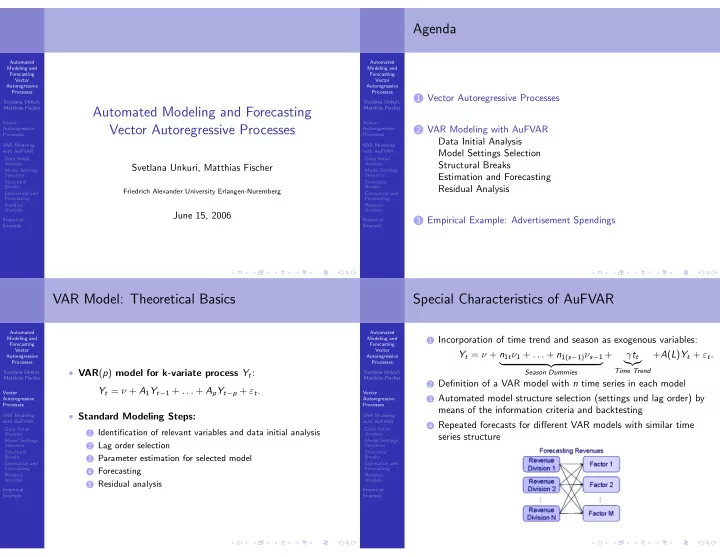

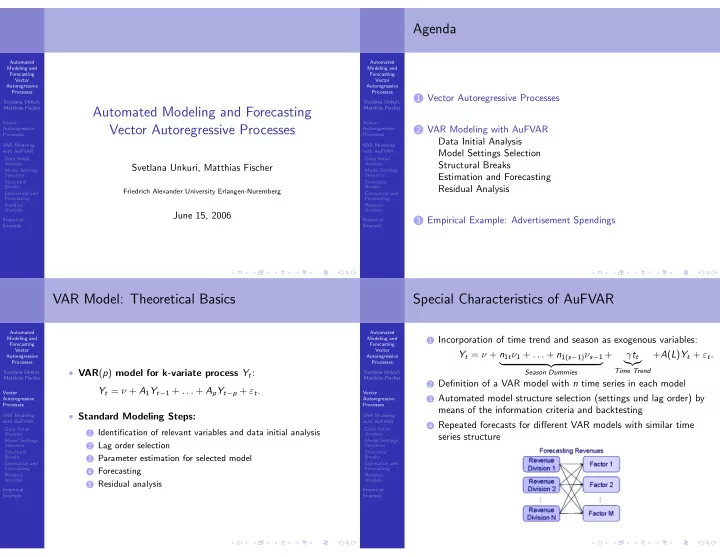

Agenda Automated Automated Modeling and Modeling and Forecasting Forecasting Vector Vector Autoregressive Autoregressive Processes Processes 1 Vector Autoregressive Processes Svetlana Unkuri, Svetlana Unkuri, Matthias Fischer Automated Modeling and Forecasting Matthias Fischer Vector Vector Vector Autoregressive Processes 2 VAR Modeling with AuFVAR Autoregressive Autoregressive Processes Processes Data Initial Analysis VAR Modeling VAR Modeling with AuFVAR with AuFVAR Model Settings Selection Data Initial Data Initial Structural Breaks Analysis Analysis Svetlana Unkuri, Matthias Fischer Model Settings Model Settings Estimation and Forecasting Selection Selection Structural Structural Residual Analysis Breaks Breaks Friedrich Alexander University Erlangen-Nuremberg Estimation and Estimation and Forecasting Forecasting Residual Residual Analysis Analysis June 15, 2006 3 Empirical Example: Advertisement Spendings Empirical Empirical Example Example VAR Model: Theoretical Basics Special Characteristics of AuFVAR Automated Automated 1 Incorporation of time trend and season as exogenous variables: Modeling and Modeling and Forecasting Forecasting Vector Vector Y t = ν + n 1 t ν 1 + . . . + n 1( s − 1) ν s − 1 + γ t t + A ( L ) Y t + ε t . Autoregressive Autoregressive ���� � �� � Processes Processes Time Trend • VAR ( p ) model for k-variate process Y t : Svetlana Unkuri, Svetlana Unkuri, Season Dummies Matthias Fischer Matthias Fischer 2 Definition of a VAR model with n time series in each model Y t = ν + A 1 Y t − 1 + . . . + A p Y t − p + ε t . Vector Vector 3 Automated model structure selection (settings und lag order) by Autoregressive Autoregressive Processes Processes means of the information criteria and backtesting • Standard Modeling Steps: VAR Modeling VAR Modeling with AuFVAR with AuFVAR 4 Repeated forecasts for different VAR models with similar time Data Initial Data Initial 1 Identification of relevant variables and data initial analysis Analysis Analysis series structure Model Settings Model Settings 2 Lag order selection Selection Selection Structural Structural 3 Parameter estimation for selected model Breaks Breaks Estimation and Estimation and Forecasting Forecasting 4 Forecasting Residual Residual Analysis Analysis 5 Residual analysis Empirical Empirical Example Example

