Q 1 2 0 2 0 - I n v e s t o r P r e s e n t a t i o n

Certain statements contained in this presentation regarding Genesis Metals Corp. and its activities constitute “forward - looking statements“. All statements that are not historical facts, including without limitation statements regarding future estimates, plans, objectives, assumptions or expectations of future performance are “forward - looking statements“. We caution you that such “forward - looking statements” involve known and unknown risks and uncertainties that could cause actual results and future events to differ materially from those anticipated in such statements. Such risks and uncertainties include fluctuations in metal prices, unpredictable results of exploration, uncertainties inherent in the estimation of mineral resources and reserves, fluctuations in the costs of goods and services, problems associated with exploration and mining operations, changes in legal, social or political conditions in the jurisdictions where the company operates, lack of appropriate funding and other risk factors. There can be no assurance that such “forward -looking FORWARD statements” will prove to be accurate. Potential investors should conduct their own investigation as to the suitability of investing in securities of the company. Genesis Metals Corp. undertakes no LOOKING obligation to update any “forward - looking statements”. We seek Safe Harbour. STATEMENTS Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. The CIM definitions were followed for the classification of Indicated and Inferred Mineral Resources. The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated Mineral Resource and it is uncertain if further exploration will result in upgrading them to an Indicated Mineral Resource category. 2 TSX.V: GIS

HIGHLIGHTS Member of the Discovery Group of Companies Quebec – Top tier Mining Jurisdiction HIGHLIGHTS Current NI 43-101 Resource as of February 2019 Potential for new high-grade discoveries on 275km 2 Chevrier Project Chevrier Gold Deposits are open for expansion with high-grade areas not systematically targeted to date 3 TSX.V: GIS

MANAGEMENT AND DIRECTORS • Former Director of Northern Empire Resources acquired by Coeur Mining; Former ADRIAN FLEMING, P.GEO CEO of Underworld Resources, acquired by Kinross Gold for $138M in June 2010 • Former Exploration Manager for Placer Dome in Sydney, VP of Exploration for CHAIRMAN and DIRECTOR Golden Star and Miramar Mining • Professional economic geologist with +25 years of international experience DAVID TERRY, PhD., P. GEO • Key roles in successful discovery/acquisition, exploration and development of a number of precious and base metal deposits, primarily in North and South America CEO, PRESIDENT and DIRECTOR • Director of Great Bear Resources • Former Director of Northern Empire Resources acquired by Coeur Mining for JEFF SUNDAR $117M in October 2018 • Former Director and VP of Underworld Resources, acquired by Kinross Gold EXECUTIVE DIRECTOR for $138M in June 2010 • Geologist with over 20 years of experience in exploration and development JOHN FLOREK, P.GEO • Former Sr. Geologist with Barrick Gold at Hemlo Mines and Placer Dome in Red DIRECTOR Lake ROBERT SCOTT, CPA, CA, • Chief Financial Officer of Great Bear Resources, CFO of Riverside Resources Inc. • Over 10 years of experience with TSX.V listed issuers, serving in officer and director CFA capacities. INDEPENDENT DIRECTOR KEENAN HOHOL, J.D. • Former General Counsel of Pan American Silver Corp and BHP Billiton • Over 20 years of international legal, commercial advisory and mgmt. experience INDEPENDENT DIRECTOR STEVE WILLIAMS MBA,P.Eng • Current VP of Bluestone Resources DIRECTOR • Former Director of Investment Banking for Canaccord Capital 4 TSX.V: GIS

