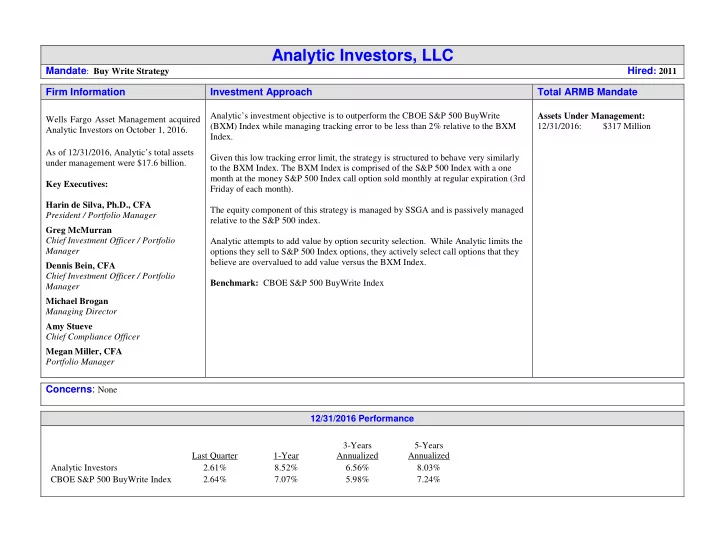

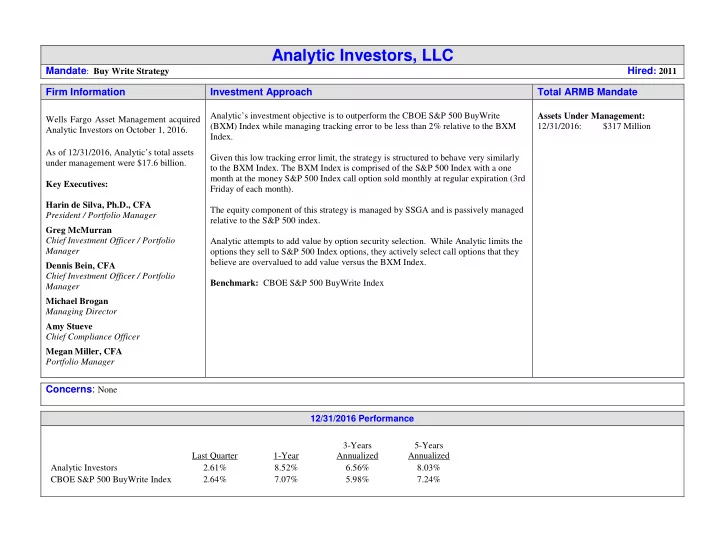

Analytic Investors, LLC Mandate : Buy Write Strategy Hired : 2011 Firm Information Investment Approach Total ARMB Mandate Analytic’s investment objective is to outperform the CBOE S&P 500 BuyWrite Assets Under Management: Wells Fargo Asset Management acquired (BXM) Index while managing tracking error to be less than 2% relative to the BXM 12/31/2016: $317 Million Analytic Investors on October 1, 2016. Index. As of 12/31/2016, Analytic’s total assets Given this low tracking error limit, the strategy is structured to behave very similarly under management were $17.6 billion. to the BXM Index. The BXM Index is comprised of the S&P 500 Index with a one month at the money S&P 500 Index call option sold monthly at regular expiration (3rd Key Executives: Friday of each month). Harin de Silva, Ph.D., CFA The equity component of this strategy is managed by SSGA and is passively managed President / Portfolio Manager relative to the S&P 500 index. Greg McMurran Chief Investment Officer / Portfolio Analytic attempts to add value by option security selection. While Analytic limits the Manager options they sell to S&P 500 Index options, they actively select call options that they believe are overvalued to add value versus the BXM Index. Dennis Bein, CFA Chief Investment Officer / Portfolio Benchmark: CBOE S&P 500 BuyWrite Index Manager Michael Brogan Managing Director Amy Stueve Chief Compliance Officer Megan Miller, CFA Portfolio Manager Concerns : None 12/31/2016 Performance 3-Years 5-Years Last Quarter 1-Year Annualized Annualized Analytic Investors 2.61% 8.52% 6.56% 8.03% CBOE S&P 500 BuyWrite Index 2.64% 7.07% 5.98% 7.24%

