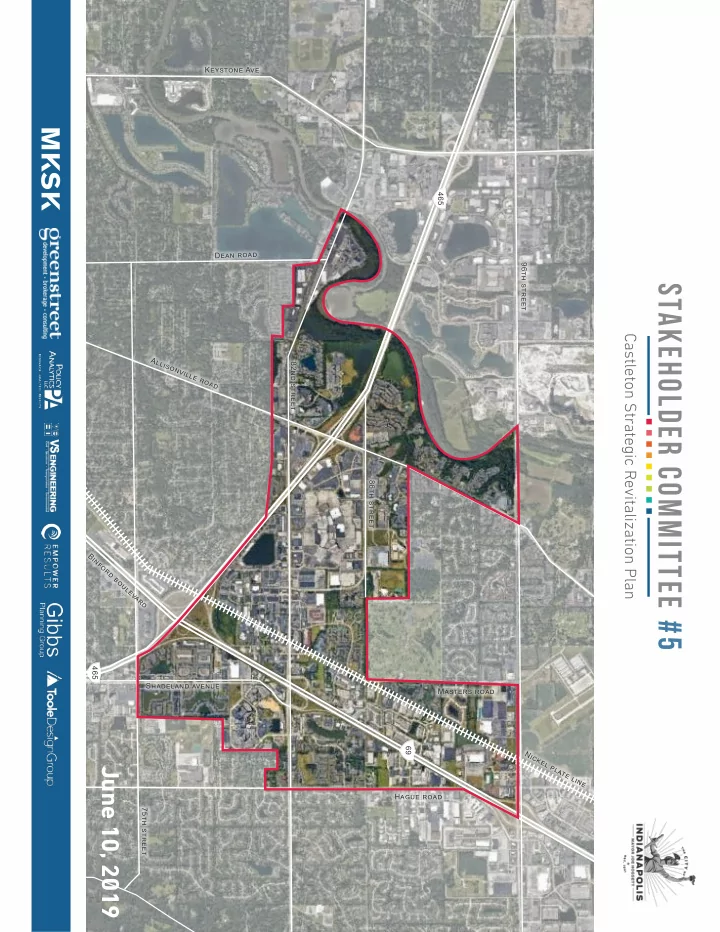

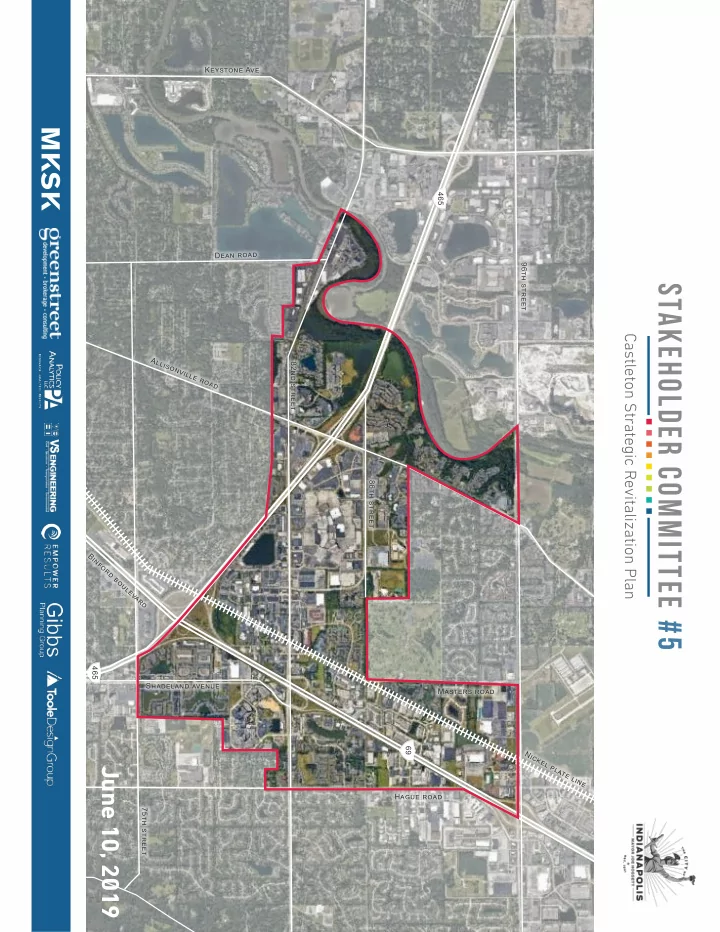

Keystone Ave 465 r o a d D e a n 96th street STAKEHOLDER COMMITTEE #5 Castleton Strategic Revitalization Plan Allisonville road 82nd street 86th street B i n f o r d b o u l e v a r d 465 Shadeland avenue Masters road 69 N i c k e l p June 10, 2019 l a t e l i n e Hague road 75th street