STRATEGIC ADVISORS • Former Director of Kaminak Gold acquired by Goldcorp for $500 Million JOHN ROBINS, P. GEO • Former Director of Northern Empire Resources acquired by Coeur Mining STRATEGIC ADVISOR • Strategic Advisor to Great Bear Resources • Former Director of Kaminak Gold acquired by Goldcorp for $500 Million JIM PATERSON • Former Director of Northern Empire Resources acquired by Coeur Mining STRATEGIC ADVISOR • Strategic Advisor to Great Bear Resources ROB CARPENTER, Ph.D. • Former CEO and co-founder of Kaminak Gold 2005 to 2013 STRATEGIC ADVISOR • Director of White Gold Corp ANDREW RAMCHARAN, Ph.D. • Former IAMGOLD Executive focused on M&A • STRATEGIC ADVISOR Former Managing Director of Project Evaluation at Sprott Inc • Former VP Exploration of NexGen Energy 2014- 2018 • Co-recipient of the PDAC Bill Dennis Award 2018 for the discovery and GARRETT AINSWORTH development of the Arrow Deposit. STRATEGIC ADVISOR • Co-recipient of the AME BC Colin Spence Award in 2013. For the discovery of the Patterson Lake South Project ÉRIC LEMIEUX, MSC, P. GEO • Former mining analyst at Laurentian Bank Securities in Montreal • Former technical advisor with PearTree Securities STRATEGIC ADVISOR 5 TSX.V: GIS

Shareh Sh ehol olders ders CORPORATE STRUCTURE Delbrook Retail 50% Eric Sprott TSX.V – GIS Symbol OTCQB – GGISF US Global SIDEX/SDBJ/ Shares Outstanding 41,500,140 FTQ Management Gold 2000 16% Fully Diluted 57,129,572 Stock Options 4,045,000 Major Shareholders Eric Sprott Warrants 11,584,432 Gold 2000 Delbrook Capital US Global Investors Management and SIDEX/SDBJ/FTQ 16% Advisors GIS Management and Consultants Retail 6 TSX.V: GIS

