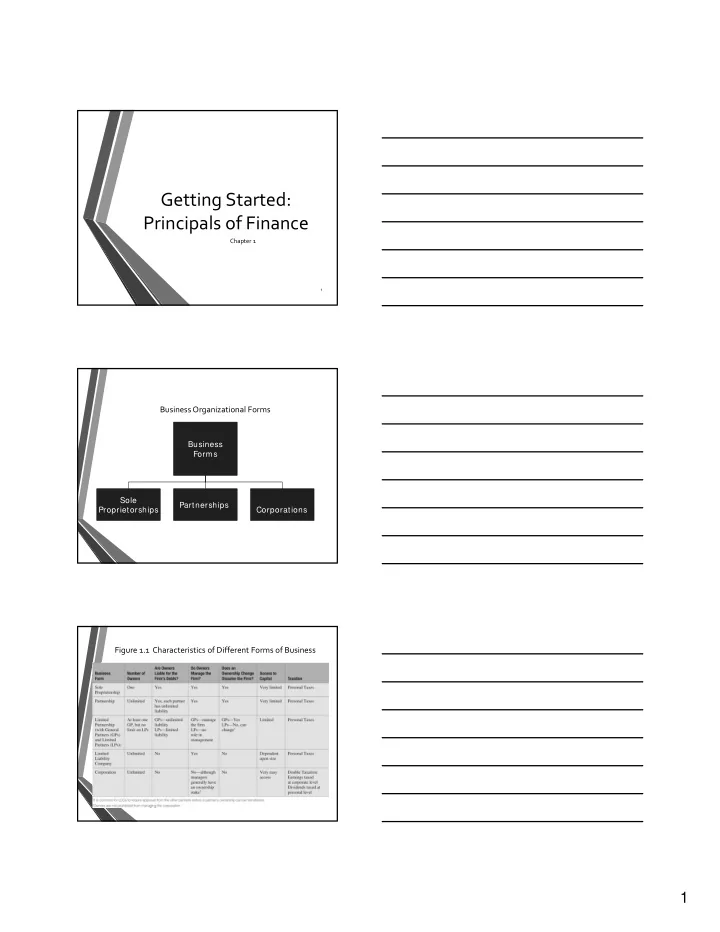

Getting Started: Principals of Finance Chapter 1 1 Business Organizational Forms Business Forms Sole Partnerships Proprietorships Corporations Figure 1.1 Characteristics of Different Forms of Business 1

Figure 1.2 How the Finance Area Fits into a Corporation PRINCIPLE 1:Money Has a Time Value • A dollar received today is worth more than a dollar received in the future. • We can invest the dollar received today to earn interest. Thus, in the future, you will have more than one dollar, as you will receive the interest on your investment. PRINCIPLE 2: There is a Risk ‐ Return Trade ‐ off • We won’t take on additional risk unless we expect to be compensated with additional return. • Higher the risk, higher will be the expected return. • Actual realized rate of return will typically be different from expected return 2

Figure 1.3 There Is a Risk ‐ Return Tradeoff PRINCIPLE 3: Cash Flows Are the Source of Value • Cash flow is the amount of cash that can actually be taken out of the business. • Profit is an accounting concept and measures a business’s performance • It is possible for a firm to report profits but have no cash. Incremental Cash Flow Financial decisions in a firm should consider “ incremental cash flow ” ‐ the difference between the cash flows the company will produce with the potential new investment and what it would make without the investment. 3

PRINCIPLE 4: Market Prices Reflect Information Investors react quickly to news/information and decisions made by managers. Good News ==> Higher stock prices Bad News ==> Lower stock price. PRINCIPLE 5: Individuals Respond to Incentives Individuals respond to incentives They will do more of what they are rewarded for doing Managers (as agents) respond to incentives they are given in the workplace. If their incentives are not properly aligned with those of the firm’s stockholders (the principal) they may not make decisions that are consistent with increasing shareholder value leading to agency costs. PRINCIPLE 5: Individuals Respond to Incentives Agency problems/costs can be mitigated through: 1. Compensation plans that reward managers when they act to maximize shareholder wealth 2. Monitoring by the board of directors 3. Monitoring by financial markets (such as auditors, bankers, security analysts, credit agencies) 4. The underperforming firms seeing their stock prices fall and face threat of being taken over and have their management teams replaced. 4

Recommend

More recommend