Bank of Montreal Reports Record Quarter Results TORONTO, May 24, 2000 - PDF document

FOR IMMEDIATE RELEASE Bank of Montreal Reports Record Quarter Results TORONTO, May 24, 2000 Bank of Montreal reported record financial results today for the quarter ended April 30, 2000. Among the highlights: Net income was $497 million

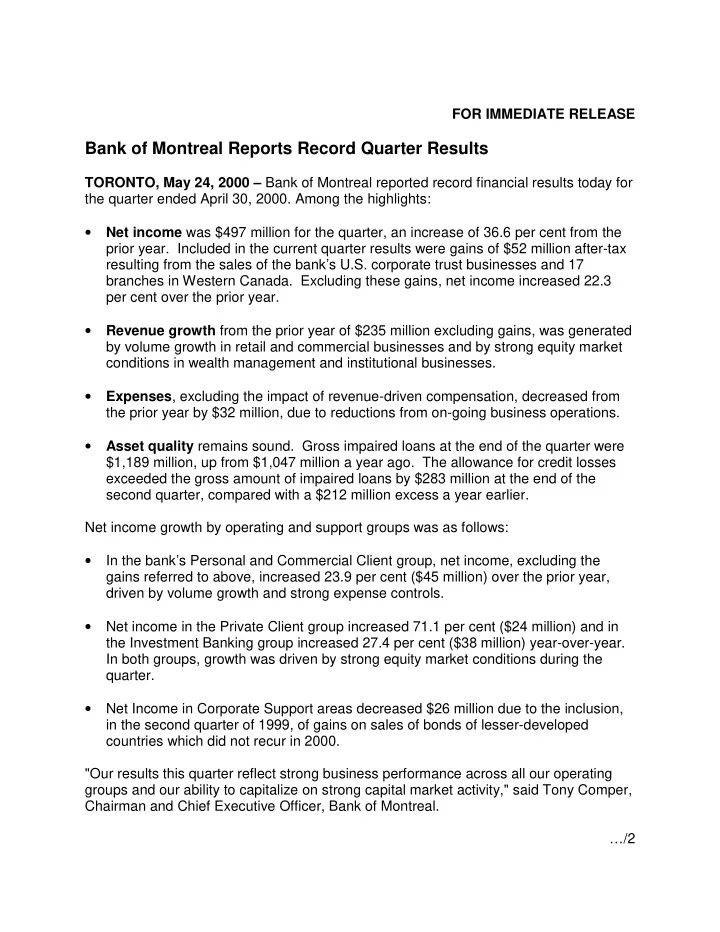

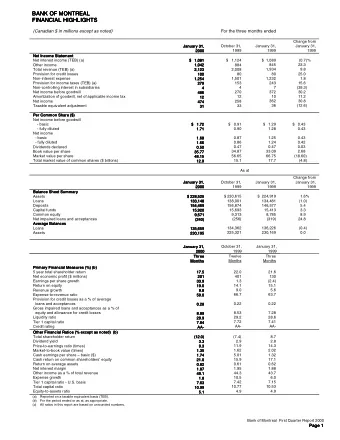

FOR IMMEDIATE RELEASE Bank of Montreal Reports Record Quarter Results TORONTO, May 24, 2000 – Bank of Montreal reported record financial results today for the quarter ended April 30, 2000. Among the highlights: • Net income was $497 million for the quarter, an increase of 36.6 per cent from the prior year. Included in the current quarter results were gains of $52 million after-tax resulting from the sales of the bank’s U.S. corporate trust businesses and 17 branches in Western Canada. Excluding these gains, net income increased 22.3 per cent over the prior year. • Revenue growth from the prior year of $235 million excluding gains, was generated by volume growth in retail and commercial businesses and by strong equity market conditions in wealth management and institutional businesses. • Expenses , excluding the impact of revenue-driven compensation, decreased from the prior year by $32 million, due to reductions from on-going business operations. • Asset quality remains sound. Gross impaired loans at the end of the quarter were $1,189 million, up from $1,047 million a year ago. The allowance for credit losses exceeded the gross amount of impaired loans by $283 million at the end of the second quarter, compared with a $212 million excess a year earlier. Net income growth by operating and support groups was as follows: • In the bank’s Personal and Commercial Client group, net income, excluding the gains referred to above, increased 23.9 per cent ($45 million) over the prior year, driven by volume growth and strong expense controls. • Net income in the Private Client group increased 71.1 per cent ($24 million) and in the Investment Banking group increased 27.4 per cent ($38 million) year-over-year. In both groups, growth was driven by strong equity market conditions during the quarter. • Net Income in Corporate Support areas decreased $26 million due to the inclusion, in the second quarter of 1999, of gains on sales of bonds of lesser-developed countries which did not recur in 2000. "Our results this quarter reflect strong business performance across all our operating groups and our ability to capitalize on strong capital market activity," said Tony Comper, Chairman and Chief Executive Officer, Bank of Montreal. …/2

