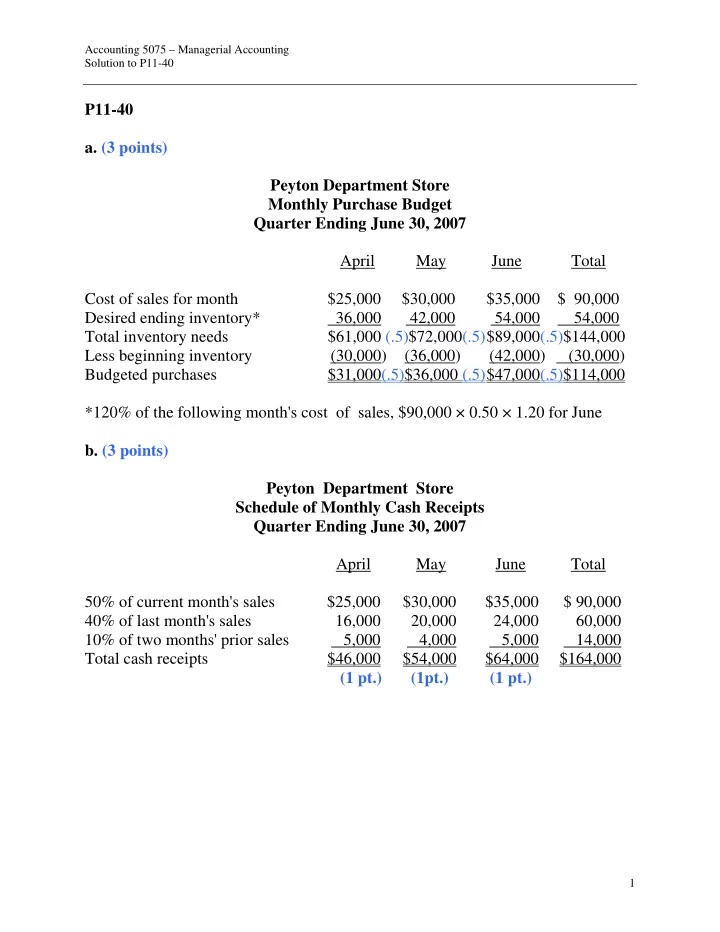

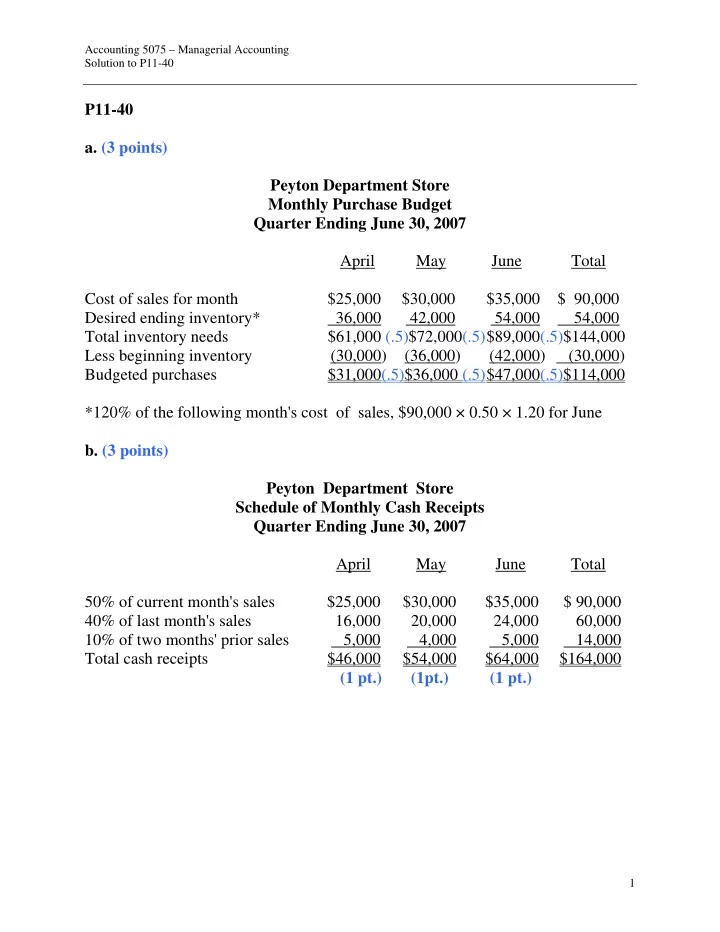

Accounting 5075 – Managerial Accounting Solution to P11-40 P11-40 a. (3 points) Peyton Department Store Monthly Purchase Budget Quarter Ending June 30, 2007 April May June Total Cost of sales for month $25,000 $30,000 $35,000 $ 90,000 Desired ending inventory* 36,000 42,000 54,000 54,000 Total inventory needs $61,000 (.5)$72,000(.5) $89,000(.5)$144,000 Less beginning inventory (30,000) (36,000) (42,000) (30,000) Budgeted purchases $31,000(.5)$36,000 (.5) $47,000(.5)$114,000 *120% of the following month's cost of sales, $90,000 × 0.50 × 1.20 for June b. (3 points) Peyton Department Store Schedule of Monthly Cash Receipts Quarter Ending June 30, 2007 April May June Total 50% of current month's sales $25,000 $30,000 $35,000 $ 90,000 40% of last month's sales 16,000 20,000 24,000 60,000 10% of two months' prior sales 5,000 4,000 5,000 14,000 Total cash receipts $46,000 $54,000 $64,000 $164,000 (1 pt.) (1pt.) (1 pt.) 1

Accounting 5075 – Managerial Accounting Solution to P11-40 P11-40 (cont.) c. (3 points) Peyton Department Store Schedule of Monthly Cash Disbursements Quarter Ending June 30, 2007 April May June Total Purchases of prior month $26,000 * $31,000 $36,000 $ 93,000 Current operating expenses** 28,000 28,000 28,000 84,000 Dividends 17,000 17,000 Total cash disbursements $71,000 $59,000 $64,000 $194,000 (1pt.) (1 pt.) (1 pt.) *From March 31, 2004, Accounts Payable **$25,000 wages and salaries + $1,000 utilities + $2,000 rent d. (4 points) Peyton Department Store Monthly Cash Budget Quarter Ending June 30, 2007 April May June Total Cash balance, beginning $ 3,000 $ 3,000 $ 3,000 $ 3,000 Receipts $46,000 $54,000 $64,000 $164,000 Disbursements (71,000) (59,000) (64,000) (194,000) Excess receipts over disb. (25,000)(.5) (5,000)(.5) 0(.5)(30,000) (.5) Balance before borrowings $(22,000) $ (2,000) $ 3,000 $ (27,000) Borrowings 25,000 5,000 0 30,000 Loan repayments 0 0 0 0 Cash balance, ending $ 3,000(.5)$ 3,000(.5)$ 3,000(.5)$ 3,000 (.5) 2

