Introduction

Policy Context Published 2009 Climate Change (Scotland) Act Consulted Spring 2017 Climate Change Plan Third Report Proposals and Policies Published Dec- 17 Consulted Scottish Energy Spring 2017 Strategy to Summer 2018 Energy Efficient Scotland Route Map Published May-18

Energy Efficient Scotland Delivery Plan The Routemap

The Aim

National Support Framework

Scale of the Energy Efficient Scotland Programme

Current Support Initiatives UK Wide Loan schemes Green Home Innovation Fund Whole House Retrofit Competition

Current Support Initiatives - Scotland Grants Advice & Information Loan schemes Procurement Frameworks

Support to date

Lessons learned • International studies • The Green Deal . • Building standards . • Scottish Government loans

Driving demand - Regulation of Domestic Sector

Energy Efficient Mortgage Market Implementation Plan Support EU Ambitions Influence Value Chain • Expand sustainable finance • From Consumer to Bond • impact on climate investor change • Secure best practices

EEMiP actions Market & Guidance for Establish an Market Institutional Consumer lending EEM Label demonstrator coordination research institutions

Demonstrator pilot – Glasgow Credit Union

Energy Efficient Scotland – Delivery workstreams Advice and information Branding, Assessmen Marketing t & Comms Delivery Mechanisms Skills & Supply Monitoring And Finance Evaluation Quality Assurance & Consumer Protection

Key Issues for Pilot from Scottish Government perspective Legal Engagement Finance across SG Pilot Ministerial State Aid Support Procurement

Key issues for Pilot partner - Glasgow Credit Union Product development Financial The Journey Education Customer Satisfaction Governance Regulatory & Monitoring requirements Scale & Timing

Potential Financial products

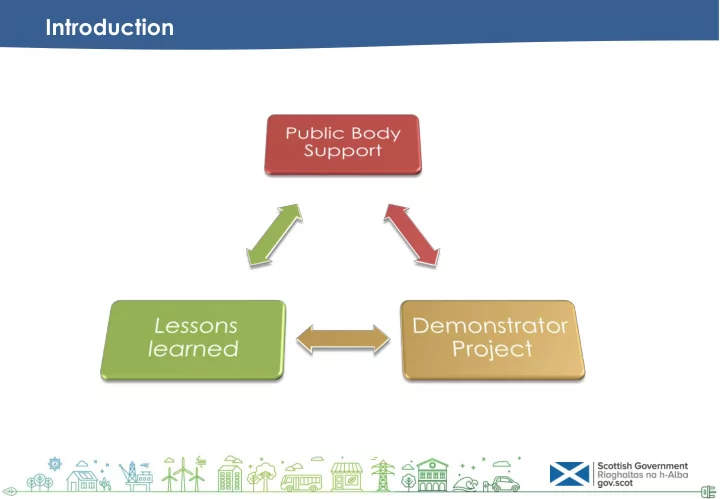

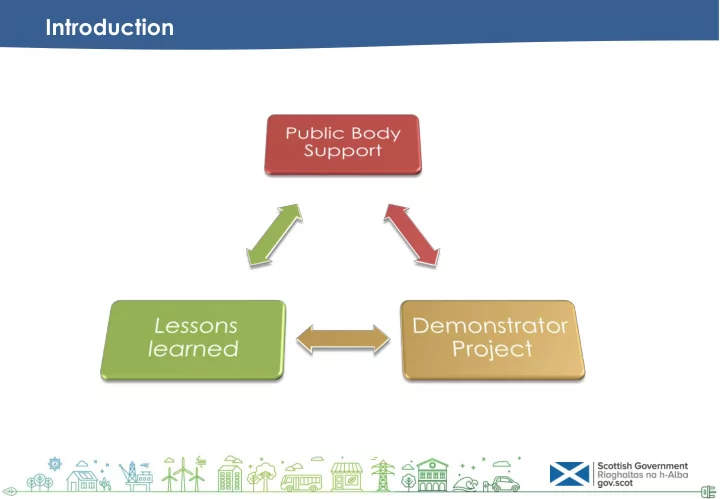

Summary Role of public bodies 3 Pillars for success Demonstrator projects Building on lessons learned Create scaleable processes Partnering is key

Any Questions

Assumptions – Capex demand drivers • Different sub-sectors have • Split between • Turnover rate SME, medium of rental differing assumptions for key and large agreements demand drivers. businesses Non Private • Sub-sectors modelled Domestic Rental individually and aggregated Energy Sector to identify total demand profile. Domestic & NDEE Sector • Owner Social % self funding applied Occupiers Housing individually to each sector • Level of • Availability of • EPC cost improvements properties own financial requiring resources based on NHM data. upgrade?

Recommend

More recommend