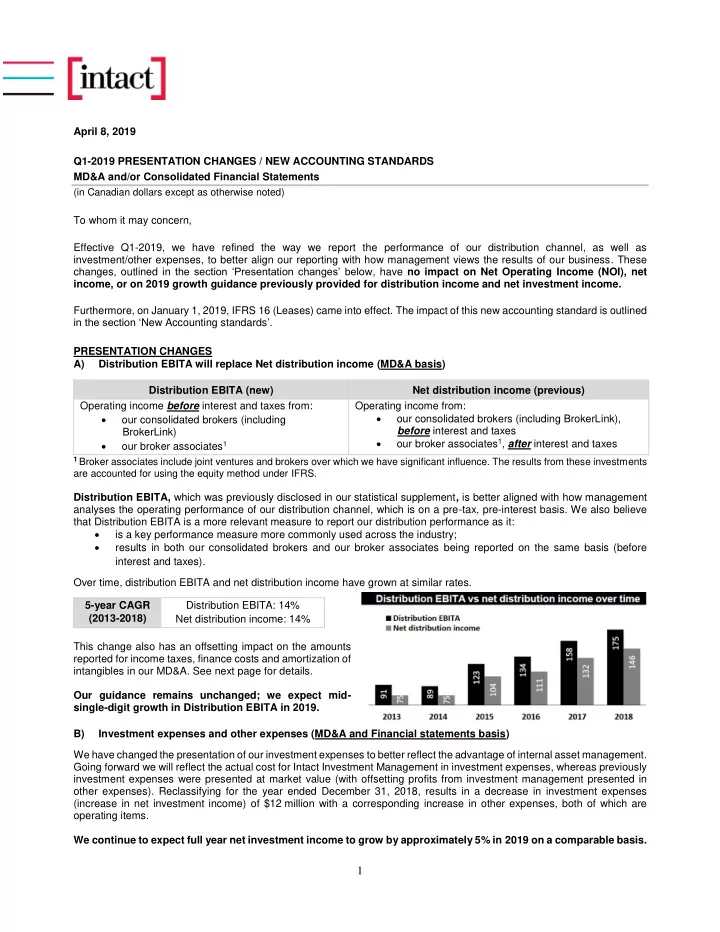

April 8, 2019 Q1-2019 PRESENTATION CHANGES / NEW ACCOUNTING STANDARDS MD&A and/or Consolidated Financial Statements (in Canadian dollars except as otherwise noted) To whom it may concern, Effective Q1-2019, we have refined the way we report the performance of our distribution channel, as well as investment/other expenses, to better align our reporting with how management views the results of our business. These changes, outlined in the section ‘Presentation changes’ below , have no impact on Net Operating Income (NOI), net income, or on 2019 growth guidance previously provided for distribution income and net investment income. Furthermore, on January 1, 2019, IFRS 16 (Leases) came into effect. The impact of this new accounting standard is outlined in the section ‘ New Accounting standards ’. PRESENTATION CHANGES A) Distribution EBITA will replace Net distribution income (MD&A basis) Distribution EBITA (new) Net distribution income (previous) Operating income from: Operating income before interest and taxes from: • • our consolidated brokers (including BrokerLink), our consolidated brokers (including before interest and taxes BrokerLink) • our broker associates 1 , after interest and taxes • our broker associates 1 1 Broker associates include joint ventures and brokers over which we have significant influence. The results from these investments are accounted for using the equity method under IFRS. Distribution EBITA, which was previously disclosed in our statistical supplement , is better aligned with how management analyses the operating performance of our distribution channel, which is on a pre-tax, pre-interest basis. We also believe that Distribution EBITA is a more relevant measure to report our distribution performance as it: • is a key performance measure more commonly used across the industry; • results in both our consolidated brokers and our broker associates being reported on the same basis (before interest and taxes). Over time, distribution EBITA and net distribution income have grown at similar rates. 5-year CAGR Distribution EBITA: 14% (2013-2018) Net distribution income: 14% This change also has an offsetting impact on the amounts reported for income taxes, finance costs and amortization of intangibles in our MD&A. See next page for details. Our guidance remains unchanged; we expect mid- single-digit growth in Distribution EBITA in 2019. B) Investment expenses and other expenses (MD&A and Financial statements basis) We have changed the presentation of our investment expenses to better reflect the advantage of internal asset management. Going forward we will reflect the actual cost for Intact Investment Management in investment expenses, whereas previously investment expenses were presented at market value (with offsetting profits from investment management presented in other expenses). Reclassifying for the year ended December 31, 2018, results in a decrease in investment expenses (increase in net investment income) of $12 million with a corresponding increase in other expenses, both of which are operating items. We continue to expect full year net investment income to grow by approximately 5% in 2019 on a comparable basis. 1

