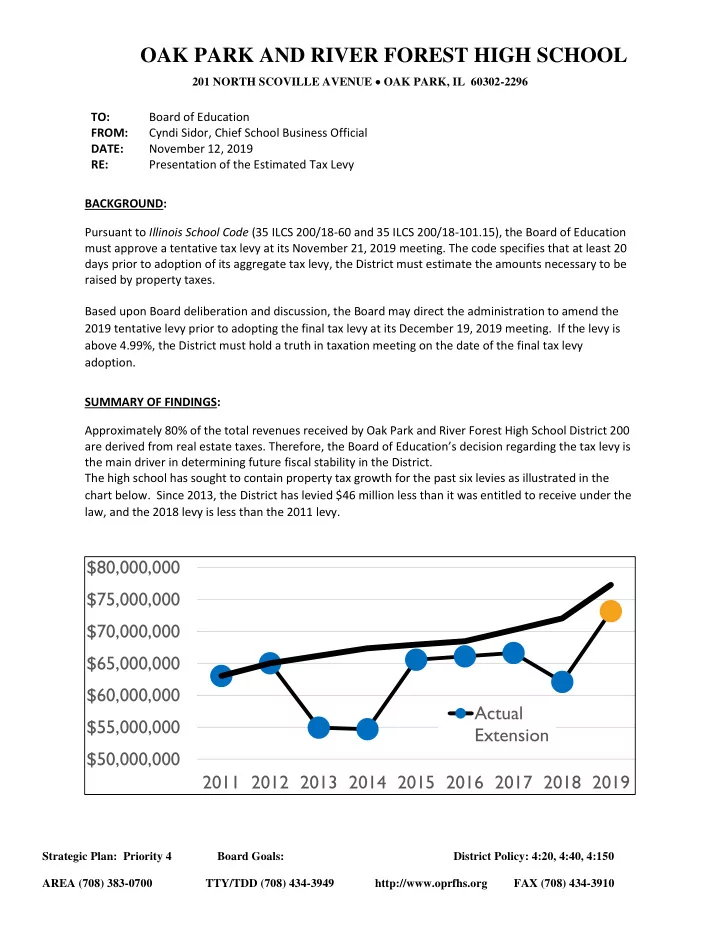

OAK PARK AND RIVER FOREST HIGH SCHOOL 201 NORTH SCOVILLE AVENUE OAK PARK, IL 60302-2296 TO: Board of Education FROM: Cyndi Sidor, Chief School Business Official DATE: November 12, 2019 RE: Presentation of the Estimated Tax Levy BACKGROUND: Pursuant to Illinois School Code (35 ILCS 200/18-60 and 35 ILCS 200/18-101.15), the Board of Education must approve a tentative tax levy at its November 21, 2019 meeting. The code specifies that at least 20 days prior to adoption of its aggregate tax levy, the District must estimate the amounts necessary to be raised by property taxes. Based upon Board deliberation and discussion, the Board may direct the administration to amend the 2019 tentative levy prior to adopting the final tax levy at its December 19, 2019 meeting. If the levy is above 4.99%, the District must hold a truth in taxation meeting on the date of the final tax levy adoption. SUMMARY OF FINDINGS: Approximately 80% of the total revenues received by Oak Park and River Forest High School District 200 are derived from real estate taxes. Therefore, the Board of Education ’s decision regarding the tax levy is the main driver in determining future fiscal stability in the District. The high school has sought to contain property tax growth for the past six levies as illustrated in the chart below. Since 2013, the District has levied $46 million less than it was entitled to receive under the law, and the 2018 levy is less than the 2011 levy. $80,000,000 $75,000,000 $70,000,000 $65,000,000 $60,000,000 Actual $55,000,000 Extension $50,000,000 2011 2012 2013 2014 2015 2016 2017 2018 2019 Strategic Plan: Priority 4 Board Goals: District Policy: 4:20, 4:40, 4:150 AREA (708) 383-0700 TTY/TDD (708) 434-3949 http://www.oprfhs.org FAX (708) 434-3910

