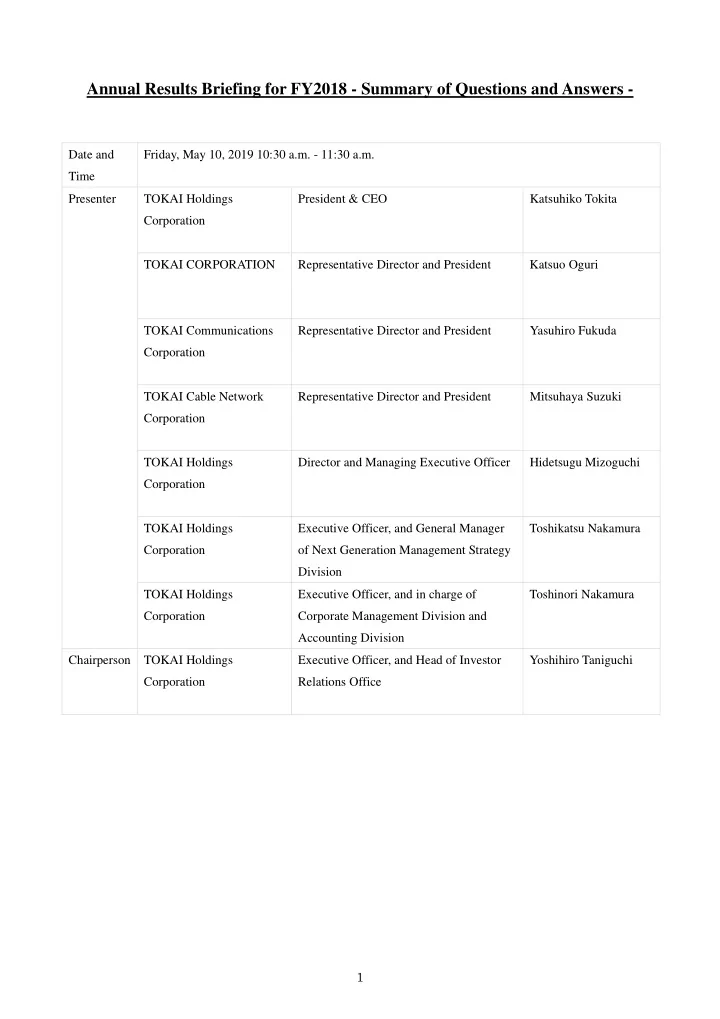

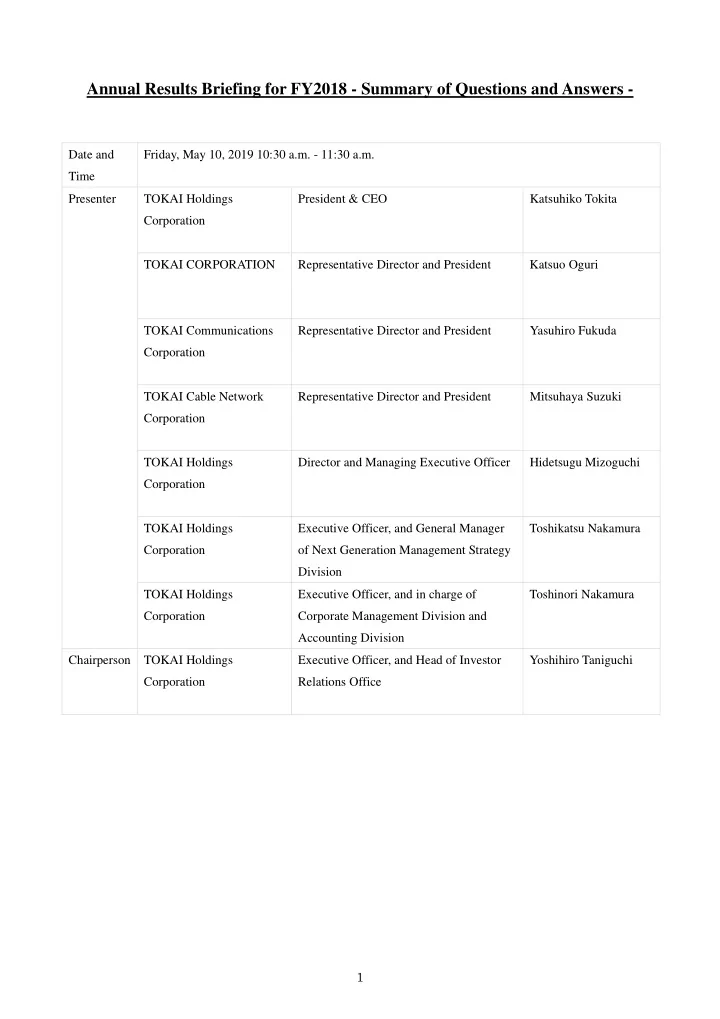

Annual Results Briefing for FY2018 - Summary of Questions and Answers - Date and Friday, May 10, 2019 10:30 a.m. - 11:30 a.m. Time Presenter TOKAI Holdings President & CEO Katsuhiko Tokita Corporation TOKAI CORPORATION Representative Director and President Katsuo Oguri TOKAI Communications Representative Director and President Yasuhiro Fukuda Corporation TOKAI Cable Network Representative Director and President Mitsuhaya Suzuki Corporation TOKAI Holdings Director and Managing Executive Officer Hidetsugu Mizoguchi Corporation TOKAI Holdings Executive Officer, and General Manager Toshikatsu Nakamura Corporation of Next Generation Management Strategy Division TOKAI Holdings Executive Officer, and in charge of Toshinori Nakamura Corporation Corporate Management Division and Accounting Division Chairperson TOKAI Holdings Executive Officer, and Head of Investor Yoshihiro Taniguchi Corporation Relations Office 1

Q. In regard to the relationship between the increase in number of customers and earnings in the LP gas business, many other companies in the same business point out that increase in number of customers does not easily link to earnings due to increasing additional expenses. In case of your company, however, increase in number of customers is linked effectively. Please explain the situation. A. Under the present situation, trade area acquisitions are conducted more than M&As in LP gas business. We are saving fixed costs and this is because we are controlling customer acquisition and maintenance costs. Furthermore, while an increase of 20,000 to 30,000 customers are expected through business alliance for the current fiscal year, since we will be succeeding customers of other companies, the number of customers can be increased without having to spend costs on acquisition and others. New business areas are also continuously expanded. Many LP gas operators are going out of business every year. Operators fell from a peak of 48,000 to the current level of less than 