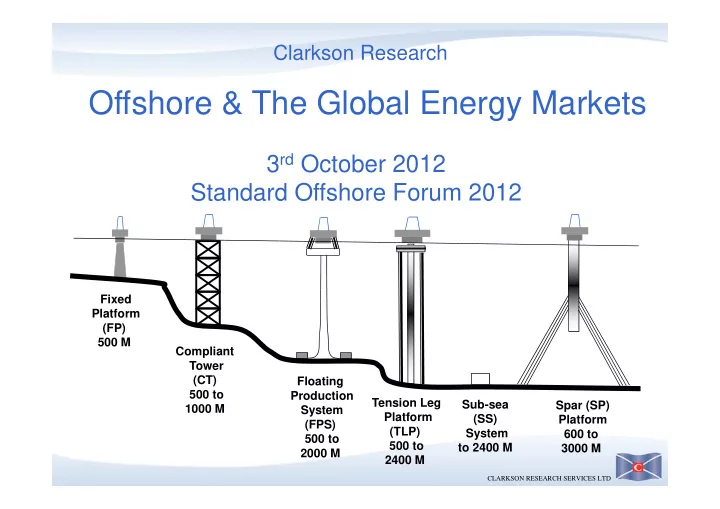

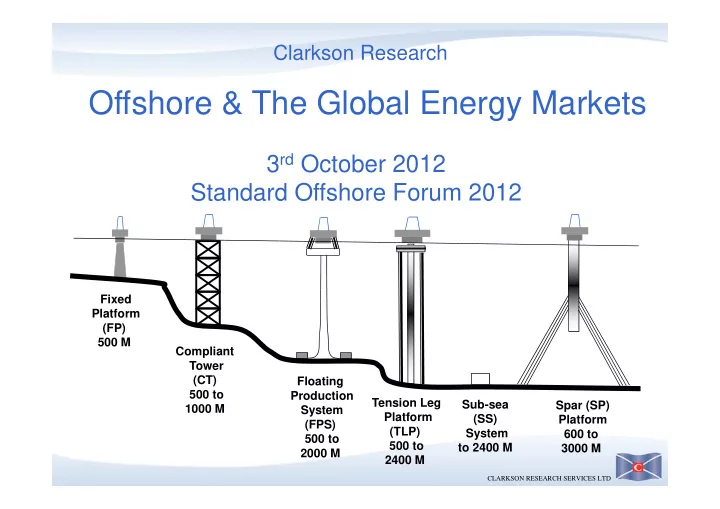

Clarkson Research Offshore & The Global Energy Markets 3 rd October 2012 Standard Offshore Forum 2012 Fixed Platform (FP) 500 M Compliant Tower (CT) Floating 500 to Production Tension Leg Sub-sea Spar (SP) 1000 M System Platform (SS) Platform (FPS) (TLP) System 600 to 500 to 500 to to 2400 M 3000 M 2000 M 2400 M CLARKSON RESEARCH SERVICES LTD

Agenda 1. Market Trends 2. Offshore and the Energy Markets 3. Offshore Oil & Gas Production 4. Offshore Regional Trends 5. Offshore Fleet & Structures 6. Conclusions CLARKSON RESEARCH SERVICES LTD

The offshore market continues its buoyant trend with heavy investment CLARKSON RESEARCH SERVICES LTD

Offshore Market (Rates) Mar ‐ 11 Sep ‐ 11 Mar ‐ 12 Sep ‐ 12 Jack ‐ Up $/day 131 139 165 160 Floater $/day 410 445 521 537 DSV Index 142 163 166 166 MSV Index 114 130 137 137 ROV Index 121 135 141 141 Accommodation Index 100 102 104 106 AHTS, 12 Mth TC $/day 43,625 46,950 46,000 46,350 PSV, 12 Mth TC $/day 21,625 29,950 27,500 28,600 Index (Mar ‐ 2011=100) 100 113 118 119 CLARKSON RESEARCH SERVICES LTD

Leading Indicators Leading Indicators of Offshore Activity 2011 Sep ‐ 12 Chng MDU Orderbook 136 195 UP Deepwater Rig Utilisation 82% 98% UP AHTS 5yo>NB Premium 89% 90% UP Oil Price $110 $113 UP Gas Price $4 $2.5 DOWN Barclays E&P 4% 5% UP IEA LT Energy Dem F'cast 4.6% 4.7% UP Rig Moves, latest quarter 289 341 UP Oil Price Forecast, long term 115 115 SAME Source: CRSL CLARKSON RESEARCH SERVICES LTD

