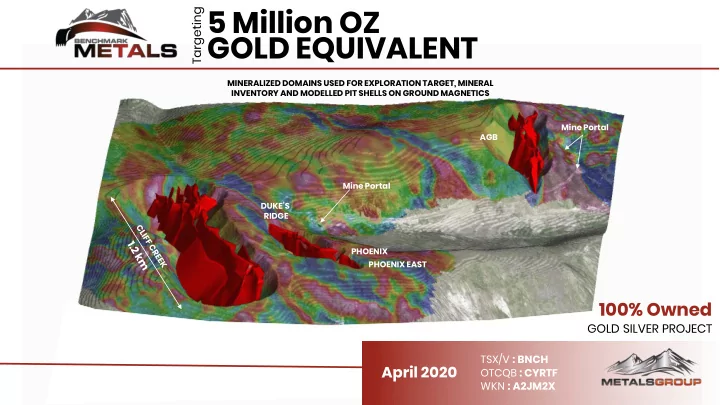

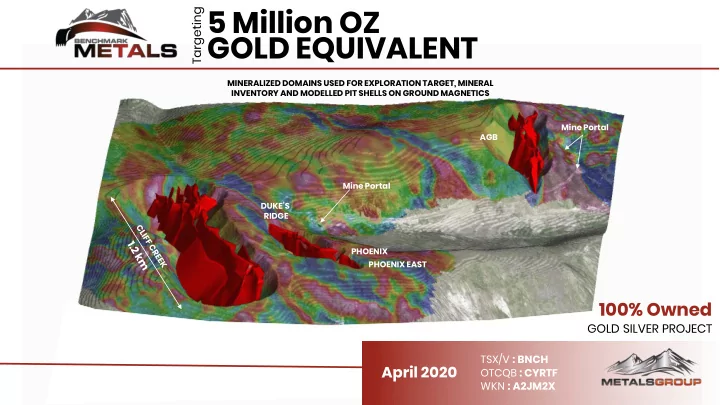

5 Million OZ Targeting GOLD EQUIVALENT MINERALIZED DOMAINS USED FOR EXPLORATION TARGET, MINERAL INVENTORY AND MODELLED PIT SHELLS ON GROUND MAGNETICS Mine Portal AGB Mine Portal DUKE’S RIDGE PHOENIX PHOENIX EAST 100% Owned GOLD SILVER PROJECT TSX/V : BNCH April 2020 OTCQB : CYRTF WKN : A2JM2X

Disclaimer Forward Looking Statements : Certain statements and/or graphics in the Company’s press releases, web site information and corporate displays, among others, constitute “forward -looking statements” . These statements are based on information currently available to the Company and the Company provides no assurance that actual results will meet management’s expectations. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by terms such as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”, or their conditional or future forms. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherentrisks and uncertainties. Actual results relating to, among other things, results of exploration, project development, reclamation and capital costs of the Company’s mineral properties, and the Company’s financial condition and prospects, could differ materially from those currently anticipated in such statements for many reasons such as: changes in general economic conditions and conditions in the financial markets ; changes in demand and prices for minerals ; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; technological and operational difficulties encountered in connection with the activities of the Company; and other matters discussed in this presentation. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on the Company’s forward-looking statements. The Company does not undertake to update any forward looking statement that may be made from time to time by the Company or on its behalf, except if required to do so by applicable securities laws. You are cautioned not to place any undue reliance on any forward-looking statement. Forward Looking Statements or Information Related to Exploration : Relating to exploration, the identification of exploration targets and any implied future investigation of such targets on the basis of specific geological, geochemical and geophysical evidence or trends are future-looking and subject to a variety of possible outcomes which may or may not include the discovery, or extension, or termination of mineralization. Further, areas around known mineralized intersections or surface showings may be marked by wording such as “open”, “untested”, “possible extension” or “exploration potential” or by symbols such as “?” . Such wording or symbols should not be construed as a certainty that mineralization continues or that the character of mineralization (e.g. grade or thickness) will remain consistent from a known and measured data point. The key risks related to exploration in general are that chances of identifying economical reserves are extremely small. The presentation contains historical exploration data that have not been verified by Benchmark Metals Inc. and may not be accurate or complete, and therefore the information should notbe relied upon. Michael Dufresne, M.Sc., P.Geol., P.Geo., an independent director of the Company, also serves as a Technical Advisor and is the Qualified Person, as defined by National Instrument 43- 101, responsible forreviewing and approving the technical content of all materials publicly disclosed by Benchmark,including the contents ofthis presentation. 2 TSX/V : BNCH | OTCQB : CYRTF | WKN : A2JM2X

