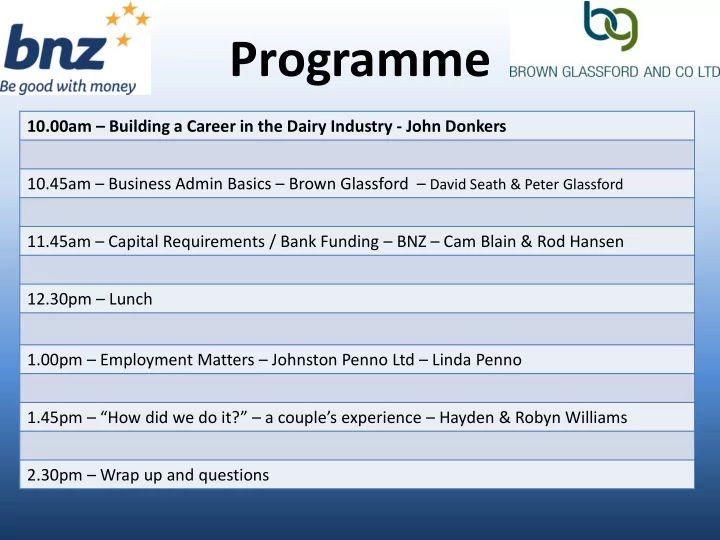

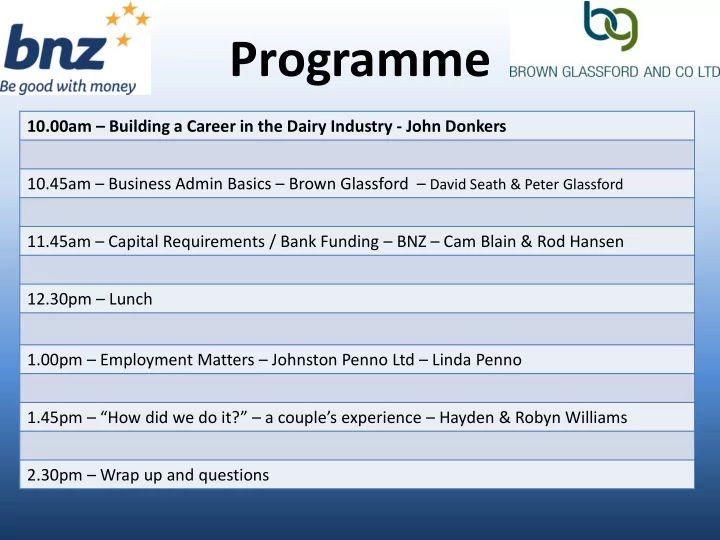

Programme 10.00am – Building a Career in the Dairy Industry - John Donkers 10.45am – Business Admin Basics – Brown Glassford – David Seath & Peter Glassford 11.45am – Capital Requirements / Bank Funding – BNZ – Cam Blain & Rod Hansen 12.30pm – Lunch 1.00pm – Employment Matters – Johnston Penno Ltd – Linda Penno 1.45pm – “How did we do it?” – a couple’s experience – Hayden & Robyn Williams 2.30pm – Wrap up and questions

Farm Business Administration Basics David Seath & Peter Glassford

Introduction Summary of Business Structures Sharefarming Basics Compliance & Tax Financial Record Keeping Risk Management Legal Matters

Structure – Sole Trader Pros Cons Easy to establish Unlimited liability – personally responsible for debts / risks Owner has total control Intermingled business and private assets Easy access to cash and profits Limited ability to spread income Losses (if any) offset against other income Graduated marginal tax rates Graduated marginal tax rates Little achieved with respect to transfer of ownership, estate planning, wealth accretion.

Structure – Partnership Pros Cons Commonly used and understood Unlimited liability – personally responsible for debts / risks. Liability is joint and several. Transparent Graduated marginal tax rates Rules govern entry and exit – agreement or Dissolution rules – death Partnership Act Easy access to cash and profits Exit and entry rules limit flexibility Income/profits shared Little achieved with respect to transfer of ownership, estate planning, wealth accretion. Losses (if any) offset against other income

Structure – Trust Pros Cons Commonly used Administration requirements Flexible (determined by Trust Deed) Difficult to use for unrelated parties Enables wider distribution of income Limited life – perpetuity period Can be a final tax payer No limited liability Useful asset protection tool Trapped losses Useful asset transfer tool Minor beneficiary rules (under 16yrs)

Structure – Company Pros Cons Limited liability Administration requirements Presumption of business - automatic Trapped losses deductibility of some expenditure Flat tax rate 28% (less than Trust and top Tax on some benefits provided to marginal tax rates) employees (FBT) Rules of engagement are clear – Continuity and commonality of shareholding shareholder agreement and/or Companies requirements Act Some flexibility to distribute income Tainted capital gains Useful asset transfer tool – transfer shares Director responsibilities need to be rather than assets understood

Structure – Look Through Co (LTC) Pros Cons Flow through of capital gains Limitation on shareholder #’s and type Flow through of losses Loss limitation rule Lets shareholders make use of carry-forward Tax consequences on share sale losses Effective use of deductions in shareholding Working owner limitations entity Additional compliance

Structure – Limited Partnership Pros Cons Limited liability Not as commonly used Flow through of “losses” Loss limitation rule Lets investors make use of carry-forward Tax consequences on exit losses Effective use of deductions in investor entity Additional compliance?

