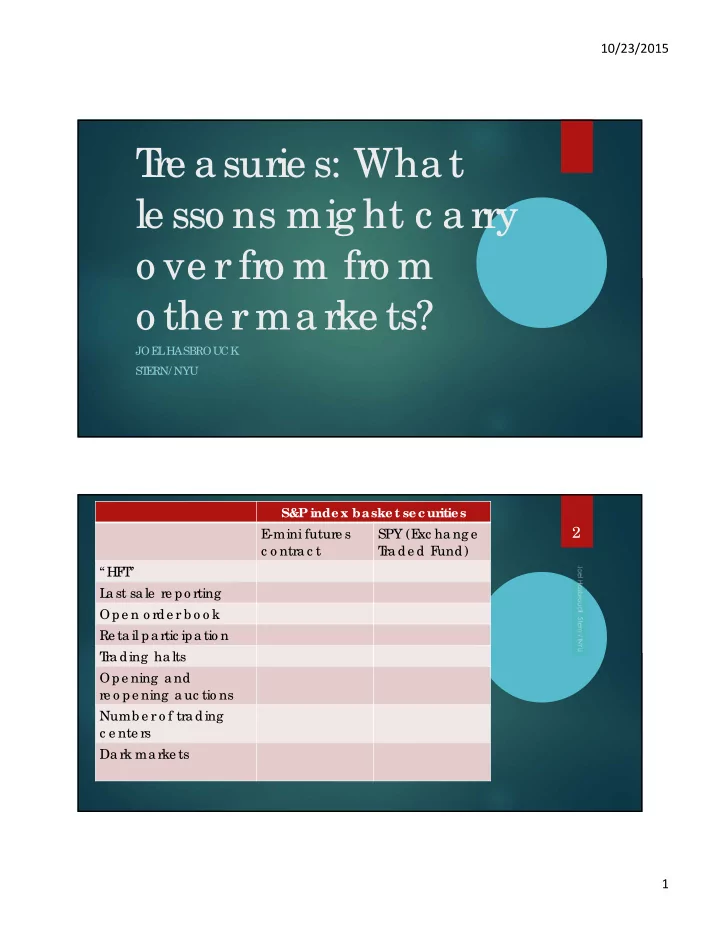

10/23/2015 T re a surie s: Wha t le sso ns mig ht c a rry o ve r fro m fro m o the r ma rke ts? JOE L HASBROUCK ST E RN/ NYU S&P index basket sec ur ities 2 E -mini future s SPY (E xc ha ng e c o ntra c t T ra de d F und) “HF T ” L a st sa le re po rting Ope n o rde r b o o k Re ta il pa rtic ipa tio n T ra ding ha lts Ope ning a nd re o pe ning a uc tio ns Numb e r o f tra ding c e nte rs Da rk ma rke ts 1

10/23/2015 S&P index basket sec ur ities 3 E -mini future s SPY (E xc ha ng e c o ntra c t T ra de d F und) “HF T ” Ye s Ye s L a st sa le re po rting Ye s Ye s Ope n o rde r b o o k Ye s Ye s Re ta il pa rtic ipa tio n Ye s Ye s T ra ding ha lts Ye s Ye s Ope ning a nd Ye s? Ye s re o pe ning a uc tio ns Numb e r o f tra ding One Ma ny c e nte rs Da rk ma rke ts I c e b e rg o rde rs Ma ny ve nue s, me c ha nisms S&P index basket sec ur ities E -mini future s SPY (E xc ha ng e On-the run c o ntra c t T ra de d F und) T re a surie s “HF T ” Ye s Ye s Ye s L a st sa le re po rting Ye s Ye s Why no t? Ope n o rde r b o o k Ye s Ye s Why no t? Re ta il pa rtic ipa tio n Ye s Ye s Why no t? T ra ding ha lts Ye s Ye s Why no t? Ope ning a nd Ye s? Ye s Why no t? re o pe ning a uc tio ns Numb e r o f tra ding One Ma ny Ho w ma ny? c e nte rs Da rk ma rke ts I c e b e rg o rde rs Ma ny ve nue s, Ye s me c ha nisms 2

