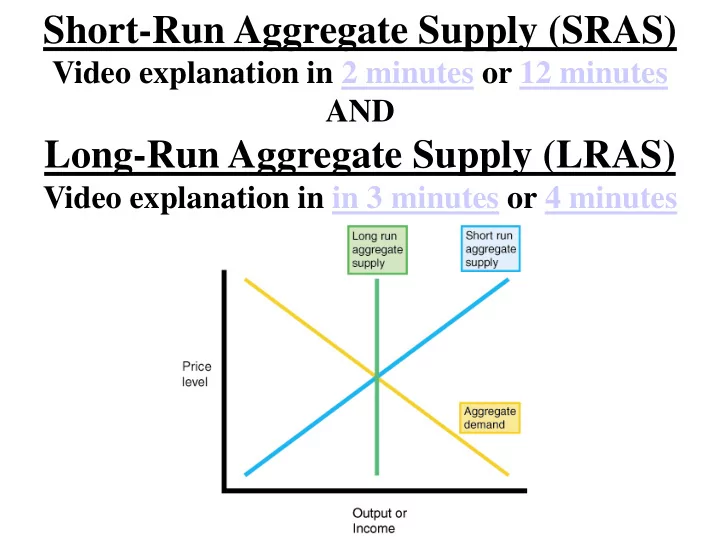

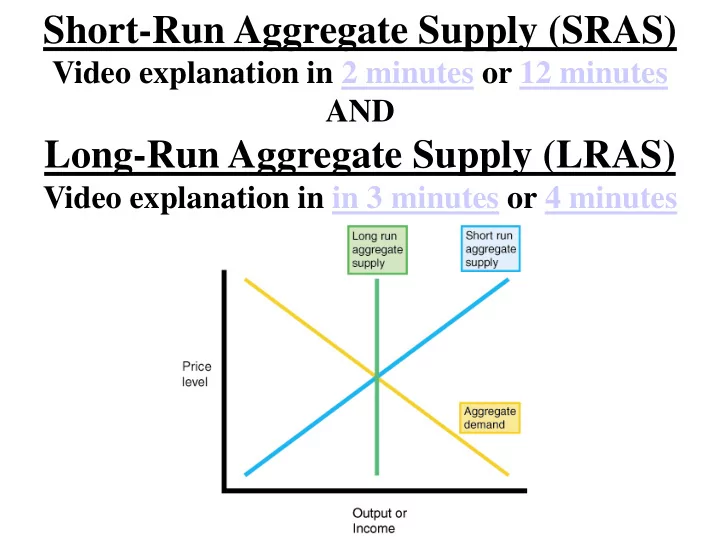

Short-Run Aggregate Supply (SRAS) Video explanation in 2 minutes or 12 minutes AND Long-Run Aggregate Supply (LRAS) Video explanation in in 3 minutes or 4 minutes

What is Aggregate Supply? Aggregate Supply is the amount of goods and services (real GDP) that firms will produce in an economy at different price levels. The supply for everything by all firms. Aggregate Supply differentiates between short run and long-run and has TWO DIFFERENT CURVES. Short-Run Aggregate Supply (SRAS) • Wages and resource prices are “sticky” and WILL NOT change as price levels change immediately. Long-Run Aggregate Supply (LRAS) • Wages and resource prices are “flexible” and WILL change as price levels change eventually.

Shifts in Aggregate Supply An increase or decrease in national production can shift the curve right or left AS 2 AS Price AS 1 Level Real domestic output (GDP R )

Shifters of Short Run Aggregate Supply 1. Change in Resource Prices Prices of Domestic and Imported Resources (Increase in price of American Wheat) (Increase in price of Canadian lumber) (Decrease in price of Chinese steel) Supply Shocks (aka an unexpected change in supply) (Could be a Negative or Positive Supply shock) Inflationary Expectations (If people expect higher prices in the future) If consumers and producers expect higher prices in the future, workers will demand higher wages and costs will increase.

Shifters of Short Run Aggregate Supply 2. Change in Actions (not just spending more or less) of the Government Ex: Taxes on Producers (Corporate taxes) Ex: Subsidies for Domestic Producers (Government Payments) Ex: Government Regulations (Government Rules on Businesses) 3. Change in Productivity Technology (New Inventions)

WHY?

WHY?

The Difference Between Short-Run & Long-Run Aggregate Supply In the short run … • Wages and resource prices are sticky and WILL NOT change when price level changes immidiately. In the long run … • Wages and resource prices are flexible and WILL change when price level changes eventually.

Simplified Example If a firm currently makes 100 units that are sold for $1 each, the only cost is $80 of labor. How much is profit? Profit = $100 - $80 = $20 What happens to profit in the short-run if prices double? • Now 100 units sell for $2, Total Revenue=$200. • Profit = $200 - $80 = $120 Firms have an incentive to make more immediately . What happens in the long-run? • Workers will eventually demand higher wages to match higher price levels. So labor costs will eventually double to $160 • Profit = $200 - $160 = $40 • Real Profit is unchanged in the long run Firms have NO incentive to produce more in the long run since REAL profit is the same.

Long- Run Aggregate Supply (LRAS) In long run, price level increases but GDP doesn’t. LRAS Price level Full-Employment (Maximum sustainable capacity) Q Y GDP R We assume that in the long-run the economy will be producing at full employment.

Shifts in LRAS Only a permanent change (not a price change) in the production possibilities of the economy can shift LRAS Price LRAS LRAS 2 LRAS 1 Level Real domestic output (GDP R )

Shifts in LRAS Only a permanent change in the production possibilities of the economy can shift LRAS The shifters of the LRAS are the same the shifters of the PPC Change in resource quantity or quality OR Change in technology

The shifters of the LRAS are the same the shifters of the PPC 1. Change in resource quantity or quality 2. Change in technology Price LRAS LRAS 1 Level Capital Goods Q Y1 Q Y GDP R Consumer Goods

WHY?

A recessionary gap occurs when AD is less than LRAS casing real GDP to fall. An inflationary gap occurs when AD greater than LRAS causing price levels to rise. Both these gaps will eventually “self correct” in the long run as AD shifts and equilibrium is reestablished, but governments often get involved sooner to attempt and “smooth out” the business cycle with FISCAL POLICY …next slideshow.

Recommend

More recommend