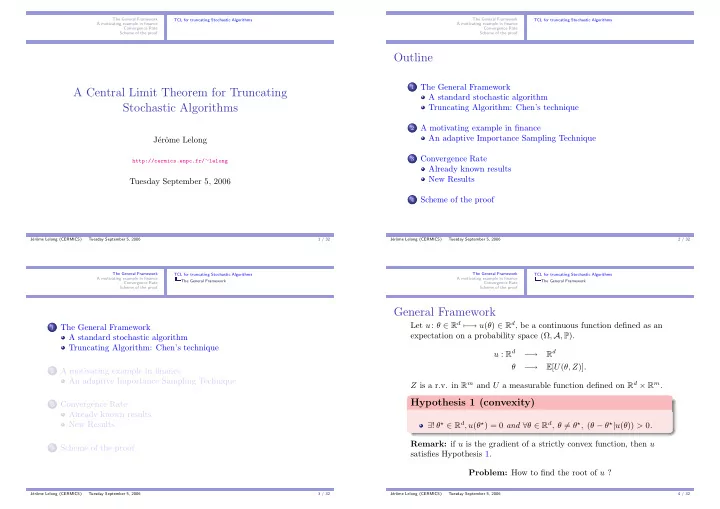

The General Framework The General Framework TCL for truncating Stochastic Algorithms TCL for truncating Stochastic Algorithms A motivating example in finance A motivating example in finance Convergence Rate Convergence Rate Scheme of the proof Scheme of the proof Outline 1 The General Framework A Central Limit Theorem for Truncating A standard stochastic algorithm Stochastic Algorithms Truncating Algorithm: Chen’s technique 2 A motivating example in finance An adaptive Importance Sampling Technique J´ erˆ ome Lelong 3 Convergence Rate http://cermics.enpc.fr/ ∼ lelong Already known results New Results Tuesday September 5, 2006 4 Scheme of the proof J´ erˆ ome Lelong (CERMICS) Tuesday September 5, 2006 1 / 32 J´ erˆ ome Lelong (CERMICS) Tuesday September 5, 2006 2 / 32 The General Framework The General Framework TCL for truncating Stochastic Algorithms TCL for truncating Stochastic Algorithms A motivating example in finance A motivating example in finance The General Framework The General Framework Convergence Rate Convergence Rate Scheme of the proof Scheme of the proof General Framework Let u : θ ∈ R d �− → u ( θ ) ∈ R d , be a continuous function defined as an 1 The General Framework expectation on a probability space (Ω , A , P ). A standard stochastic algorithm Truncating Algorithm: Chen’s technique u : R d R d − → θ − → E [ U ( θ, Z )] . 2 A motivating example in finance An adaptive Importance Sampling Technique Z is a r.v. in R m and U a measurable function defined on R d × R m . Hypothesis 1 (convexity) 3 Convergence Rate Already known results ∃ ! θ ⋆ ∈ R d , u ( θ ⋆ ) = 0 and ∀ θ ∈ R d , θ � = θ ⋆ , ( θ − θ ⋆ | u ( θ )) > 0 . New Results Remark: if u is the gradient of a strictly convex function, then u 4 Scheme of the proof satisfies Hypothesis 1. Problem: How to find the root of u ? J´ erˆ ome Lelong (CERMICS) Tuesday September 5, 2006 3 / 32 J´ erˆ ome Lelong (CERMICS) Tuesday September 5, 2006 4 / 32

