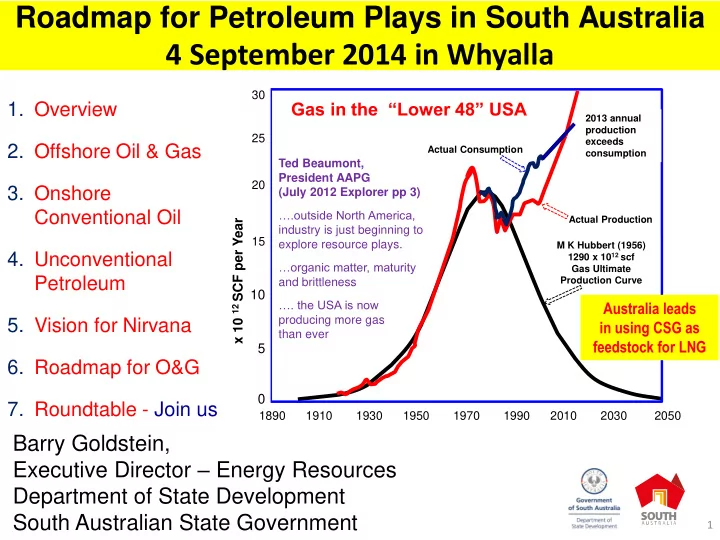

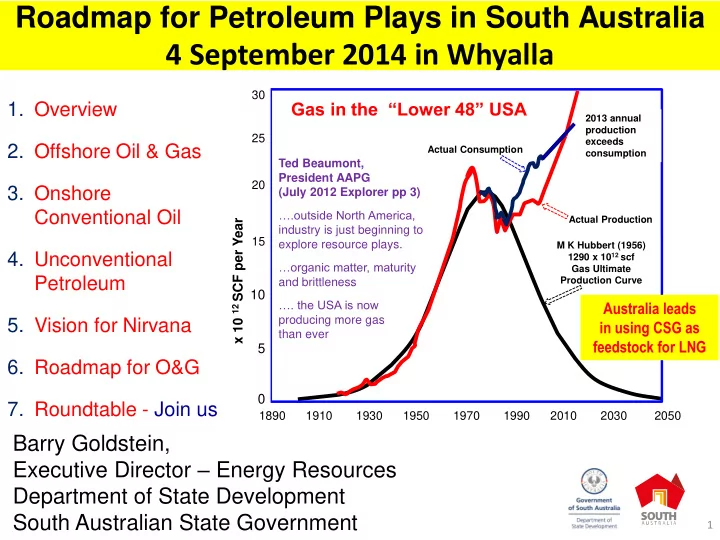

Roadmap for Petroleum Plays in South Australia 4 September 2014 in Whyalla 30 Gas in the “Lower 48” USA 1. Overview 2013 annual production 25 exceeds 2. Offshore Oil & Gas Actual Consumption consumption Ted Beaumont, President AAPG 20 3. Onshore (July 2012 Explorer pp 3) Conventional Oil ….outside North America, Actual Production x 10 12 SCF per Year industry is just beginning to 15 explore resource plays. M K Hubbert (1956) 4. Unconventional 1290 x 10 12 scf …organic matter, maturity Gas Ultimate Petroleum and brittleness Production Curve 10 …. the USA is now Australia leads producing more gas 5. Vision for Nirvana in using CSG as than ever feedstock for LNG 5 6. Roadmap for O&G 0 7. Roundtable - Join us 1890 1910 1930 1950 1970 1990 2010 2030 2050 Barry Goldstein, Executive Director – Energy Resources Department of State Development South Australian State Government 1

