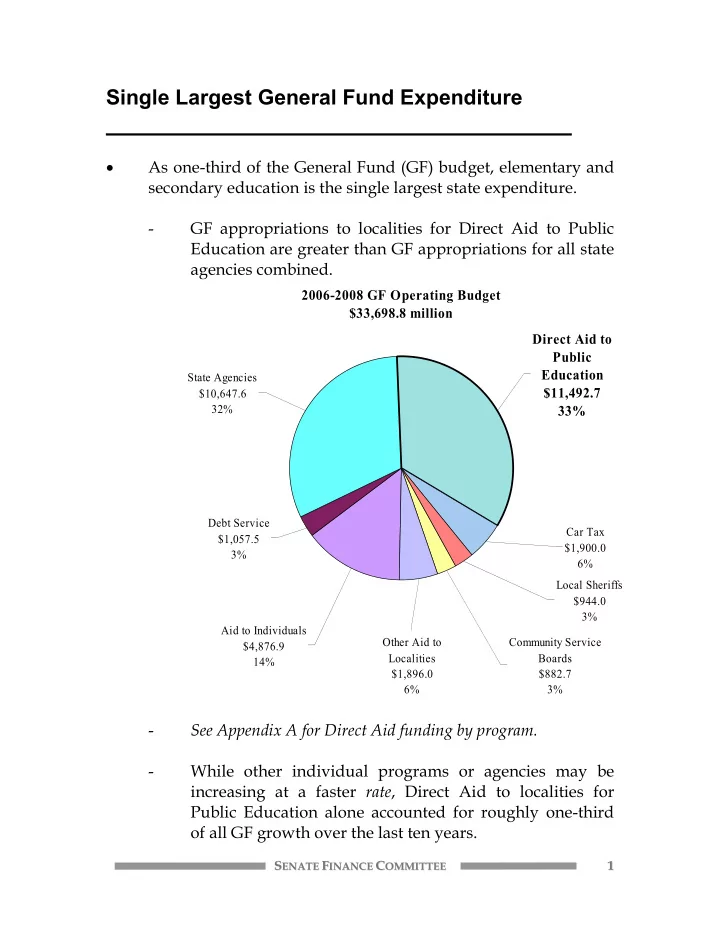

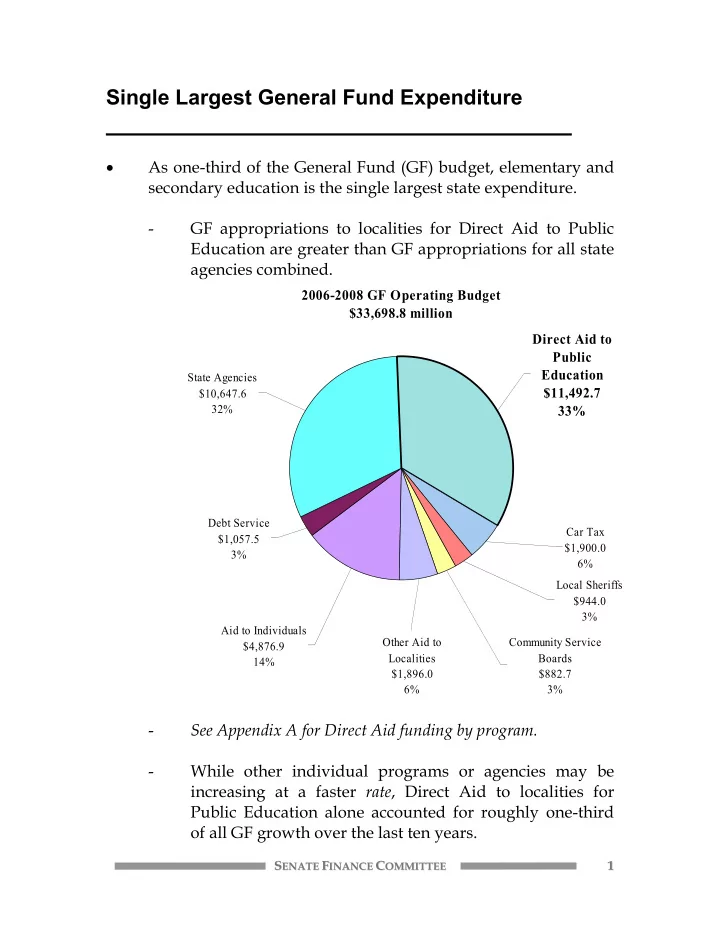

Single Largest General Fund Expenditure • As one-third of the General Fund (GF) budget, elementary and secondary education is the single largest state expenditure. - GF appropriations to localities for Direct Aid to Public Education are greater than GF appropriations for all state agencies combined. 2006-2008 GF Operating Budget $33,698.8 million Direct Aid to Public Education State Agencies $11,492.7 $10,647.6 32% 33% Debt Service Car Tax $1,057.5 $1,900.0 3% 6% Local Sheriffs $944.0 3% Aid to Individuals Other Aid to Community Service $4,876.9 Localities Boards 14% $1,896.0 $882.7 6% 3% - See Appendix A for Direct Aid funding by program. - While other individual programs or agencies may be increasing at a faster rate , Direct Aid to localities for Public Education alone accounted for roughly one-third of all GF growth over the last ten years. 1 S E S F F I C C O 1 E EN NA AT TE E IN NA AN NC CE E OM MM MI IT TT TE EE

Annual Spending in Virginia (All Sources) Will Top $11 Billion This Biennium • Total expenditures on operations for K-12 public education (excluding capital and pre-kindergarten) from state, local, and federal sources combined has increased from just under $6 billion in FY 1996 to $10.8 billion in FY 2005. - This is an increase of 80.8 percent, an average of 6.8 percent annually . Operating Expenditures on K-12 Public Education, All Sources FY1996 - FY2005 $10.8B 10.0 8.0 ($ in b illio n s) $6B 6.0 4.0 2.0 - 96 97 98 99 00 01 02 03 04 05 Fiscal Year State State Sales Tax Local Federal Source: “Table 15 of the Superintendent’s Annual Report for Virginia” - See Appendix B for the most recent “Table 15 of the Superintendent’s Annual Report for Virginia” (FY 2005) for operating expenditures, all sources, by school division. 2 S E S F F I C C O 2 E EN NA AT TE E IN NA AN NC CE E OM MM MI IT TT TE EE

