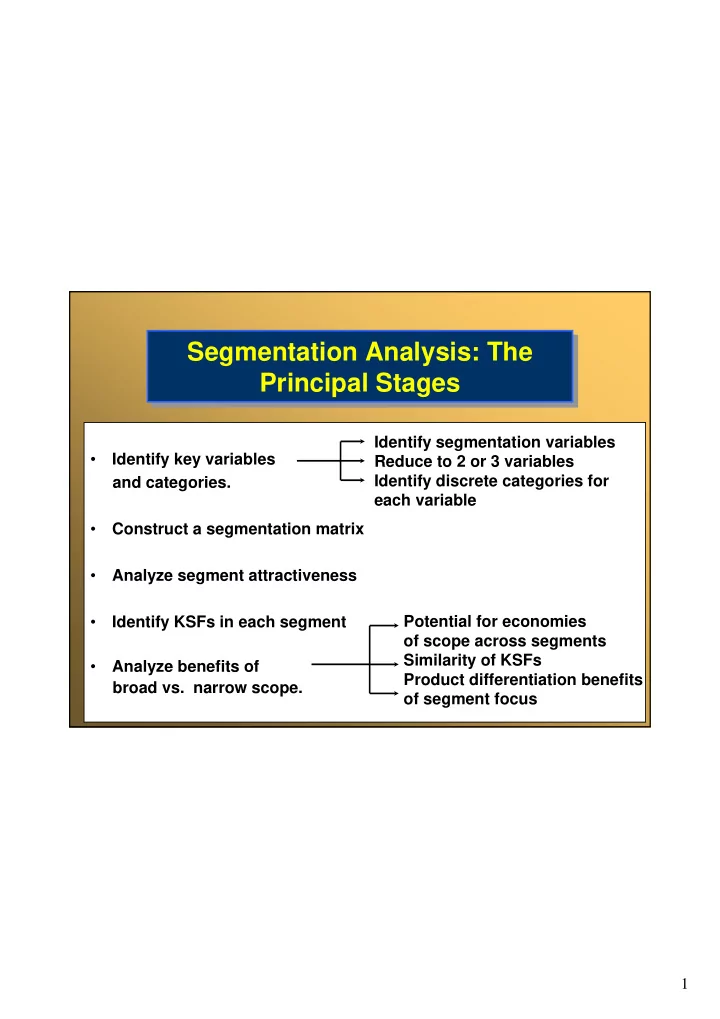

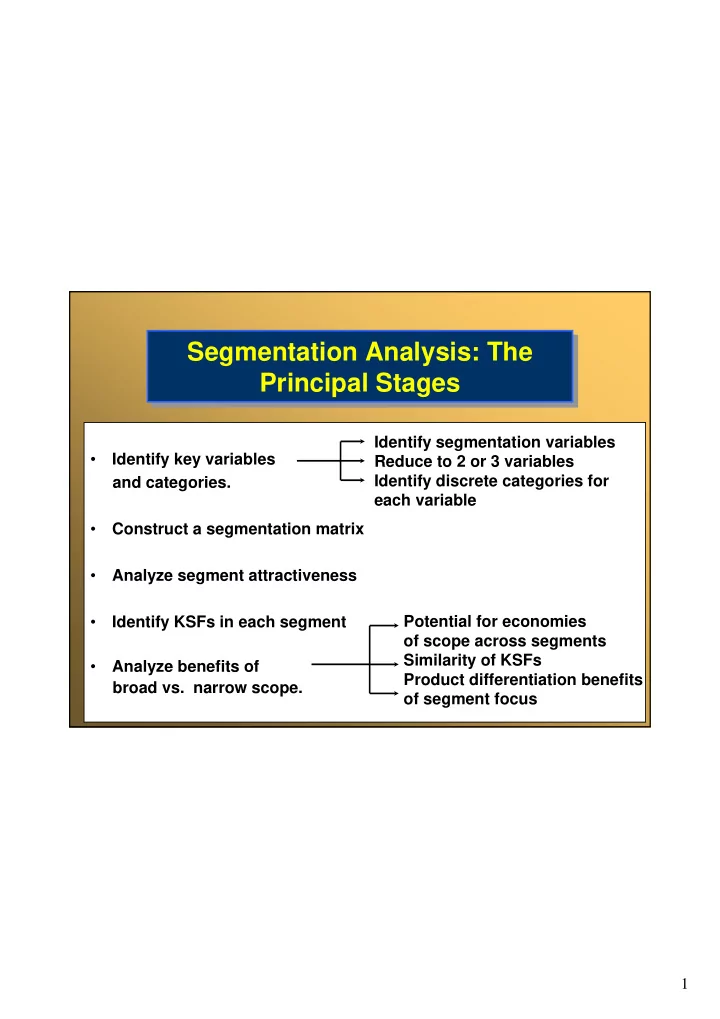

Segmentation Analysis: The Segmentation Analysis: The Principal Stages Principal Stages Identify segmentation variables • Identify key variables Reduce to 2 or 3 variables Identify discrete categories for and categories. each variable • Construct a segmentation matrix • Analyze segment attractiveness • Identify KSFs in each segment Potential for economies of scope across segments Similarity of KSFs • Analyze benefits of Product differentiation benefits broad vs. narrow scope. of segment focus 1