Oil Price Scenarios & IEA Scenarios 150 Brent $/bbl 140 130 120 110 100 $2009/bbl 90 80 Current 70 current policies 60 50 150 $140/bl 40 30 scenario: price 20 140 10 Oil Price (2011 $) 0 Jan-05 Jul-05 Jan-06 Jul-06 Jan-07 Jul-07 Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 130 pushed up to 450 Scenario New 120 $140/barrel in 2035 New Policies $118/bl 110 Current Policies (at 2011 constant 100 450 prices) 90 $92/bl 80 New policies take the 70 price down to Approximate deepwater offshore cost/bbl 60 50 $113/barrel 40 The Carbon 450 30 Scenario takes the 20 10 price down to 0 $90/barrel 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 2020 2025 2030 2035 Figure 3: The IEA Oil price scenarios 2011 CLARKSON RESEARCH SERVICES LTD

Offshore Investment & Oil Prices Number of Units $ per barrel Development Production 1,000 140 Support Oil Price (2009 $s) 900 120 800 2000s 1970s This boom 100 700 This offshore accompanied boom followed 600 80 the oil price the 1973 “Oil 500 rise Crisis” 60 400 300 40 200 20 100 0 0 <=1960* 1963 1966 1969 1972 1975 1978 1981 1984 1987 1990 1993 1996 1999 2002 2005 2008 2011 Year of Build Figure 2: Age profile of mobile offshore fleet (11,678 structures) on 1 Sep 2012 CLARKSON RESEARCH SERVICES LTD

“Offshore oil is driven by high oil prices and trends in oil demand” CLARKSON RESEARCH SERVICES LTD

Global Energy Outlook – Steady Demand Growth Global Energy Demand/Supply Projections Source Period Source Date Oil Gas Coal Nuclear Hydro Renewables Biofuels CURRENT SHARE Jul ‐ 12 33% 24% 30% 5% 6% 2% BP 2010 ‐ 2030 Jun ‐ 12 0.8% 2.2% 1.1% 2.5% 2.0% 9.3% 6.3% Exxon 2005 ‐ 2030 Aug ‐ 11 0.8% 1.8% 0.5% 2.3% 2.2% 9.6% IEA 2008 ‐ 2035 Dec ‐ 11 0.5% 1.4% 0.6% 2.2% 2.0% 7.9% 1.7% EIA 2008 ‐ 2030 Aug ‐ 12 1.0% 1.6% 1.5% 2.4% OPEC 2010 ‐ 2035 Jul ‐ 12 1.4% Statoil 2010 ‐ 2030 Nov ‐ 11 1.5% 2.2% Mean of Forecasts 1.0% 1.8% 0.9% 2.4% 2.1% 8.9% 4.0% CLARKSON RESEARCH SERVICES LTD

Offshore Energy Within the Global Context Offshore Oil and Gas Shares 1980 2010 2020 Oil % Offshore 22% 31% 33% Gas % Offshore 28% 31% 39% Offshore Energy Shares of Total Energy 1980 2010 2020 Total Energy % Offshore Oil 10% 10% 11% Total Energy % Offshore Gas 3% 8% 10% Total Energy % Offshore O & G 13% 18% 21% Also: Offshore Wind Source: CRSL Capacity Nearly 4,000 MW CLARKSON RESEARCH SERVICES LTD

“ What is the 35 future for Oil Gas offshore oil & 30 gas? 25 M B o e p d 20 15 10 5 0 1 9 8 0 1 9 8 2 1 9 8 4 1 9 8 6 1 9 8 8 1 9 9 0 1 9 9 2 1 9 9 4 1 9 9 6 1 9 9 8 2 0 0 0 2 0 0 2 2 0 0 4 2 0 0 6 2 0 0 8 2 0 1 0 2 0 1 2 CLARKSON RESEARCH SERVICES LTD

Offshore Oil Production & Forecast • Production fell forecast Caspian Black Sea West Africa between 2005 and 35 Asia Pacific Sth America M East & ISC NW Europe ? 2010, but we Nth America 30 expected growth to Stagnation 30m bpd the next 25 five years 20 Million BPD • South America, Middle East and 15 West Africa 10 contribute the most absolute growth. 5 • North Sea & US 0 Gulf steady or 1980 1985 1990 1995 2000 2005 2010 2015 2020 declining but still Updated Sept 2012 important. CLARKSON RESEARCH SERVICES LTD