Growth Has Occurred in All Fund Sources, Keeping the Relative Percentages Stable • Under the Constitution of Virginia, K-12 education is a shared responsibility of state and local governments. Federal funds make up a relatively small percentage of spending. - The relative percentage of spending from each source remained approximately the same between FY 1996 and FY 2005, indicating that the growth in state and local spending has been fairly even. Federal FY1996 = 6% State $6.0 billion 35% 44% Local 50% State Sales Tax 9% FY2005 = $10.8 billion Federal 7% State 34% 43% Local 50% State Sales Tax 9% 3 S E S F F I C C O 3 E EN NA AT TE E IN NA AN NC CE E OM MM MI IT TT TE EE

But doesn’t the State pay 55% of SOQ Costs? • Yes, but most localities spend beyond the SOQ’s local effort requirements. • Per the Constitution (See Appendix C.) , the key components of the SOQ funding framework are: 1) The Board of Education prescribes the SOQ (subject to revision only by the General Assembly), 2) The General Assembly decides what the SOQ costs are, and 3) The General Assembly decides how the costs will be shared between the state and localities. • The Task Force on Financing the SOQ (1972-73) concluded the following funding guidelines seemed to be implicit in the Constitution: 1) The SOQ must be realistic in relation to current educational practice, 2) The estimate of the cost must be realistic in relation to current costs for education, and 3) The local share must be based on local ability to pay. • So, in the Appropriation Act, through the composite index of local ability-to-pay formula, the state currently pays 55 percent , on average, of total SOQ costs. - However, since most localities spend beyond the state’s “required local effort” level, state funds (including sales tax) represent about 43 percent , on average, of all K-12 operating spending. 4 S E S F F I C C O 4 E EN NA AT TE E IN NA AN NC CE E OM MM MI IT TT TE EE

Factors Affecting the Growth in Education Spending Over the Last Ten Years � Increasing enrollment � Inflation Growth in teacher salaries, health insurance � costs, retirement system contribution rates � Reduced (improved) student-teacher ratios State school construction (1998) and lottery � funding (1999) Implementing the Federal No Child Left Behind � Act of 2001 2004 Session SOQ revisions, ¼ cent sales tax, and � at-risk four-year-olds preschool � Biennial re-benchmarking of the SOQ Other factors � 5 S E S F F I C C O 5 E EN NA AT TE E IN NA AN NC CE E OM MM MI IT TT TE EE

