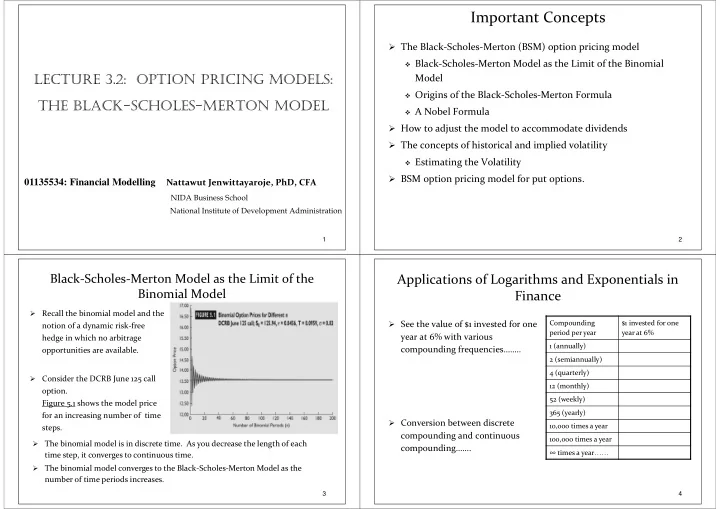

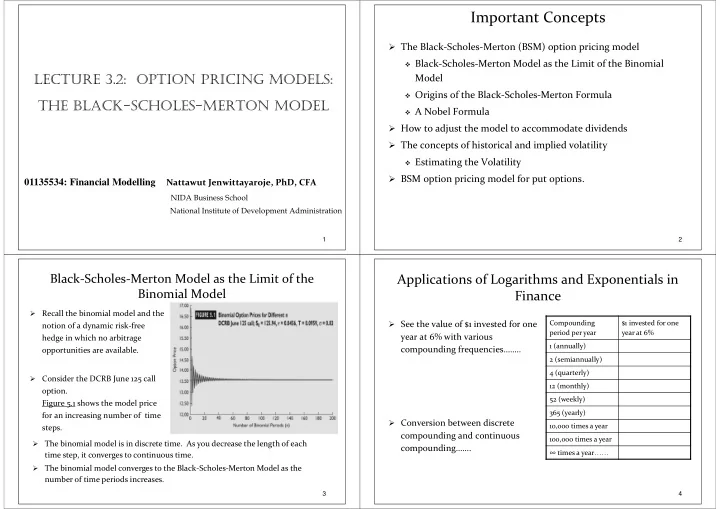

Important Concepts The Black ‐ Scholes ‐ Merton (BSM) option pricing model Black ‐ Scholes ‐ Merton Model as the Limit of the Binomial LECTURE 3.2: OPTION PRICING MODELS: Model Origins of the Black ‐ Scholes ‐ Merton Formula THE BLACK-SCHOLES-MERTON MODEL A Nobel Formula How to adjust the model to accommodate dividends The concepts of historical and implied volatility Estimating the Volatility BSM option pricing model for put options. 01135534: Financial Modelling Nattawut Jenwittayaroje, PhD, CFA NIDA Business School National Institute of Development Administration 1 2 Black ‐ Scholes ‐ Merton Model as the Limit of the Applications of Logarithms and Exponentials in Binomial Model Finance Recall the binomial model and the See the value of $1 invested for one Compounding $1 invested for one notion of a dynamic risk ‐ free period per year year at 6% year at 6% with various hedge in which no arbitrage 1 (annually) compounding frequencies…….. opportunities are available. 2 (semiannually) 4 (quarterly) Consider the DCRB June 125 call 12 (monthly) option. 52 (weekly) Figure 5.1 shows the model price 365 (yearly) for an increasing number of time Conversion between discrete 10,000 times a year steps. compounding and continuous 100,000 times a year The binomial model is in discrete time. As you decrease the length of each compounding……. ∞ times a year …… time step, it converges to continuous time. The binomial model converges to the Black ‐ Scholes ‐ Merton Model as the number of time periods increases. 3 4

