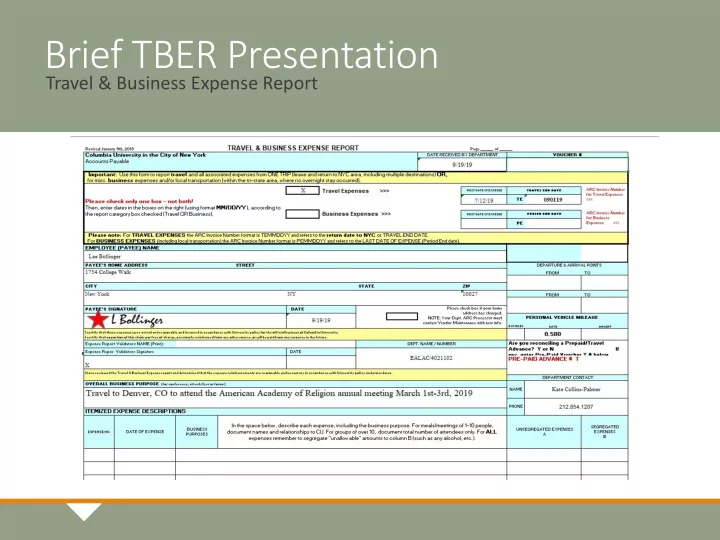

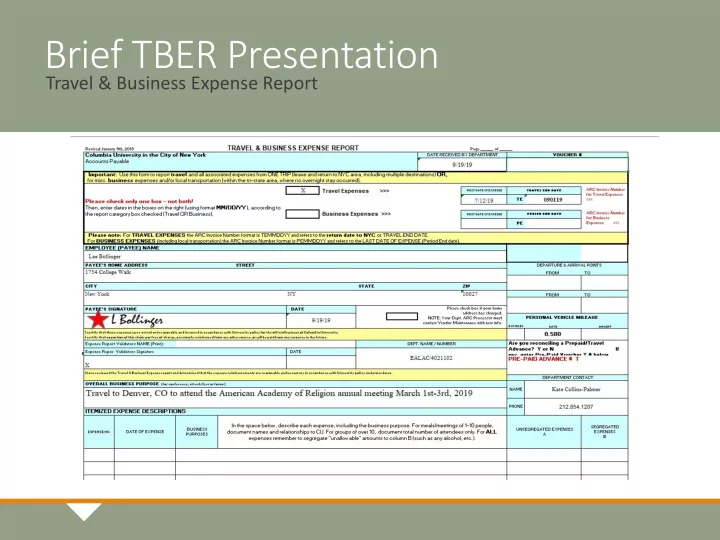

Brief TBER Presentation Travel & Business Expense Report

Training objective • Faster reimbursement to you! • Manage University risk

Payee signature

Incorrect address

Business Purpose - you know your purchases better than we do! • The Five Ws! • Who traveled or attended the event? • What was the event or activity/what was purchased? • When did the event take place? • Where did it take place? • Why is this Columbia business? Examples: • Travel • “Travel to Denver, CO to attend the American Academy of Religion • annual meeting Nov. 17-20 th , 2018” Business • “Lunch with Tony Lee, CU Business Officer, at Le Monde on 11/29/18 • to discuss department renovations”

Missing or insufficient business purpose

Missing or insufficient business purpose

Organize receipts Tape to the front of an • 8 ½ x 11 sheet of paper Label sequentially • Business purpose for • EACH receipt on the TBER

Proper Documentation Meals: Flights: Class Economy Total cost • • Date of expense Departure and arrival dates and • • Payment method/proof of payment cities • Itemized receipt When to get flight comparisons • • Number of attendees NEVER BOOK WITH POINTS • • If <10, names and affiliations • If >10, state number of attendees Hotels: • Meal limits (these are per person and Domestic = $350 limit • • exclude tips & tax) International = $400 limit • Breakfast = $25 • Lunch = $35 • Dinner = $75 •

Meal attendees

Itemized receipt & proof of purchase

Unsegregated vs. Segregated Certain expenses need to be segregated to a different natural accounts Segregated expenses Alcohol • Flowers • Gifts • Meals exceeding threshold • Business class flight tickets •

Exceeded meal thresholds & conference flyer

Business class flight

Flight comparison Economy class Business class If you have supplemental approval to book business class or want to pay the business class difference yourself, you MUST get a price comparison

Specific Problem Areas Request for reimbursement MUST be submitted within 120 days (approx. 4 • months) of expenditure date otherwise your reimbursement will be taxed by the IRS Supplies or books that cost more than $500 require special permission BEFORE • you purchase Submit flyers from conference/lecture/event to which the expenditures pertain • We cannot reimburse for gas • reimburse per mile • If you ever need to rent a car, please contact the department first •

Specific Problem Areas Honorarium • Do not pay out of pocket • Provide flyer from the lecture/conference • Check visa types • 30% withholding for non-residents • May only be paid to individuals outside of the university (non-affiliates) • Graphic/Website Design • Scope of Work • Purchase Order • Vendor Management •

Missing receipts

Missing receipts

Submitting Your TBER Please submit your receipts to the financial assistant in person (407 Kent Hall) or via email Kate Collins-Palmer krc2140@columbia.edu TBER will be reviewed and date stamped as received or returned to your mailbox with the “TBER Checklist” indicating what is missing Once fixed, we will recognize it as submitted You may submit a hard copy or electronic version of your report

TBER Checklist

Recommend

More recommend