18,000. Since this trend is expected to accelerate in due course, we will increase the number of customers by acquiring or forming business alliance with such operators without cost. Q. Please explain your views on system reform (electricity deregulation, city gas deregulation). A. In regard to electricity deregulation, we have formed an alliance with Tokyo Electric Power Company (TEPCO) to mainly provide electricity and gas as a set. This product service is intended to be used as a means to retain our customers when solicited by rival companies. Customer acquisition in gas business requires specific know-how, but with our know-how developed in the past, acquisition will be possible. In regard to city gas deregulation, currently, there are approximately 200 operators nationwide including both public and private. There are many operators who have been protected under an authorized system developed before the deregulation, and public operators will be privatized in the future. The city gas business will now be starting in Gunma Prefecture and Akita Prefecture. In that sense, we intend to greatly make use of deregulation. Q. Please explain the achievements in the overseas business and its future potentials. A. Overseas business is currently being developed in China, Taiwan, and Myanmar. In China, a local company was established in 2012 and drinking water business is being developed. Stylish in-house water dispensers, which were developed in the following year, are now being manufactured and exported. Currently, business is expanding through manufacture and sales of advanced-function water dispensers with energy saving and automatic washing functions. Surplus was achieved in the FY2018 and further expansion is planned in the future. In Taiwan, we established a joint venture in 2013 with SYSCOM (SYSCOM Computer Engineering Co., Ltd.), Taiwan’s top IT company, and business was launched. Now, the business is developed mainly in SI and development related areas, and surplus has already been achieved. Efforts toward business expansion will continue to be made. 2

