1. Overview - 1 -

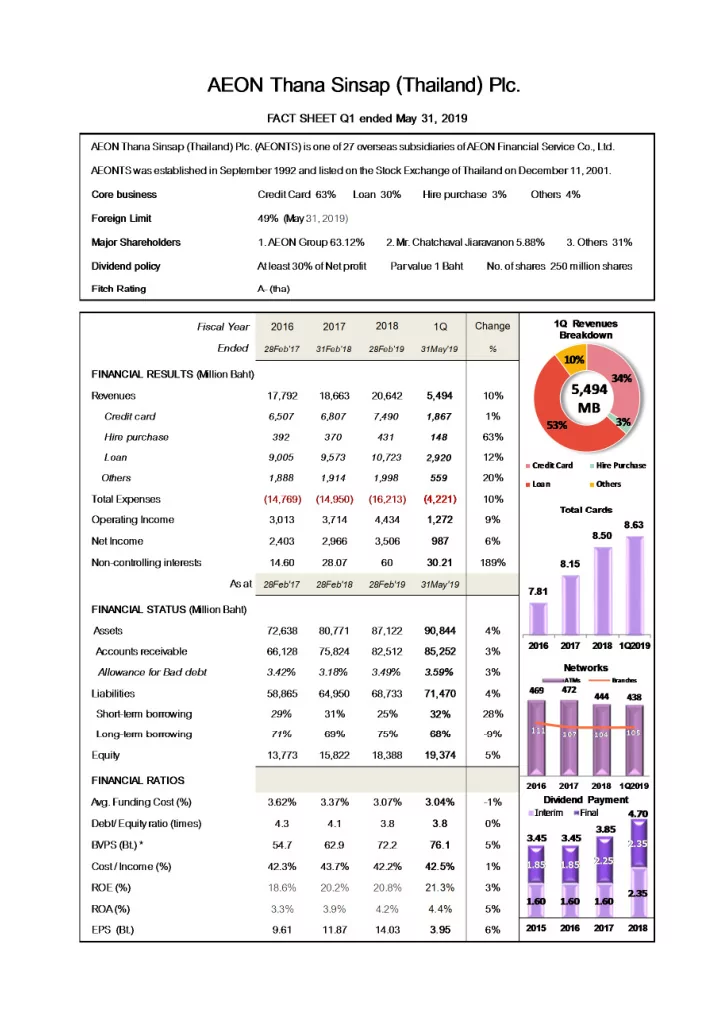

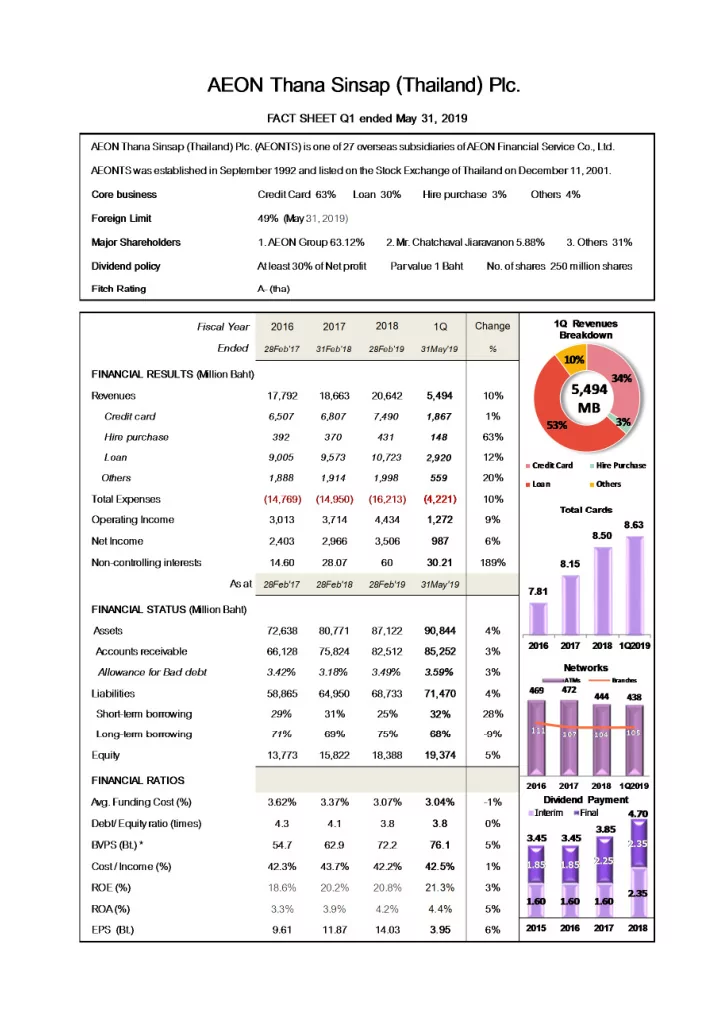

2. Summary Results 1) Consolidated Company Performance The Company's core business is retail finance services, including, credit card, personal loan and hire purchase. The credit card business representing 63% of total trading volume, loan shares 30%, hire purchase shares 3%, and others 4%, respectively. (Million Baht) 2016 2017 2018 1Q Fiscal Year 28Feb'17 31Feb'18 28Feb'19 31May'19 Amount y-y Amount y-y Amount y-y Amount y-y Turnover 90,817 -7% 101,151 11% 105,144 4% 28,285 10% Revenues 17,792 2% 18,663 5% 20,642 11% 5,494 10% Net Income 2,403 -2% 2,966 23% 3,506 18% 987 6% - On October 5, 2011, the Company has consolidated AEON SPECIALIZED BANK (CAMBODIA) PLC, established in Cambodia to conduct retail fiance business, currently holding with 50% of ownership, and 50% from AFS Corporation. - On November 2, 2012 and January 11, 2011, the Company established AEON Microfinance (Myanmar) Co., Ltd. and AEON Leasing Service (Lao), respectively, to conduct retail finance business, holding 100% - Since September 2012, the company has consolidated ACS Servicing (Thailand) Co., Ltd and AEON Insurance to its financial statements. ACSS is debt collection services company while AEON Insurance is life & non life insurance brokers. - The Company has changed the accounting period from end of February 20th to end on the last day of February. 2016 2017 2018 1Q Fiscal Year 28Feb'17 31Feb'18 28Feb'19 31May'19 Par Value : Baht 1.00 1.00 1.00 1.00 Book Value : Baht 62.9 67.8 72.2 76.1 Earning per share (EPS) : Baht 11.87 3.71 14.03 3.95 Return on Asset (ROA) : % 4.1% 4.6% 4.2% 4.4% Return on Equity (ROE) : % 20.2% 22.6% 20.8% 21.3% Assets 80,771 82,105 87,122 90,844 Liabilities 64,950 65,158 68,733 71,470 Equity 15,822 16,947 18,388 19,374 Equity ratio 19.5% 20.6% 20.7% 20.9% Dividend Payment : Baht 3.85 - 4.70 - Payout Ratio : % 32.4% - 33.5% - Note: The Company changed par value from 5 Baht to 1 Baht in June 2004. - 2 -

