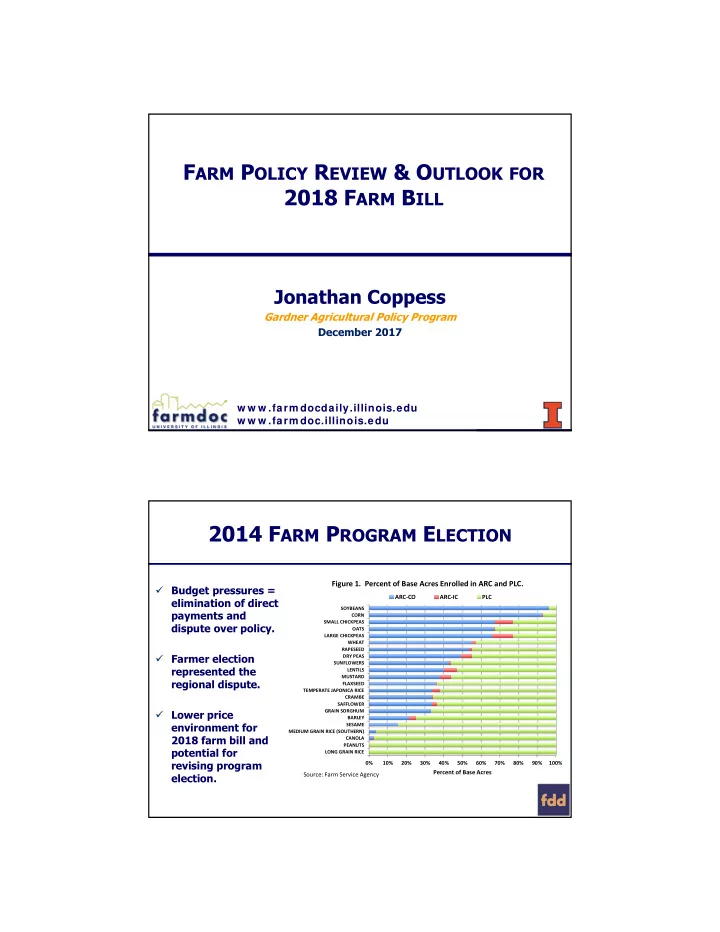

F ARM P OLICY R EVIEW & O UTLOOK FOR 2018 F ARM B ILL Jonathan Coppess Gardner Agricultural Policy Program December 2017 w w w .farm docdaily.illinois.edu w w w .farm doc.illinois.edu 2014 F ARM P ROGRAM E LECTION Figure 1. Percent of Base Acres Enrolled in ARC and PLC. Budget pressures = ARC‐CO ARC‐IC PLC elimination of direct SOYBEANS payments and CORN SMALL CHICKPEAS dispute over policy. OATS LARGE CHICKPEAS WHEAT RAPESEED Farmer election DRY PEAS SUNFLOWERS represented the LENTILS MUSTARD regional dispute. FLAXSEED TEMPERATE JAPONICA RICE CRAMBE SAFFLOWER Lower price GRAIN SORGHUM BARLEY environment for SESAME MEDIUM GRAIN RICE (SOUTHERN) 2018 farm bill and CANOLA PEANUTS potential for LONG GRAIN RICE revising program 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Percent of Base Acres election. Source: Farm Service Agency

F ARM P ROGRAM R EVIEW : ARC-CO Corn-Christian County, IL • Benchmark = 5-year $7.00 250 Olympic average price & yield (drop high and low). $6.00 200 • Guarantee from 86% to $5.00 150 76% of benchmark. $4.00 100 • Payments on 85% of base. $3.00 50 • Key feature is the $2.00 adjustment of price & yield components. $1.00 0 2009201020112012201320142015201620172018 MYA Price Reference Price Benchmark Price County Yield Benchmark Yield F ARM P ROGRAM R EVIEW : PLC Prices (MYA-NASS; CBO forecasts) • 2014 Farm Bill $16.00 $1.00 raised reference prices; deficiencies $0.90 $14.00 paid on 85% of $0.80 $12.00 base. $0.70 $ per pound cotton $10.00 $ per Bushel $0.60 • Not all reference $8.00 $0.50 prices are the same; $0.40 $6.00 lack of transparency $0.30 $4.00 and equity. $0.20 $2.00 $0.10 • Peanut price trigger $0.00 $0.00 (not shown) has averaged 120% of MYA since 2002. Corn Soybeans Wheat Corn Fixed (eff.) Soybeans Fixed (eff.) Wheat Fixed (eff.) Cotton Cotton Fixed (eff.)

