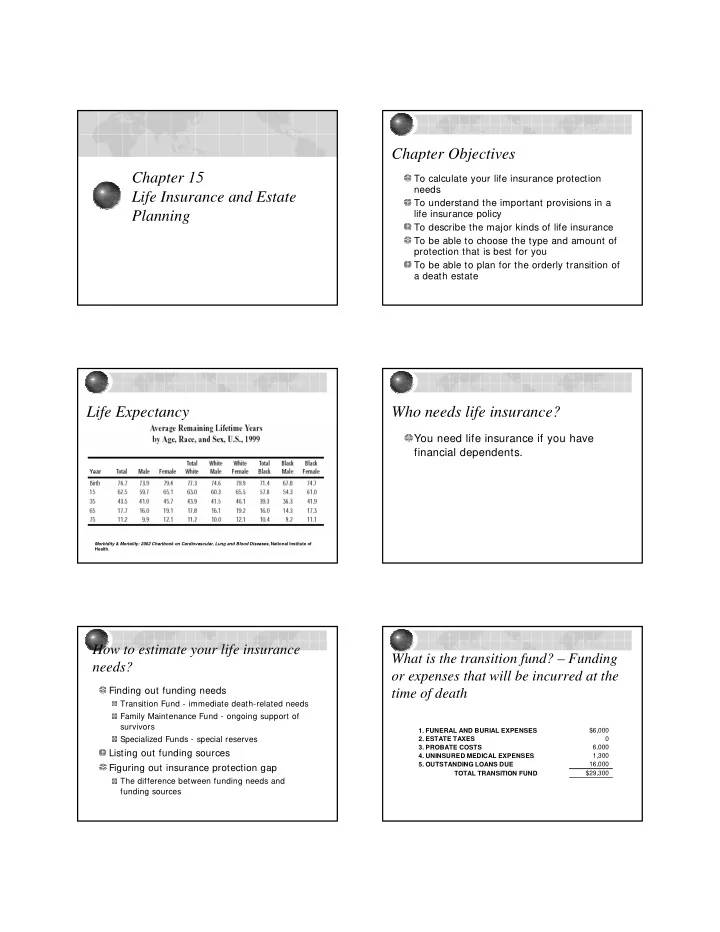

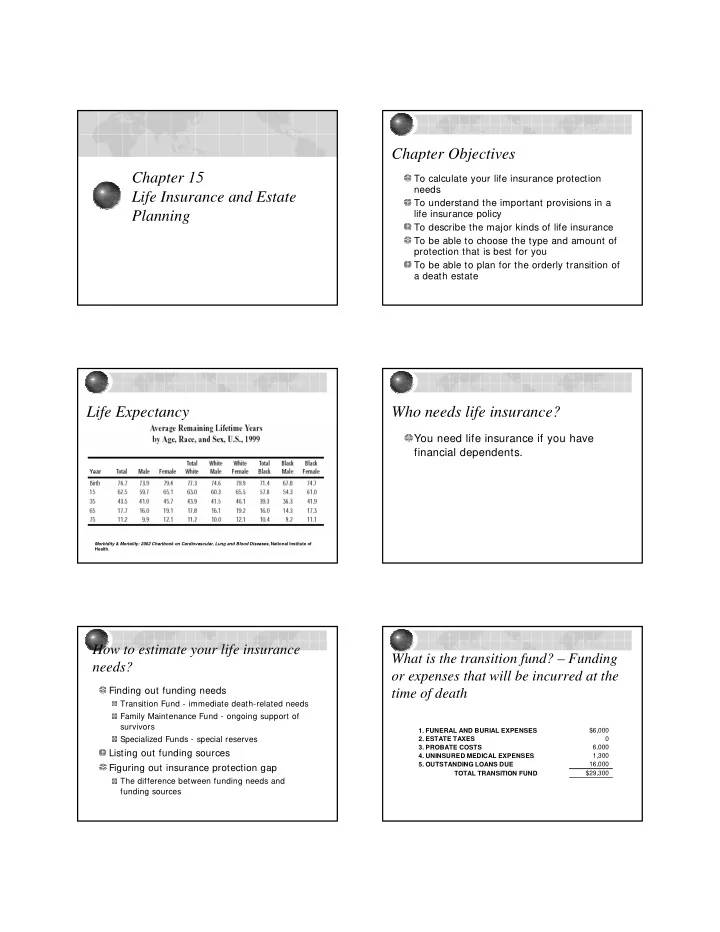

Chapter Objectives Chapter 15 To calculate your life insurance protection needs Life Insurance and Estate To understand the important provisions in a Planning life insurance policy To describe the major kinds of life insurance To be able to choose the type and amount of protection that is best for you To be able to plan for the orderly transition of a death estate Life Expectancy Who needs life insurance? You need life insurance if you have financial dependents. Morbidity & Mortality: 2002 Chartbook on Cardiovascular, Lung and Blood Diseases , National Institute of Health. How to estimate your life insurance What is the transition fund? – Funding needs? or expenses that will be incurred at the Finding out funding needs time of death Transition Fund - immediate death-related needs Family Maintenance Fund - ongoing support of survivors 1. FUNERAL AND BURIAL EXPENSES $6,000 Specialized Funds - special reserves 2. ESTATE TAXES 0 6,000 3. PROBATE COSTS Listing out funding sources 1,300 4. UNINSURED MEDICAL EXPENSES 5. OUTSTANDING LOANS DUE 16,000 Figuring out insurance protection gap $29,300 TOTAL TRANSITION FUND The difference between funding needs and funding sources

