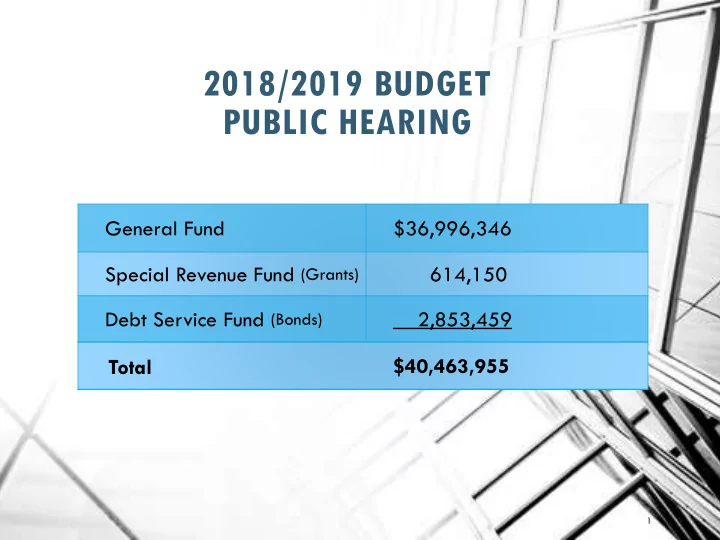

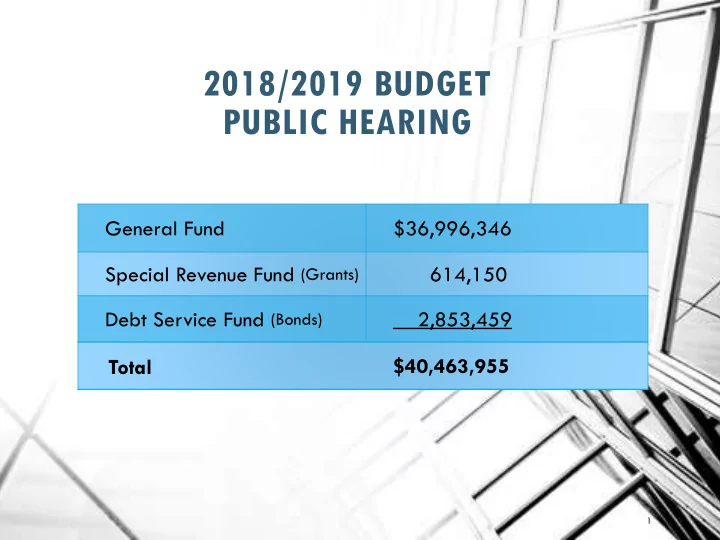

2018/2019 BUDGET PUBLIC HEARING General Fund $36,996,346 Special Revenue Fund (Grants) 614,150 Debt Service Fund (Bonds) 2,853,459 $40,463,955 Total 1

BUDGET GOALS 2

CLEARVIEW REGIONAL 2018-2019 GENERAL FUND REVENUE $36,996,346 State Aid 41% Tuition Federal 2% 0% Reserves 0% Miscellaneous Fund Balance 1% 4% Tax Levy 52% Fund Balance Tax Levy Miscellaneous State Aid Tuition Federal Reserves 3

2018/19 REVENUE COMPARISON 2017/2018 2018/2019 Fund Balance $ 1,284,416 $ 1,566,536 Reserves 1,381,771 98,218 Tax Levy 18,521,388 19,230,312 Miscellaneous 131,000 308,000 Tuition 502,000 530,000 Extraordinary Aid 220,000 220,000 Federal Aid 39,260 43,186 State Aid 15,000,094 15,000,094 * Total $37,079,929 $36,996,346 * Could be reduced 4

STUDENT ENROLLMENT 10/15/00 1,821.0 10/15/09 2,499.0 48 10/15/10 2,564.0 65 10/15/11 2,540.0 (24) 10/15/12 2,488.5 (51.5) 10/15/13 2,516.0 27.5 10/15/14 2,489.5 (26.5) 10/15/15 2,437.5 (52) 10/15/16 2,371.5 (66) 10/15/17 2,321.5 (50) 40.8% Increase in Enrollment 2000 2010 + 743 Decrease in Enrollment Since Oct. 2010 = (242.5) students 5