Data Initial Analysis in AuFVAR Model Selection Automated Automated Modeling and Modeling and Forecasting Forecasting Vector Vector Autoregressive Autoregressive Processes Processes Svetlana Unkuri, Svetlana Unkuri, Matthias Fischer Matthias Fischer Vector Vector Autoregressive Autoregressive Processes Processes VAR Modeling VAR Modeling Definition the different VAR models (with/without trend/season, lag with AuFVAR with AuFVAR 1 Stationarity Test: ADF Test Data Initial Data Initial order variation) and selection the model with the least criterion value: Analysis Analysis • Function: adf . test (modified) Model Settings Model Settings Selection Selection 2 Granger Causality Test Structural Structural 1 Information Criteria, e.g. Breaks Breaks • Function: grangertest (standard) Estimation and Estimation and Σ ε ( p )) + 2 Forecasting Forecasting AIC ( p ) = ln det( � T pK 2 , Residual 3 Log Level Transformation Residual Analysis Analysis • Natural Logarithm of Time Series Empirical Empirical 2 Backtesting (out-of-sample): Example Example � � h � � � 1 ( y T + h − y t ( h )) 2 . RMSE = h i =1 Test for Structural Breaks Estimation and Forecasting Automated Automated Modeling and Modeling and Forecasting Forecasting Vector Vector Autoregressive Autoregressive Processes Processes Svetlana Unkuri, Svetlana Unkuri, Matthias Fischer Matthias Fischer Vector Vector Autoregressive Autoregressive Processes Processes VAR Modeling VAR Modeling 1 Estimation of the appropriate model after testing for structural • Testing for the structural breaks: with AuFVAR with AuFVAR Data Initial Data Initial breaks Function breakpoints , library strucchange Analysis Analysis Model Settings Model Settings • Function: estVARXls for the models with intercept and lagged Selection Selection 1 Determining the number of breakpoints Structural Structural variables (standard) Breaks Breaks 2 Computation of the optimal breakpoints Estimation and Estimation and • Function: estVARXlsM for the models with additional time Forecasting Forecasting 3 Adjustment of the model definition Residual Residual trend and/or season (modified) Analysis Analysis Empirical Empirical 2 Forecasting the time series, computation of confidence bounds Example Example and corresponding plots

Residual Analysis Example: Time Series and Forecasting Data Automated Automated Modeling and Modeling and • Variables to be forecasted: Forecasting Forecasting Vector Vector • Common Advertisement Earnings (with/without media) Autoregressive Autoregressive Processes Processes • Further possible variables for the VAR model: Svetlana Unkuri, Svetlana Unkuri, 1 ZEW Index (Centre for European Economic Research) Matthias Fischer Matthias Fischer 2 Incoming Orders (Germany) Vector Vector 3 CDAX (Composite DAX) Autoregressive Autoregressive Processes Processes VAR Modeling VAR Modeling 1 Portmanteau Test for Autocorrelation: with AuFVAR with AuFVAR Data Initial Data Initial Analysis Analysis • The standard test statistic, if time series length T ≥ 100 Model Settings Model Settings Selection Selection • The modified test statistic otherwise Structural Structural Breaks Breaks Estimation and Estimation and Forecasting Forecasting 2 Test for Nonnormality based on Skewness and Kurtosis Residual Residual Analysis Analysis (L¨ utkepohl, 1993) Empirical Empirical Example Example

Recommend

More recommend