Reclassification of comparative periods We will reclassify the comparative figures in our Q1-2019 reports in order to ensure comparability and consistency with this new presentation. The impact of these presentation changes for Q1-2018 and FY 2018 are presented in the tables below: – Impact of changes (reclassifications for Q1-2018) As previously (A) Impact of (B) Investment vs For the quarter ended March 31, 2018 reported Distribution EBITA other expenses As reclassified Underwriting income 19 - - 19 Net investment income 122 - 3 125 Distribution EBITA/Net distribution income 24 6 - 30 Finance costs (25) (3) - (28) Other income (expense) (1) - (3) (4) PTOI 139 3 - 142 Operating tax expense (19) (3) - (22) 120 NOI 120 - - 0.81 NOIPS (in dollars) 0.81 - - 15.5% Operating effective tax rate 13.5% 2.0 pts - Non-operating gains (losses) (19) (1) - (20) 3 Non-operating income tax recovery 2 1 - Net income 103 - - 103 Total effective tax rate 14.2% 1.4 pts - 15.6% – Impact of changes (reclassifications for FY-2018) As previously (A) Impact of (B) Investment vs For the year ended Dec. 31, 2018 reported Distribution EBITA other expenses As reclassified Underwriting income 474 - - 474 Net investment income 529 - 12 541 Distribution EBITA/Net distribution income 146 29 - 175 Finance costs (103) (11) - (114) Other income (expense) (18) - (12) (30) PTOI 1,028 18 - 1,046 Operating tax expense (189) (18) - (207) NOI 839 - - 839 5.74 NOIPS (in dollars) 5.74 - - 19.8% Operating effective tax rate 18.4% 1.4 pts - Non-operating gains (losses) (142) (5) - (147) 15 Non-operating income tax recovery 10 5 - Net income 707 - - 707 Total effective tax rate 20.2% 1.2 pts - 21.4% See the attached document for reclassified figures for the last 9 quarters and last five years. 2

NEW ACCOUNTING STANDARDS IFRS 16 (Leases), effective January 1, 2019 As disclosed in Note 33.2 of our Consolidated Financial Statements for the year ended December 31, 2018, IFRS 16 (Leases) is effective for annual periods beginning on or after January 1, 2019. The standard requires lessees to recognize most leases on their balance sheets as right-of-use assets (representing the right to use the underlying assets), with the corresponding lease liabilities (representing the obligation to make lease payments). Operating lease expenses, which were previously mostly recorded in underwriting expenses, will be replaced by depreciation expenses (mostly recorded in underwriting expenses) and interest expenses (recorded in finance costs). We expect finance costs to increase by $3 million per quarter in 2019, with the overall impact on net income being minimal. The cumulative effect of adoption will be recognized in opening Retained earnings as at January 1, 2019, with no restatement to the comparative figures. The adoption of IFRS 16 will lead to the recognition of operating leases, mainly real estate leases. As a result, we expect to account for right-of-use assets of $358 million, lease liabilities of $441 million, write-off of net liabilities recognized under the previous standard of $29 million, and a reduction of shareholders’ equity of $ 39 million, net of income taxes. The impact of these balance sheet restatements is expected to have minimal impacts on our debt-to-total capital ratio, our MCT ratio and our total excess capital. For the definitions of measures and other insurance-related terms used in this document, refer to the MD&A and to the glossary available in the “Investors” section of our website at www.intactfc.com. Ken Anderson Vice President Investor Relations & Treasurer 1 855 646-8228 ext. 87383 kenneth.anderson@intact.net 3

Recommend

More recommend