Overview – Oil and Gas onshore and Offshore South Australia • 4 Cooper CO2013 blocks attracted Simpson Pedirka Basin Basin aggregate $103 million work program Eromanga Basin Cooper bids (Senex x 2, Strike, Bridgeport) Moomba Arckaringa Officer Basin Basin • Western Flank oil play in the Cooper- Basin Eromanga continues with 50+ % success in finding avg. 2.5 mln bbls oil Olympic Arrowie Dam Mine Basin • Huge potential for gas in unconventional reservoirs in the Cooper Basin • Encourage results from Otway Basin Polda Basin exploration (Beach/Cooper) Stansbury Bight Basin Bight Basin attracting the majors – Basin • massive investment Petroleum exploration licence • Frontier basins’ plays include: (Onshore: PEL Offshore EPP) 200 km Petroleum exploration licence Conventional oil and gas application (PELA) Gas pipeline Otway Acreage release blocks – bids Gas and liquids pipeline Unconventional regional plays close 29 May 2014 Basin Oil pipeline Selected mine Parks with no petroleum exploration access 2

Offshore Bight Basin Commonwealth Waters $1.2 bln guaranteed 2011-16 + $1.1 Bbln non-guaranteed 2017-20 BP & Statoil EPPs 37 to 40 Santos- Murphy CHEVRON EPP44 & EPP45 Chevron SANTOS & MURPHY BP - EPP43 Statoil Bight BIGHT Petroleum PETROLEUM EPP 41 and EPP 42 3

Oil exploration wells (Jan 2002- Retention Leases for Oil Aug 14), western Cooper – Eromanga o 52% post-3D were discoveries Proven Cooper-Eromanga oil play (and find-size ) o 28% post-2D were discoveries o Average 2.5 mmbo find size o 10 operators for 25 companies Petroleum Licence Holders 4

Natural gas and oil in unconventional rock-reservoirs EIA / ARI 2013 Technically Recoverable Shale Resource Estimates Gas (TCF) Oil (Billion Bbls) Fast follower criteria outside North America 1 USA 1,161 1 Russia 75 2 China 1,115 2 USA 48 • The right rocks (liquids rich better) 3 Argentina 802 3 China 32 4 Algeria 707 4 Argentina 27 • Markets 5 Canada 573 5 Libya 26 • Supportive investment frameworks 6 Mexico 545 6 Australia 18 7 Australia 437 7 Venezuela 13 • Trusted regulatory frameworks 8 South Africa 390 8 Mexico 13 9 Russia 285 9 Pakistan 9 • Pre-existing infrastructure 10 Brazil 245 10 Canada 9 11 Others 1,535 11 Others 65 • Two ends against the middle – descend Total 7,795 Total 335 5 cost & ascend productivity curves

Vision for Nirvana: Centuries of safe, secure, competitive energy supplies that meet community expectations for net outcomes To reach the vision • Potential risks to social, natural and economic environments are reduced to as low as reasonably practical ( ALARP ); and meet community expectations for net outcomes BEFORE IT IS PERSONAL – before approval sought for land access; • Affected people and enterprises get timely information describing risks and rewards to enable informed opinions; • Convene roundtables to deliver roadmap s for projects to inform: the PUBLIC, GOVERNMENTS, INVESTORS, AND REGULATORS and in doing so – enable/attract welcomed oil and gas projects. • South Australia’s Roadmap (Dec. 2012) Worth joining the Roundtable 6

Roadmap for Unconventional Gas Now under the auspices of the Roundtable for Oil and Gas Projects Search words: DSD & Unconventional Gas Informed by a Roundtable including: industry; governments; peak bodies for protecting environments and aboriginal people; research institutions and a few individuals Now 440 members & 6 working groups: 1. Training; 2. Supply hubs, roads, rail and airstrips for the Cooper- Eromanga basins; 3. Water use in the Cooper-Eromanga basins; 4. SA- Qld ‘wharf to well’ corridors for the Cooper - Eromanga basins; 5. Cost effective, trustworthy GHG detection; and 7 7 6. Supplier’s forum to boost local content

Top 5 of 125 Roadmap Recommendations = signif progress Deploy fit-for-purpose licence terms and 1 conditions Enable fit for purpose skills 2 Use water wisely 3 Communicate effectively to demonstrate the 4 efficacy of managing environmental risks Regulation simultaneously meets public and 5 investor expectations for net outcomes