3. Industry Overview 1) Economic Indicators 2016 2017 2018 1Q 31 Dec'16 31 Dec'17 31 Dec'18 31 Mar'19 Gross Domestic Product (y-y) 3.3% 3.9% 3.7% 2.8% Private Consumption Expenditures 3.0% 3.2% 5.3% 4.6% Headline Inflation 0.2% 0.7% 0.8% 0.7% Unemployment rate 1.0% 1.2% 1.1% 0.9% Source : NESDB, BOT, and UTCC 2) Credit Card and Personal Loan under Supervision in Thailand 31 Dec'16 31 Dec'17 31 Dec'18 31 Mar'19 Amount y-y Amount y-y Amount y-y Amount y-y Credit Card Number of Account (million accounts) 20.14 6% 20.33 1% 22.11 9% 22.47 9% Credit Outstanding (billion baht) 360.10 8% 394.12 9% 418.75 6% 386.64 8% Personal Loan under Supervision Number of Account (million accounts) 12.18 3% 12.78 5% 13.41 5% 13.89 8% Loan Outstanding (billion baht) 333.00 5% 354.24 6% 383.28 8% 492.09 39% Source : Bank of Thailand 3) Number of AEONTS Cards 28Feb'17 28Feb'18 28Feb'19 31Mar'19 Number of Credit Cards (million cards) 2.38 2.50 2.62 2.68 Number of Member Cards (million cards) 5.43 5.65 5.90 5.95 Total (million cards) 7.81 8.15 8.52 8.63 4) AEONTS Networks 28Feb'17 28Feb'18 28Feb'19 31Mar'19 Branches 111 107 104 105 Bangkok 35% 33% 31% 30% Province 65% 67% 69% 70% ATMs (machine) 469 472 440 438 Bangkok 46% 45% 42% 41% Province 54% 55% 58% 59% Affiliated Dealers 17,463 17,767 4,851* 6,307 Bangkok 31% 31% 22% 25% Province 69% 69% 78% 75% *We closed mini-counters and inactive dealers. 5) Oversea Businesses Cambodia, Laos and Myanmar 31 Dec'16 31 Dec'17 31 Dec'18 31 Mar'19 Number of Customers 125,000 173,000 262,676 287,330 Number of Dealers 1,977 2,302 3,818 4,192 11 12 16 16 Number of Branches - 3 -

4. Financial Highlights 1) Turnovers (Million Baht) Fiscal Year 2016 2017 2018 1Q 28Feb'17 28Feb'18 28Feb'19 31May'19 Amount % y-y Amount % y-y Amount % y-y Amount % y-y AEONTS (Consolidated) 90,817 100% -7% 101,151 100% 11% 105,144 100% 4% 28,285 100% 10% Cambodia 1,534 2% 34% 1,890 2% 23% 3,309 3% 75% 1,248 4% 95% Myanmar 795 0.9% 3% 1,280 1% 61% 2,119 2% 66% 689 2% 43% Laos 207 0.2% 104% 331 0.3% 60% 390 0.4% 18% 88 0.3% 3% 2) Revenues (Million Baht) Fiscal Year 2016 2017 2018 1Q 28Feb'17 28Feb'18 28Feb'19 31May'19 Amount % y-y Amount % y-y Amount % y-y Amount % y-y 1. Credit Card 6,507 37% 4% 6,807 37% 5% 7,490 36% 10% 1,867 34% 1% 2. Hire Purchase 392 2% -9% 370 2% -6% 431 2% 17% 148 3% 63% 3. Loan 9,005 51% 2% 9,573 51% 6% 10,723 52% 12% 2,920 53% 12% 4. Collection income 209 1% 3% 234 1% 12% 266 1% 14% 67 1% 5% 5. Commission income 471 3% -1% 492 3% 5% 513 2% 4% 133 2% 6% 6. Bad debt recovery 500 3% -6% 603 3% 21% 764 4% 27% 234 4% 38% 7. Others 708 4% 2% 585 3% -17% 455 2% -22% 125 2% 14% Total (Consolidated) 17,792 100% 2% 18,663 100% 5% 20,642 100% 11% 5,494 100% 10% AEON Insurance 712 4% 5% 737 4% 762 4% 197 4% 4% 3% 4% ACS Servicing 1,413 8% 22% 1,604 9% 834 4% 198 4% 14% -48% -36% Cambodia 319 2% 22% 352 2% 504 2% 188 3% 10% 43% 104% Myanmar 98 1% 41% 159 1% 272 1% 89 2% 63% 71% 53% Laos 40 0.2% 89% 76 0.4% 102 0.5% 29 0.5% 89% 34% 30% 587 ##### 587 ##### 3.30% 3) Accounts Receivable (Million Baht) Fiscal Year 2016 2017 2018 1Q 29Feb'17 28Feb'18 28Feb'19 31May'19 Amount % y-y* Amount % y-y* Amount % y-y* Amount % y-y* 1. Credit Card 28,711 43% 13% 34,588 46% 20% 36,623 44% 6% 37,067 43% 1% 2. Hire Purchase 1,444 2% -12% 1,267 2% -12% 2,118 3% 67% 2,611 3% 23% 3. Loan 35,827 54% -1% 39,797 52% 11% 43,590 53% 10% 45,446 53% 4% 4. Others 146 0.2% -55% 172 0.2% 18% 180 0.2% 5% 127 0.1% -29% Total 66,128 100% 4% 75,824 100% 15% 82,512 100% 9% 85,252 100% 3% Overseas (CLM) 1,808 3% 37% 2,164 3% 20% 3,627 4% 68% 4,230 5% 17% Note: *Compared with the the end of previous fiscal year - 4 -