ALASKA RETIREMENT MANAGEMENT BOARD REVIEW March 2, 2017

Contents Analytic Buy-Write Strategy 1 Firm Update 2 Investment Objective and Results 3 Volatility Risk Premium and BXM Index 4 Appendix Analytic Attendees: Greg McMurran, Chief Investment Officer, Portfolio Manager Megan Miller, CFA, Portfolio Manager Kevin Clark, CFA, Director, Relationship Management 2 ANALYTIC INVESTORS DISCIPLINED | RESPONSIVE | RISK CONTROLLED ANALYTIC INVESTORS DISCIPLINED | RESPONSIVE | RISK CONTROLLED

Profile Quantitative Investment Manager Organization Clients Total Client Relationships: 81* Headquarters: Los Angeles 50% Financial Services Investment professionals: 19 20% Public 4 1 3 11 11% Corporations Client Service/Marketing: 11 20 10% Multiemployer 10 4% Insurance 50 4% Superannuation/Sovereign Wealth Fund Capabilities 1% Endowments/Foundations/ Charitable Benchmark Oriented (Beta 1) Asset Composition ─ Core Equity Total Assets:$17.6B USD* ─ Short Extension 1.7 Low Volatility Equity 5.0 $ 1.7 Benchmark Oriented Alternatives $ 10.9 Low Volatility Equity ─ Long/Short Equity 10.9 $ 5.0 Alternatives As of 12/31/2016 ─ Covered Call *Includes four clients and $1.52B of non-discretionary ─ Market Neutral Equity assets as of 11/30/2016, where Analytic does not have trading authority over the client portfolio. 3 ANALYTIC INVESTORS DISCIPLINED | RESPONSIVE | RISK CONTROLLED ANALYTIC INVESTORS DISCIPLINED | RESPONSIVE | RISK CONTROLLED

Investment Team PORTFOLIO MANAGERS Harindra de Silva, Ph.D., CFA – President / Portfolio Manager Dennis Bein, CFA – Chief Investment Officer / Portfolio Manager Joined firm in 1995; 31 years of investment experience Joined firm in 1995 Ph.D. in Finance, University of California, Irvine 26 years of investment experience MBA in Finance, University of Rochester MBA in Finance, University of California, Riverside MS in Econometrics, University of Rochester BS in Business Administration, University of California, Riverside BS in Mechanical Engineering, University of Manchester David Krider, CFA – Portfolio Manager Ryan Brown , CFA – Portfolio Manager Joined firm in 2005 Joined firm in 2007 14 years of investment experience 11 years of investment experience BA in Economics, California Institute of Technology MS in Finance, University of Utah BS in Computer Science, California Institute of Technology BS in Economics, Brigham Young University Greg McMurran – Chief Investment Officer / Portfolio Manager Megan Miller, CFA – Portfolio Manager Joined firm in 1976 Joined firm in 2008 40 years of investment experience 11 years of investment experience MA in Economics, California State University, Fullerton BS in Mathematics, University of California, Los Angeles BS in Economics, University of California, Irvine CHAIRMAN TRADING Roger Clarke, Ph.D. – Chairman Andrew Claeys, CFA – Director of Trading Joined firm in 1985 Joined firm in 2007 39 years of investment experience 12 years of investment experience Ph.D. in Finance, Stanford University BS in Business Administration, University of Denver MBA, Brigham Young University MS in Economics, Stanford University BA in Physics, Brigham Young University RESEARCH ADVISORS Doug Savarese, CFA – Research Advisor Stephen Thorley, Ph.D., CFA – Research Advisor Joined firm in 1998 Joined firm in 2000 29 years of investment experience 27 years of investment experience BA in Mathematics, The Richard Stockton College of New Jersey Ph.D. in Financial Economics, University of Washington BS in Business Administration, The Richard Stockton College of New MBA in Business, Brigham Young University Jersey B.S. in Mathematics, Brigham Young University As of 9/30/2016 4 ANALYTIC INVESTORS DISCIPLINED | RESPONSIVE | RISK CONTROLLED ANALYTIC INVESTORS DISCIPLINED | RESPONSIVE | RISK CONTROLLED

