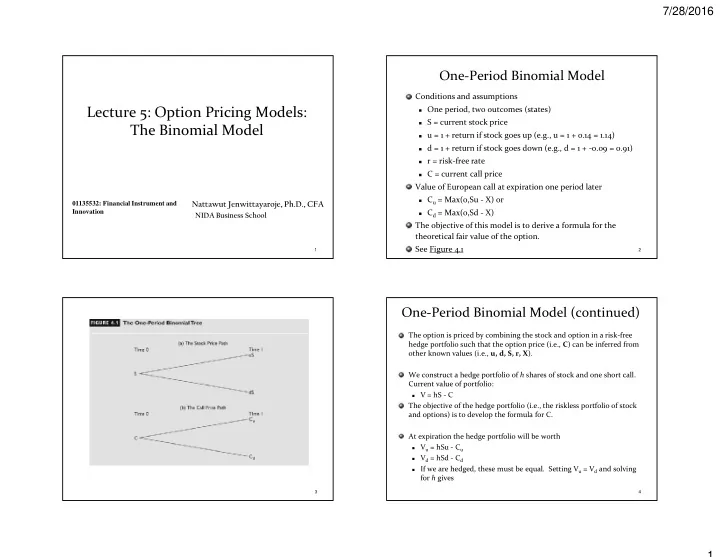

7/28/2016 One-Period Binomial Model Conditions and assumptions Lecture 5: Option Pricing Models: One period, two outcomes (states) S = current stock price The Binomial Model u = 1 + return if stock goes up (e.g., u = 1 + 0.14 = 1.14) d = 1 + return if stock goes down (e.g., d = 1 + -0.09 = 0.91) r = risk-free rate C = current call price Value of European call at expiration one period later C u = Max(0,Su - X) or Nattawut Jenwittayaroje, Ph.D., CFA 01135532: Financial Instrument and Innovation C d = Max(0,Sd - X) NIDA Business School The objective of this model is to derive a formula for the theoretical fair value of the option. See Figure 4.1 1 2 One-Period Binomial Model (continued) The option is priced by combining the stock and option in a risk-free hedge portfolio such that the option price (i.e., C ) can be inferred from other known values (i.e., u, d, S, r, X ). We construct a hedge portfolio of h shares of stock and one short call. Current value of portfolio: V = hS - C The objective of the hedge portfolio (i.e., the riskless portfolio of stock and options) is to develop the formula for C. At expiration the hedge portfolio will be worth V u = hSu - C u V d = hSd - C d If we are hedged, these must be equal. Setting V u = V d and solving for h gives 3 4 1

7/28/2016 One-Period Binomial Model (continued) One-Period Binomial Model (continued) Thus, the theoretical value of the option is These values are all known so h is easily computed Since the portfolio is riskless, it should earn the risk-free rate. Thus This is the theoretical value of the call as determined by the stock price, exercise price, risk-free rate, and up and V(1+r) = V u (or V d ) down factors. Substituting for V and V u Note how the call price is a weighted average of the two (hS - C)(1+r) = hSu – C u possible call prices the next period, discounted at the risk- Substituting for h, free rate . The call’s value if the stock goes up (down) in the next period is weighted by the factor p (1-p). 5 6 One-Period Binomial Model (continued) State Prices An Illustrative Example: S = 100, X = 100, u = 1.25, d = 0.80, r = 0.07 Another way to price options using a binomial model is to define “state price” First find the values of C u , C d , h, and p: Specifically, a state price is a present value of a risk neutral C u = Max(0,100(1.25) - 100) = 25 price. C d = Max(0,100(.80) - 100) = 0 h = (25 - 0)/(125 - 80) = 0.556 p = (1.07 - 0.80)/(1.25 - 0.80) = 0.6 Then insert into the formula for C: Where q u is an ‘up’ state price, q d is a ‘down’ state price, p is a risk neutral probability, and r is a risk-free rate per period. 7 8 2

7/28/2016 Two-Period Binomial Model State Prices vs Risk-Neutral Prices We now let the stock go up/down another period so that it ends up Su 2 , Sud or Sd 2 . See Figure 4.3. The option expires after two periods with three possible values: 9 10 11 12 3

