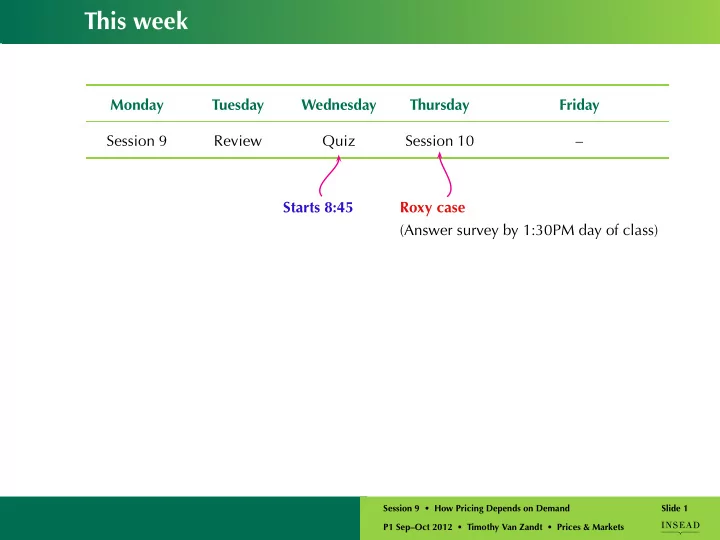

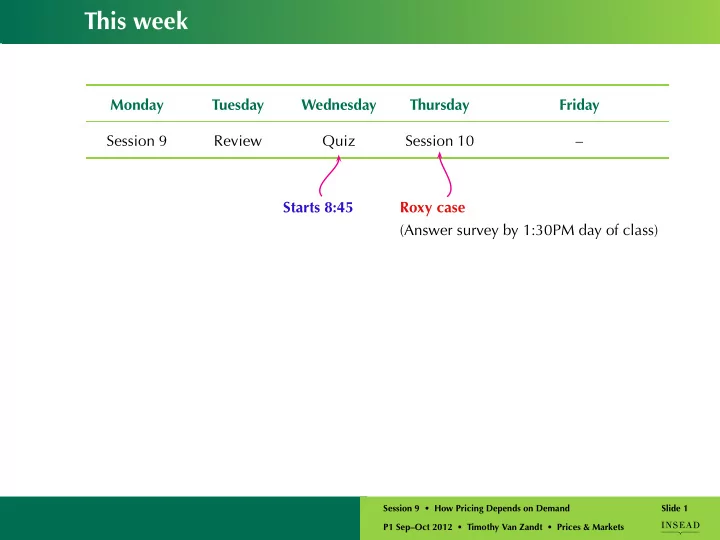

This week Monday Tuesday Wednesday Thursday Friday Session 9 Review Quiz Session 10 – Starts 8:45 Roxy case (Answer survey by 1:30PM day of class) Session 9 • How Pricing Depends on Demand Slide 1 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Pricing with market power Firms are price-takers Firms have market power (Perfect competition) (Imperfect competition) (Sessions 1–6) Individual Equilibrium decisions (Sessions 7–11) (Sessions 12–15) Session 9 • How Pricing Depends on Demand Slide 2 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Review: elasticity and the sign of MR • Where demand is elastic , MR>0 (higher output → more revenue) • Where demand is inelastic , MR<0 (higher output → less revenue) Never set price where demand is inelastic! Better to raise price (produce less)! Brings both lower cost and more revenue. Session 9 • How Pricing Depends on Demand Slide 3 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

From a 2001 study on telecom privatization in Peru (1990s data) service, indicating some degree of substitution between the two products. Based on these estimates and deriving Equation 7 with regard to price, we can recover the price elasticities of the demand for use for each of the three services under study (see Table 11). Table 11 Price Elasticities of the Use Demand City Services Elasticity 1/ Lima Local -0.494 Domestic Long Distance -0.478 International Long Distance -1.095 2/ Province Local -0.689 Domestic Long Distance -0.548 International Long Distance -1.585 1/ Lima Metropolitana's High, Medium, Low and Very Low SEL 2/ Cusco, Arequipa, Trujillo and Chiclayo's High and Medium SEL Table 11 shows that, use demand for local and domestic long-distance services are inelastic in the different cities of Peru. This result is consistent with many other 13 Session 9 • How Pricing Depends on Demand Slide 4 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Review: elasticity of linear demand On the next slide: 1. Mark the choke price. 2. Write the formula for elasticity of a linear demand curve. 3. What is the elasticity at P = 20 ? 4. Mark the regions on the curve where demand is inelastic and elastic. 5. Mark the points where demand is perfectly elastic, unit elastic, and perfectly inelastic. 6. Mark the point at which revenue is highest. Session 9 • How Pricing Depends on Demand Slide 5 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Review: elasticity of linear demand P 30 25 20 15 10 5 Q 50 100 150 200 250 300 Session 9 • How Pricing Depends on Demand Slide 6 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Elasticity and a shift in demand This firm X competes mainly with one other firm Y . Demand curve in previous figure is Q = 300 − 10 P . = X ’s demand curve when firm Y ’s price is 25. More generally, X ’s demand function is Q = 100 − 10 P + 8 P Y . 1. Which way does X ’s demand curve shift if Y lowers its price to 20? 2. Write out the formula for the new demand curve and graph it. 3. What is now the elasticity of X ’s demand at P = 20 ? 4. Is demand more or less elastic than when firm Y ’s price was 25? Session 9 • How Pricing Depends on Demand Slide 7 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Elasticity and a shift in demand P 30 25 20 15 10 5 Q 50 100 150 200 250 300 Session 9 • How Pricing Depends on Demand Slide 8 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Our intuition about elasticity Telecom in Peru: In which market is demand more price sensitive: the provinces or the capital city ? Demand is typically more elastic for people with lower income. Session 9 • How Pricing Depends on Demand Slide 9 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