The General Framework The General Framework TCL for truncating Stochastic Algorithms TCL for truncating Stochastic Algorithms A motivating example in finance A motivating example in finance The General Framework The General Framework Convergence Rate Convergence Rate Scheme of the proof A standard stochastic algorithm Scheme of the proof Truncating Algorithm: Chen’s technique For “sub-linear” functions For “fast” growing functions: an intuitive approach Assume that for all θ ∈ R d E [ � U ( θ, Z ) � 2 ] ≤ K (1 + � θ � 2 ) . (1) Consider an increasing sequence of compact sets ( K j ) j such that We define for θ 0 ∈ R d � ∞ j =0 K j = R d . θ n +1 = θ n − γ n +1 U ( θ n , Z n +1 ) . (2) Consider ( Z n ) n and ( γ n ) n as defined previously. Prevent the algorithm from blowing up: ( Z n ) n is i.i.d. following the law of Z . At each step, θ n should remain in a given compact set. If such is � γ i = ∞ � γ 2 γ n ց 0 , i < ∞ . γ n > 0 , and not the case, reset the algorithm and consider a larger compact set. Theorem 1 (Robbins Monro) This is due to Chen (see [Chen and Zhu, 1986]). Assume Hypothesis 1 and that Equation (1) is true then, the sequence (2) converges a.s. to θ ⋆ . Condition (1) is barely satisfied in practice. J´ erˆ ome Lelong (CERMICS) Tuesday September 5, 2006 5 / 32 J´ erˆ ome Lelong (CERMICS) Tuesday September 5, 2006 6 / 32 The General Framework The General Framework TCL for truncating Stochastic Algorithms TCL for truncating Stochastic Algorithms A motivating example in finance A motivating example in finance The General Framework The General Framework Convergence Rate Convergence Rate Scheme of the proof Scheme of the proof Truncating Algorithm: Chen’s technique Truncating Algorithm: Chen’s technique For “fast” growing functions For “fast” growing functions: mathematical approach For θ 0 ∈ K 0 and σ 0 = 0, we define ( θ n ) n and ( σ n ) n θ ⋆ + θ n + 1 2 = θ n − γ n +1 U ( θ n , Z n +1 ) , if θ n + 1 2 ∈ K σ n θ n +1 = θ n + 1 and σ n +1 = σ n , (3) θ n +1 = θ 0 θ n + + 2 if θ n + 1 2 / ∈ K σ n θ n +1 = θ 0 and σ n +1 = σ n + 1 . θ n +1 = θ n + 1 + σ n counts the number of truncations up to time n . 2 K σ n = K σ n +1 F n = σ ( Z k ; k ≤ n ). θ n is F n − measurable and Z n +1 independent of F n . θ n + 1 2 + K σ n +1 = K σ n +1 J´ erˆ ome Lelong (CERMICS) Tuesday September 5, 2006 7 / 32 J´ erˆ ome Lelong (CERMICS) Tuesday September 5, 2006 8 / 32

The General Framework The General Framework TCL for truncating Stochastic Algorithms TCL for truncating Stochastic Algorithms A motivating example in finance A motivating example in finance The General Framework The General Framework Convergence Rate Convergence Rate Scheme of the proof Truncating Algorithm: Chen’s technique Scheme of the proof Truncating Algorithm: Chen’s technique a.s convergence of Chen’s procedure It is often more convenient to rewrite (3) as follows θ n +1 = θ n − γ n +1 u ( θ n ) − γ n +1 δM n +1 + γ n +1 p n +1 (4) � �� � � �� � � �� � Hypothesis 2 (integrability) Newton algorithm noise term truncation term � �� � For all p > 0 , the series � standard Robbins Monro algorithm n γ n +1 δM n +1 1 � θ n �≤ p converges a.s. where → E [ � U ( θ, Z ) � 2 ] are Hypothesis 2 is satisfied as soon as u and θ �− bounded on any compact sets (or continuous). Hint δM n +1 = U ( θ n , Z n +1 ) − u ( θ n ) , � 1 Theorem 2 u ( θ n ) + δM n +1 + γ n +1 ( θ 0 − θ n ) if θ n + 1 2 / ∈ K σ n , and p n +1 = 0 otherwise. Under Hypotheses 1 and 2, the sequence ( θ n ) n defined by (3) converges a.s. to θ ⋆ and the sequence ( σ n ) n is a.s. finite. δM n is a martingale increment, A proof of this theorem can be found in [Delyon, 1996]. p n is the truncation term. J´ erˆ ome Lelong (CERMICS) Tuesday September 5, 2006 9 / 32 J´ erˆ ome Lelong (CERMICS) Tuesday September 5, 2006 10 / 32 The General Framework The General Framework TCL for truncating Stochastic Algorithms TCL for truncating Stochastic Algorithms A motivating example in finance A motivating example in finance A motivating example in finance A motivating example in finance Convergence Rate Convergence Rate Scheme of the proof Scheme of the proof An adaptive Importance Sampling Technique General Problem 1 The General Framework Option pricing problem in a Brownian driven model (no jump): A standard stochastic algorithm compute E [ ψ ( G )] by a MC method with G ∼ N (0 , I d ). Truncating Algorithm: Chen’s technique One way of reducing the variance is to perform importance sampling techniques. For all θ ∈ R d , 2 A motivating example in finance An adaptive Importance Sampling Technique � � ψ ( G + θ ) e − θ · G − | θ | 2 E [ ψ ( G )] = E . (5) 2 3 Convergence Rate Minimise Already known results � ψ ( G + θ ) 2 e − 2 θ · G −| θ | 2 � � � ψ ( G ) 2 e − θ · G + | θ | 2 New Results v ( θ ) = E = E . 2 � � ( θ − G ) ψ ( G ) 2 e − θ · G + | θ | 2 4 Scheme of the proof ∇ v ( θ ) = E . (6) 2 J´ erˆ ome Lelong (CERMICS) Tuesday September 5, 2006 11 / 32 J´ erˆ ome Lelong (CERMICS) Tuesday September 5, 2006 12 / 32

Recommend

More recommend