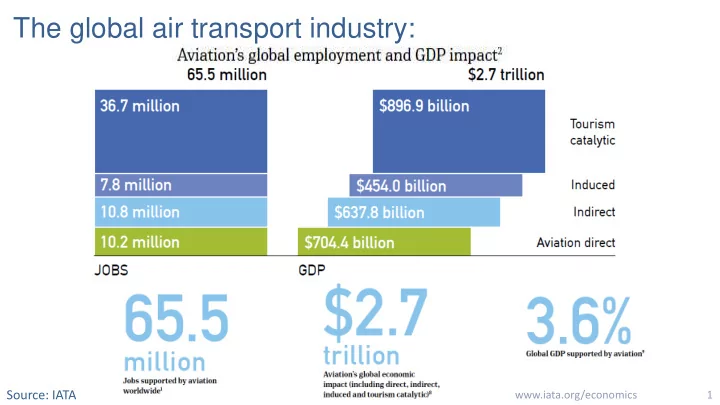

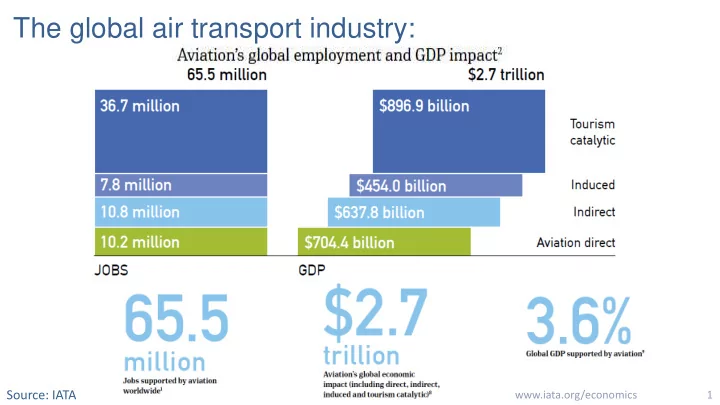

The global air transport industry: Source: IATA www.iata.org/economics 1

The global industry outlook remains bright… 3.5% Average annual growth in global air passenger journeys over the next 20 years 2.0x The number of air passenger journeys in 2037 compared with today Source: IATA/Tourism Economics www.iata.org/economics 2

20-year air passenger growth is shifting East & South Source: IATA/Tourism Economics 3 www.iata.org/economics

In Africa, air transport supports… …6.2 million jobs & $55.8 billion of GDP Source: ATAG www.iata.org/economics 4

Demand for air travel in Africa to soar in the middle run million passengers per year (O-D basis) 400 350 No Policy Change 334 Policy Stimulus & Market Liberalisation 300 Pick-up in Protectionism 250 200 150 135 100 2017 2019 2021 2023 2025 2027 2029 2031 2033 2035 2037 Source: IATA/Oxford Economics 5 www.iata.org/economics

Source: ATAG www.iata.org/economics 6

20-year passenger growth outlook (2017-37) Source: IATA/Tourism Economics 7 www.iata.org/economics

The markets of tomorrow Source: IATA/Tourism Economics 8 www.iata.org/economics

Top 10 air markets in Africa shows few changes 2017 2019 2021 2023 2025 2027 2029 2031 2033 2035 2037 1 S. Africa S. Africa Egypt Egypt 2 Morocco 3 Morocco Algeria 4 Tunisia 5 Nigeria Nigeria 6 Algeria Tunisia 7 Kenya Kenya 8 Ethiopia Ethiopia 9 Mauritius Tanzania 10 Sudan Tanzania Source: IATA/Oxford Economics www.iata.org/economics 9

Drivers of demand for air travel in Africa: Population Total population evolution: Africa African Population in Million 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 Source: IATA/Oxford Economics www.iata.org/economics 10

Drivers of demand for air travel in Africa: Income Per capita GDP evolution: Africa African per Capita GDP in Real USD 2,500 2,000 1,500 1,000 500 0 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 Source: IATA/Oxford Economics www.iata.org/economics 11

Strong increase in # of passengers over next 20 years Number of passengers in African countries with strong airline industry Tanzania South… Nigeria 2017 Kenya 2037 Ethiopia Morocco Egypt 0 10,000 20,000 30,000 40,000 50,000 60,000 Number of passengers per year (‘000) Source: IATA/Oxford Economics www.iata.org/economics 12

… translating into high annual passenger growth rate Passenger average yearly growth rate for period 2017-2037 Compound annual growth rate (CAGR) for passengers 7 6.4 6.3 6.2 6 5.4 5 4.6 3.8 4 3.7 3 2.3 2 1 Egypt Morocco Ethiopia Kenya Nigeria South Africa Tanzania Africa Source: IATA/Oxford Economics www.iata.org/economics 13

Visa openness index 2018 Source: UNWTO 14 www.iata.org/economics

Air travel connectivity from Africa to the World: 2008 Source: SRS Analyser www.iata.org/economics 15

Air travel connectivity from Africa to the World: 2018 Source: SRS Analyser www.iata.org/economics 16

Air travel connectivity within Africa: 2008 Source: SRS Analyser www.iata.org/economics 17

Air travel connectivity within Africa: 2018 Source: SRS Analyser www.iata.org/economics 18

Regional profitability remains very uneven Net post-tax profit margins 9% 2015 2016 2017 2018 4% -1% -6% N America Europe Asia Pacific Middle East L America Africa Source: IATA Economics using data from ICAO, The Airline Analyst, IATA forecasts

Regional (net) profitability – Africa US$bn 0.5 2% 0.0 0% -0.5 -2% -1.0 -4% Net profit (Left axis) -1.5 -6% -2.0 -8% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018f www.iata.org/economics 20 Source: IATA

Airline Cost Drivers in Africa Differences in cost sources: Africa vs Industry User charges Flight equipment maintenance and overhaul Higher than Aircraft fuel and oil The 0% line industry Ticketing, sales and promotion indicates the average industry average. Flight equipment rentals Other operating expenses Flight equipment insurance Depreciation and amortization Lower than Other expenses (flight operations) industry average Passenger services Flight crew salaries and expenses Station expenses -6% -4% -2% 0% 2% 4% 6% Percentage points difference in shares of total regional costs.

How IATA initiatives impact cost-drivers in Africa Differences in cost sources: Africa vs Industry User charges Advocacy Flight equipment maintenance and overhaul ASA best practice clauses Aircraft fuel and oil Ticketing, sales and promotion Airport Privatization Efforts Higher than Flight equipment rentals The 0% line industry Standards & initiatives indicates the average Other operating expenses related to distribution issues industry average. Flight equipment insurance Smarter Regulation Depreciation and amortization Other expenses (flight operations) Passenger services Lower than Flight crew salaries and expenses industry Station expenses -6% -4% -2% 0% 2% 4% 6% Percentage points difference in shares of total regional costs.

Recommend

More recommend