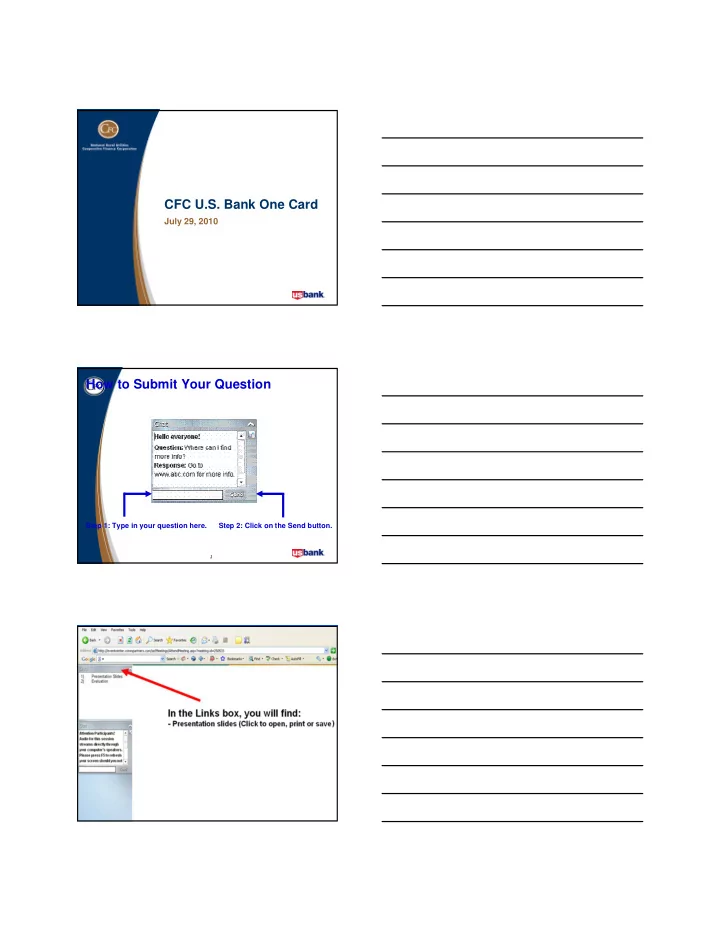

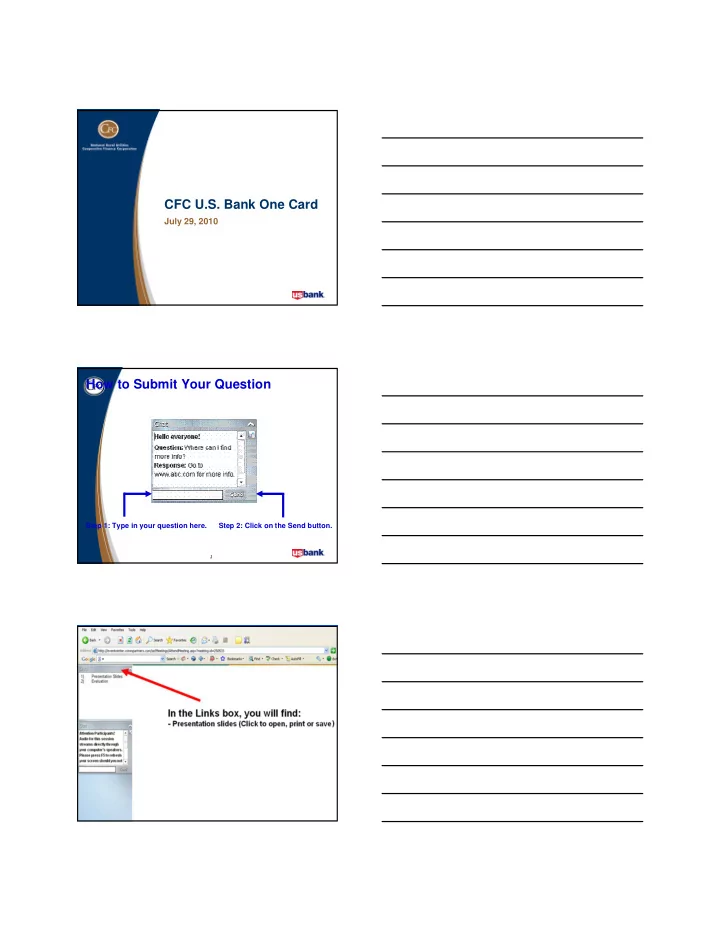

CFC U.S. Bank One Card July 29, 2010 How to Submit Your Question Step 1: Type in your question here. Step 2: Click on the Send button. 2 3

CFC U.S. Bank One Card July 29, 2010 Polling Question • Of the following five comic strips, which one has been continuously published for the longest time? a) Hazel b) Blondie c) Dennis the Menace d) Beetle Bailey e) The Lockhorns 5 CFC U.S. Bank One Card July 29, 2010

Background • Original card programs began in 2001 • Consolidated products into One Card program in August 2006 • Program currently has 158 participants and generated about $16 million in aggregated spending last year 7 U.S. Bank – A Strategic Resource • $281 billion in assets • 6 th -largest commercial bank in the United States • Unparalleled industry experience • Solutions for the entire payment continuum • Program design/implementation expertise • Unsurpassed resource commitments • World-class, U.S.-based customer service 8 U.S. Bank Strategic Benefits • A strong commitment to the payments business • More industry experience than all other banks combined • Ubiquitous merchant acceptance • Competitive commercial card advantages for CFC members • Long-term relationship with a strong and stable commercial bank 9

Does My Co-op Need a Commercial Card? Commercial Card Opportunity 2008 Commercial Consumption Expenditures (CCE) 100% = $19.7T Commercial Cards 3.1% Cash, Checks and ACH 96.9% 11 Purchasing Landscape • Annual purchasing card spending in North America grew from $110 billion in 2005 to $137 billion in 2007 • Purchasing card spending in North America is expected to increase to $218 billion by 2012— that’s about 12-percent growth each year 12

