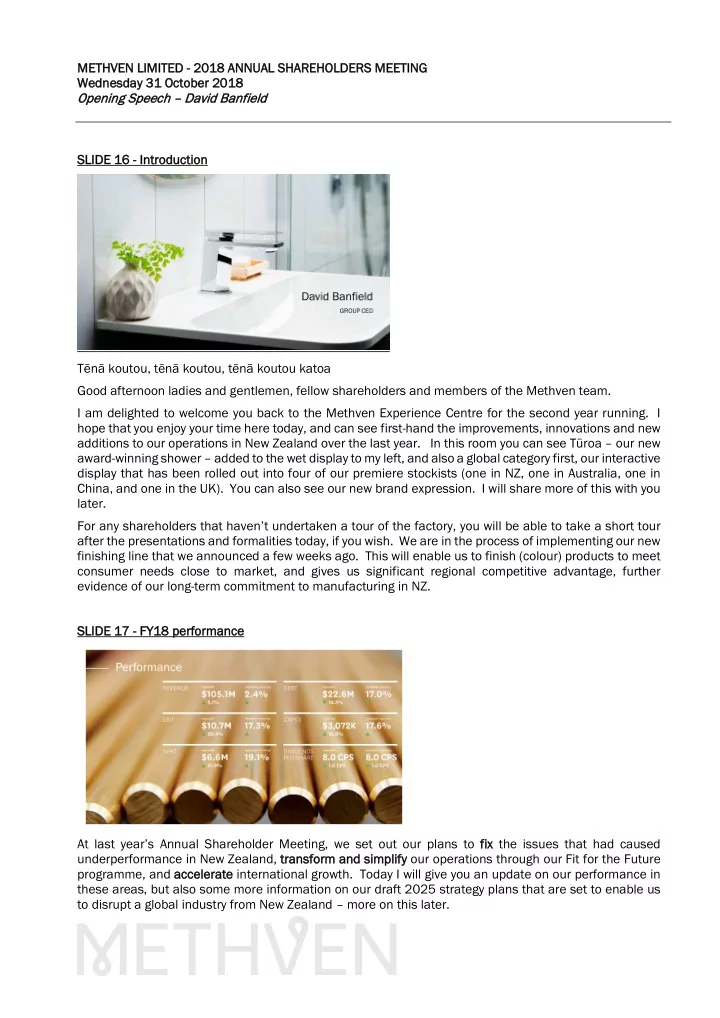

METHVE VEN L LIMITED - 201 018 ANNUAL SH SHARE REHOLDERS M RS MEETING Wedn dnesday ay 31 O 31 Oct ctober er 2 2018 018 Opening S Speech – Dav avid B Ban anfi field SL SLIDE 16 6 - Introd oduction on Tēnā koutou, tēnā koutou, tēnā koutou katoa Good afternoon ladies and g entlemen, fellow shareholders and members of the Methven team. I am delighted to welcome you back to the Methven Experience Centre for the second year running. I hope that you enjoy your time here today , and can see first- hand the improvements, innovations and new additions to our operations in New Zealand over the last year. I n this room you can see Tūroa – our new award-winning shower – added to the wet display to my left , and also a global category first , our interactive display that has been rolled out into four of our premiere stockists (one in NZ, one in Australia , one in China , and one in the UK). You can also see our new brand expression. I will share more of this with you later. For any shareholders that haven’t undertaken a tour of the factory , you will be able to take a short tour after the presentations and formalities today , if you wish. We are in the process of implementing our new finishing line that we announced a few weeks ago . This will enable us to finish (colour) products to meet consumer needs close to market, and gives us significant regional competitive advantage, f urther evidence of our long-term commitment to manufacturing in NZ. SL SLIDE 17 17 - FY1 Y18 perfor ormance At last year’s Annual Shareholder Meeting , we set out our plans to fix ix the issues that had caused u nderperformance in New Zealand, transform and s simpli lify our operations through our Fit for the Future programme , and accelerate international growth. Today I will give you an update on our performance in these areas , but also some more information on our draft 2025 strategy plans that are set to enable us to disrupt a global industry from New Zealand – more on this later.

