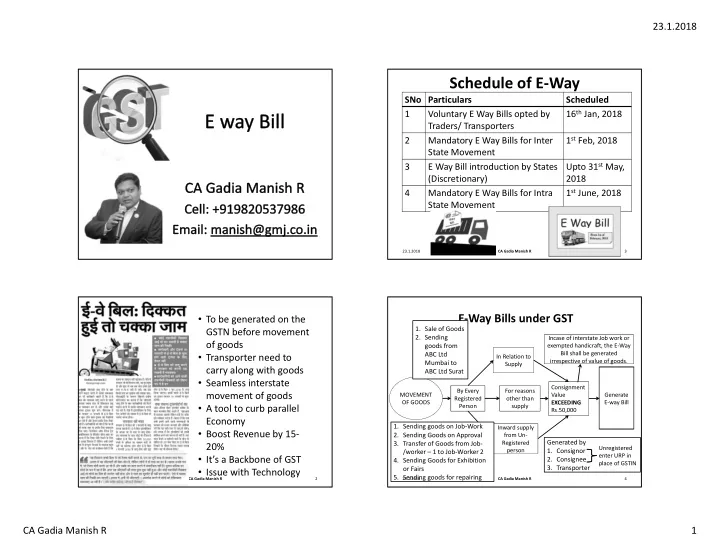

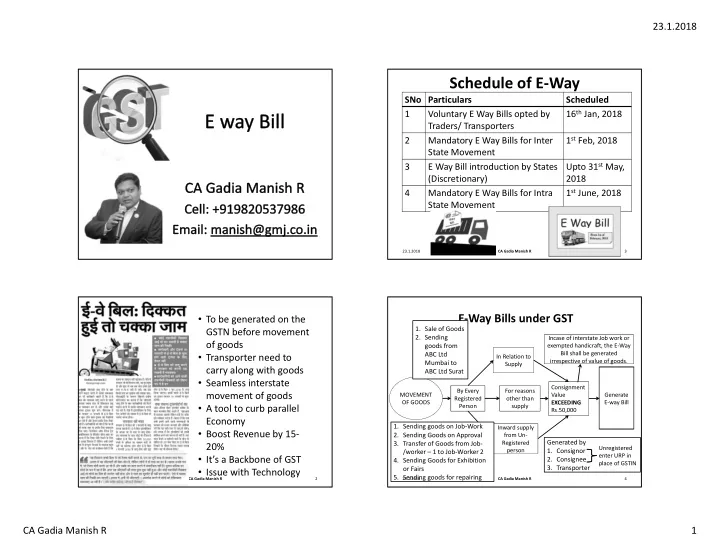

23.1.2018 Schedule of E-Way SNo Particulars Scheduled 16 th Jan, 2018 1 Voluntary E Way Bills opted by Traders/ Transporters 1 st Feb, 2018 2 Mandatory E Way Bills for Inter State Movement Upto 31 st May, 3 E Way Bill introduction by States (Discretionary) 2018 1 st June, 2018 4 Mandatory E Way Bills for Intra State Movement 23.1.2018 CA Gadia Manish R 3 E-Way Bills under GST • To be generated on the 1. Sale of Goods GSTN before movement 2. Sending Incase of interstate Job work or of goods goods from exempted handicraft, the E-Way Bill shall be generated • Transporter need to ABC Ltd In Relation to irrespective of value of goods. p g Mumbai to Supply carry along with goods ABC Ltd Surat • Seamless interstate Consignment By Every For reasons movement of goods MOVEMENT Value Generate Registered other than OF GOODS EXCEEDING E-way Bill • A tool to curb parallel Person supply Rs.50,000 Economy 1. Sending goods on Job-Work Inward supply • Boost Revenue by 15- 2. Sending Goods on Approval from Un- Registered Generated by 3. Transfer of Goods from Job- 20% Unregistered person 1. Consignor /worker – 1 to Job-Worker 2 • It’s a Backbone of GST enter URP in 2. Consignee 4. Sending Goods for Exhibition place of GSTIN 3. Transporter • Issue with Technology or Fairs 5. Sending goods for repairing 23.1.2018 CA Gadia Manish R 2 23.1.2018 CA Gadia Manish R 4 CA Gadia Manish R 1

