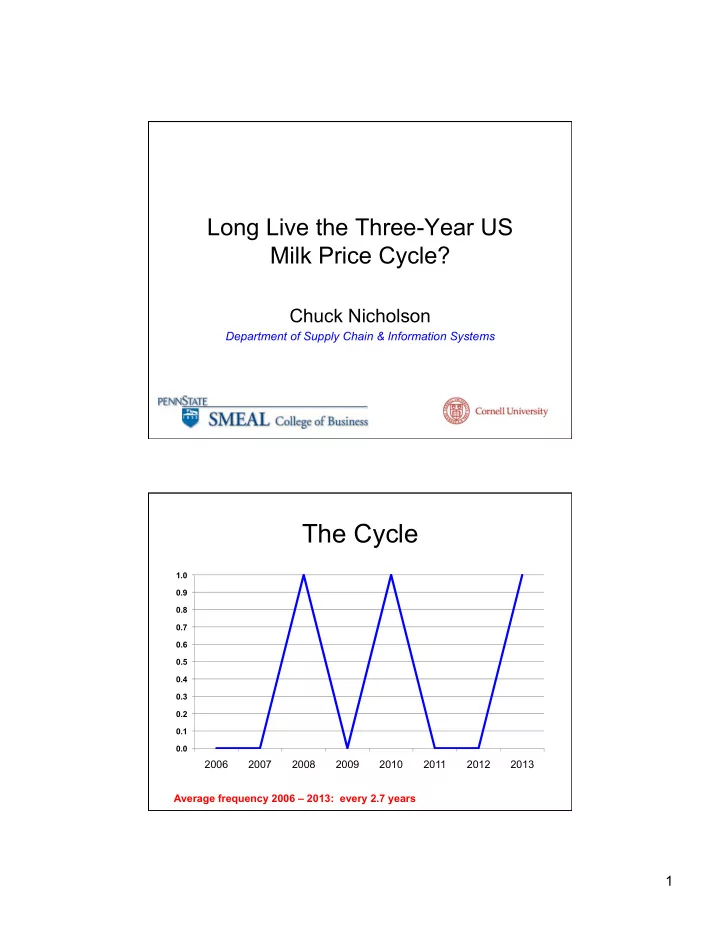

Long Live the Three-Year US Milk Price Cycle? Chuck Nicholson Department of Supply Chain & Information Systems The Cycle 1.0 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0.0 2006 2007 2008 2009 2010 2011 2012 2013 Average frequency 2006 – 2013: every 2.7 years 1

The Cycle 1.0 Chuck Talks about Price Cycles 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0.0 2006 2007 2008 2009 2010 2011 2012 2013 Average frequency 2006 – 2013: every 2.7 years All-Milk Price Cycles (2008) 9, 26 and 36 month cycles $6.00/cwt variation Amplitude of cycles increasing? 2

All-Milk Price Cycles (2010) Largest cyclical component 36 month period Seasonal and cyclical components Other Cycles (2010) Range of Amplitude of Largest Amplitude Variable Level Seasonal Amplitude of Largest Effect Effect Cycle Cycle All-Milk Price $3.00/cwt $1.00/cwt 36-month $9.00/cwt Daily Milk Production 235 mil lbs 40 mil lbs 34-month 10 mil lbs Milk-Feed Price 1.2 0.5 33-month 1.0 Cheese Price $0.30/lb $0.20/cwt 36-month $0.80/lb Whey Price* $0.50/lb $0.05/lb 34-month $0.09/lb Class III Price $4.00/cwt $1.60/cwt 37-month $8.00/cwt NDM Price $0.65 $0.10/lb 34-month $0.70/cwt Butter Price $0.75 $0.20/lb 36-month $0.70/lb Class IV $4.00/cwt $2.00/cwt 34-month $8.50/cwt *Since 2000 Indicates cyclical component large relative to range and(or) seasonal Rough convergence of periods of largest cycles 3

What’s New? Context is now different: • Rabobank says “the cycle is dead” due to trade linkages – Dysrhythmia (October 2012) • Did the 2009 shock “re-set” or eliminate the cycles? • World of higher feed prices and new business models This I Believe…About Milk Price Cycles Which represents your view? A. They never existed / evidence not sufficient B. They existed but now they are dead C. They existed but I’m not sure what the future holds D. They existed and probably will in the future 4

Today’s Questions • What does updated statistical analysis indicate about the cycle? • What causes cycles? – Caused, if dead • If the (a) cycle is still with us, what are the implications? Methods • State-space (decomposition) statistical analysis of All-milk price – Level (average) – Slope (trend) – Seasonal (within year cycle) – Cycle • Controls for effect of feed cost – Also tested for effects of trade value/volume 5

Methods • Quarterly data 1996(2) to 2012(1) – 17 years, post-URA – All-milk price and NASS 16% protein ration • Compare forecast to actual data for 2012(2) to 2013(1) – If consistent, suggestive of continued cycle to date Key Findings • Slope, seasonal and cyclical factors important • Feed contributes $0.77/cwt for every $1 change in ration value • Trade variables have limited impact 6