Account Summary Alaska Retirement Management Board Outperform BXM Index, over time, net of fees Manage Tracking Error to be less than 2% versus the BXM Index OBJECTIVES Long U.S. equity positions managed by SSgA (passive S&P 500 Index) Call options managed by Analytic Inception Date: March 9, 2011 December 31, 2016 Account Value: $316.6 Million RESULTS Annualized Since Inception Excess Return: 1.05% Since Inception Tracking Error: 1.50% 5 ANALYTIC INVESTORS DISCIPLINED | RESPONSIVE | RISK CONTROLLED ANALYTIC INVESTORS DISCIPLINED | RESPONSIVE | RISK CONTROLLED

Performance Alaska Retirement Management Board Performance March 9, 2011 (Inception) – December 31, 2016 15 ANNUALIZED RETURN (%) S&P 500 Index 10 ARMB BXM 5 0 0 5 10 15 20 Periods greater than one year are annualized. STANDARD DEVIATION (%) Performance is presented gross of fees and does not reflect the deduction of Volatility investment advisory fees. Standard Return (%) Reduction vs. Deviation (%) Client’s return will be S&P 500 reduced by the advisory fees (as described in Part II ARMB (Gross) 7.78 32.3% 7.88 of the adviser’s Form ADV) and any other expenses it may incur in the CBOE BuyWrite (BXM) Index 6.83 8.09 29.7% management of its investment advisory S&P 500 Index 11.89 11.51 accounts. Past performance does not guarantee future results. 6 ANALYTIC INVESTORS DISCIPLINED | RESPONSIVE | RISK CONTROLLED ANALYTIC INVESTORS DISCIPLINED | RESPONSIVE | RISK CONTROLLED

Source: Bloomberg ANALYTIC INVESTORS DISCIPLINED | RESPONSIVE | RISK CONTROLLED ANALYTIC INVESTORS DISCIPLINED | RESPONSIVE | RISK CONTROLLED Volatility IMPLIED VOLATILITY SPREAD Underpriced Overpriced VOLATILITY LEVEL (SPX) -50% -40% -30% -20% -10% 10% 20% 30% 40% 50% 60% 70% 80% 90% 10% 20% 30% 40% 0% 0% Jan-96 Jan-96 Jun-96 Jun-96 Nov-96 Nov-96 Apr-97 Apr-97 January 1996 – December 2016 The Market Tends to Consistently Overprice Volatility Sep-97 Sep-97 Implied minus Realized Volatility Spread Realized Volatility (25 Day) Implied Volatility (VIX) Feb-98 Feb-98 Jul-98 Jul-98 Dec-98 Dec-98 May-99 May-99 Oct-99 Oct-99 Mar-00 Mar-00 Aug-00 Aug-00 Jan-01 Jan-01 Jun-01 Jun-01 Nov-01 Nov-01 Apr-02 Apr-02 Sep-02 Sep-02 Feb-03 Feb-03 Jul-03 Jul-03 Dec-03 Dec-03 May-04 May-04 Oct-04 Oct-04 Mar-05 Mar-05 Aug-05 Aug-05 Jan-06 Jan-06 Jun-06 Jun-06 Nov-06 Nov-06 Apr-07 Apr-07 Sep-07 Sep-07 Feb-08 Feb-08 Jul-08 Jul-08 Dec-08 Dec-08 May-09 May-09 Oct-09 Oct-09 Mar-10 Mar-10 Aug-10 Aug-10 Jan-11 Jan-11 Jun-11 Jun-11 Nov-11 Nov-11 Apr-12 Apr-12 Sep-12 Sep-12 Average Spread: Feb-13 Feb-13 Jul-13 Jul-13 Dec-13 Dec-13 4.32 May-14 May-14 Oct-14 Oct-14 Mar-15 Mar-15 Aug-15 Aug-15 Jan-16 Jan-16 Jun-16 Jun-16 7 Nov-16 Nov-16

Analytic Our Edge Research focused on obtaining better exposure to the Volatility Risk Premium RESEARCH than present in BXM by adjusting option strikes and expirations Implementing a BXM replicating option portfolio has proved difficult for other managers IMPLEMENTATION Our investment and trading experience has resulted in a low tracking error high value added BXM replicating covered call portfolio We have consistently maintained a low tracking error option portfolio and a RISK MANAGEMENT hedging option portfolio relative to BXM 8 ANALYTIC INVESTORS DISCIPLINED | RESPONSIVE | RISK CONTROLLED ANALYTIC INVESTORS DISCIPLINED | RESPONSIVE | RISK CONTROLLED

Recommend

More recommend