Accounting 5075 – Managerial Accounting Solution to P11-40 P11-40 (cont.) e. (6 points) Peyton Department Store Budgeted Monthly Income Statements Quarter Ending June 30, 2007 April May June Total Sales $50,000 $60,000 $70,000 $180,000 Cost of sales (25,000) (30,000) (35,000) (90,000) Gross profit $25,000 (.5)$30,000(.5) $35,000 (.5) $ 90,000(.5) Operating expenses: Wages and salaries $25,000 $25,000 $25,000 $ 75,000 Depreciation 100 100 100 300 Utilities 1,000 1,000 1,000 3,000 Rent 2,000 2,000 2,000 6,000 Insurance 400 400 400 1,200 Interest* 250 300 300 850 Total expenses (28,750)(.5)(28,800)(.5) (28,800)(.5) (86,350)(.5) Net income $ (3,750)(.5)$ 1,200(.5) $ 6,200(.5) $ 3,650(.5) *Computation of monthly interest expense: April, $25,000 × 0.01 = $250 May, $30,000 × 0.01 = $300 June, $30,000 × 0.01 = $300 3

Accounting 5075 – Managerial Accounting Solution to P11-40 P11-40 (cont.) f . (6 points) Peyton Department Store Budgeted Balance Sheet June 30, 2007 Assets Liabilities and Equity Cash $ 3,000(.5) Merchandise payable $ 47,000 (.5) Accounts receivable* 41,000(.5) Dividend payable 17,000 (.5) Inventory 54,000(.5) Rent payable 2,000 (.5) Prepaid insurance** 800(.5) Loans payable 30,000 (.5) Fixtures*** 24,700 (.5) Interest payable 850 (.5) Total assets $123,500 (.5) Stockholders' equity**** 26,650 (.5) Total liab. & equity $123,500 *Accounts Receivable 50% of June sales $35,000 10% of May sales 6,000 Total $41,000 **Prepaid Insurance $2,000 / 5 months = $400 per month $400 × 3 months = $1,200 insurance expense $2,000 - $1,200 = $800 insurance balance 6/30/07 ***Fixtures March 31, 2007 balance $25,000 Less depreciation ($100 per month × 3 months) (300) June 30, 2007 balance $24,700 ****Stockholders' Equity Beginning equity $40,000 Plus income 3,650 Less dividends (17,000) Ending equity $26,650 4

Recommend

More recommend