Model Testing • Model passes all the usual statistical tests on errors (residuals) – Normal, not serially correlated, homoskedastic Predicted versus Actual 2007-2012 7

All-Milk and Feed Impact 25 20 15 $/cwt 10 5 0 1996(2) 1998(2) 2000(2) 2002(2) 2004(2) 2006(2) 2008(2) 2010(2) 2012(2) All Milk Feed Effect Feed has an impact on prices, but not on existence or timing of cycles Seasonal and Cyclical Effects 6 4 2 $/cwt 0 1996(2) 1998(2) 2000(2) 2002(2) 2004(2) 2006(2) 2008(2) 2010(2) 2012(2) -2 -4 -6 Seasonal Cycle Cyclical pattern exists through 2012, but peak of recent cycle lower 8

Cycle Findings • Cycle length = 3.2 years – 38 months • Recent amplitude estimate = $1.50/cwt – Less than previous cycle Ex Post Forecast Observations for 2012(2) to 2013(1) broadly consistent with model forecast 9

Price & Production Cycles Are Very Common • Agricultural commodities • Other commodities • Housing • GDP Hog Production Cycle 2.5 2.0 1.5 % Difference from Trend 1.0 0.5 0.0 1988 1992 1996 2000 2004 2008 2012 -0.5 -1.0 -1.5 10

Wheat Price Cycle 3.5 3.0 2.5 2.0 % Difference from Trend 1.5 1.0 0.5 0.0 1970 1974 1978 1982 1986 1990 1994 1998 2002 2006 2010 -0.5 -1.0 -1.5 -2.0 Housing Price Cycle 25.0 20.0 % Difference from Exponential Growth 15.0 10.0 5.0 0.0 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 -5.0 -10.0 -15.0 -20.0 -25.0 11

GDP Cycle 15.0 10.0 % Difference from Exponential Growth 5.0 0.0 1947q1 1955q1 1963q1 1971q1 1979q1 1987q1 1995q1 2003q1 2011q1 -5.0 -10.0 -15.0 -20.0 What’s in Common? • Oscillations • What causes oscillations? • In systems speak: • “Negative feedback loops with a delay” – System structure causes behavior – This is the ONLY “system structure” that creates oscillatory behavior 12

Common Modes of Behavior Exponential Growth Goal Seeking S-shaped Growth Time Time Time Growth with Overshoot Overshoot and Collapse Oscillation Time Time Time Oscillation is a very common behavior—it is caused by an underlying structure Structure for Oscillations State%of%the Measurement, + Reporting and System Perception Desired%State Delays Action and 7 Effect + Delays Discrepancy Correc4ve Ac4on + Administrative and Decision-Making Delays 13

Structure for Milk Price Oscillations (One structure among many possible ones) Measurement, + Farm Reporting and Profitability Perception Desired1Farm Delays Profitability Action and = Effect + Delays Discrepancy Adjustment1of Administrative Cow1Numbers and and1Feeding Decision-Making + Delays In Supply Chain Speak… • Instability is common in supply chains • Often the result of individual businesses responding rationally to incentives • But with delays and without sufficient coordination 14

Have You Played “The Beer Game”? • Game played to simulate supply chain ordering decisions • Often used with groups of top executives • Usually results in instability--oscillations Inventory Amounts Vary a Lot! Actual results from The Beer Game with Executives 15

This Instability is Called the “Bullwhip Effect” Orders vary and often amplified as they move upstream in the supply chain Why Cycles? • Interaction of physical delays in production and capacity adjustment with boundedly rational decision making by individual producers and investors • Persistence of cycles suggests that learning and market forces that might stabilize cycles are weak 16

What Do Models Suggest About Future Cycles? • Forecasting three years ahead with State- space model – Model ignoring feed prices (so don’t have to forecast these) SSM Suggests Continued Dampened Cycles 17

What Do Models Suggest About Future Cycles? • We also modified our structural dynamic model – Updated to 2011 base data – Incorporates these supply chain effects • Suggests continued cyclical behavior – Although dampened by assumed lower feed price values based on USDA forecast Dynamic Model Projections 22 21 20 19 $/cwt 18 17 16 15 1-13 1-14 1-15 1-16 1-17 1-18 1-19 Somewhat larger amplitude (SSM uses a dampening factor) 18

The Bottom Line • There is evidence that cycles are not dead – But they may be dampened in the future? • Cycles arise from rational decisions by supply chain actors – Especially on the supply side? • If cycles exist, forecasts and policy analyses should account for them The King is Dead… • Long live the King! 19

Must These Cycles Exist in Dairy? 60 50 40 Annual % Price Change 30 20 10 0 1991 1995 1999 2003 2007 -10 -20 -30 -40 Price change behavior differs for different countries—one much more cyclical 20

Recommend

More recommend