Purchasing Landscape 13 Bottom-Line Results • Average net savings of $69+ per transaction • Average procurement cycle time reduction of 6.3 days • Average reduction in supplier base of 31% • 38% increase in ability to negotiate preferred pricing • Happier and more productive employees 14 Real-World Successes* Procure-to-pay and commercial card programs build the bottom line. – One electric utility expanded its card program from emergency purchases only to all its routine purchasing, reducing manual AP check payments by more than 65%. – A leading provider of technology and business solutions plans to move more than $8 million of company spend from paper checks to its commercial card program. – A construction company saved more than $100,000 and grew its commercial card program from $1 million to $6 million by eliminating local “house” charge accounts. *2008 Visa Global Procure-to-Pay and Commercial Best Practices Study, Deloitte Consulting 15

The Program What is a One Card? Meets the needs of every co-op’s spending activity—combining the benefits of corporate and purchasing cards in a single card program Corporate Travel Purchasing Card One Card Card Designed to pay for travel and Designed to pay for small dollar, Designed to manage both T&E entertainment (T&E) expenses frequently purchased items and procurement expenses � � � Airfare � Office equipment and supplies � Office equipment and supplies � Hotel � Maintenance, repair and � T&E � Car rental � Maintenance, repair and operations � Meals � Budgetary spend operations � Entertainment � Computer hardware, software � Budgetary spend � Meeting and event planning � Meeting and event planning and peripherals � Employee relocation � Printing and duplicating services � Miscellaneous services � Employee relocation � Professional, temporary and janitorial services 17 Program Benefits • No annual fees or interest • No credit check on cardholders • No individual liability • Flexible online reporting and administration capabilities • Exciting rebate opportunity 18