23.1.2018 Registration For E-Way Bill Create own Registered One E-way Person masters like list of bill . Visit customers, suppliers, products, www.ewaybill.nic.in Transporters, etc. New E-way bill is to be Generated. If Transporter :- If Registered :- If Un-Registered :- Select Enrollment for Sign up by Furnishing Select Enrollment for Transporters and Fill the GSTIN Citizens up Application Form The Registration Form Will be On Submission of For every new Conveyance new E-way For every new Conveyance new E-way Auto Filled, However if this Form a This Tab is not yet required the details can be Transporter-ID Will Active bill is to be generated. bill is to be generated. Modified be generated 23.1.2018 CA Gadia Manish R 5 23.1.2018 CA Gadia Manish R 7 Procedure for Generation of E-Way bills MULTIPLE CONSIGNMENTS in one 1. E-Way Bill may be voluntarily FORM GST EWB – 01 conveyance y generated even in the case where consignment value is less than Generate different E-Way Bills for Consolidate the E-Way bills in Rs.50,000. PART A of the Form each consignment Form GST EWB – 02 Once EWB is generated the 2. Where the movement of goods is caused by an unregistered person , Consignee has to accept the • To be Filled by consignor before E-way he or the transporter may generate E-way EWB by Visiting commencement of movement of an E-Way Bill. bill-2 bill-3 goods. www.ewaybill.nic.in E-way (if in this case, the goods are E-way • EWB generated will serve as basis supplied to registered person the bill-4 bill-1 movement shall be said to be caused for Form GSTR- 1 If the EWB is not accepted by the recipient ). by consignee within 72 Part B of GST EWB – 01 FORM GST EWB-02 hours of generation of If consignor / Consignee can be filled by the does not generate E-way Transporter (Vehicle EWB It will be deemed that E-Way Bill bill then transporter will Number) the EWB has been accepted Consolidated eway bill contains details of different EWBs which are Number generate e-way bill on the E-way Bill can also (EBN) moving towards one direction, and these EWBs will have different basis of information be generated by furnished in Part A of validity periods SMS EWB-01 23.1.2018 CA Gadia Manish R 6 23.1.2018 CA Gadia Manish R 8 CA Gadia Manish R 2

23.1.2018 EWB Not to be made Validity of E-Way bill. E-way Bill is not required to be generated in the following Scenarios:- S No • If the goods transported are Specified in Annexure like DISTANCE VALIDITY PERIOD fruits, vegetable, fish, water, precious stones, jwellery, 1 Less than 100 km One Day House hold items, passenger baggage, etc. 2 For every 100 Km or part One additional • If the goods are being transported through a thereof thereafter day Non-motorized conveyance NOTE: “Relevant Date” means the date on which the e-way bill • If the goods are being transported from the port, airport, has been generated and the period of validity shall be counted air cargo complex and Land customs station to an Inland from the time at which the e-way bill was generated. Container Depot or a Container freight station for Commissioner may, by Notification extend the validity period of clearance by Customs e-way bill for certain categories of goods. • If the movement of goods is within such areas as notified In exceptional cases, the goods cannot be transported with the under respective State GST Rules. time, the transporter may generate another e-way bill. 23.1.2018 CA Gadia Manish R 9 23.1.2018 CA Gadia Manish R 11 Cancellation of E-Way Edit? Documents and Devices Bills Delete? 1. The person in charge of conveyance shall carry: (i) the invoice, bill of supply or delivery challan, as the case may When the goods are When the goods are not being transported be; and not being transported. as per the Information (ii) copy of e-way bill or the e-way number, either physically or in E-Way bill. mapped to a Radio Frequency Identification Device (RFID). 2. The tax invoice issued by the registered person is to be uploaded The E-way bill must be canceled on common portal using FORM GST INV- 01 . The Invoice electronically within 24 hours of the Reference Number received on upload of tax invoice shall be generation of E-way bill. produced for verification by the proper officer. • Invoice Reference Number shall be valid for 30 days from the The E-Way Bill cannot be cancelled if it has been date of uploading. verified in transit 23.1.2018 CA Gadia Manish R 12 CA Gadia Manish R 3