OAK PARK AND RIVER FOREST HIGH SCHOOL 201 NORTH SCOVILLE AVENUE OAK PARK, IL 60302-2296 Currently, the District’s total revenues and total expenses are essentially balanced. The Board ’s decision regarding the tax levy will impact the probability of future balanced budgets, as well as the level of fund balance reserves available for major capital projects. In December 2018 when the Board approved the initial major long-term facilities project recommended by the administration, the Board directed administration to come up with a funding plan for a second major project by May 2020. The Board specified that the funding plan should include annual levy increases equal to CPI (Consumer Price Index), which is the maximum allowable under the Property Tax Extension Limitation Law (PTELL). Therefore, for the 2019 tax levy administration recommends levying at CPI, which is a 1.9% increase in tax dollars. We also recommend capturing new property from the TIF, which does not increase the D istrict’s portion of property tax bills, plus a nominal increase for taxable new property in the District. Based on historical data, we are projecting total new taxable property to be $123.8 million ($120 million from the TIF and $3.8 million from new property). The total recommended tentative tax levy request is $73,162,733, which represents an increase of 7.75% compared to the final 2018 tax extension of $68,036,000. Again, we want to stress that the impact to residents’ property tax bills will be limited to a 1.9% increase. The D istrict’s Community Finance Advisory Committee (CFAC) reviewed various options for the tax levy. The majority support the administration’s recommendation to levy the CPI of 1.9%, plus the TIF and new property. In looking toward the future, we recommend a gradual, long-term increase in tax revenues matching the rate of inflation, which is in line with the recommendation of the Community Finance Advisory Committee. This is instead of flat levies followed in subsequent years by a large tax increase, as can be seen in the chart for the 2013-2015 levies. Concurrent with this recommendation, we must also aggressively look at limiting expenditures in order to maintain balanced budgets and avoid or significantly defer the need to go to referendum. RECOMMENDATION: For the Committee of the Whole to review and recommend the Estimated 2019 Tax Levy, as presented, and move this item forward to the Board of Education for approval at its November 21, 2019 meeting. Strategic Plan: Priority 4 Board Goals: District Policy: 4:20, 4:40, 4:150 AREA (708) 383-0700 TTY/TDD (708) 434-3949 http://www.oprfhs.org FAX (708) 434-3910

2019 E STIMATED T AX L EVY O AK P ARK AND R IVER F OREST H IGH S CHOOL D ISTRICT 200

TIMELINE FOR 2019 LEVY Date Party Responsible Action Item November 5, 2019 Community Finance Advisory Committee Present Estimated 2019 Levy Meeting November 12, 2019 Committee of the Whole Meeting Present Estimated 2019 Levy November 21, 2019 Board of Education Meeting Adopt Estimated 2019 Levy November 22, 2019 Administrative Responsibility Place Estimated 2019 Levy on Public Display in Business Office November 26, 2019 Administrative Responsibility Write Truth in Taxation public notice and submit to paper December 11, 2019 Administrative Responsibility Notice of Truth in Taxation Public Hearing published in local newspaper December 19, 2019 Board of Education Meeting Truth in Taxation Hearing December 19, 2019 Board of Education Meeting Official Adoption of the 2019 Levy December 20, 2019 Administrative Responsibility Board of Education Resolution and Certificate of Tax Levy filed at Cook County Clerk’s Office 2