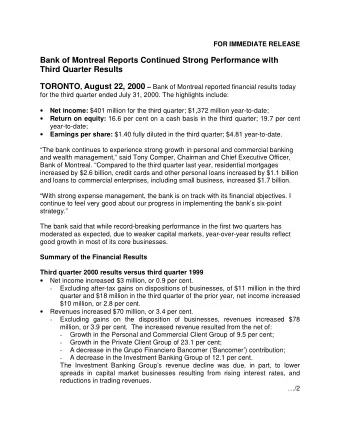

-2- "The achievement of these outstanding results reflects the bank's business focus, our ongoing objective of getting it right with our customers and the accomplishments of our employees." Quarterly Highlights Q2 2000 Q2 2000 Q2 2000 YTD B/(W) B/(W) B/(W) Q2 1999 Q1 2000 1999 Q2 Q2 2000 2000 $ % $ % YTD $ % Reported Net income ($ millions) $497 133 36.6 23 4.9 $971 245 33.7 Fully diluted EPS $1.75 0.50 40.0 0.09 5.4 $3.41 0.92 36.9 Basic EPS $1.76 0.50 39.7 0.08 4.8 $3.44 0.93 37.1 Return on equity (%) 19.8 - 4.3 - 0.8 19.4 - 4.1 Return on equity - cash basis (%) 21.8 - 4.4 - 0.8 21.4 - 4.2 Reported results – excluding gains * Net income ($ millions) $445 81 22.3 38 9.4 $852 126 17.3 Fully diluted EPS $1.56 0.31 24.8 0.14 9.9 $2.98 0.49 19.7 Basic EPS $1.57 0.31 24.6 0.14 9.8 $3.00 0.49 19.5 Return on equity (%) 17.6 - 2.1 - 1.4 16.9 - 1.6 Return on equity - cash basis (%) 19.5 - 2.1 - 1.6 18.7 - 1.5 * after-tax gains include $44 million from the sale of the bank’s U.S. corporate trust businesses and $8 million from the sale of branches in Western Canada in the second quarter of 2000 and $67 million from the sale of Partners First in the first quarter of 2000. Second Quarter 2000 Compared with Second Quarter 1999 Net income for the second quarter was $497 million, an increase of $133 million over the prior year. Net income for the quarter included after-tax gains of $44 million from the sale of U.S. corporate trust businesses and $8 million from the completion of certain of the previously announced sales of branches in Alberta, Saskatchewan and Manitoba. Excluding the gains, net income increased $81 million, or 22.3 per cent. High activity levels in equity markets resulted in strong growth in securities commissions and fees, underwriting fees and trading income in wealth management and institutional businesses. In addition, an increase in loan and term deposit volumes drove increased revenue in retail and wealth management businesses. These increases were partially offset by higher revenue-driven compensation expenses, a higher provision for credit losses, a lower contribution from the bank’s investment in Grupo Financiero Bancomer and the impact of a reduction in net interest margin in Canada. …/3

-3- Second Quarter 2000 Compared with First Quarter 2000 Net income for the second quarter reflected an increase of $23 million over the first quarter. The first quarter of 2000 included a $67 million after-tax gain from the sale of the bank’s investment in Partners First, a U.S. credit card issuing business. Excluding the gains on sales in both quarters, the net income increase was $38 million, or 9.4 per cent. Net income growth was driven by increased revenues in wealth management and institutional businesses for the same reasons as noted above. Revenue growth was partly offset by an increase in revenue-driven compensation expenses and higher income taxes, due to a higher proportion of Canadian income. 2000 Year-to-date Compared with 1999 Year-to-date Year-to-date net income was $971 million, an increase of $245 million. Excluding the gains on sales included in the current year-to-date results, the net income increase was $126 million, or 17.3 per cent and was driven by revenue growth of $312 million, partly offset by expense growth of $99 million and a $40 million increase in the provision for credit losses. Earnings in Canada were $276 million, or 55.4 per cent of the bank’s earnings in the quarter. Earnings from outside of Canada were $221 million, or 44.6 per cent of total earnings, with $157 million (31.5 per cent) in the U.S., $24 million (5.0 per cent) in Mexico, and $40 million (8.1 per cent) in other countries. During the first half of the year, equity markets were particularly strong and contributed to the overall increase in net income. Equity market volumes moderated somewhat in the latter part of the second quarter from the exceptional levels seen to that point. Strategic Highlights Bank of Montreal continued to make progress in implementing its six-point growth strategy: 1. Continue to aggressively build the value of Harris • On a U.S. GAAP basis, Harris Bank earnings were US $87 million, up US $32 million, or 59.9 per cent from the same quarter a year earlier. Excluding the gains on sales of the corporate trust businesses and securities gains, earnings increased 16.0 per cent. 2. Rapidly grow the wealth management business • Private Client Group net income increased by 71.1 per cent and revenues by 42.4 per cent over the prior year. • Assets under management and administration and term deposits increased $28.2 billion, or 14.6 per cent over the prior year. …/4

Recommend

More recommend

Explore More Topics

Stay informed with curated content and fresh updates.

![EXTRACTIVE INDUSTRIES TRANSPARENCY INITIATIVE Using the EITI Standard for Reform [Date]](https://c.sambuz.com/887931/extractive-industries-s.webp)