The Basis for Segmentation: Customer and Product Characteristics The Basis for Segmentation: Customer and Product Characteristics *Size *Size *Technical *Technical Industrial buyers sophistication Industrial buyers sophistication *OEM/replacement *OEM/replacement *Demographics *Demographics Characteristics Characteristics Household buyers *Lifestyle Household buyers *Lifestyle of the Buyers of the Buyers *Purchase occasion *Purchase occasion *Size *Size *Distributor/broker Distribution channel *Distributor/broker Distribution channel *Exclusive/ *Exclusive/ Opportunities for nonexclusive Opportunities for nonexclusive Geographical Differentiation *General/special Geographical Differentiation *General/special location list location list *Physical size *Physical size *Price level *Price level *Product features *Product features Characteristics Characteristics *Technology design *Technology design of the Product of the Product *Inputs used (e.g. raw materials) *Inputs used (e.g. raw materials) *Performance characteristics *Performance characteristics *Pre-sales & post-sales services *Pre-sales & post-sales services 2

Segmenting the European Metal Can Industry Segmenting the European Metal Can Industry F ran c e G e rm an y F o o d F ru it J u ice P et f o o d S o ft d r in k B ee r O il S p ain /Po rt. S te el 3 -p iec e Ita ly S te el 2 -p iec e A lu m in u m 2 -p ie ce G e n era l c an s C o m p o s ite ca n s A e ro s o l c an s 3

Segmenting the World Automobile Market Segmenting the World Automobile Market REGION US& Canada W.Europe E.Europe Asia Lat America Australia Africa Luxury Cars Full-size sedans Mid-size sedans Small sedans Station wagons Passenger minivans Sports cars Sport-utility Pick-up trucks 4

25 % 20 n i Leasing g r 15 a m g Warranty Aftermarket n i t parts a Auto 10 r Auto e manufacturing p Auto rental O Auto insurance loans 5 Gasoline 0 100% 0 Share of industry revenue 5

Segmentation and Key Success Factors in the U.S. Bicycle Industry Segmentation and Key Success Factors in the U.S. Bicycle Industry SEGMENT KEY SUCCESS FACTORS * Low-costs through global sourcing of components Low price bicycles sold primarily & low-wage assembly. through department and discount * Supply contract with major retailer. stores, mainly under the retailer’s Leading competitors: Taiwanese & Chinese assemblers, own brand (e.g. Sears’ “Free Spirit”); some U.S manufacturers, e.g. Murray Ohio, Huffy *Cost effieciency through large scale operation and either low wages or automated manufacturing. Medium-priced bicycles sold *Reputation for quality (durability, reliability) through primarily under manufacturer’s brand effective marketing to dealers and/or consumers. name and distributed mainly through * International marketing & distribution. specialist bicycles stores; Leading competitors: Raleigh, Giant, Peugeot, Fuji *Quality of components and assembly, Innovation in design (e.g. minimizing weight and wind resistence). High-priced bicycles for enthusiasts. *Reputation (e.g. through success in racing, through effective brand management). *Strong dealer relations. Children’s bicycles (and tricycles) sold primarily through toy retailers (discount Similar to low-price bicycle segment. toy stores, department stores, and specialist toy stores). 6

Strategic Group Analysis Strategic Group Analysis A strategic group is a group of firms in an industry following the same or similar strategy. Identifying strategic groups: • Identify principal strategic variables which distinguish firms. • Position each firm in relation to these variables. • Identify clusters. 7

Strategic Groups in the World Automobile Industry Strategic Groups in the World Automobile Industry GLOBAL, BROAD-LINE Broad PRODUCERS REGIONALLY-FOCUSED e.g., GM, Ford, Toyota, Nissan, BROAD-LINE Honda, VW, Daimler Chrysler PRODUCERS e.g. Fiat, PSA, Renault, GLOBAL SUPPLIERS OF NARROW MODEL RANGE NATIONALLY FOCUSED, e.g., Volvo, Subaru, Isuzu, INTERMEDIATE LINE Suzuki, Saab, Hyundai PRODUCT PRODUCERS RANGE RANGE e.g. Tofas, Kia, Proton, Maruti LUXURY CAR MANUFACTURERS e.g., Jaguar, Rolls Royce, NATIONALLY- FOCUSED, BMW SMALL, SPECIALIST PRODUCERS e.g., Bristol (U.K.), Classic Roadsters (U.S.), Morgan (U.K.) PERFORMANCE CAR PRODUCERS e.g., Porsche, Narrow Maserati, Lotus National GEOGRAPHICAL SCOPE Global 8

Strategic Groups Within the World Petroleum Industry Strategic Groups Within the World Petroleum Industry INTERNATIONAL INTEGRATED OIL Premier UPSTREAM MAJORS 2.0 Oil COMPANIES INTERNATIONAL Enterprise UPSTREAM, Kuwait Petroleum REGIONALLY PDVSA FOCUSED INTEGRATED 1.5 NATIONAL DOMESTIC DOWNSTREAM Vertical Balance PRODUCTION Iran OIL COMPANIES COMPANIES NOC Statoil BP-Amoco Exxon 1.0 -Mobil INTEGRATED Pemex Petronas Chevron Royal Dutch INTERNATIONAL -Shell Gp. MAJORS YPF Phillips Indian Oil Phillips Petrobras Texaco 0.5 ENI Elf-Fina-Total ENI Repsol INTERNATIONAL Repsol Nippon DOWNSTREAM E.g. Neste Tosco OIL COMPANIES 0 0 10 20 30 40 50 60 70 80 NATIONALLY-FOCUSED Geographical Scope DOWNSTREAM COMPANIES 9

Recommend

More recommend