A Nobel Formula Origins of the Black ‐ Scholes ‐ Merton Formula The Black ‐ Scholes ‐ Merton model gives the correct formula for a European call under certain assumptions. Black, Scholes, Merton and the 1997 Nobel Prize The general idea of the Black ‐ Scholes ‐ Merton model is the same as that F. Black and M. S. Scholes. “The Pricing of Options and Corporate of the binomial model, except that in BSM model, trading occurs Liabilities.” Journal of Political Economy , 81 (May ‐ June 1973), 637 ‐ continuously. So in BSM, a hedge portfolio is established and maintained 659. by constantly adjusting the relative proportions of stock and options, a R. C. Merton. “The Theory of Rational Option Pricing.” Bell process called dynamic trading . Journal of Economics and Management Science , 4 (Spring 1973), 141 ‐ 183. The model is derived with complex mathematics but is easily understandable. The Black ‐ Scholes ‐ Merton formula 5 6 A Digression on Using the Normal Distribution A Nobel Formula (continued) The familiar normal, bell ‐ shaped curve (Figure 5.5) where See Table 5.1 for determining the normal probability for d 1 and N(d 1 ), N(d 2 ) = cumulative normal d 2 . This gives you N(d 1 ) and N(d 2 ). probability σ = annualized standard deviation (volatility) of the continuously compounded (log) return on the stock r c = continuously compounded risk- free rate S 0 = current stock price X = exercise price T = time to expiration in years 7 8

The cumulative probabilities of the standard normal distribution A Nobel Formula (continued) A Numerical Example Price the DCRB June 125 call S 0 = 125.94, X = 125, r c = ln(1.0456) = 0.0446, where 4.56% is simple risk ‐ free rate, and 4.46% is continuously compounded risk ‐ free rate T = 0.0959, = 0.83. 9 10 Black ‐ Scholes ‐ Merton Model When the Stock Pays Black-Scholes-Merton Model When the Stock Pays Discrete Discrete Dividends Dividends Known Discrete Dividends Assume a single dividend of D t where the ex ‐ dividend date is time t during the option’s life. Subtract present value of dividends from stock price. Adjusted stock price, S , is inserted into the B ‐ S ‐ M model. See Table 5.3 for example. Continuous Dividend Yield Assume the stock pays dividends continuously at the rate of . Subtract present value of dividends from stock price. Adjusted stock price, S , is inserted into the B ‐ S model. See Table 5.4 for example. This approach could also be used if the underlying is a foreign currency, where the yield is replaced by the continuously compounded foreign risk ‐ free rate. 11 12

Black-Scholes-Merton Model When the Stock Pays Contin Continuous uous Put Option Pricing Models Dividends Restate put ‐ call parity with continuous discounting Substituting the B ‐ S ‐ M formula for C above gives the B ‐ S ‐ M put option pricing model The put option can also be represented as; where N(d 1 ) and N(d 2 ) are the same as in the call model. Note calculation of put price: 13 14 Estimating the Historical Volatility Estimating the Volatility There are two approaches to estimating volatility: 1) the historical volatility, and 2) the implied volatility. Historical Volatility The historical volatility estimate is based on the assumption that the volatility that prevailed over the recent past will continue to hold in the future. The historical volatility is estimated from a sample of recent continuously compounded returns on the stock. This is the volatility over a recent time period. Collect daily (weekly, or monthly) returns on the stock. Convert each return to its continuously compounded equivalent by taking ln(1 + return). Calculate variance. Annualize by multiplying by 250 (daily returns), 52 (weekly returns) or 12 (monthly returns). Take square root. See Table 5.6 for example with DCRB. 15 16

Estimating the Implied Volatility Interpreting the Implied Volatility Implied Volatility The CBOE has constructed indices of implied volatility of one ‐ month at ‐ the ‐ This is the volatility money options based on the S&P 500 (VIX) and Nasdaq (VXN). See Figure 5.20. implied when the market A number of studies have examined whether implied volatility is a good price of the option is set predictor of the future volatility of a stock. A general consensus is that to the model price. implied volatility is a better reflection of the appropriate volatility for pricing an option than is the historical volatility. Figure 5.17 illustrates the procedure. Substitute estimates of the volatility into the B ‐ S ‐ M formula until the market price converges to the model price. 17 18 Interpreting the Implied Volatility Summary VIX is usually referred to as Figure 5.21 shows the relationship between call, put, underlying S&P500 from Sep 2007 to May 2011 the fear index . It represents asset, risk ‐ free bond, put ‐ call parity, and Black ‐ Scholes ‐ Merton one measure of the market’s call and put option pricing models. expectation of stock market (annualized) volatility over the next 30 day period. For example, if VIX is 20%, the S&P500 is expected to move up or down about 20/sqrt(12) = 5.8% over the next 30 day period. Or there VIX from Sep 2007 to May 2011 is a 68% likelihood (one SD) that the magnitude of the S&P500’s 30-day return will be less than 5.8% (either up or down). 19 20 Source: www.bloomberg.com

Recommend

More recommend