SCHOOL FUNDING REFORM ACT OF 2008 DOE ran formula using 2008/09 information Funding held harmless back to 2008/09 Clearview total increase in state aid $0 as of today News coverage indicates that the DOE could modernize the formula and cut State aid to overfunded districts in June The article said that Clearview is overfunded by $824,053 Clearview is still spending under the adequacy level as defined by SFRA in the amount of $1,257,328 for 18/19, meaning if funding was available Clearview would be able to spend substantially more Tax levy still capped at 2% increase 6

ALLOCATION OF GENERAL FUND APPROPRIATIONS 73% $26,869,510 Salaries & Benefits Special Education* 2,748,632 7% Buildings & Grounds* 1,369,750 4% Utilities 990,000 3% Transportation* 1,136,994 3% Capital Outlay 809,742 4% Other 3,071,718 10% $36,996,346 * Excludes Salaries & Benefits 7

LIMITED RESOURCES CAUSED $550,000 + IN CUTS BUDGET BALANCED BY REPRIORITIZATION OF EXPENSES Textbooks – Now includes several 2 or 3 year financing agreements Equipment – several items cut – budget includes musical instruments, scoreboard for lacrosse/field hockey, B&G equipment, 2 buses, fume hood for science lab Transportation – overall decrease to dept. budget of 7.3%; Paid off leases. Technology – Replacement devices, new firewall, lease of surveillance cameras, full-time Technology Director Facility Improvements – intercom upgrades HS & MS, flooring replacement in a few areas, renovate bathrooms HS 100 wing for handicap accessibility, replace cooling tower (with insurance refund) 8

CHANGES IN APPROPRIATIONS Health Insurance + $405,192 Replace Cooling Tower + $250,000 PERS Employer Share + $ 47,305 Equipment + $211,998 Supplies, Textbooks + $81,236 Other Fixed Costs – i.e. energy, architect

REPAIRS TO H.S. HVAC – 3 YEAR FOCUS Dehumidification Strategies & Capping Existing Roof Openings & Chilled Water Pipe Insulation Replacement 21 Classrooms – 400, 600, 100 this spring Restore the controls on outside air dampers in classrooms to assure they close when required Repair exhaust fans and insure they are responding to the controls system and operating when needed Remove gravity vents found to be opening directly from above ceiling spaces to the roof which are no longer needed Implement classroom ventilation upgrades – demand ventilation control via a CO2 sensor. Replace individual classroom temperature sensors with combination temperature & humidity sensors to address room temperature and humidity. Expand the new STEM Lab building control system to accommodate this work Longer term projects – replace equipment at end of life, add A.C. where needed & replace insulation 10

COST SAVINGS MEASURES Defer the purchase of certain equipment Defer certain facilities & maintenance projects Leasing vs. purchase when necessary Cuts across department lines to eliminate increases Competitively shopping for property & workers compensation insurance 11

SHARED SERVICES Transportation Services for Mantua & Harrison Elementary Schools Shared Bus Maintenance ACES for electricity and gas, Ed Data for purchase of supplies Middlesex ESC & Camden County ESC for bus purchasing, supplies and other capital projects GCSSSD for transportation, CST services, services to nonpublic schools Insurance purchasing consortium for workers compensation County Purchasing Cooperative for diesel/gas & asphalt 12

PROPOSED TAX RATE Harrison Municipal Share 51.66% +.56% Net Valuation $1,530,035,240 Ratables Increased $1,327,043 Rate per Hundred = .738 Proposed General & Debt Service Funds Increase = 3.24 cents $100,000 Home Regional School Taxes $32.44 increase per year 13

PROPOSED TAX RATE Mantua Municipal Share 48.33% (.56%) Net Valuation $1,334,185,026 Ratables Increased $4,689,519 Rate per Hundred = .792 Proposed General and Debt Service Funds Increase = 1.53 cents $100,000 Home Regional School Taxes $15.33 increase per year 14

Recommend

More recommend