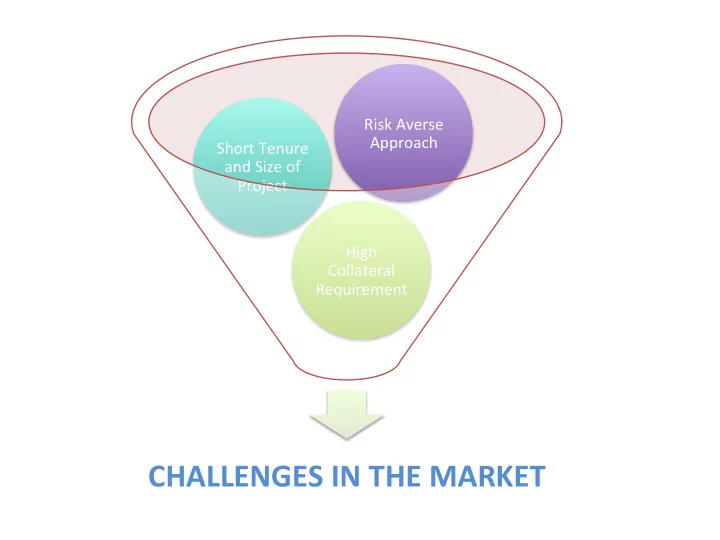

Risk%Averse% Approach% Short%Tenure% and%Size%of% Project% High% Collateral% Requirement% CHALLENGES)IN)THE)MARKET)

What%Are%the%Op+ons?% COMMERCIAL(FINANCING( • Mainly(Corporate(Financing( • Handful(of(project(financing(with(high(collateral( requirement( PUBLIC/PRIVATE(FINANCING( • LPEI/(EXIM(BANK( • PT(SMI( • PIP( InternaNonal(Development(Funding( • Loan/Equity(or(Mezannine(

The objective of Energy Efficiency Project Finance Program (“ EEPFP ”) is to reduce existing barriers for energy-consuming export-import industrial facility owners in Indonesia (“ Hosts ”) to obtain local debt financing for properly implemented EEPs on commercially attractive terms.

EEPFP is a Joint program by Indonesian Exim Bank and Asian Development Bank to offer a below-market rate loan that has Limited Collateral specific features: Requirements 1. Require limited collateral : Energy saving as primary collateral Free Technical Assistance (Project Concept & 2. Free Technical Assistance: Offers Investment Grade Audit) free technical assistance in a form of project concept and Investment Grade Audit Positive Cash Flow 3. Positive Cash Flow : Ensures the project saving to be able to pay for the loan installment and to have POSITIVE Cash Flow for the company EEPFP Aims to encourage PILOT PROJECT of Energy Efficiency Loan with financial structure that is more attractive to companies compare to conventional loans

PUSAT INVESTASI PEMERINTAH supports green financing

CLEAN ENERGY FOCUS Waste Management Water (REDD+) & Degradation Plus From Deforestation Reduction Emission Bioethanol Biomass Management Transport PUSAT INVESTASI PEMERINTAH Green Energy Renewable Sektor prioritas menurut KMK 177, antara lain meliputi: and development of public-private partnership change through expansion and acceleration of government investment Purpose: to suppor green development especially in managing climate as mandated by KMK Nomor 177/KMK.01/2010 PIP is commited to do investment on Green Projects Partners: Regional Government, State Owned Enterprises and Private sector

INVESTMENT FOCUS CLEAN ENERGY Street Lighting Upgrade Waste to Energy Building Retrofit Mini Hydro Energy Efficiency Renewable Energy Geothermal Others: Biomass, Biogas, Solar

FEATURES Interest Loan other banks) be 80% (above Proportion can Loan Mechanism Collaborative Tenure Loan Rate collaborative PIP FINANCING is Assistance that and Technical Cooperation repayment early penalty for and no Longer tenure market Below the Proportion

Recommend

More recommend