F ARM P ROGRAM R EVIEW • ARC-CO has Program Payments-Christian Co. averaged $36.17 $80.00 per base acre. $70.00 $60.00 • PLC has averaged $29 per base $50.00 acre. $40.00 $30.00 • Under current price scenarios, $20.00 ARC unlikely to $10.00 trigger payments; $0.00 PLC likely to. 2014 2015 2016 2017 2018 ARC-CO PLC O VERVIEW OF C ROP I NSURANCE • 2017 total Crop Insurance liability was ($Millions) over $100b. $20,000 $18,000 • Over 1m $16,000 policies $14,000 covering $12,000 almost 300m $10,000 acres $8,000 insured. $6,000 $4,000 • Loss ratio $2,000 0.28. $0 Premium Subsidy Total Premium Indemnity Farmer Paid

F ARM B ILL C ONSERVATION T ITLE Reserve or Retirement •CRP (1985): 10-15 year rental to reserve from production •ACEP (1990): Easement purchased on land; wetlands, grasslands; farmland Working Lands •EQIP (1996): cost-share assistance for practices; meet or avoid regulation •CSP (2002): 5-year contracts for maintaining and improving conservation •RCPP (2014): works across programs; regional basis; private funding match Compliance (1985) •Determines eligibility for Federal assistance, including premium subsidy •Highly Erodible Land w/ plan; no converting or farming on converted wetlands •Significance: added in Eighties crisis; crop insurance removed 1996; reattached 2014 Outlook 2018. SEVEN ISSUES FOR THE NEXT FARM BILL

I SSUE #1: CBO B ASELINE CBO June 2017 Baseline Budget rules create “zero sum” $25,000 effort Increases in $20,000 baseline for program or title requires offsets $15,000 elsewhere in the Millions baseline (program, crop or title). $10,000 CBO estimates spending for 10 $5,000 years based on existing policy. $0 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 Crop Insurance Conservation Total Title 1 I SSUE #2: C ROP I NSURANCE • At roughly $6b per year, premium discount is a target. • Admin./Heritage: save over $30b by capping discount, eliminating harvest price, AGI. • Flake-Shaheen, save $24b from harvest price, rate of return $750k AGI passed and capping Senate 2012 and House narrowly 2013 (66 and 59 premium defeated crop insurance votes, respectively) reform amendment subsidies/AGI. 2013 (208 to 217)

I SSUE #3: R EVISING ARC • Yield fixes: Corn Prices trend yield $7.00 instead of 5-year Olympic; use $6.00 RMA yields. $5.00 • Price fixes: different moving $4.00 average prices (3-year; 10- $3.00 year). $2.00 • Higher guarantee (e.g. $1.00 90%) and bigger coverage band (e.g. 15-20%). MYA 5YOMA 10 Yr Avg 3 Yr Avg Reference ARC & PLC IN THE B ASELINE Outlays: CBO, June 2017 Baseline ($ millions) • Notable shift $9,000.00 in Title I baseline $8,000.00 from ARC to $7,000.00 PLC. $6,000.00 $5,000.00 • CBO assumes $4,000.00 82% of corn base takes $3,000.00 PLC; low ARC $2,000.00 payments. $1,000.00 $0.00 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 PLC ARC-CO Crop Insurance Conservation Total Title 1

I SSUE #4: C OTTONSEED & D AIRY • Cotton removed in 2014 because of WTO dispute with Brazil. • Demand that cottonseed be added to list of covered commodities at $15.00 cwt. ($0.15/lb.). • Potentially $5.4 billion in baseline cost; what gets cut (corn, crop insurance, conservation, all of the above)? • Dairy: seeking fixes to Margin Protection Program; feed cost calculation; premium; cost unknown. I SSUE #5: CRP AND C ONSERVATION 2014 Farm Bill reduced CRP Statistics (USDA-FSA) acreage cap to 24 million acres. 50 $80.00 45 Lower prices have $70.00 increased interest in an 40 Million Acres Under Contract $ per Acre, national average increase to cap; wildlife $60.00 and hunting interests 35 are pushing. $50.00 30 Previous high was from 25 $40.00 2002 Farm Bill at 39.2m; Concerns about baseline 20 $30.00 and offset issues; impact on working lands 15 programs. $20.00 10 $10.00 Problems with 5 increasing rental rates in some areas competing 0 $0.00 with cash rents in low price environment. CRP Acres Farm Bills Acreage Cap Rental Rate

I SSUE #6: SNAP • Substantial increase in nutrition assistance particularly since 2008 recession; increases political pressure. • Recent hearings raise concerns about error rates, fraud, etc. • Signal another partisan SNAP fight? • Congressional challenges in general, will this make it worse? SNAP: H ISTORICAL B ACKGROUND 60,000 $90,000.00 $80,000.00 50,000 $70,000.00 40,000 $60,000.00 $50,000.00 30,000 Helped farm programs in 1964; added $40,000.00 to farm bill in 1973; spending is on 20,000 $30,000.00 food, which benefits farmers. $20,000.00 Controversial amendment in 2013 and 10,000 farm bill defeat in House (195 to 234). $10,000.00 0 $0.00 Strongest opponents of SNAP tend to 1969 1973 1977 1981 1985 1989 1993 1997 2001 2005 2009 2013 2017p 2021p 2025p oppose farm programs and crop insurance. Participants (thousands) Total Costs ($Millions) Source: USDA; CBO (projections)

I SSUE #7: T AX & D EFICIT . Deficits & Tax Legislation (CBO) • Before the tax legislation, $1,600.00 CBO estimated debt would increase from $15.5 trillion $1,400.00 to $25.5 trillion by 2027. $1,200.00 $1,000.00 • Statutory Pay-As-You-Go (PAYGO) would require $800.00 Billions offsets for tax bill; Congress would need to $600.00 revise. $400.00 $200.00 • Note: 2018 PAYGO estimate is $38 billion. $0.00 -$200.00 Deficit Tax Bill PAYGO

Recommend

More recommend