| PAGE 2 I now move on to the results. Today, for the purpose of comparability , I will mainly focus on the constant currency results that take local results and translate them at a consistent rate across both years but will also cover reported performance. I am encouraged to report that for the third time in four years , we delivered results in line with our guidance , and also results that show the impact that a focus on profitable international growth can have on our performance. Earnings before interest and tax (“EBIT”) finished at $10.7m, a 20.4% increase on the same period FY17 and up 17.3% in constant currency ( this was +15.4% reported and +12.6% in constant currency, excluding the positive impact of prior period adjustments). Revenue finished the year at $105.1m, a 5.1% increase on the same period FY17 and a 2.4% increase in constant currency. Net profit after tax (“NPAT”) finished at $6.6m, up 21.9% on FY17 and up 19.1% in constant currency (+14.4% reported and +11.9% in constant currency, excluding the positive impact of prior period adjustments), slightly improved verses guidance. We experienced s trong momentum in international sales, with revenue improved by 11.6% and EBIT contribution up 54.1%. EBIT margins improved in all international markets due to consumer -led innovation, foc used cost- out activity, and better operating leverage. Market share gains were achieved in all markets outside New Zealand. More detail on this later. We s saw aw g goo ood m management of of d debt a and c cash wit with Net debt decreased by $4.5m or 17.0%, and cashflow from operating activities improved by $9.4m due to improved inventory control, and SKU reduction activity supporting organisational simplification. Our final dividend was 4 cents per share , bringing the total to 8 cents for the whole year , an increase of 33% on the 2017 final dividend. The dividend was partially imputed. SL SLIDE 18 18 – Key p prior orities a and foc ocus We endeavour to give you transparency about our goals and also performance against those goals using a simple slider mechanism colour coded green , amber, red. As you can see from the chart on the screen , we achieved four of our goals , partially achieved three , and failed to achieve one. I will focus on four areas today , three relating to our ongoing business and one relating to global disruption as we look to fix ix u nderperformance in New Zealand, transform and s simpli lify y our operations through Fit 4 the Future , and accel cceler erate international growth , with a special focus on China. Finally , I will share the final element which will enable Methven to dis isrupt the global plumbing industry from New Zealand and at the same time ,

| PAGE 3 significantly reduce our long- term working capital needs. SLIDE 19 – New SL ew Ze Zealand nd I start with our immediate goal to fix ix our sales in the N ew Zealand market. The New Zealand market finished the year with revenue - 7.2% versus the prior period and EBIT +$97k. Tapware underperformance and normalisation of demand in the Canterbury region caused this sales decline. The market showed signs that it was stabilising, with sales broadly flat year -on-year in the last quarter of the year. EBIT impact was minimised due to the efficiency initiatives previously disclosed. There has been a huge focus on delivering consumer- relevant tapware NPD . This NPD is in the process of being rolled out to the market in FY19, but includes Tūroa (showers, taps and accessories ) , a total revamp of our Satinjet range, new Nefa valving, new colour/finishes and solutions utilising our chamber that will be operational by January , and finally , most exciting of all , our new tapware platform that will launch in May/June , delivering 3 times as many products for the same investment. SLIDE 20 SL 20 – Fit 4 4 t the F Future p programme p progress Our ongoing work to transform and simplify our core operations though our Fit 4 the Future programme continues at pace. The plan is targeted to deliver a 300-basis point improvement in margin, reduce fixed costs by $3 million per year (to be re - invested in international brand building promoting sales growth), and reduce the

| PAGE 4 revenue needed to break even by $1.0 million per month. In this perio d, we have seen strong progress, with 73% of efficiency programmes and 82% of profitability programmes on target. In-sourcing activity into our own factories is progressing well , with a more significant increase planned throughout FY19. We have simplified the business further, reducing our finished goods SKU count by 33% and freeing up c ash in the process. In addition, we have digitised core operational processes, delivering scalable solutions that support our future growth ambitions while also delivering enhanced customer service. As a component of our long-term commitment to premium manufacturing capability in New Zealand. You will be able to see where our colour chamber will be homed on the tour today. The Fit 4 the Future plan will deliver an annualised gross benefit of $1.6 million before re- investment in new initiatives in FY19, and is on track to deliver to our expectations. SL SLIDE 21 21 – Accelerating i internation onal p perfor ormance Accelerating international revenue and earnings is crucial to our long-term performance , and we are extremely encouraged by our performance , with us growing EBIT contribution and Methven market share in every market outside New Zealand. Total international sales increased by 12% and international earnings by 54% as our focus on profitable international growth delivered. In particular , our Methven-branded growth of nearly 13% in Australia and 37% growth in the UK , showed the relevance of innovation designed and manufactured in New Zealand to i nternational markets. SL SLIDE 22 22 – Headlin ines - Au Australia Australia earnings increased by 32.9% over this period as we achieved better operating leverage and margin from sales growth flowed through. We recorded revenue and market share growth . Sales increased 3.7% (A$1.4 million) over the period due to range extensions and contract wins. Methven-

| PAGE 5 b randed sales increased by 12.7%, highlighting the relevance of our innovation to the market. Second half growth slightly lagged behind our expectations as new product launches were pushed into FY19. SL SLIDE 23 23 – Headlin ines - UK UK The UK team achieved total revenue growth of 9%, just below the double-digit target , and EBIT by 31.0% as volume margin benefits flowed through. Methven- branded sales increased by 37%, highlighting the relevance of our innovation to the market. Gross margin was negatively impacted by GBP/USD exchange rate over the period, though is forecast to recover in FY19. We continue to be recognised by the industry for service and innovation. Our new UK brand ambassador , George Clarke, is high profile , is totally engaged in the magic we create in our products , and is our biggest advocate – this sets us up well for the future. SL SLIDE 24 24 – Foc ocus on on C China I now move on to China. Many of you have asked for more information on our strategy and plans for China and the broader Asia markets . I am pleased to share with you today some of our results, our strategy and go -to- market model and as importantly , the work being done now to sow the seeds for the next ten years. Within China and Asia, we have adopted a four -stage model. Stage one – Market study (trade and consumer). Stage two – Partner appointment Stage three – Business start- up, and finally Stage four – Ready to Grow (where we feel that we have the optimum conditions for long -term profitable growth).

Recommend

More recommend