7/28/2016 Two-Period Binomial Model (continued) Two-Period Binomial Model (continued) The price of the call today can again be calculated as a weighted average After one period the call will have one period to go before of the two possible call prices in the next period (even if the call does not expiration. Thus, using a single-period model, it will worth expire at the end of the next period); either of the following two values In summary, the two-period binomial option pricing formula provides the option price as a weighted average of the two possible option prices the In a single-period world, a call option’s value is a weighted next period, discounted at the risk-free rate. The two future option prices, average of the option’s two possible values at the end of the next in turn, are obtained from the one-period binomial model. period. •The hedge ratios are different in the different states: 13 14 Two-Period Binomial Model (continued) Two-Period Binomial Model (continued) An Illustrative Example The two values of the call at the end of the first period are Input: S = 100, X = 100, u = 1.25, d = 0.80, r = 0.07 Su 2 = 100(1.25) 2 = 156.25 Sud = 100(1.25)(0.80) = 100 Sd 2 = 100(0.80) 2 = 64 The call option prices are as follows The value of p is the same, (1+r-d) / (u-d) , regardless of the number of periods in the model. 15 16 4

7/28/2016 Pricing Put Options Two-Period Binomial Model (continued) Therefore, the value of the call today is Pricing a put with the binomial model is the same procedure as pricing a call, except that the expiration payoffs are computed by using put payoff formula. Consider a European put where S = 100, X = 100, u = 1.25, d = 0.80, r = 0.07 In our example the put prices at expiration are; 17 18 Pricing Put Options Pricing Put Options P=(1+0.07-0.80)/(1.25-0.80) The two values of the put at the end of the first period are Therefore, the value of the put today is 19 20 5

7/28/2016 American Calls and Early Exercise The multi-period binomial model is an excellent opportunity to illustrate how American options can be exercised early. Consider the American call where S = 100, X = 100, u = 1.25, d = 0.80, r = 0.07 (the same as the previous European call) Pricing American Options Now we must consider the possibility of exercising the call early. At time 1 the European call values were C u = 31.54 when the stock is at 125 C d = 0.0 when the stock is at 80 When the stock is at 125, the call is in-the-money by $25, but it is still lower than holding value. So not early exercise it. The value of the American call today is now the same at 21 22 American Puts and Early Exercise American Calls and Early Exercise The multi-period binomial model is an excellent opportunity to The binomial model can easily illustrate how American options can be exercised early. accommodate the early exercise of Consider the American put where an American call by simply S = 100, X = 100, u = 1.25, d = 0.80, r = 0.07 (the same as the comparing the computed value previous European put) (holding value) and intrinsic value Now we must consider the possibility of exercising the put early. (exercise value), and select the greater value. At time 1 the European put values were American Call Path P u = 0.00 when the stock is at 125 P d = 13.46 when the stock is at 80 When the stock is at 80, the put is in-the-money by $20 so exercise it early. Replace P u = 13.46 with P u = 20. The value of the American put today is higher at Exercise or intrinsic Exercise or intrinsic 23 24 value = $0 value = $25 6

7/28/2016 American Puts and Early Exercise Extending the Binomial Model to n Periods The binomial model can easily With n periods to go, the binomial model can be easily accommodate the early exercise of extended. The basic procedure is the same. an American put by simply replacing the computed value with intrinsic value if the latter is See Figure 4.9 in which we see below the stock prices, the greater. prices of European, and American puts. This illustrates the early exercise possibilities for American puts, which can occur in multiple time periods. At each step, we must check for early exercise by comparing the value if exercised to the value if not exercised and use the higher value of the two. Exercise or 25 26 intrinsic value Extending the Binomial Model to n Periods S = 100, X = 100, u = 1.25, d = 0.80, r = 0.07 With n periods and no dividends, the European call price is given as follows; With n periods and no dividends, the European put price is given as follows; Early exercise of American put 27 28 7

7/28/2016 Extending the Binomial Model to n Periods How to determine parameters (u, d, and risk-free rates) for n periods and a Fixed Option Life With 3 periods and no dividends, the European call price is given as follows; The risk-free rate is adjusted to (1 + r) T/n -1 The up and down parameters are adjusted to where is the annualized volatility. T is time to maturity in year of the option n is the number of periods 29 30 How to determine parameters (u, d, and risk-free How to determine parameters (u, d, and risk-free rates) for n periods and a Fixed Option Life rates) for n periods and a Fixed Option Life The new option prices would be Let us price the DCRB June 125 call with TWO periods. 2 = Max(0, 181.14 - 125) = 56.14 C u The parameters are as follows; the stock price is 125.94, the C ud = Max(0, 125.94 - 125) = 0.94 option has 35 days remaining, the risk-free rate is 4.56 2 = Max(0, 87.56 - 125) = 0.00 C d percent per year, and the (annual) DCRB volatility is 83%. So, the prices of the option at time 1 are p would be (1.00214 - 0.8338)/(1.1993 - 0.8338) = .4606; The price of the option at time 0 is, therefore, 1 - p = .5394. 31 32 8

Recommend

More recommend