From a 2001 study on telecom privatization in Peru (1990s data) service, indicating some degree of substitution between the two products. Based on these estimates and deriving Equation 7 with regard to price, we can recover the price elasticities of the demand for use for each of the three services under study (see Table 11). Table 11 Price Elasticities of the Use Demand City Services Elasticity 1/ Lima Local -0.494 Domestic Long Distance -0.478 International Long Distance -1.095 2/ Province Local -0.689 Domestic Long Distance -0.548 International Long Distance -1.585 1/ Lima Metropolitana's High, Medium, Low and Very Low SEL 2/ Cusco, Arequipa, Trujillo and Chiclayo's High and Medium SEL Table 11 shows that, use demand for local and domestic long-distance services are inelastic in the different cities of Peru. This result is consistent with many other 13 Session 9 • How Pricing Depends on Demand Slide 10 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

More intuition about elasticity 1. The more close substitutes a good has, the elastic is demand. 2. ⇒ Demand for a particular brand (Samsung) or type ( 23 ′′ flat panel) is elastic than demand for the entire category (computer displays). 3. ⇒ The more differentiated the brand, the elastic is demand. 4. ⇒ Advertising usually both increases demand and makes it elastic. 5. When a product’s close substitutes become more expensive, demand for the product becomes elastic. Session 9 • How Pricing Depends on Demand Slide 11 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Elasticity of demand for some cars in USA (1980s data) Model Elasticity Mazda 323 6.3 Honda Accord 4.8 Nissan Maxima 4.8 Nissan Sentra 6.5 Ford Taurus 4.2 Ford Escort 6.0 Lexus LS400 3.0 Chevrolet Cavalier 6.4 Cadillac Seville 3.9 BMW 735i 3.5 But for entire category: 0.8 Session 9 • How Pricing Depends on Demand Slide 12 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Session 9: How demand affects pricing ✓ 1. Review of elasticity. ➥ 2. How a shift in demand affects pricing 3. Applications Session 9 • How Pricing Depends on Demand Slide 13 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

� � Price after a shift in demand: perfect competition € 90 60 s ( P ) 30 d new ( P ) d ( P ) Q 3000 6000 9000 Change in price is due entirely to increasing marginal costs (of existing firms, of new entrants, or of scarce inputs). Session 9 • How Pricing Depends on Demand Slide 14 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

But for a firm with market power? $ 25 20 P π 15 MC 10 d ( P ) 5 20 40 60 80 100 120 140 160 Q π Q MR Pricing reflects both marginal cost and a markup over MC. Session 9 • How Pricing Depends on Demand Slide 15 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

From last class, variants of the same equation Less elastic demand ⇒ markup is a larger fraction of P � 1 � P − MC = P E Less elastic demand ⇒ markup is greater multiple of MC � � 1 P − MC = MC E − 1 Session 9 • How Pricing Depends on Demand Slide 16 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

So, with constant MC, if demand becomes … … less elastic at each price, then the firm should raise its price. This is called the “price-sensitivity” effect. Session 9 • How Pricing Depends on Demand Slide 17 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

For which demand curve do you charge a higher price? (Assume constant MC .) P P 18 18 16 16 14 14 12 12 10 10 8 8 6 6 4 4 d 1 ( P ) d 2 ( P ) 2 2 2 4 6 8 10 12 14 16 18 2 4 6 8 10 12 14 16 18 Q Q Session 9 • How Pricing Depends on Demand Slide 18 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

MR, the markup, and elasticity Starting at P = 8 , for which demand curve is MR smaller? P P 18 18 16 16 14 14 12 12 10 10 8 8 6 6 4 4 d 1 ( P ) d 2 ( P ) 2 2 2 4 6 8 10 12 14 16 18 2 4 6 8 10 12 14 16 18 Q Q Session 9 • How Pricing Depends on Demand Slide 19 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

At a price P : E 2 < E 1 implies MR 2 < MR 1 � � dP 1 − 1 MR = P + dQ × Q or MR = P E P P 18 18 16 16 14 14 12 12 10 10 8 8 6 6 4 4 d 1 ( P ) d 2 ( P ) 2 2 2 4 6 8 10 12 14 16 18 2 4 6 8 10 12 14 16 18 Q Q Session 9 • How Pricing Depends on Demand Slide 20 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

For which demand curve do you charge a higher price? (Assume constant MC .) P 5 4 3 2 d 1 ( P ) 1 d 2 ( P ) 1 2 3 4 5 6 7 Q Session 9 • How Pricing Depends on Demand Slide 21 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

For which demand curve do you charge a higher price? (Assume constant MC .) P 5 4 3 2 d 2 ( P ) 1 d 1 ( P ) 1 2 3 4 5 6 7 Q Session 9 • How Pricing Depends on Demand Slide 22 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Recommend

More recommend