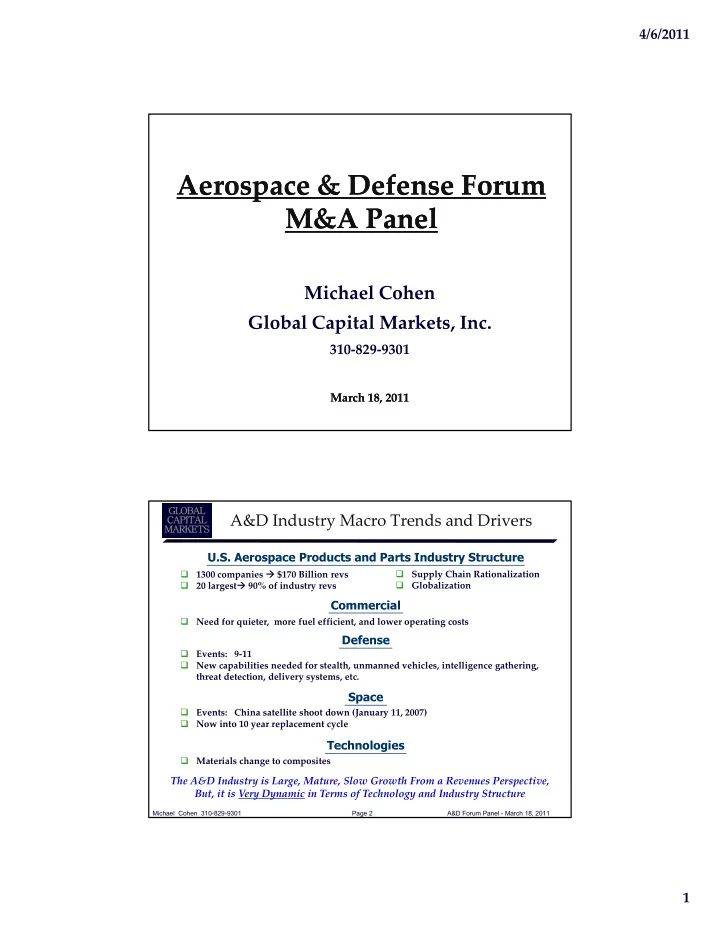

4/6/2011 Aerospace & Defense Forum Aerospace & Defense Forum M&A Panel M&A Panel M&A Panel M&A Panel Michael Cohen Global Capital Markets, Inc. Global Capital Markets Inc 310 ‐ 829 ‐ 9301 March 18, 2011 March 18, 2011 A&D Industry Macro Trends and Drivers U.S. Aerospace Products and Parts Industry Structure � 1300 companies � $170 Billion revs � Supply Chain Rationalization � � 20 largest � 90% of industry revs Globalization Commercial Commercial � Need for quieter, more fuel efficient, and lower operating costs Defense � Events: 9 ‐ 11 � New capabilities needed for stealth, unmanned vehicles, intelligence gathering, threat detection, delivery systems, etc. Space � � Events: China satellite shoot down (January 11 2007) Events: China satellite shoot down (January 11, 2007) � Now into 10 year replacement cycle Technologies � Materials change to composites The A&D Industry is Large, Mature, Slow Growth From a Revenues Perspective, But, it is Very Dynamic in Terms of Technology and Industry Structure Michael Cohen 310-829-9301 Page 2 A&D Forum Panel - March 18, 2011 1

4/6/2011 Aerospace Materials Change [1] Michael Cohen Proprietary Information. SDD = System Development and Demonstration The Aero Industry is Undergoing a Fundamental Materials Change Michael Cohen 310-829-9301 Page 3 A&D Forum Panel - March 18, 2011 Supply Chain Rationalization and Globalization � Prime Contractors are focusing on aircraft design, integration, and marketing � At Boeing, 70 ‐ 80% of the content for a given airplane is procured g, g p p from outside sources � Supply chains are being reduced and streamlined � Prime Contractors have greatly downsized in ‐ house fabrication � Work is being sourced globally through strategic and risk sharing partners � Prime Contractors are migrating to suppliers that can produce higher level value ‐ added sub ‐ assemblies � There is a very limited base of well qualified suppliers for composite sub ‐ assemblies OEM s Are Driving a Rationalization of the Supplier Base Michael Cohen 310-829-9301 Page 4 A&D Forum Panel - March 18, 2011 2

4/6/2011 Supplier Impacts � Metal parts suppliers are not capable in composites � Suppliers must develop, or acquire, composite parts capabilities � “Critical Mass” is now over $40M revenues and is driving consolidation among Tier 3 parts suppliers � Quality is still a prerequisite ‐‐ value, speed, responsiveness, agility, and financial strength have become very important � Suppliers need to be more sophisticated to address engineering issues and manage scheduling and production processes � Greater strategic alignment and electronic linkages for contracts, schedules, delivery releases, plans, specs, etc. are occurring � Sole source and risk sharing partnerships are now more prevalent A&D Suppliers are Adapting and Consolidating Michael Cohen 310-829-9301 Page 5 A&D Forum Panel - March 18, 2011 California Comments � Government � JPL � NASA Ames � NASA Ames � Vandenberg � C ‐ 17 – winding down � New Air Tanker � Commercial � Space � Scaled Composites ‐ Virgin Galactic � SpaceX � Sea Launch Michael Cohen 310-829-9301 Page 6 A&D Forum Panel - March 18, 2011 3

Recommend

More recommend