Separation of fracture stimulation in the Cooper Basin from fresh water supplies Deepest water bores for human/stock/agriculture use No evidence or realistic expectation of fracture stimulation resulting in the contamination of fresh water supplies or damaging induced seismicity in the far northeast of South Australia where 700+ deep petroleum wells and a few geothermal (hot rock) wells have been fracture stimulated Number of fracture stimulated stages in 717 fracture stimulated wells in the Cooper Basin to end Aug.’14

Key Conclusions 1. Huge potential in unconventional reservoirs in the Cooper. ~$3.5 bln investment 2014-19. 2. Huge potential offshore in the Bight Basin. ~$2.3 Bln investment to 2020 3. Trustworthy regulation / regulators 4. Worth joining the Roundtable for Oil & Gas Projects – Just do it! 10

Roadmap for Petroleum Plays in South Australia 4 September 2014 in Whyalla Go to GO TO GO TO South Australia AUSTRALIA AUSTRALIA DRILL A WELL DRILL A WELL BINGO BINGO SORTED SORTED Barry Goldstein, Executive Director – Energy Resources South Australian State Government 11

Key Matters Considered in Decision-Making for the Regulation of PRLs • The highest priority defined by the Roundtable for Unconventional Gas is the appropriate recognition of the life- cycle for finding, appraising, developing and producing resources. Fit-for-purpose licenses terms are the most direct way to recognize this life cycle. This is equally relevant to all mineral and energy resource sectors. The Subject Area Arrangement: Avoids 18 -24 months delay in exploration/discoveries after: intermittent relinquishments; call for bids; bids; negotiation of land access agreements; and grant of successively smaller PELs; Accelerates investment at contestable levels through renewal terms in ways not achieved with PELs; Delivers investment, jobs, production and royalties, sooner - clearly in the interest of the People of South Australia; Industry as a whole has greater investment efficiency; Attains very competitive levels of investment without the perverse outcome of ‘winner’s curse’ bidding; 12

The Subject Area Arrangement (continued): Based on DMITRE’s mapping of the proven oil play trend - 21 companies in JVs under 10 Operators may opt into Subject Area Agreements (e.g. cross-section of industry will benefit, including service companies who will get more extensive contracts;. Nurtures small enterprises to become medium to large in size enterprises; Overcome a looming issue: Ever-smaller licences attracting circa $20 million bids (400 sq km 3D + 4 exploration wells) stretch the financial competence of ASX IPOs – and financial competence is a requirement for compliant licence-holders; Seeks secure investment at a time the State needs stronger investment; Farm-outs and sales are expected to further accelerate investment than is likely to be attracted through success, intermittent work program bids; A company approached Government with a proprietary request to progress applications for PRLs; Undertook targeted consultation with a cross-section of key Operators, at least one non-Operator and service companies active in the Cooper-Eromanga basins; The clear majority of enterprises considered the concept of PRLs for oil as a significant (even visionary) step worth taking; With regret, there little chance that all regulatory decision will please all stakeholders, always; 13

CO 2 and Gas Wetness, South Australian Cooper Basin (Epsilon, Patchawarra, Tirrawarra, and Merrimelia Formations) Bbls Propane + Butane Bbls Condensate % CO 2 per MMcf Gas per MMcf Gas 14 Patchawarra Absent Patchawarra Absent Patchawarra Absent

Deep Cooper Basin (Gidgealpa Coals): Enormous Generation Capacity Patchawarra Formation Toolachee Formation Cumulative Coal Thickness Cumulative Coal Thickness Senex’s Paning 2 (May 2013): Single 63,000 pound proppant fracture stim. in Toolachee coal (~2900m). Up to 90,000 scf/d, over 4 days. Santos, Beach, Origin JV 15

Recap 5 Working Groups #1 Training #2 Supply hubs, roads, rail and airstrips for the Cooper-Eromanga basins #3 Water use in the Cooper-Eromanga basins #4 SA-Qld 'wharf to well' corridors for the Cooper- Eromanga basins #5 Cost-effective, trustworthy GHG detection #6 Suppliers’ Forum 16

Recommend

More recommend