AGENDA 02 03 01 RETAIL TRENDS REVENUE PROJECT STRATEGIES UPDATE 04 05 FEASIBILITY NEXT STEPS 2

01 PROJECT UPDATE

PROJECT REFRESHER 2019 > TASK 1 TASK 2 TASK 3 TASK 4 ANALYSIS + STRATEGIES + LEARNING DOCUMENTATION OPPORTUNITIES RECOMMENDATIONS Understanding Putting it all together Laying the Groundwork Visioning Castleton today » Capturing Input » Targeting Analysis » Testing Strategies and » Understanding the (physical, market, Recommendations » Explaining Projects Site retail etc.) » Framework and » Setting Goals and » Partnerships and » Exploring Case Catalyst Site Ideation Priorities Implementation Studies Steps » Placemaking » Defjning Big Picture » Phasing and Costs » Feasibility Testing Opportunities COMPLETED COMPLETED IN PROGRESS 4

UPCOMING INPUT GROUP & STAKEHOLDER PUBLIC INDIVIDUAL COMMITTEE #6 WORKSHOPS MEETINGS July TBD June 18 » » Review Draft Document 5:30-7pm Heritage More occurring in June TOC/Outline Christian School » Employer, Realtor, » June 20 Initial Developer and Recommendations » 7-8:30pm East 91st Residential Focus Street Christian Church » Priority Areas / Test Groups Our Focus Fits » 16 Individual / Small » » Introduction Discuss Feedback Group Meetings » » Process Discuss Public Workshop » Existing Conditions » Analysis Findings » Testing Opportunities 5

ONGOING INDIVIDUAL & GROUP FEEDBACK » Traffjc, bus service, access and poor circulation are major impediments to development. » As the mall goes, so goes the area. What is Simon’s plan for the mall’s future ? » The area is over-retailed with high vacancy . These block the mall and creates poor impression . » The City needs to do a better job telegraphing fmexibility with zoning and providing development tools . » Nickel Plate Trail is crucial. » Need green housing options in the center of the area. » Create a distinct identity to compete with Fishers & Downtown Indy. 6

SURVEY REMINDER 900+ R E S P O N S E S S O F A R ! RESIDENTS VISITORS EMPLOYERS EMPLOYEES 658 141 24 55 mycastleton.com 7

SURVEY DEMOGRAPHICS 8

EARLY SURVEY FINDINGS TOP ASSETS Highway 23% Connections / Location 17% Retail Options 16% Food Options RESIDENTS VISITORS EMPLOYERS EMPLOYEES Highway Highway 25% 20% Retail Options Food Options 24% 34% Connections / Connections / Location Location Highway 21% Food Options 19% Connections / Services (Hospitals, Services (Hospitals, 17% 17% Location hotels, schools, etc) Castleton Square hotels, schools, etc) 21% Mall 18% Retail Options 15% 11% Retail Options Retail Options Castleton Square 18% Mall 9

EARLY SURVEY FINDINGS TOP ISSUES / CONCERNS Traffjc / Traffjc 19% Patterns Retail Vacancies 19% / Changing Retail Environment Public Safety / 15% Crime RESIDENTS VISITORS EMPLOYERS EMPLOYEES Retail Vacancies Traffjc / Traffjc Traffjc / Traffjc Traffjc / Traffjc 23% 17% 21% 18% / Changing Retail Patterns Patterns Patterns Environment Public Safety / Public Safety / 15% Appeal / Perception 15% 14% Traffjc / Traffjc Crime Crime 15% Patterns Retail Vacancies Retail Vacancies Retail Vacancies 11% / Changing Retail 13% 13% Public Safety / / Changing Retail / Changing Retail 13% Environment Crime Environment Environment Public Safety / 11% Crime Lack of Sidewalks, 11% Crosswalks 10

EARLY SURVEY FINDINGS MISSING RETAIL Grocery 33% Non-Chain / Local 31% Higher End / Upscale 21% Boutiques 13% 11

EARLY SURVEY FINDINGS MISSING RESTAURANT Non-chain / Local 41% Better Quality Ethnic Higher End / Fine Options 16% Brewery Dining / Adult 11% Focused 19% Farm to Table / 14% Healthy 10% 12

EARLY SURVEY FINDINGS MISSING ENTERTAINMENT Park / Green Space 27% Music Venue 22% Family / Kid Outside Activities Friendly 24% 14% Indoor Amusements Sports / Outdoor 12% Rec Trails 10% 22% 13

EARLY SURVEY FINDINGS EMPLOYERS HAVE YOU EVER THOUGHT ABOUT RELOCATING YOUR BUSINESS? NO YES NO ANSWER 68% 14% 18% IF YES, WHY? POOR ROADS, NEED A LARGER DECLINING PROPERTY WOULD PREFER TO SPACE WITH BETTER CONDITIONS & LOW OWN A SPACE PARKING END RETAIL 14

