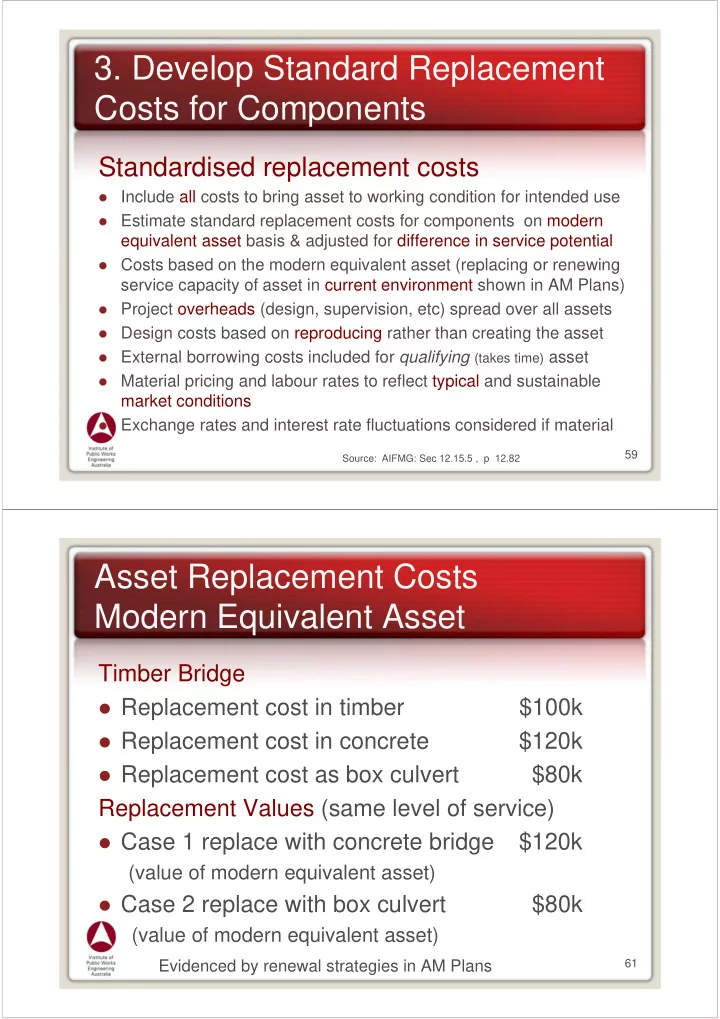

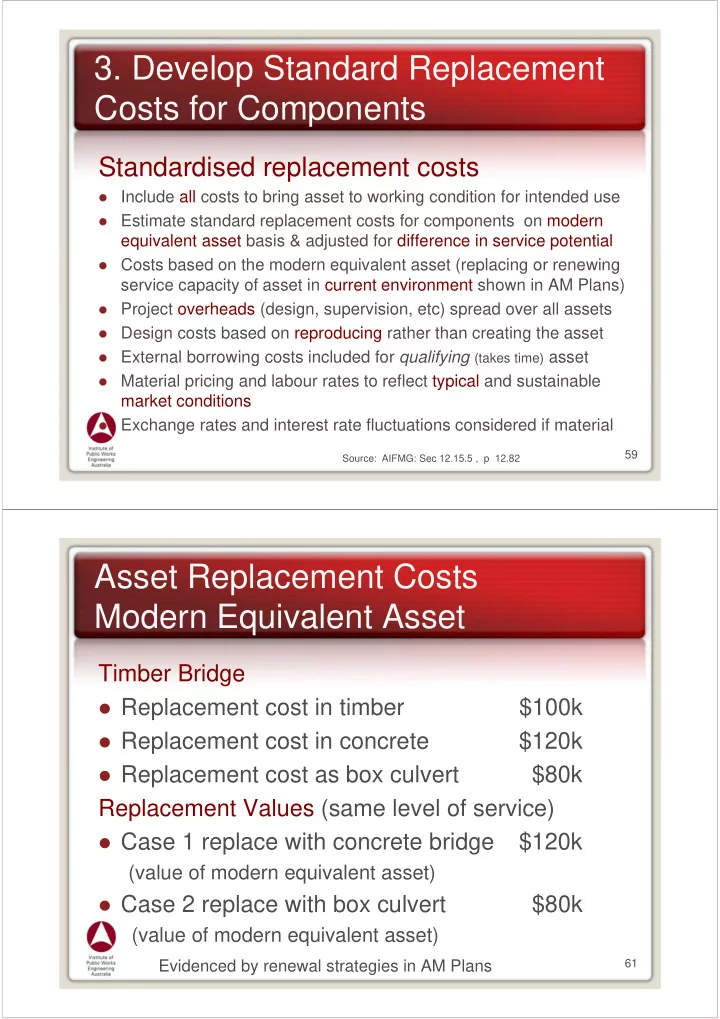

3. Develop Standard Replacement Costs for Components Standardised replacement costs Include all costs to bring asset to working condition for intended use Estimate standard replacement costs for components on modern equivalent asset basis & adjusted for difference in service potential Costs based on the modern equivalent asset (replacing or renewing service capacity of asset in current environment shown in AM Plans) Project overheads (design, supervision, etc) spread over all assets Design costs based on reproducing rather than creating the asset External borrowing costs included for qualifying (takes time) asset Material pricing and labour rates to reflect typical and sustainable market conditions Exchange rates and interest rate fluctuations considered if material 59 Source: AIFMG: Sec 12.15.5 , p 12.82 Asset Replacement Costs Modern Equivalent Asset Timber Bridge Replacement cost in timber $100k Replacement cost in concrete $120k Replacement cost as box culvert $80k Replacement Values (same level of service) Case 1 replace with concrete bridge $120k (value of modern equivalent asset) Case 2 replace with box culvert $80k (value of modern equivalent asset) Evidenced by renewal strategies in AM Plans 61

Asset Replacement Costs Modern Equivalent Asset 2 coat flush seal $6 /m 2 Replace with 2 coat seal $4 /m 2 Replace with single coat seal Replacement Values (same level of service) $6 /m 2 Case 1 replace with 2 coat seal (value of modern equivalent asset) Case 2 replace with single coat seal $4 /m 2 (value of modern equivalent asset) Evidenced by renewal strategies in AM Plans 62 4. Assess Residual Value for Components Residual Value Estimated amount that an organisation