ABITIBI GREENSTONE BELT OVER 170 Moz OF GOLD PRODUCTION 7 TSX.V: GIS

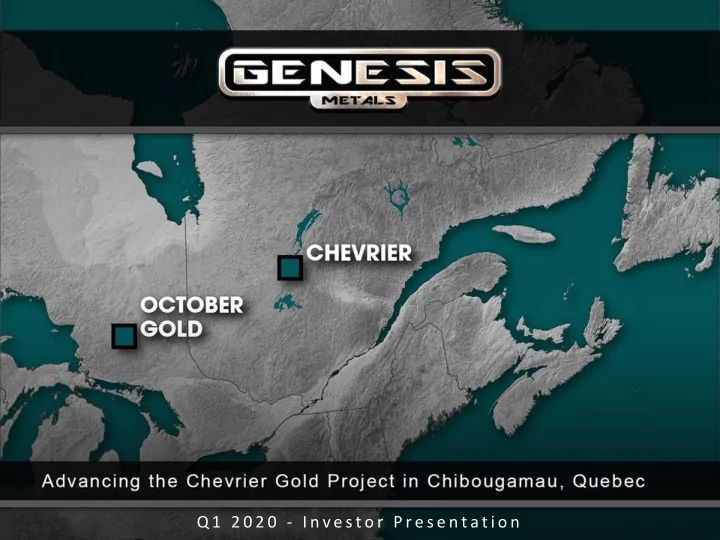

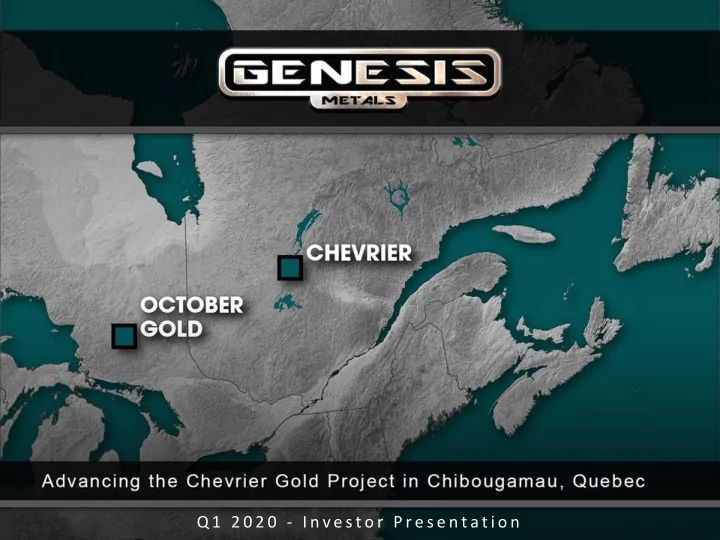

HIGHLIGHTS 35km SW of Chibougamau, Quebec with excellent infrastructure Covers 15km of gold endowed Fancamp Deformation Zone CHEVRIER Chevrier Deposit Indicated Resource: 395,000 ounces of gold averaging 1.45 g/t Au at PROJECT Chevrier Deposit Inferred Resource: 297,000 ounces of gold averaging 1.33 g/t Au Opportunity to expand tonnage and GRADE of existing Resources Opportunity to identify new high-grade discoveries 8 TSX.V: GIS

CHEVRIER GOLD DEPOSIT LOCATION EXCELLENT ACCESS AND INFRASTRUCTURE: 1)Power-Line 2)Airport 3)Regional road 4)Main forestry road 9 TSX.V: GIS

CHIBOUGAMAU MINING DISTRICT OVER 6.7 MILLION OUNCES OF HISTORICAL GOLD PRODUCTION Property expanded to 275 sq km 10 TSX.V: GIS

CHEVRIER Current NI 43-101 Mineral Resource Estimate Main Zone Open Pit Resources Containe tained d Grad ade e Cut-off ff Catego egory Tonn nnes es Assumptions (US$) (oz z Au) (g/t Au) (g/t Au) Price of gold $1400 Indica dicated ted 6,602,000 1.39 0.50 295,000 CAD:USD Exchange rate 1.25 Open Pit Mining Cost (per ton) $2.20 Processing Cost (per ton) $12.00 Infer ferred red 1.294,000 1.35 0.50 56,000 G&A Cost (per ton) $2.50 Mill Recovery 95% Pit Slope (degrees) 50 Containe ntained d Grade ade Cut-off ff (g/t Catego egory Tonn nnes es ( oz Au) (g/t Au) Au) Main Zone Underground Indic dicated ted 1,890,000 1.64 0.95 100,000 Resources Inferr nferred ed 4,622,000 1.33 0.95 198,000 Containe tained d Grad ade e Cut-off ff Categor egory Tonnes es ( oz Au) (g/t Au) (g/t Au) East Zone Resources Open en Pit, Infer ferred red 311,000 1.53 0.50 15,000 Under dergroun ound, d, 732,000 1.19 0.95 28,000 Infer ferred red TSX.V: GIS

Highlights from MAIN ZONE 2017 Drilling Phase 1 • 2.94 g/t Au Over 58.70 m in hole GM-17-09 (from 74.6 meters downhole) • 1.93 g/t Au over 43 m in hole GM-17-15 (from 49.6 meters downhole) • 1.89 g/t Au over 38.4 in hole GM-17-20 (from 95 meters downhole) • 1.23 g/t Au over 24.45 in hole GM-17-22 (from 19.5 meters downhole) • 1.06 g/t Au over 27.55 in hole GM-17-16 (from 112 meters downhole) Phase 2 • 8.73 g/t Au over 21.35 m in hole GM-17-42 (from 107 meters downhole) • 5.06 g/t Au over 8.45 m in hole GM-17-41 (from 108.2 meters downhole) • 4.47 g/t Au over 12.45 m in hole GM-17-46 (from 19.35 meters downhole) • 4.26 g/t Au over 19.40 m in hole GM-17-48 (from 67.3 meters downhole) • 3.59 g/t Au over 22.60 m in hole GM-17-42 (from 13.4 meters downhole) • 1.04 g/t Au over 50.05 m in hole GM-17-44 (from 109 meters downhole) (Core lengths are shown. True length is calculated to be 65% of core lengths) 12 TSX.V: GIS

Plan view showing mineralized zones Plan View: Main Zone Block Model Oblique Plan View: Main Zone A X 1 B1 X A1 B C 13 TSX.V: GIS

CHEVRIER MAIN ZONE LONG SECTION (Main A1 vein – Block Model) X X 1 400 m 200 m 0 m Open to depth th -200 m 21 0 200 m 14 TSX.V: GIS

Recommend

More recommend