23.1.2018 Scenario I Verification of documents and conveyances 1. Can be carried out by Commissioner or an Un-Registered Un-Registered officer as appointed by him on this behalf to Person - 1 Person - 2 intercept any conveyance. 2. RFID readers shall be installed at the place of Since all the On generation of Consignments taken EWB he may also verification. together are above generate a Rs.50,000/- The consolidated EWB Transporter has to generate an EWB 3. Physical Verification of conveyances He may generate this on the basis of Invoice/Bill of supply/Deliver Challan as the case maybe 23.1.2018 CA Gadia Manish R 13 23.1.2018 CA Gadia Manish R 16 Scenario II Inspection and verification of Goods < 10 Kms Summary Repot Final Repot Inspection of Sending Goods from/or to 24 3 Part A of FORM Part B of FORM goods in transit hrs days Warehouse/Place of business GST EWB – 03 GST EWB - 03 of Consignor/Consignee to/from the transporter for Note: further transportation within 1. Physical Verification done during transit at one place in the the state state or in any other State, no further physical verification can be carried out in the state unless in case where evasion of tax is However details have to be No need to furnish the suspected. details of conveyance in furnished in Part A of EWB-01 2. Where the goods are intercepted or detained for a period Part B of Form EWB-01 by the registered Person and exceeding 30 minutes, the transporter may upload information details in Part – B may be in FORM GST EWB - 04 filled by the Transporter. 23.1.2018 CA Gadia Manish R 14 23.1.2018 CA Gadia Manish R 17 CA Gadia Manish R 4

23.1.2018 Scenario V Scenario III Shifting from Mumbai to Allahabad. 1,315 Kms Hired a GTA for Transporting Validity of EWB – 14 all household Items. Days Whether EWB has to be generated? New EWB has to be generated by No. Used personal the transporter by filling in details in Part B of EWB-01.. Whether this and household Due to Strike will be from Maharashtra to Tamil effects are not Transport Nadu or Only Karnataka to Tamil hindered for required to Nadu? 10 days and generate an EWB. EWB Expired 23.1.2018 CA Gadia Manish R 18 23.1.2018 CA Gadia Manish R 20 Scenario IV Scenario VI Handed over Courier to Consignment I:- Consignment II:- Consignment II:- Courier Agency Sending goods on Household furniture. Sale of certain Job-work Rs. Goods Rs. 28,000/- 28,000/- Will accumulate all Couriers and Send it through GTA – Air Now in this case the Courier Agency became the Consignor and Courier Agency will have to issue an EWB EWB has to be generated 23.1.2018 CA Gadia Manish R 19 23.1.2018 CA Gadia Manish R 21 CA Gadia Manish R 5

23.1.2018 Scenario VII Bill to Ship to Same legal entity Cost of Machinery :- Rs.1,00,000/- Lease Rent Recoverable :- Rs.25,000/- Transaction Value = Rs.25,000/- Bill to Ship to Whether E-way Bill has to be generated? E-way Bill will have to be generated Consignor 23.1.2018 CA Gadia Manish R 22 23.1.2018 CA Gadia Manish R 24 Bill to Ship to Different legal entity Multiple Premises Two Bill to Ship to • All three are in same state? Can create • All three are in different state? multiple sub • Transporter will carry both the group and give invoice and Eway bill different rights Consignor 23.1.2018 CA Gadia Manish R 23 23.1.2018 CA Gadia Manish R 25 CA Gadia Manish R 6

Recommend

More recommend