Offshore Gas Production Forecast 200 • Offshore gas ramp Asia Pacific up rates far quicker. Middle East 175 Med • Production reaches NW Europe 150 West Africa 150 mmcfd by the South America 125 end of the decade. North America mmcfd 100 • Asia Pacific and 75 Middle East are growing strongly. 50 • Major Brazilian fields 25 expected in the 0 second half of the 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 decade. Source: CRSL CLARKSON RESEARCH SERVICES LTD

3,000 2,700 2,400 2,100 Water Depth 1,800 Offshore Oil 1,500 1,200 Discoveries 900 600 300 0 1972 1977 1982 1987 1992 1997 2002 2007 2012 Offshore Gas Discoveries CLARKSON RESEARCH SERVICES LTD

Average Water Depth (M) 1,000 Source: Clarkson Research 100 200 300 400 500 600 700 800 900 0 1980 1981 1982 1983 Discoveries Start-Ups 1984 1985 1986 1987 1988 1989 1990 Offshore Getting Deeper 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Million BPD 10 15 20 25 30 0 5 1981 1983 1985 Shallow Water (<500m) Deepwater (>500m) 1987 1989 CLARKSON RESEARCH SERVICES LTD 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011

DP Fleet Age Profile 50% 400 % of the fleey 45% DP in each year 350 Utility Support 40% Survey 300 Rescue & Salvage 35% PSV/Supply>3,000 DWT Number of Vessels PSV/Supply<3,000 DWT Offshore Dredger 250 30% Mobile Production MDU Logistics 25% 200 Lift Boat / Installation Construction Vessel Construction Support 20% AHTS >8,000 BHP 150 AHTS <8,000 BHP & AHT A d ti U it 15% 100 10% 50 5% 0% 0 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 Source: CRSL CLARKSON RESEARCH SERVICES LTD

• Offshore is a regional market with “Development specific requirements in each trends help identify • Following trends and forecasts is future investment important needs” CLARKSON RESEARCH SERVICES LTD

World Oil Producing Regions 4. Europe Offshore:2.8 m bpd Growth: -2% pa 1. N. America Offshore: 4.0 m bpd 5. Med/ Caspian 7. Asia Growth: -1% pa Offshore: 2.1 m Pacific bpd Offshore: Growth: 3% pa 3.4 m bpd Growth: 1% 3. West 6. M East pa Africa 2. S&C & India Offshore: America Offshore: 4.5 m bpd Offshore: 6.7 m bpd Growth: 2.9 m bpd Growth: 4% pa Growth: 2% pa 2% pa CLARKSON RESEARCH SERVICES LTD

Other Producing No. Offshore Fields by Development Type FPSO, Mobile, Other Ext. 95 Region… FPSO Subsea Fixed Other 88 MOPU Reach Other, 47 USA Gulf of Mexico 42 184 9 634 Subsea, Mexico Gulf of Mexico 1 1 55 1 613 EC Canada 2 1 7 USA West Coast 1 15 USA Alaska 3 13 5 N AMERICA 2 42 186 14 724 6 EC Sth America 24 8 24 7 40 3 Caribbean 2 9 46 4 Fixed, Ext. WC Sth America 21 S&C AMERICA 24 8 26 16 107 7 2049 Reach, West Africa 24 7 44 7 242 11 226 South Africa 1 6 1 AFRICA 24 8 50 7 243 11 • Over 3,000 North Sea 17 13 224 106 264 Western Europe 6 6 13 2 Russian Arctic 2 1 producing fields. Baltic 1 1 N&W EUROPE 17 14 232 113 278 2 Mediterranean 1 31 12 149 4 • Brazil biggest Caspian/Black Sea 3 7 2 29 10 MEDITERRANEAN 1 3 38 14 178 14 Middle East 1 1 3 64 4 FPSO market, Indian Subcontinent 1 1 1 1 24 East Africa 2 MIDDLE EAST/ISC 1 2 4 4 88 4 followed by Asia SE Asia 6 10 40 32 297 2 Australasia 13 22 15 46 China 3 1 15 9 83 1 Pacific. Russian Far East 2 3 Japan / Korea 2 ASIA PACIFIC 22 11 77 58 431 3 • North Sea largest TOTAL 91 88 613 226 2,049 47 Americas 29% 57% 35% 13% 41% 28% subsea market in Africa 26% 9% 8% 3% 12% 23% Europe 20% 19% 44% 56% 22% 34% Middle East/ISC 1% 2% 1% 2% 4% 9% numbers terms . Asia Pacific 24% 13% 13% 26% 21% 6% CLARKSON RESEARCH SERVICES LTD

Recommend

More recommend