would obtain from disposal of an asset less estimated costs of disposal, if assets was already at the age and condition expected at end of its useful life Applicable where infrastructure can be sold/traded to a third party and amount received from sale is greater than cost of sale For infrastructure components, residual value is generally zero and has no effect in calculation of depreciable amount 65 Source: AIFMG: Sec 12.15.6 , p 12.84

Recognising ‘optimal’ Renewals Use componentisation and valuation as modern equivalent assets Gives same result without use of residual value Avoids possible non-compliance with Accounting Standards 66 Assessing Useful Life Useful life used should reflect the actual service performance of the asset rather than an ‘ideal’ or preferred timeframe 73

Consumption of Future Economic Benefits FEB for infrastructure assets = entity’s ability to provide services to its customers/community in the future Methodology for determining consumption of FEB Define services 1. Identify measure of consumption of services 2. Identify pattern of consumption 3. Select depreciation method 4. 75 Auditing of Infrastructure “Show me how you determined” 1. Asset quantities 2. Unit rates 3. Residual value 4. Remaining life 5. Useful life e.g. Sale invoice less costs of sale (1 x 2) – 3 = Depreciable Amount 115

Allen Mapstone, JRA Taking a long term view to M 0439 347 437 E allen.jra@bigpond.com Infrastructure Financial Management Jeremy McAnally, JRA M 0467 642 391 E jmcanally@jr.net.au A common Technical and Financial Jim Dixon, GAAP Consulting view through M 0400 098 515 E jimdixon@iprimus.com.au Asset Management Plans & Long Term Financial Plans John Comrie, JAC Comrie P/L M 0414 516 566 E john@jaccomrie.com.au 148

Recommend

More recommend