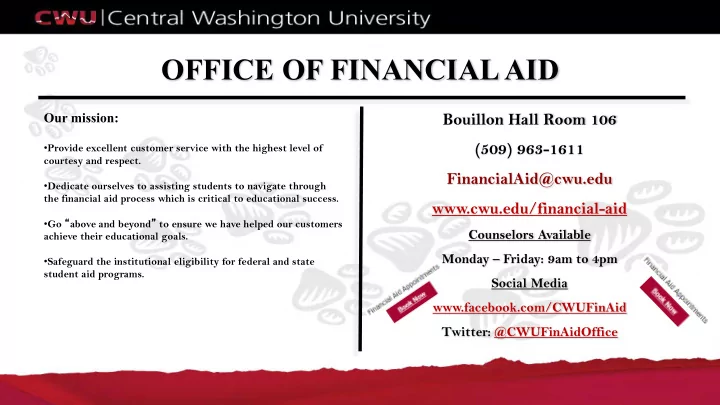

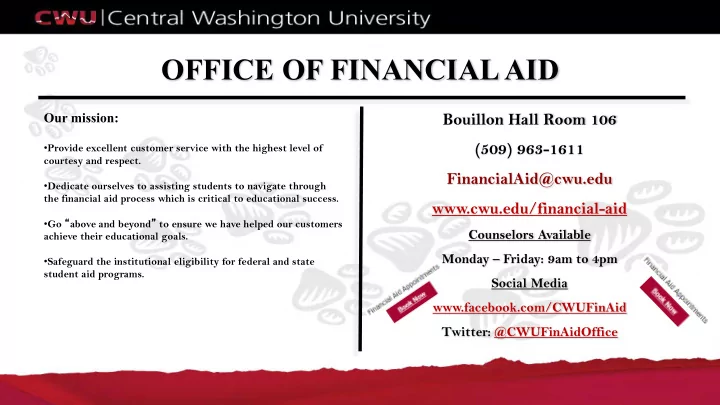

OFFICE OF FINANCIAL AID Our mission: Bouillon Hall Room 106 (509) 963-1611 • Provide excellent customer service with the highest level of courtesy and respect. FinancialAid@cwu.edu • Dedicate ourselves to assisting students to navigate through the financial aid process which is critical to educational success. www.cwu.edu/financial-aid • Go “ above and beyond ” to ensure we have helped our customers Counselors Available achieve their educational goals. Monday – Friday: 9am to 4pm • Safeguard the institutional eligibility for federal and state student aid programs. Social Media www.facebook.com/CWUFinAid Twitter: @CWUFinAidOffice

What is Financial Aid? Any Money you get to pay for your charges and expenses while attending CWU.

What Makes Up Financial Aid Gift Aid (does not have to be paid back) • Tuition Awards • Grants • Scholarships Self-Help and Third Party Support (award is either earned through employment or must be paid back after graduation) • Work Study • Loans (Sub, Unsub, PLUS) • Private loans-bank/credit union • Outside Assistance (GI Bill/ Veterans / Outside Organization)

2019-2020 Federal Loans Subsidized Unsubsidized - 4.53% Interest Rate - 4.53% Interest Rate - Repayment begins 6 months after graduation or - Repayment begins 6 months after graduation or drop below 6 credits drop below 6 credits - Interest begins 6 months after graduation or drop - Interest begins as soon as it’s disbursed below 6 credits Aggregate Limits Dependent Students Independent Students 0 – 45 Credits Completed: $9,500 0 – 45 Credits Completed: $5,500 46 – 90 Credits Completed: $6,500 46 – 90 Credits Completed: $10,500 91 – + Credits Completed: $7,500 91 – + Credits Completed: $12,500 $31,000 Total Undergraduate Limits $57,500 Total Undergraduate Limits

What can Your Financial Aid Pay for? Cost of Attendance….If you’ve completed your Authorization to Pay Form and accept everything offered to you, Financial Aid can be used to pay for any charges on your account and every day living expenses. Tuition & S&A Fee (In State / Out of State) Fees (Mandatory) Housing / Food (Room and Board) Books / Supplies (From the bookstore / Online / Store) Transportation (Car Insurance / Gas) Misc. Living Expenses (Personal Hygiene Products / Clothes)