Structure – Equity Partnership • Loose terminology to describe a farming enterprise consisting of investors rather than all shareholders taking an active role in farm operations • Generally consist two types of structure – standard company or limited partnership Pros Cons Access to larger scale whilst not being large Illiquidity of small shareholdings scale yourself Access to skill base of diverse investors Lesser level of control Opportunity of farm ownership for skilled Less flexibility in decision making – large managers number of owners Attract (possibly) the best employees Additional compliance costs

Sharefarming Basics – Lower Order Type of Agreement Capital Required to Fund Covered by Statute/Law Working capital Variable Order Sharemilking Agreement Farm machinery (not all agreements) 2001 (ex Fed Farmers) Income Costs Proportion of milk income (less milk quality Basic – pay 100% of labour, shed operating penalties) costs, fuel, ACC, administration Or Fixed dollar rate eg: $1.00/kgMS Own machinery – running costs including repairs & maintenance < 300 cows – LOSM gets minimum 21% of Possibly - % of other inputs eg: nitrogen, milk income feed Calf sales and/or calf rearing (not all agreements)

S/farming Basics – 50% Sharemilking Type of Agreement Capital Required to Fund Various forms (more flexible than LOSM) Working capital Subject to agreement between the parties Livestock (including replacements) Farm Machinery Income Costs 50% (usually) of milk income Cost share tends to vary according to the agreement Share of dividend income now less common Sharemilker typically pays costs associated with livestock, farm machinery, insurance/ACC, and admin 100% of income from livestock sales Owner typically pays costs associated with land and buildings Parties generally share cost of feed and grazing

Compliance & Tax Tax Basics – so you’re going into business ? IRD Number – if you or your business entity doesn’t have one, an application will need to be made to IRD Balance date – the default IRD balance date is 31 March, however, an application can be made to IRD for a different date eg 31 May is common for dairy businesses GST Registration – where turnover >$60k you must register for GST, if <$60k you may register voluntarily Employing Staff ? - need to register as an employer with IRD – understand PAYE, Kiwisaver Providing other benefits to employees – may need to register for Fringe Benefit Tax (FBT) with IRD Borrowing money from family or friends and paying more than $5,000 in interest – will need to register for Resident Withholding Tax (RWT), deduct it from the interest paid, and return/pay it to IRD

Compliance & Tax Tax Specifics – Provisional Tax System Essentially requires a individual or business earning business income to pay income tax progressively over the year – generally in three instalments. Terminal tax – the difference between the instalments paid during the year and the actual tax payable ie: can either be further tax to pay or a tax refund Generally no requirement to pay provisional tax in the first year of business – BUT BEWARE YEAR 2 - in year 2 you pay terminal tax on year 1 income and provisional tax on year 2 income – this can be a cashflow killer – plan for it ! Provisional tax can be calculated on two bases – uplift (prior year + 5%) or estimate – your choice ultimately depends on budgeted income for the coming year – your accountant should discuss this with you each year and/or when income is known to be changing (eg: change in dairy company price forecasts) Voluntary payments – you can make voluntary payments over and above the minimum payments required by IRD – useful to minimise IRD interest for companies and trusts

Compliance & Tax Tax Specifics - GST Registration – you must register if turnover is or will be >$60k in a 12 month period, if <60k then you may register voluntarily. Account for GST on either “payments basis” ( ie: when you make and receive payments) or “invoice basis” ( ie: when you issue or receive an invoice) Payments basis – may use this when turnover is or will be <$2m in a 12 month period (or if not, then by application to IRD). Otherwise use the invoice basis (or sometimes a hybrid of the two – relatively uncommon) How often does GST have to be filed ? Most use a 2 month period. You may elect to use a 1 month period, but must use a 1 month period if turnover >$24m. You may apply to use 6 monthly if turnover <$500k. 2 monthly is common and a useful way to keep on top of your record keeping. Shortfall penalties apply when you fail to account for GST or fail to pay GST owed to the IRD – these can be severe. In some case you can be fined or imprisoned for up to five years for abuse of the GST system

Compliance & Tax Tax Specifics - Employers You are responsible for deducting and paying the correct amount of; • Income tax (PAYE) • Kiwisaver contributions (if they are a member of Kiwisaver, minimum 3%) • Student loan payments (if they have a student loan) • Child support payments (if they owe child support) Employee Accommodation – where an employee is provided with accommodation, then you must include the value of that accommodation when calculating the amount of PAYE to deduct eg: market rent of farm house say $400/fortnight, add to gross fortnightly pay for that employee when calculating PAYE Employer returns must be filed and any payments due paid monthly (if PAYE <$500k else twice monthly) Shortfall penalties apply when you fail to deduct PAYE or fail to pay PAYE on to the IRD – these can be severe. In some case you can be fined or imprisoned for up to five years for abuse of the PAYE system

Recommend

More recommend