About Benchmark Metals Inc. Benchmark Metals Inc. is a mineral exploration company focused on proving and developing the substantial resource potential of the Lawyer’s Gold and Silver project , located in the prolific Golden Horseshoe of northern British Columbia, Canada. LAWYERS GOLD & SILVER Benchmark is a member of the Metals Group of Companies , PROJECT and is led by a dynamic group of resource sector professionals with a long track record of success in evaluating and advancing mining projects from exploration through to VANCOUVER production, attracting capital and overcoming adversity to deliver exceptional shareholder value 3 TSX/V : BNCH | OTCQB : CYRTF | WKN : A2JM2X

Investment Opportunity LAWYERS PROJECT 350 COMPARABLE EXPLORATION COMPANIES IN CANADA 100 % owned • Located in the prolific Golden Horseshoe Apr 07, 2020 • 300 Developing substantial resource potential • Past producer with ~$50 million in existing infrastructure • MARKET CAPITALIZATION ($ MILLIONS) Proven and profitable mining jurisdiction • 250 CATALYSTS FOR GROWTH Up to 50,000 metres of drilling in 2020 • 200 New resource estimate following drilling • Benchmark’s current price Fully funded with +$10 million • 150 provides attractive buying opportunity when compared with GOLD & SILVER peers Near surface epithermal Au-Ag system • 100 Potential link to deeper porphyry system • High-grade drill intercepts within a larger bulk tonnage • 50 system 7.0 m at 108 g/t gold & 911 g/t silver* • 0 33.53 m at 5.76 g/t gold & 128.65 g/t silver* • Additional discovery targets identified along a 20+ km trend • *Assay interval lengths are core length and are estimated to be 80 to 90% of true width 4 TSX/V : BNCH | OTCQB : CYRTF | WKN : A2JM2X

Why Invest in Gold & Silver NOT JUST PRECIOUS, BUT USEFUL Photovoltaic 8% Electronics 24% >1 B oz Other industrial Global Silver 14% Deflation Silverware Demand 6% Price 2018 Geopolitical Appreciation Uncertainty Coins and bars Risk Jewelry 18% Management 21% 10 Currency Hedge Reasons to invest Inflation in gold Hedge Increasing Demand Tangible History of Asset Maintaining Portfolio its Diversification Value Source GFMS, Thomas Reuters, Silver institute 5 TSX/V : BNCH | OTCQB : CYRTF | WKN : A2JM2X

Why Invest in Benchmark ? THE MINE LIFE CYCLE $10 Start Up Becomes Tier 1 MARKET CAP Confirmed Deposit Company Becomes Tier 2 $8 Company MANAGEMENT THE Reality Sets In 5 M’S SHARE PRICE $6 MONEY Production BENCHMARK $4 FOR PICKING GOLD Decision POSITIONED FOR MINERALS MINING STOCKS GROWTH $2 MINE LIFE CYCLE BENCHMARK $0 Discovery Development Production Speculation Investment Revaluation 1-2 years Analysis 2-3 years THE WORLDS LARGEST HEDGE FUND 2-3 years SEES GOLD RISING 30% TO US$2000 Source: Bridgewater’s co -chief investment officer Greg Jensen 6 TSX/V : BNCH | OTCQB : CYRTF | WKN : A2JM2X

Why Invest in Benchmark? - Rapidly advancing towards production scenarios 2018 2020 2021 Acquired the Project Expansion Drilling PEA Results to substantiate Block modeling of numerous zones. Extensive data compilation and small a world-class gold- Mineral Inventory Target. work program to determine future silver asset. Pit shell modeling. scope and scale of the project. Working towards mine 50,000 m expansion and definition drill program. development & Additional new discovery potential. production scenarios Inaugural Field Program Resource Estimate Drilling provided bulk-tonnage potential and Targeting multi-million oz potential large gold-silver mineralized zones from surface. Advanced work programs to enable Eric Sprott becomes major shareholder. Economic & Engineering Studies. 2019 2021 WORLDS LARGEST HEDGE FUND SEES GOLD RISING 30% TO US $2000 Source: Bridgewater’s co -chief investment officer Greg Jensen 7 TSX/V : BNCH | OTCQB : CYRTF | WKN : A2JM2X

Corporate Snapshot SHARE PRICE – TSX.V: BNCH Internal Drivers Positive External Drivers Gold & Silver Growing demand for drill results precious metals Resource expansion Start of a new bull market New discoveries SHARE STRUCTURE Mar 31, 2020 Currentshares outstanding& Market Cap @ $0.25 112.8 M $28.20 M Working Capital $10.20 M Land Increased capital In the money Warrants 5.9 M $1.32 M investments acquisitions In the money Options 1.8 M $0.31 M In the money Diluted Working C apital $11.83 M Resurgence in Precious Metals sector In the money Diluted Shares & Market Cap @ $0.25 120.5 M $30.13 M Fully diluted Working Capital $19.74 M Fully Diluted Shares and Market Cap @ $0.25 141.0 M $35.25 M 8 TSX/V : BNCH | OTCQB : CYRTF | WKN : A2JM2X

Recommend

More recommend