Loan Reality Check First Year: $3,500 Subsidized / $2,000 Unsubsidized Loan Sophomore Year: $4,500 Subsidized / $2,000 Unsubsidized Loan Junior Year: $5,500 Subsidized / $2,000 Unsubsidized Loan Senior Year: $5,500 Subsidized / $2,000 Unsubsidized Loan Total: $27,000 Repayment Plan Calculation of: AGI: $40,000, Family Size = 1 First Monthly Last Monthly Total Amount Interest Repayment Plan Repayment Period Payment Payment Paid Accured Standard $288 $288 $34,524 $7,524 120 Months / 10 Years Income-Based Repayment $272 $288 $34,639 $7,639 122 Months / 10+ Years Graduated $163 $489 $36,471 $9,471 120 Months / 10 Years Revised Pay as you Earn $182 $374 $37,259 $10,259 141 Months / ~12 Years Pay As you Earn $182 $288 $37,474 $10,474 149 Months / 12.5 Years IBR for New Borrowers $182 $288 $37,474 $10,474 149 Months / 12.5 Years Income-Contingent Repayment $214 $251 $37,858 $10,858 164 Months / 13.6 Years

2019-2020 Cost of Attendance for the Year Tuition (10-18 credits per quarter for 3 quarters) ($6,318 Resident or $21,999 Non-Resident) Fees ($1,955) Housing / Food ($12,637) ($10,926 - $16,580) Books / Supplies (Budgeted at $900) Transportation (Budgeted at $1,170) Misc. Living Expenses (Budgeted at $1,752) TOTAL: $24,732 – Resident TOTAL: $40,413 – Non-Resident

Why Do You Still Owe Money? Maybe you didn’t do your Authorization to pay? Maybe you live on campus and your financial aid is disbursing equally each quarter but your charges for housing are not equal each quarter

Refunds Refunds are given to students when they accept more financial aid than what is charged. Refunds can be used to pay for living expenses while attending college BUT…you can also utilize your refund to pay back your loan or help determine how much is actually needed for future quarters

How to Maximize the Funds you Get If you live on campus make sure to request we adjust your Financial Aid disbursements to match your actual cost of attendance. Your Financial Aid is for you to use towards living expenses BUT that doesn’t mean just because you have a refund you should go wild and crazy….save any refund you get so that you won’t be in a situation where you can’t afford life. Get a Job on campus – you can walk so you won’t have to spend extra money on gas and even $100 a month could help reduce your debt.

Satisfactory Academic Progress Federal Aid Requirements 1. Cumulative Credit Completion Rate (PACE) 2. Minimum Grade Point Average (GPA) 3. Maximum Time Frame Requirement 4. CWU Academic Standing Requirement State Aid Requirements 1. Cumulative Credit Completion Rate 2. Minimum Grade Point Average (GPA) 3. Maximum Time Frame Requirement 4. CWU Academic Standing Requirement Institutional Aid Requirements 1. CWU Academic Standing Requirement

Satisfactory Academic Progress: PACE

Satisfactory Academic Progress: Maximum Time Frame

Satisfactory Academic Progress: Minimum Cumulative GPA

Ways to Finish with Less Debt Budget and don’t accept more than you need

Important Time Frames and Deadlines - Tuition and Fees due 5 th day of the quarter - Financial Aid Refund 10 th day of the quarter - Payment Plan Enrollment 5 – 10 th day of quarter - Unpaid Tuition Late Fees 11 th and 30 th day of quarter

Important Time Frames and Deadlines FAFSA / WASFA - Priority Deadline : October 1 – February 1 Scholarship Central - Open : October 1 – February 1 Verification Deadline - Submitted by : April 1 SAP Petition Deadline - 1 st day of the quarter Summer Financial Aid Application - May 1 st

Enrollment Requirements Loans: At least ½ Time (6 Credits) Grants: 12 + Credits = Full Time / Full Award 9 – 11 Credits = ¾ Time / 75% Award 6 – 8 Credits = ½ Time / 50% Award 1 – 5 Credits = Less than ½ Time / 25% - 0% Award (depending)

Scholarships www.cwu.edu/scholarships Apply to over 320 CWU scholarships Outside scholarship listings Scholarship Central Search Scholarships Washington State residents Out-of-state students Washington State residents Non-Resident

Facebook / Twitter / CWU Mobile Facebook: CWU Financial Aid - CWUFinAid Federal Student Aid - FederalStudentAid Twitter: CWU Financial Aid @CWUFinAidOffice Federal Student Aid @FAFSA App: CWU Mobile

Federal Student Aid

NSLDS

StudentLoans.Gov

• Central Washington University’s Partnership with FATV

Central Washington University’s Financial Aid Answers 24/7 website - cwu.financialaidtv.com

QUESTIONS?

Recommend

More recommend