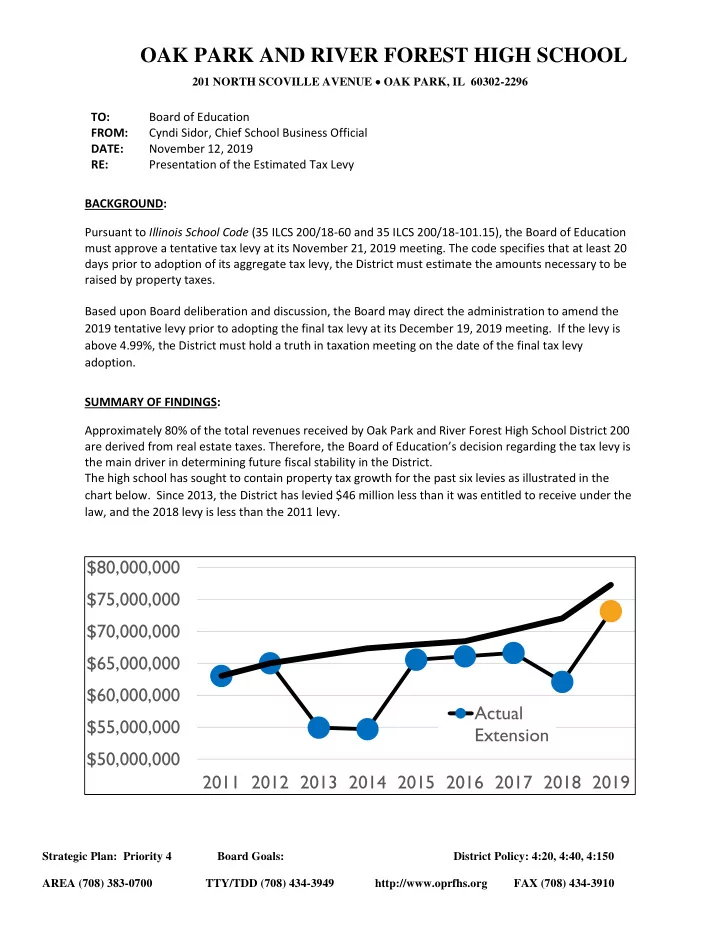

H ISTORICAL C OMPARISON OF A CTUAL T AX E XTENSION TO M AXIMUM A LLOWABLE E XTENSION U NDER T AX CAPS $80,000,000 $75,000,000 2019 $70,000,000 Tentative $65,000,000 $60,000,000 $5.8M Abatement Actual Extension Maximum Allowable $55,000,000 Extension $50,000,000 2011 2012 2013 2014 2015 2016 2017 2018 2019 Since the 2013-2018 tax year, the District has extended $46 million less than it was entitled to under tax cap law 3

COMPONENTS OF THE 2019 ESTIMATED LEVY • CPI - 1.9% • No increase to existing taxpayers • $120M Expiring TIF • $3.8M New Property • T otal Extension = $73.1M 4

P ROJECTED T OTAL R EVENUES VS . E XPENSES (178,000) 88,000 Black line represents balanced budgets 77% 79% (921,000) (3,281,000) (1,730,000) (1,416,000) (4,048,000) 124% 89% 69% 72% 77% (5,509,000) (9,820,000) 72% (5,350,000) 78% 87% (11,242,000) 74% (12,147,000) 103% FY19 FY20 FY21 FY22 FY23 FY24 FY25 Not Taking CPI Tentative 2019 Levy 5

P ROJECTED T OTAL R EVENUES VS . E XPENSES I NCLUDING P ROJECT 2 CONSTRUCTION Black line represents balanced budgets (3,281,000) (2,912,000) (921,000) 89% (4,048,000) 74% 124% 77% (9,820,000) (4,416,000) 78% (5,350,000) (5,509,000) 67% 87% 72% (11,242,000) (12,147,000) 74% 103% (22,642,000) 42% (24,194,000) 35% FY19 FY20 FY21 FY22 FY23 FY24 FY25 Not Taking CPI Tentative 2019 Levy Assuming Project 2 design work begins in FY24 and the construction begins in FY25 6

ALIGNING EXPENDITURES TO CPI The District will not be able to sustain a balanced budget if the expenditures continue to grow past the rate of CPI. If expenditure growth continues to exceed CPI, the result will be a reduction in fund balance that the District will not be able to sustain. The District must address all expenditures to be in line with CPI. 7

Recommend

More recommend