysis by clicking on the below picture. The table shows the four largest drawdowns in the oil price (in USD) over the past decade, and the performance of each sector relative to the MSCI World index over the same period. Source: MSCI, S&P, Reuters, Bloomberg, CB Fonder 8

Save Earth Fund C B S AV E E AR T H FU N D Analysis: Active allocation The returns differ significantly between the three sectors; active allocation matters MSCI World is practically never the best performer; every year (with narrow exceptions in 2011 and 2014) a green sector has given a greater return, why the prospects for active allocation are good. Renewable energy, as a high-Beta sector, has very volatile returns: 2007 and 2013 were stellar years for the sector, while 2008, 2010, and 2011 were lousy. Cleantech has a somewhat similar return profile, but without the extremes. Over the past 10 years the water sector has performed better or in line with the world index, which is why we argue that the sector is an appropriate base in our portfolio – to which cleantech and renewable energy is added as compliments. Each sector’s excess return against the MSCI World index, per calendar year since 2005 Source: Reuters, Bloomberg, S&P, MSCI, CB Fonder. Data as of 2014-12-31 9

Recommend

More recommend