City of Alameda Contract Period: June 30, 2013 June 24, 2017 1 - PowerPoint PPT Presentation

City of Alameda Contract Period: June 30, 2013 June 24, 2017 1 International Association of Firefighters, Local 689 (IAFF) represents regular sworn Fire employees. Alameda Fire Management Association (AFMA) represents sworn Fire

City of Alameda Contract Period: June 30, 2013 – June 24, 2017 1

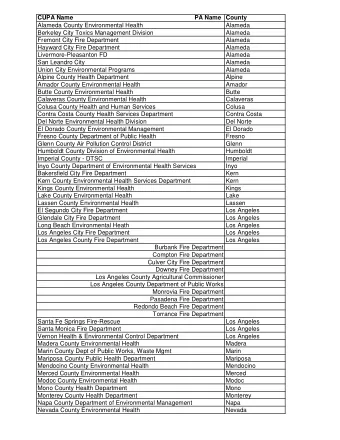

International Association of Firefighters, Local 689 (IAFF) represents regular sworn Fire employees. Alameda Fire Management Association (AFMA) represents sworn Fire management personnel. Alameda Police Officers Association (APOA) represents regular sworn Police employees. Alameda Police Managers Association (APMA) represents sworn Police management personnel. 2

1. Improving the City’s budget position, both regarding short term cash flow, and with respect to long term liability for pension retirement and medical costs. 3

1. Improving the City’s budget position, both regarding short term cash flow, and with respect to long term liability for pension retirement and medical costs. 2. Incorporating into the contract all pre- existing side-letters and benefits changes mandated by new California Public Pension Reform Law. 4

1. Improving the City’s budget position, both regarding short term cash flow, and with respect to long term liability for pension retirement and medical costs. 2. Incorporating into the contract all pre-existing side-letters and benefits changes mandated by new California Public Pension Reform Law. 3. Creating more efficient delivery of service to the public, with employee premium compensation based upon employee attainment in areas that can be objectively demonstrated through education and certification. 5

1. Improving the City’s budget position, both regarding short term cash flow, and with respect to long term liability for pension retirement and medical costs. 2. Incorporating into the contract all pre-existing side-letters and benefits changes mandated by new California Public Pension Reform Law. 3. Creating more efficient delivery of service to the public, with employee premium compensation based upon employee attainment in areas that can be objectively demonstrated through education and certification. 4. Settling the five year old grievance dispute between the City and the International Association of Fire Fighters. This is estimated to cost the City more than $7M by 2017 if it is not settled. 6

Financial Analysis of IAFF Grievance Exposure to City of Alameda Retention Pay Totals Plus FLSA on Base Pay (Estimated 5%) Plus PERS Total Effect FY 07/08 369,555 18,478 143,572 531,605 FY 08/09 418,369 20,918 162,537 601,824 FY 09/10 406,475 20,324 157,916 584,715 FY 10/11 422,750 21,137 164,238 608,126 FY 11/12 466,645 23,332 181,292 671,269 FY 12/13 478,913 23,946 186,058 688,916 Projected Exposure through 6/30/13 3,686,455 FY 13/14 561,464 28,073 207,741 797,278 FY 14/15 582,512 29,126 209,704 821,342 FY 15/16 624,119 31,206 218,441 873,766 FY 16/17 698,088 34,904 237,350 970,342 Additional Projected Exposure if new MOU not implemented 3,462,727 Total Projected Exposure $ 7,149,183 7

Increases employee pension cost sharing by 1% each fiscal year for four years. Raises the amount contributed by employees to their pension premium by 67% 67% (from 9% of salary to 15% of salary). Estimated City savings over the life of the contracts: IAFF: $1,668,000 o AFMA: $ 123,000 o APOA: $1,328,000 o APMA: $ 230,000 o Total $3,349,000 8

State pension reform limits imposition of employee PERS contribution to 12% beginning January 1, 2018. 9

State pension reform limits imposition of employee PERS contribution to 12% beginning January 1, 2018. Imposition of contract is complex and requires special processes under both Alameda Charter and separate State Law. 10

State pension reform limits imposition of employee PERS contribution to 12% beginning January 1, 2018. Imposition of contract is complex and requires special processes under both Alameda Charter and separate State Law. The negotiated 15% voluntary contribution is 25% 25% highe her than the possible State maximum that can be achieved through imposition. 11