Enrollment Trends & Forecast: Statewide • Enrollment in Virginia has been steadily increasing since the late-1980s to the current level of about 1.2 million students statewide. - Between FY 1996 and FY 2005, the average annual increase in end-of-year Average Daily Membership (ADM) was about 12,000 students, or 1.1 percent. • However, the August 2006 forecast for FY 2007 through FY 2011 by the Weldon Cooper Center at UVA actually predicts a slowing of the growth compared with recent years. - Almost 30,000 additional students in the next five years (an average of almost 6,000 per year) represents an increase of about 0.5 percent per year. “straight line” Virginia Fall Membership: 1974-2010 forecast 1,250,000 Actuals 1,200,000 1,150,000 WCC Students Forecast 1,100,000 1,050,000 1,000,000 950,000 5 7 9 1 3 5 7 9 1 3 5 7 9 1 3 5 7 9 1 7 7 7 8 8 8 8 8 9 9 9 9 9 0 0 0 0 0 1 - - - - - - - - - - - - - - - - - - - 4 6 8 0 2 4 6 8 0 2 4 6 8 0 2 4 6 8 0 7 7 7 8 8 8 8 8 9 9 9 9 9 0 0 0 0 0 1 9 9 9 9 9 9 9 9 9 9 9 9 9 0 0 0 0 0 0 1 1 1 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 6 S E S F F I C C O 6 E EN NA AT TE E IN NA AN NC CE E OM MM MI IT TT TE EE

Enrollment Forecast: By Locality • Despite the predicted slowing of growth statewide, individually, school divisions are forecast to decrease by as much as 23 percent (Covington) and increase by as much as 46 percent (Loudoun). (See Appendix D for forecast by division.) School Divisions Forecast to Lose More Than 400 Students FY 2006 Decrease Percent Enrollment By FY 2011 Change Virginia Beach City 73,917 -4,517 -6.1 Norfolk City 34,023 -1,667 -4.9 Richmond City 23,472 -1,548 -6.6 Hampton City 22,700 -1,448 -6.4 Roanoke City 12,638 -964 -7.6 Newport News City 31,356 -914 -2.9 Henry 7,679 -786 -10.2 Fairfax 161,316 -781 -0.5 Arlington 17,653 -707 -4.0 Petersburg City 4,902 -667 -13.6 Portsmouth City 15,530 -531 -3.4 Danville City 6,951 -464 -6.7 Buchanan 3,500 -433 -12.4 Halifax 5,894 -426 -7.2 School Divisions Forecast to Gain More Than 1600 Students FY 2006 Decrease Percent Enrollment By FY 2011 Change Loudoun 46,658 21,350 45.8 Prince William 67,705 16,298 24.1 Spotsylvania 23,525 5,458 23.2 Stafford 25,927 5,288 20.4 Chesterfield 56,677 3,828 6.8 Henrico 47,045 3,256 6.9 Suffolk City 13,749 1,861 13.5 Williamsburg City 9,820 1,706 17.4 Frederick 12,211 1,621 13.3 7 S E S F F I C C O 7 E EN NA AT TE E IN NA AN NC CE E OM MM MI IT TT TE EE

Spending, Adjusted for Enrollment & Inflation • Adjusted for enrollment growth and inflation, operating spending from all sources increased by 31.8 percent, an average of 3.1 percent annually , between 1996 and 2005. - In other words, over half of that raw 80.8 percent increase (page 2) in spending is accounted for by enrollment and inflation. Operating Expenditures, K-12 Public Education, All Sources FY1997 - FY2005 In Constant FY 2005 Dollars 10,000 $9,202 9,000 31.8 % Dollars Per Pupil, in Constant FY2005 Dollars 8,000 $6,980 7,000 6,000 5,000 4,000 3,000 2,000 1,000 - 96 97 98 99 00 01 02 03 04 05 State State Sales Tax Local Federal Notes • This chart reflects the standard measure of inflation, the Consumer Price Index, which has increased by an average of 2.5 percent per year between FY 1996 and FY 2005. - The U.S. Bureau of Labor Statistics also calculates Employment Cost Indexes for public schools and public colleges. These measures averaged 3.1 percent per year over the same period. • For purposes of the SOQ, base year prevailing support costs are adjusted based on inflation factors that are specific to the cost category. (Base year prevailing salaries are adjusted for increases approved by the General Assembly the prior biennium.) 8 S E S F F I C C O 8 E EN NA AT TE E IN NA AN NC CE E OM MM MI IT TT TE EE

Recommend

More recommend