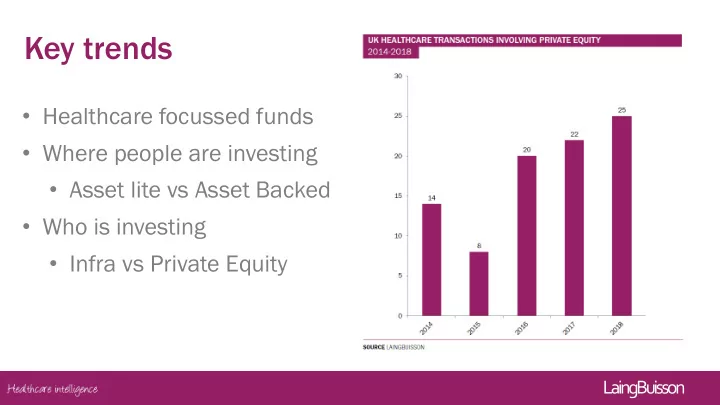

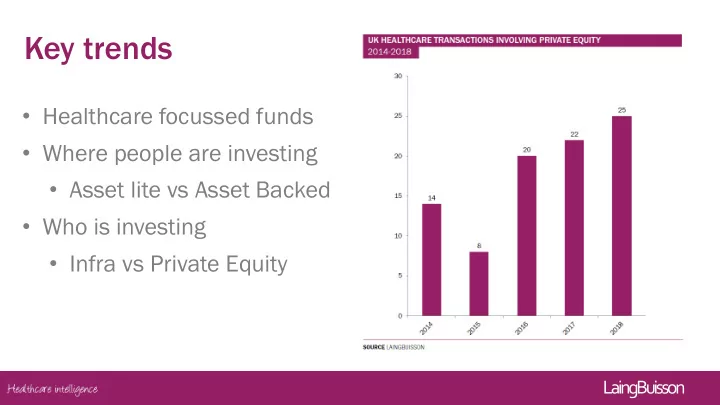

Key trends • Healthcare focussed funds • Where people are investing • Asset lite vs Asset Backed • Who is investing • Infra vs Private Equity LaingBuisson LaingBuisson

Sector focus LaingBuisson LaingBuisson

Sector focus The he UK an and EU ar are seeing healthc hcare re onl nly fund nds eme merge as as we well ? LaingBuisson LaingBuisson

Healthcare Services - 83% of capital deployed LaingBuisson LaingBuisson

LaingBuisson LaingBuisson

Recent deal activity… • 3 deals in 2019 already • August Equity/Hallmarq Vetinary Imaging • Waterland/Sandcastle Care • Apposite Capital/Riverdale • 2018 highlights included • BCP/Vetpartners • Genstar/CRF • Core Equity/Portman • Permira/Corin • CapVest/Core/PICS (with CMA) LaingBuisson LaingBuisson

…but a number of ongoing processes… LaingBuisson LaingBuisson

Infra - Looking Ahead • Infrastructure funds are looking for Core+ returns and investing in “Social Infrastructure” • Antin/Kisimul/Hesley • Infravia/Mater • AMP/Regard/CMG • iCON/Choice Care Group • Antin/Amedes/Inicia/Almaviva/Westerleigh LaingBuisson LaingBuisson

Recent deal flow LaingBuisson LaingBuisson

Private equity Private e equi uity remains compe petitive b but ut ne needs t to work harder to find an n ang ngle • Off market • Buy & Build • Leverage • Operational improvement • Political risk • Cyclicality • Management risk • Higher growth • Asset lite LaingBuisson LaingBuisson

Childcare as an example Success stories • • Bain Capital with Bright Horizons • Ontario Teachers’ Pension Plan (OTPP) with Busy Bees (Temasek now has 25%) New platforms emerging • • Innervation, Phoenix Capital Partners, Livingbridge, Foresight, BGF LaingBuisson LaingBuisson

Recommend

More recommend