Program Benefits • Simplify and streamline operations • Save time, money and resources • Stay in control and in compliance • Tailor the card program to your specific needs • Provide a convenient payment tool to employees • Make better-informed business decisions 19 Types of One Card Accounts • Individual Cardholder Accounts – A card assigned to an individual employee that has the employee’s name on the card • Department Cardholder Accounts – A card that is commonly used by a department or for a specific type of purchase • Ghost Accounts – A virtual, card-free purchasing account tied to a single department, supplier or spend category 20 One Card for Purchasing • Reduces volume of purchase orders, invoices and check payments • Improves purchasing management and provides reporting for IRS and state regulators • Enables monitoring of corporate policy compliance • Improves employee spending controls • Reduces supplier base by an average of 48% • Facilitates vendor negotiations 21

One Card for T&E • Customized authorization controls • Online account access • Cash advance option • Ability to interface with your accounting software • Comprehensive travel benefits – Worldwide automatic travel accident insurance: $250,000 – Excess lost/damaged luggage coverage: $1,250 22 Typical Co-op Cardholders • Human resources • Plant and maintenance employees • Technical and office staff • General administration • Purchasing department • Advertising/marketing staff • Sales force 23 Typical Co-op Expenditures • Oil and fuel • Computer and software purchases • Utilities payments • Office supplies • Continuing education expenses • Online purchases • Airfare and hotel expenses 24

Polling Question • In which decade did using commercial credit cards for fleet management take off? a) 1950’s b) 1960’s c) 1970’s d) 1980s e) 1990’s 25 One Card Rebate Opportunity Rebate Overview • Participating cooperatives have the opportunity to qualify for an annual cash rebate • The rebate period runs annually from September through August • Program attained a rebate for the 2009-2010 rebate year with $16 million in total spend and an average transaction size of $125. • On track to receive a rebate this year with $15.9 million total spend and $144 average transaction size (as of 6/10). 27

How the Rebate Works • Participating cooperatives must collectively generate at least $5 million in annual charge volume and have an average transaction size of at least $120 • The higher the collective charge volume, the higher the percentage of rebate • Once the collective program rebate is attained, cooperatives can earn a portion of that rebate if they meet the individual eligibility requirement 28 Individual Rebate Eligibility • The cooperative’s annual spend must be at least $175,000 • If the cooperative has an average transaction size of least $120, the rebate is even higher 29 Making One Card Work for You

Access Online Free Web-based access tool provides: – Convenient, secure online access to data— anytime, anywhere – Account setup and maintenance – Ability to adjust cardholder spending limits – Access to view cardholder statements online – Reports to better understand spending patterns, vendor usage and policy compliance – Automated posting capabilities to integrate card data with accounting and general ledger entries 31 AutoPay • Amount due is automatically drawn from specified account • Cycling date is the 16th of every month unless on a weekend or holiday • Cooperative chooses a draft date that is within 14 days of the 16th 32 Fleet Capabilities • Cards issued at a driver or vehicle level • Enhanced spending controls – Ability to limit spending to fuel and/or maintenance only – Prompts for driver ID and odometer reading – Velocity controls and hard limits • Accepted by Visa and MasterCard merchants worldwide • Enhanced fleet data capture ─ provided by most major oil companies 33

Merchant Category Codes • Provide a method of understanding and managing company spending by category code • Use merchant category codes (MCCs) to prevent employee misuse • Open and close MCC blocks for flexibility as necessary to your organization and supplier base • Automate annual IRS Form 1099-MISC reporting 34 Flexible Spending Management • Authorization parameters – Monthly spending limit – Daily spending limit – Single-purchase limit (SPL) • Supplier category restrictions – Travel, casinos, jewelry, liquor, etc. 35 Automated Accounting Methods • Default account code assigned to each card – Cost center, budget code, company code, etc. • General Ledger object codes assigned by type of purchase – Office supplies, computer equipment, hotels, hardware stores, etc. • Accounting codes can be changed/edited as needed • Transaction data can be exported for integration with accounting software 36

Recommend

More recommend