EARLY SURVEY FINDINGS EMPLOYERS WHAT DO YOU FIND ATTRACTIVE ABOUT OTHER COMMERCIAL DISTRICTS THAT IS ABSENT FROM THE CASTLETON AREA? AREAS FOR A FENCED SIDEWALKS. COMMUNICATION IN YARD. BETWEEN COMMUNITY UPGRADED BUILDING ORGANIZATIONS. APPEARANCE, MORE PROFESSIONAL. WALK-ABILITY AND LOCATION. OPTIONS TO SHOP BIKE/WALKING TRAILS. AND EAT LOCAL. GREAT OPPORTUNITY WALK-IN TRAFFIC, ROUND-A-BOUTS. TO BRING UPSCALE ATTRACTIVE SENIOR HOUSING. ENVIRONMENT. DINING OPTIONS. LESS TRAFFIC. AESTHETICS. BETTER MIXED USE INFRASTRUCTURE. RESTAURANTS. 15

EARLY SURVEY FINDINGS TOP IMPACTFUL, Plan for Empty SHORT TERM OUTCOMES 25% Storefronts Litter Clean-Up / 14% Beautifjcation 13% More Green Spaces RESIDENTS VISITORS EMPLOYERS EMPLOYEES Plan for Empty Plan for Empty Litter Clean-Up/ Plan for Empty 23% 22% 21% 19% Storefronts Storefronts Beautifjcation Storefronts Litter Clean-up/ Litter Clean-Up/ Plan for Empty Litter Clean-Up/ 12% 15% 19% 13% Beautifjcation Beautifjcation Storefronts Beautifjcation Roadway 12% 13% 10% More Green Spaces More Green Spaces More Green spaces 11% Connectivity Trail/Pedestrian Trail/Pedestrian 12% 10% Connectivity Connectivity Development of a 10% Brand/Marketing 16

EARLY SURVEY FINDINGS FUTURE WORDS 18% Family Friendly 15% Walkable 14% Welcoming RESIDENTS VISITORS EMPLOYERS EMPLOYEES 18% 15% 20% 16% Family Friendly Family Friendly Welcoming Walkable 14% 15% 14% 14% Walkable Welcoming Family Friendly Family Friendly 13% 12% 14% 12% Welcoming Walkable Bustling Welcoming 12% Modern 17

EARLY SURVEY FINDINGS SUMMARY » Top issues and assets both converge around access/connectivity and retail. This shows that there are opportunities to reposition both. » Respondents are looking for grocery options of difgerent sizes, non-chain restaurants and more diversity in food and restaurant style options. » Desired entertainment options include outdoor activities such as parks, music, trails and family activities . » Business owners, in general, are seeking to stay in Castleton but would like improvements and greater amenities in walking distance. » Short term opportunities include beautifjcation, occupying empty storefronts and adding green space. » The future of Castleton is welcoming and walkable with a focus on family. » There is concern over public safety however we have discovered that to be more of a perception than a realty. 18

REVISED THEMES Integrate pedestrians, cyclists, landscaping, drainage signage and better 82nd as a Place store frontage to give the corridor an identity. Make a complete street. Reconnecting People Improve access and promote places where community comes together. Restoring the Natural Connect people to nature by daylighting drainage waterways and introducing green spaces. Heritage for People Redevelop Castleton’s brand into a signature piece of a revitalization Reclaiming Identity strategy that addresses declining retail and increasing vacancies. The Rail that Divides, Now Plan Nickel Plate Trail connections to surrounding neighborhoods/ centers to act as a catalyst for development. Connects Provide a diversity of activity where people of walks of life can feel safe A Place for All and fjnd something to do. Identify and encourage unique destinations that energize place and make The “IT” Factor people say “I’m going to Castleton for that!” Village Centers, Re-imagine Castleton as a series of walkable villages with a mix of housing, retail, offjce, and amenities. Not Strip Centers 19

REVISED THEMES 20

02 RETAIL TRENDS

TRADE AREA 22

SUPPLY AND DEMAND 23

03 REVENUE STRATEGIES

EXISTING 96TH STREET TIF 25

DEVELOPMENT TYPOLOGIES SINGLE USE Single family Townhome Multifamily Commercial 1 2 3 4 Residential Residential Residential Retail Retail SF 0 Retail SF 0 Retail SF 0 Retail SF 10,000 Restaurant SF 0 Restaurant SF 0 Restaurant SF 0 Restaurant SF 0 Offjce SF 0 Offjce SF 0 Offjce SF 0 Offjce SF 0 Residential SF 10,000 Residential SF 21,000 Residential SF 78,000 Residential SF 0 Total SF 10,000 Total SF 21,000 Total SF 78,000 Total SF 10,000 Residential Units 0 Residential Units 0 Residential Units 70 Residential Units 0 Residential Lots 4 Residential Lots 12 Residential Lots 0 Residential Lots 0 *1acre typical 29

Recommend

More recommend