What are the specialized funds? – What is the family maintenance For emergency, education of fund? – Funding for the ongoing children, and retirement of spouse support of dependent family $12,000 1. EMERGENCY FUND 2. EDUCATIONAL FUND MONTHLY SURVIVORS' EXPENSES $4,000 $670 COST PER CHILD $44,000 MONTHLY SURVIVORS' TAKE-HOME PAY MONTHLY SURVIVORS' BENEFITS $1,980 NUMBER OF CHILDREN 3 TOTAL CONTRIBUTION BY SURVIVORS ($2,650) $132,000 MONTLY MAINTENANCE REQUIREMENT $1,350 3. RETIREMENT FUND $16,200 ANNUAL MAINTENANCE REQUIREMENT ANNUAL REQUIREMENT $5,000 Multiply by Annuity Factor RETIREMENT YEARS 20 Term of Fund (years) 10 $100,000 2% Annual real return 4. OTHER FUNDS* $0 Annuity Factor 9.1622 TOTAL SPECIALIZED FUNDS $244,000 $148,428 FAMILY MAINTENANCE FUND What are the total funding needs? What are the total funding sources? FUNDING NEEDS FUNDING SOURCES FINANCIAL INVESTMENTS $56,000 TRANSITION FUND $29,300 $10,000 TANGIBLE GOODS MAINTENANCE FUND $148,428 LIFE INSURANCE $244,000 SPECIALIZED FUNDS GROUP $50,000 TOTAL NEEDS $421,728 INDIVIDUAL 0 SOCIAL SECURITY 255 TOTAL SOURCES (116,255) What is the insurance protection gap? Some useful Website for calculating – This is the amount of life insurance life insurance needs you need to buy Forbes at http://www.forbes.com/tools/calculator/life_ins urance.jhtml TOTAL NEEDS $421,728 Yahoo Insurance at FUNDING SOURCES (116,255) http://insurance.yahoo.com/l1.html $305,473 UNFUNDED NEEDS 0 UNFUNDED ESTATE LIQUIDITY Life-line.org at http://www.life-line.org/ ***THE LIFE INSURANCE PROTECTION GAP*** $305,473 Insweb at http://www.insweb.com/ Smartmoney.com at http://www.smartmoney.com/insurance/life/in dex.cfm?story= intro

The special language of life What are participating vs. insurance policy - The basic policy nonparticipating insurance? Face Amount Nonparticipating insurance typically stock insurance companies dollar amount of life insurance protection premiums not dependent upon the future earnings stated on the face of the policy and mortality experience of the company Premium Participating insurance periodic payment on policy typically mutual insurance companies may return part of the premium as a dividend if company has favorable earning What are cash value and surrender What is “lives covered”? value? Single life policy Cash value taken out on the life of one person equal to the savings accumulated during the existence of the policy Joint life policy insured can typically borrow against cash value covers more than one person, pays out at the Surrender value death of the first amount returned to the policy holder at Survivorship joint life termination pays out at the death of the last individual cash value plus surrender dividends less Family policy outstanding loans and surrender charges coverage for several family members in one policy What are “riders”? Who is the “beneficiary”? Specialized provision meant to modify or extend Beneficiary coverage. Examples (Textbook page 390): accelerated death benefits person or entity that receives proceeds accidental death benefits Co-beneficiaries disability waiver premium nonforfeiture persons or entities that receive proceeds incontestability clause guaranteed insurability Contingent beneficiary convertibility also called secondary beneficiary renewability cost of living adjustment receives proceeds if primary beneficiary settlement options dies before you do grace period

What are the different types of life What are the types of term insurance? insurance policies? I ncreasing-Premium Term Level death benefit with increasing premiums in order to offset age- Term Insurance related risks Renewable term may be extended over some predefined period no cash value buildup; provides only death without proof of insurability protection Level-Premium Term Holds premium constant over a set number of years such as 5, 10, Cash Value Insurance 15, or 20. provides both death protection and cash may be renewed at a higher premium Decreasing Term value buildup premium remains constant functions as both death protection and a increased risk of mortality offset by declining death protection Group Mortgage Life savings vehicle a type of decreasing term insurance meant to payoff the balance on a mortgage What is whole life (straight or What are the types of cash value ordinary life)? insurance policies? Whole life Premiums: level over time Limited payment life Face value = cash value + death protection Modified whole life Over time, cash value increases, death Adjustable life protection decreases, but face value Universal life stays the same. Variable life Variable-universal life What is modified whole life? What is limited payment life? Premiums: level up to certain age, Premiums: level, lower than whole life usually 65, then cease automatically reduces the death benefit Higher premiums in early years than as the insured ages as an attempt to straight life before premiums cease meet the needs of the family throughout the life cycle Interest earned on cash value offsets premiums in later years

What is adjustable life? What is universal life? Flexible premium payments that affect the Both premium payments and face size of the cash value build up amount are adjustable within limits Premium is a contribution that is voluntary Typically contains a guaranteed within certain limits insurability rider for increasing face Contribution is split between charge for term amount insurance and an interest earning account Periodic reports on term protection, management expenses, and interest earned on cash value What is variable life? What is variable-universal life? Similar to universal life but with fixed Combines the flexible premiums of annual premiums universal life with the investment selection of variable life. The insurer chooses an investment portfolio offered by the insurance company thus there is speculative risk What are the tax advantage of cash value insurance? How to select the right type of policy? Interest earned on cash value avoids Term insurance provides the greatest face immediate taxation amount of death protection at the lowest premium Taxes must be paid when interest is Compare cash value insurance with other paid out or policy is surrendered investments Pay out may be avoided by a policy Consider a term plus savings plan loan Review the tax advantage of cash value Beneficiaries receive a tax-free payout insurance (see next slide) at death of insured Comparison shop

Recommend

More recommend