4. Financial Highlights (Cont’d) 4) Cost structure (Million Baht) Fiscal Year 2016 2017 2018 1Q 28Feb'17 28Feb'18 28Feb'19 31May'19 % % % % Amount y-y Amount y-y Amount y-y Amount y-y Rev Rev Rev Rev Operating and admin expenses 7,509 42% 3% 8,153 44% 9% 8,702 42% 7% 2,282 42% 9% Bad debt and doubtful accounts 5,117 29% 8% 4,679 25% -9% 5,285 26% 13% 1,395 25% 16% Funding cost 2,110 12% -8% 2,104 11% 0% 2,175 11% 3% 544 10% -1% Other expenses 32 0% - 13 0% -58% 51 0% 278% 1 0% -13% Total Expenses 14,769 83% 3% 14,950 80% 1% 16,213 79% 8% 4,221 77% 10% 5) Bad Debt (Million Baht) Fiscal Year 2016 2017 2018 1Q 28Feb'17 28Feb'18 28Feb'19 31May'19 Amount y-y Amount y-y Amount y-y Amount y-y 1. Beginning Allowance 2,412 -1% 2,260 -6% 2,416 7% 2,880 19% 2. Provision for Bad debt 5,117 4,679 5,285 1,395 8% -9% 13% 16% 3. Write-off amount (5,269) 10% (4,523) -14% (4,820) 7% (1,213) 14% 4. Ending Allowance 2,260 -6% 2,416 7% 2,880 19% 3,062 20% % of Accounts Receivable 3.42% 3.18% 3.49% 3.59% D3 up / Accounts Receivable 2.71% 2.35% 2.76% 2.82% Coverage Ratio 126% 136% 126% 127% 6) Breakdown of Borrowings (All converted into Thai Baht) (Million Baht) 28Feb'17 28Feb'18 28Feb'19 31May'19 3,502 3,952 7,100 9,141 Short Term Loans 2,580 2,820 4,690 6,221 Baht Yen - - - - 565 384 1,142 1,471 USD Lak 150 225 315 298 207 523 954 1,151 MMK Current portion of loans&B/E 9,391 12,662 6,072 8,254 3,472 1,685 2,981 4,106 Current portion of Debenture 39,283 41,034 47,505 45,027 Long Term Loans Baht 2,499 8,491 9,893 11,395 13,849 6,964 8,541 7,574 Yen USD 11,685 12,671 16,112 15,766 11,250 12,908 12,958 10,292 Debenture (baht)- Long term Total Borrowings 55,648 59,334 63,658 66,528 LTB/Total Borrowings 71% 69% 75% 68% - 5 -

Recommend

More recommend