In Myanmar, a local company was established in 2014. Its business initially started from installation work of gas pipelines targeting corporates, facilities, and others. As orders increased in the following year, the company shifted to a joint venture with ITO (ITO Corporation) to strengthen its organizational structure. Orders of gas pipeline construction work including ones in plants advancing into industrial parks and in large scale commercial facilities have been received. Sales for FY2018 have been approximately five fold as compared to FY2016. Currently, Myanmar is showing remarkable economic development. Commercial and industrial demands are significantly growing and its future business is with expectation. Surplus is planned to be achieved in FY2019. We are further reviewing future possibilities of developing LP gas business in other countries following Myanmar. Incidentally, since Myanmar was subject to restriction on foreign investment, a local company was established initially as a gas pipeline construction company. With the recent deregulation of restriction on foreign investment, we will consider developing a full-scale gas business which originally had been our objective. Q. What are views toward the future Information and Communications business such as data center and corporate customer businesses? A. Currently, Ministry of Economy, Trade and Industry (METI) and Ministry of Internal Affairs and Communications (MIC) are collectively working on a digital-based corporate reform in a form of digital transformation (DX), and we, too, are making advancement in the digitalization accordingly. Smooth system development is expected at this point. On the other hand, the 2025 digital cliff and shortfall in human resources are raised by the public. We also recognize this as a business challenge. Corporate customer business, however, is favorable. This business recorded increase in income and profit year on year, and is planned to record a significant increase in income and profit under the end of the current fiscal year forecast. In addition, while digital transformation is promoted, improvements in legacy systems are worked on. Large growth in SI and entrusted development businesses is expected in the future. Q. FY2018 is exceeding IP20 when excluding the impact of procurement cost. FY2019 is almost the same as IP20 when excluding the impact of procurement cost. Why is FY2019 budget formed by leaving IP20 as it is? A. The FY2019 budget is compiled by taking into account a considerable amount of increase in profit due to the increase in number of customers. Meanwhile, system enhancement and infrastructure development are necessary to some extent when aiming to achieve the final year of IP20 “JUMP”. These costs have also been taken into account in the budget. 3

Q. Please explain the background to the exceedance of the medium-term management plan in the CATV business together with its future outlook. A. CATV business is progressing smoothly. Until several years ago, although a situation continued where there was a net decrease in the number of broadcasting customers, business has entered into a net increasing trend from FY2016. We are able to increase the number of customers, including communication customers, to more than 20,000 every year. We see this trend will likely be continued for the time being. Meanwhile, CATV business has a characteristic of a process industry in a sense. Since the business is developed by setting up various equipment including fiber-optic related investment, costs such as investment cost, deprecation cost, and leasing cost are reflected in profit. We have been winding coaxial cables for the past two years while smoothly proceeding with the fiber-optic related investment. Although this is carried out according to the plan responding to 4K/8K broadcasting, the public is not showing much excitement toward it. Consequently, the plan was reconsidered, and as a result, for the past two years, more is linked to profit. In the future, we will invest appropriately while looking at the social trend, and continue increasing the number of customers. M&A will also be further actively promoted with a hope to enhance growth of CATV business. Q. Please explain more in detail the present situation on how M&A has been reviewed, and based on such review, how M&A will be reviewed in the future. A. In the previous briefing, we explained 26 deals were under review. Now, there are 44. In the past six months, deals related to city gas and CATV have come up. TLC is our strength and since both city gas and CATV are community-based businesses, to promote TLC, these businesses are most appropriate. It takes approximately one and a half years to two years until M&A deals are closed from the time information is disclosed. At this moment, approximately 10 deals are simultaneously under review. We feel that it is a matter of how merits of a counterparty and ours can reach an agreement. Current situation is that various talks are being made. We view that they will be realized to some extent in the coming two years. City gas and CATV are process industries, and currently each operator is about to enter into a period of reinvestment. This situation is what existing operators are concerned with. We will review M&A by also taking this matter into account, and hope to attain results in the next two years. 4

Recommend

More recommend