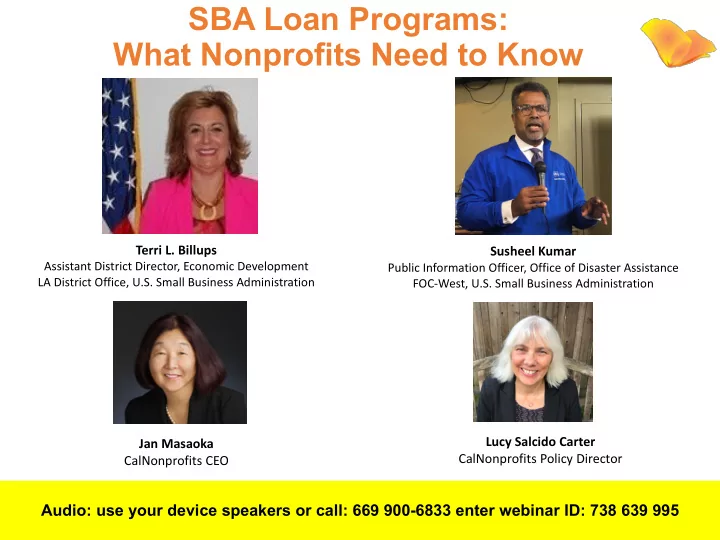

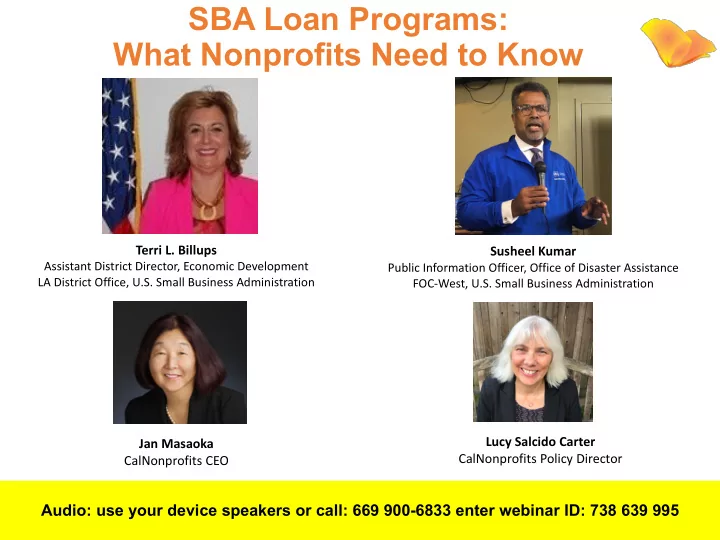

SBA Loan Programs: What Nonprofits Need to Know Terri L. Billups Susheel Kumar Assistant District Director, Economic Development Public Information Officer, Office of Disaster Assistance LA District Office, U.S. Small Business Administration FOC-West, U.S. Small Business Administration Lucy Salcido Carter Jan Masaoka CalNonprofits Policy Director CalNonprofits CEO Audio: use your device speakers or call: 669 900-6833 enter webinar ID: 738 639 995

SBA Loan Programs EIDL PPP Economic Injury Paycheck Protection Disaster Loans / Program / Advance Program 7A loans For each program: • What benefits does it provide? • Who is eligible? • How do nonprofits apply? • What information does the application require? Q and A Additional Resources

Paycheck Protection Plan Source: https://www.sba.gov/page/coronavirus-covid-19-small-business-guidance-loan-resources

SBA’s Economic Injury Disaster Loan Terms • Personal Guarantees : Maximum Loan Amount : Statutory Maximum • Under $200,000.00 None required of $2 million . • Over $200,000.00 Required • 3.75 percent for small businesses and • 2.75 percent for nonprofit organizations Fixed interest rates for this disaster are • Maximum amortization for 30 years Terms: with terms up to 30 years. Eligibility for these working capital loans are • To check size standards, visit based on the definition of size (must be a small https://www.sba.gov/document/support--table-size-standards. business) and type of business & it’s financial resources. • Funding Directly from the U.S. Treasury Proceeds Office of Disaster Assistance

SBA’s Working Capital Loans Apply: www.covid19relief.sba.gov •NO Real estate collateral for under $500,000.00 Collateral •General UCC-1 filing on business assets Collateral There is No cost to apply, • $100 UCC -1 fees NO points, NO Closing Costs, NO Prepayment Penalty 1st payment due in 12 months. There is no obligation to take the loan if offered. Applicants can have an existing SBA Disaster Loan and still qualify for an EIDL for this disaster, but the loans cannot be consolidated.

These resources Additional Resources will be emailed to you later General Information about COVID-19 Federal Loan Programs U.S. Treasury Department: https://home.treasury.gov/ U.S. Small Business Administration https://www.sba.gov/page/coronavirus-covid-19-small-business-guidance-loan-resources#section-header-0 National Council of Nonprofits – Loans Available through the CARES Act https://www.councilofnonprofits.org/sites/default/files/documents/cares-act-loan-options-for-nonprofits.pdf US Chamber of Commerce – Coronavirus Emergency Loans Guide for Small Businesses and Nonprofits https://www.uschamberfoundation.org/sites/default/files/C3_COVID_EmergencyLoanGuide.pdf Paycheck Protection Program (PPP) Information General information https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program-ppp PPP Application Form https://www.sba.gov/sites/default/files/2020-04/PPP%20Borrower%20Application%20Form.pdf Economic Injury Disaster Loan (EIDL) Advance Program Information https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/economic-injury-disaster-loan-emergency-advance

We're glad you could join us today! For additional questions and concerns on policies for nonprofits during the COVID-19 crisis, please email us at COVID19@calnonprofits.org Thank you Susheel, Terri, and SBA! Jan Masaoka, CEO CalNonprofits Lucy Salcido Carter, Public Policy Director CalNonprofits

Recommend

More recommend