10/23/2015 L a st sa le re po rting o f o n-the -run 5 tre a surie s: why no t? De a le rs wo uld b e re luc ta nt to a c c o mmo da te c usto me rs kno wing tha t the tra de s wo uld b e ma de pub lic b e fo re the y ha d a c ha nc e to wo rk o ff the ir po sitio n. Pa rtia l e xc e ptio ns T RACE do e sn’ t pub lish size s la rg e r tha n $5 Millio n. T he L o ndo n Sto c k E xc ha ng e ha s a pub lic a tio n de la y to la rg e tra de s. “I t wo uldn’ t re a lly he lp inve sto rs g e t b e tte r pric e s.” finra -ma rke ts.mo rning sta r.c o m/ Bo ndCe nte r, No v. 6, 2013 6 3

10/23/2015 An o pe n limit o rde r b o o k. Why no t? 7 US e q uity ma rke ts did no t a lwa ys ha ve this. SE C’ s Orde r Ha ndling Rule s, 1996 Re g NMS Ac c e ss Rule , 2008 Bro ke rs must disse mina te c usto me rs b ids a nd o ffe rs. Ma rke ts must a llo w no n-me mb e r c usto me rs to e xe c ute a g a inst the ir a dve rtise d q uo te s. F uture s ma rke ts did no t a lwa ys ha ve this. T he CME ’ s Glo b e x syste m wa s o rig ina lly a n “o ff-ho urs” ma rke t. Sma ll inve sto r pa rtic ipa tio n. Why 8 no t? T he tre a sury e nc o ura g e s pa rtic ipa tio n in the prima ry ma rke t (T re a suryDire c t a uc tio ns) But tra ding c o sts a re hig h in the se c o nda ry ma rke t. A re c e nt q uo te o n the OT R 10-yr T -no te fro m a re ta il b ro ke r’ s we b site wa s 99.671 b id, o ffe re d a t 99.719 Bid-a sk spre a d o f 4.8 b ps A typic a l spre a d o n the SPY is $0.01/ $200=0.5 b ps. 4

10/23/2015 T ra ding ha lts/ pa use s. Why no t? 9 On F rida y, Oc to b e r 16, 2015, tra ding in a b o ut thirty NASDAQ NMS sto c ks wa s pa use d due to “limit-up, limit- do wn” ha lts. T he y ha ve b e c o me ro utine . Ope ning a nd re -o pe ning a uc tio ns 10 E q uity ma rke ts use a sing le -pric e do ub le -a uc tio n c o nduc te d b y the prima ry listing e xc ha ng e . I sn’ t this just like the prima ry ma rke t a uc tio n? NO. I t must b e tig htly inte g ra te d with the se c o nda ry ma rke t. 5

10/23/2015 On- vs. off-the-r un 11 Off-the -run b o nds: wha t is to b e 12 do ne ? L o w a c tivity sto c ks: the E uro ne xt so lutio ns De sig na te d ma rke t ma ke rs pa id b y the issue r Pe rio dic c a ll a uc tio ns. 6

10/23/2015 Wha t’ s le ft? 13 Sho uld the ma rke t b e c o nso lida te d o r fra g me nte d? Ho w do we g e t the b e ne fits o f ma rke t-c e nte r c o mpe titio n a nd o rde r c o mpe titio n? Sho uld we a llo w da rk ma rke ts? Da rk ma rke ts mig ht b e pre fe rre d b y c e rta in tra ding c lie nte le s. But the y mig ht we a ke n the lit ma rke ts. Wha t will sto c k ma rke ts lo o k like in the 14 future ? (a slide fro m the 1990 de c k) At the mo me nt flo o r ma rke ts a ppe a r surprising ly ro b ust. T he NYSE ha s the lio n’ s sha re o f tra ding in the ir liste d sto c ks. NASDAQ is a de a le r ma rke t. T he CME , CBT a nd NYME X do mina te future s tra ding . But ma ny no n-US e xc ha ng e s use e le c tro nic tra ding . Ho w mig ht the US flo o r ma rke ts “g o e le c tro nic ”? T he CBT ’ s Auro ra syste m mig ht just b e lig hting the wa y. Ne xt slide : a n Auro ra sc re e n sho t 7

10/23/2015 15 8

Recommend

More recommend