State pension reform limits imposition of employee PERS contribution to 12% beginning January 1, 2018. Imposition of contract is complex and requires special processes under both Alameda Charter and separate State Law. The negotiated 15% voluntary contribution is 25% h higher er than the possible State maximum that can be achieved through imposition. Changes the final retirement benefit compensation calculation formula from single-highest year to a consecutive 3-year period for new employees as well as current employees. 12

State pension reform limits imposition of employee PERS contribution to 12% beginning January 1, 2018. Imposition of contract is complex and requires special processes under both Alameda Charter and separate State Law. The negotiated 15% voluntary contribution is 25% h higher er than the possible State maximum that can be achieved through imposition. Changes the final retirement benefit compensation calculation formula from single-highest year to a consecutive 3-year period for new employees as well as current employees. State pension reform only mandates this 3-year averaging for new employees. 13

State pension reform limits imposition of employee PERS contribution to 12% beginning January 1, 2018. Imposition of contract is complex and requires special processes under both Alameda Charter and separate State Law. The negotiated 15% voluntary contribution is 25% 25% h higher than the possible State maximum that can be achieved through imposition. Changes the final retirement benefit compensation calculation formula from single-highest year to a consecutive 3-year period for new employees as well as current employees. State pension reform only mandates this 3-year averaging for new employees. As mandated by State pension reform, new employees’ retirement formula is 2.7% @ 57 yrs. old instead of 3% @ 50 yrs. old. 14

State pension reform limits imposition of employee PERS contribution to 12% beginning January 1, 2018. Imposition of contract is complex and requires special processes under both Alameda Charter and separate State Law. The negotiated 15% voluntary contribution is 25% 25% h higher than the possible State maximum that can be achieved through imposition. Changes the final retirement benefit compensation calculation formula from single-highest year to a consecutive 3-year period for new employees as well as current employees. State pension reform only mandates this 3-year averaging for new employees. As mandated by State pension reform, new employees’ retirement formula is 2.7% @ 57 yrs. old instead of 3% @ 50 yrs. old. 15

2014 - 15% of the increase of Kaiser or Blue Shield premiums beginning January 1 16

2014 - 15% of the increase of Kaiser or Blue Shield premiums beginning January 1 2015 - 25% of the increase of Kaiser or Blue Shield premiums beginning January 1 17

2014 - 15% of the increase of Kaiser or Blue Shield premiums beginning January 1 2015 - 25% of the increase of Kaiser or Blue Shield premiums beginning January 1 2016 - 25% of the increase of Kaiser er premiums beginning January 1 18

2014 - 15% of the increase of Kaiser or Blue Shield premiums beginning January 1 2015 - 25% of the increase of Kaiser or Blue Shield premiums beginning January 1 2016 - 25% of the increase of Kaiser er premiums beginning January 1 2017 - 50% of the increase of Kaiser er premiums beginning January 1 19

2014 - 15% of the increase of Kaiser or Blue Shield premiums beginning January 1 2015 - 25% of the increase of Kaiser or Blue Shield premiums beginning January 1 2016 - 25% of the increase of Kais iser premiums beginning January 1 2017 - 50% of the increase of Kais iser premiums beginning January 1 Note: The basis of the City’s contribution to public safety employees health care premium moves down from the Blue Shield premium to the Kaiser rate on 1/1/16. Estimated City Savings: IAFF: $ 629,000 ◦ AFMA: $ 27,000 ◦ APOA: $ 531,000 ◦ APMA: $ 64,000 ◦ Total $1,251,000 20

No employee pay raises for the first six months of the contracts. 21

No employee pay raises for the first six months of the contracts. Wage increases effective the first full pay period in 2014, 2015, and 2016 will be based upon 50% of the rate of growth during the previous fiscal year in the Balanced Revenue Index (BRI) 22

No employee pay raises for the first six months of the contracts. Wage increases effective the first full pay period in 2014, 2015, and 2016 will be based upon 50% of the rate of growth during the previous fiscal year in the Balanced Revenue Index (BRI) ◦ 2014 - minimum increase of 1.5% and a maximum increase of 4% 23

No employee pay raises for the first six months of the contracts. Wage increases effective the first full pay period in 2014, 2015, and 2016 will be based upon 50% of the rate of growth during the previous fiscal year in the Balanced Revenue Index (BRI) ◦ 2014 - minimum increase of 1.5% and a maximum increase of 4% ◦ 2015 - minimum increases of 2% and maximum increases of 5% 24

Recommend

More recommend

Explore More Topics

Stay informed with curated content and fresh updates.