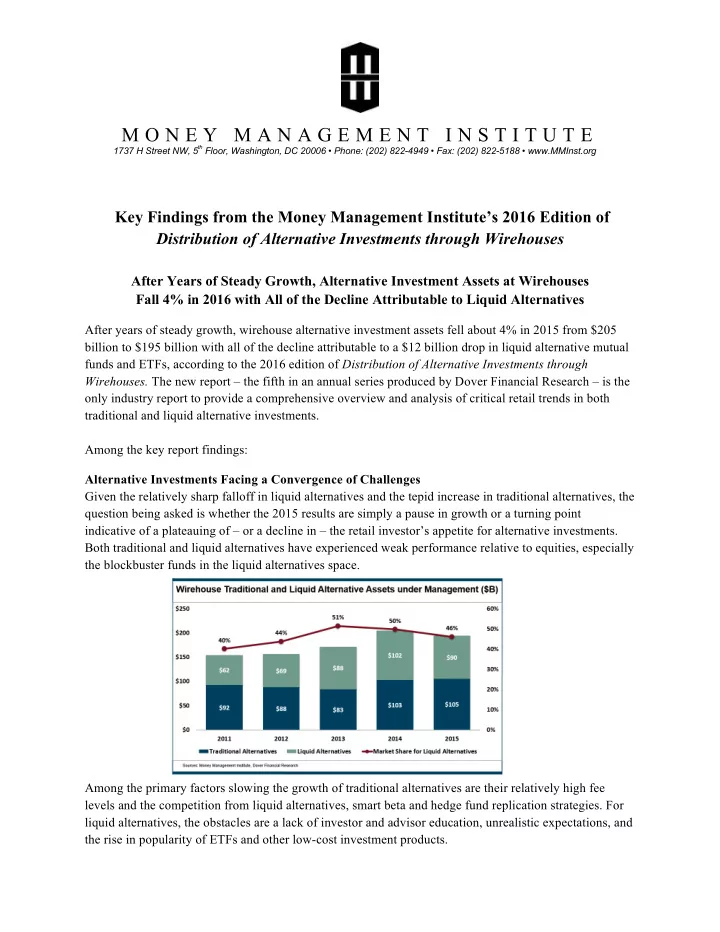

M O N E Y M A N A G E M E N T I N S T I T U T E th Floor, Washington, DC 20006 • Phone: (202) 822-4949 • Fax: (202) 822-5188 • www.MMInst.org 1737 H Street NW, 5 Key Findings from the Money Management Institute’s 2016 Edition of Distribution of Alternative Investments through Wirehouses After Years of Steady Growth, Alternative Investment Assets at Wirehouses Fall 4% in 2016 with All of the Decline Attributable to Liquid Alternatives After years of steady growth, wirehouse alternative investment assets fell about 4% in 2015 from $205 billion to $195 billion with all of the decline attributable to a $12 billion drop in liquid alternative mutual funds and ETFs, according to the 2016 edition of Distribution of Alternative Investments through Wirehouses. The new report – the fifth in an annual series produced by Dover Financial Research – is the only industry report to provide a comprehensive overview and analysis of critical retail trends in both traditional and liquid alternative investments. Among the key report findings: Alternative Investments Facing a Convergence of Challenges Given the relatively sharp falloff in liquid alternatives and the tepid increase in traditional alternatives, the question being asked is whether the 2015 results are simply a pause in growth or a turning point indicative of a plateauing of – or a decline in – the retail investor’s appetite for alternative investments. Both traditional and liquid alternatives have experienced weak performance relative to equities, especially the blockbuster funds in the liquid alternatives space. Among the primary factors slowing the growth of traditional alternatives are their relatively high fee levels and the competition from liquid alternatives, smart beta and hedge fund replication strategies. For liquid alternatives, the obstacles are a lack of investor and advisor education, unrealistic expectations, and the rise in popularity of ETFs and other low-cost investment products.

2016 MMI Distribution of Alternative Investments through Wirehouses – 2 A Changing Role for Alternative Investments The most recent bull market has changed the role of alternatives, bringing new risks and new opportunities. Overall, it appears that alternatives are currently being used opportunistically by financial advisors and investors to boost returns, concentrating rather than diversifying risk. A bear market would tend to make diversification a priority once again for investors, perhaps rekindling a broader appetite for alternatives. Future market cycles will continue to test the integrity of alternative strategies. Two Key Trends in Traditional Alternatives: The Rise of Private Equity and the Shift Toward Single-Manager Hedge Funds While hedge funds continued to dominate wirehouse holdings of traditional alternatives in 2015, private equity captured half of gross sales. Given the downturn in energy and other key market segments and a weak first quarter for stocks as a backdrop, the interest in private equity reflects investor demand for sources of enhanced yield and higher returns. Similarly, the long-term wirehouse shift to single-manager hedge funds is perceived to be the result of the quest for higher returns in a low yield environment. The transition from the higher-fee fund-of-funds approach to the single-manager format across all asset classes suggests a concentration of risk, but it also reflects a wirehouse commitment to deeper due diligence and a greater comfort level in understanding the risks associated with individual managers. Yet single-manager funds – impacted by the broader markets – have not had an easy time of it, and 2016 promises to be another challenging year for all hedge funds. Nontraditional Bonds Dominate the Liquid Alternatives Space As the liquid alternatives industry shrank in 2015, nontraditional bonds dominated, accounting for almost half of wirehouse assets as commodity strategies became a smaller part of the picture. Yet by yearend, nontraditional bonds had suffered a significant reversal in flows and were in net redemptions, as were long/short equities. Managed futures rebounded after years of neglect – perhaps because of performance chasing rather than seeking diversification – and energy and precious metals ETFs may have stabilized somewhat, given higher oil prices and reduced outflows in metals.

2016 MMI Distribution of Alternative Investments through Wirehouses – 3 Due to their complex nature, liquid alts are primarily distributed through fee-based advisory platforms with advisors integrating them into portfolio solutions rather than selling them as products. Commission- based brokers are heavy users of alternative ETFs, which offer leveraged and inverse bets on indices, commodities, and volatility. The Outlook: Wirehouses Remain Committed to Diversification and Liquid Alternatives Although the growth in liquid alternatives has slowed as commodity strategies slumped and blockbuster funds experienced poor performance, wirehouse gatekeepers are committed to the integration of alternatives into investor portfolios and continue to recommend strategic allocations to alternatives of 10% to 20% or more. That translates into significant opportunity for the alternatives industry going forward since actual retail usage is in the single digits with some firms indicating that alternative investment holdings in most client portfolios is 5% or less. For these reasons, the study concludes, the falloff in assets in 2015 represents a pause in asset growth rather than a decline from a peak, and 2016 will be a year in which the industry reassesses products and distribution dynamics and grapples with changing market forces. The ongoing shift toward goals-based wealth management will promote the growth of “retail” alternative investments as a means of helping achieve investor goals. If you have questions about this summary or the full report, please contact: Hilary Fiorella Money Management Institute (202) 822-4949 hfiorella@mminst.org Jean Sullivan Dover Financial Research (781) 461-0922 jean_s@doverfr.com

Recommend

More recommend